Introduction

The company will focus on determining the profitability of investing $500,000 in the fried chicken restaurant business. The purpose of the research is to persuade the investors to infuse funds into the proposed fried chicken restaurant business for five years. The New York entity name is “American Fried Chicken”.

The researcher authorizes the administration to include this paper in the current registered academic program. Placing one’s scarce cash resources in the fried chicken business will profitably benefit the investors. BODY. Marketing strategy will ensure the investment fills the growing needs of fried chicken clients (Schlosser, 2012, p. 52). First, the company will produce quality Chicken products.

The chicken products will contain 12 secret herbs and spices. The current and prospective customers of the company will prefer to continually return for another fried chicken meal. Next, the company will advertise the benefits of buying the company’s fried chicken products. The company will spend $25,000 for advertising and promotion activities.

The company will take advantage of advertising its products using the television, newspaper, and radio alternatives. The company will set up the fast food restaurant chain in New York City. With the huge population, the company will be able to generate revenues and net profits. Lastly, the company will price the fried chicken products at reasonable prices.

The company will mimic the average price of the company’s biggest competitor, Kentucky Fried Chicken fast food chain. The company will also strive to sell competing fried chicken menu choices.

The menu choices are based on the popular Kentucky Fried Chicken menu choices. The food choices include the breakfast meal, the bucket meal, menu containing six fried chicken pieces, and menu containing two fried chicken pieces (Wenderoth, 2009, p. 7).

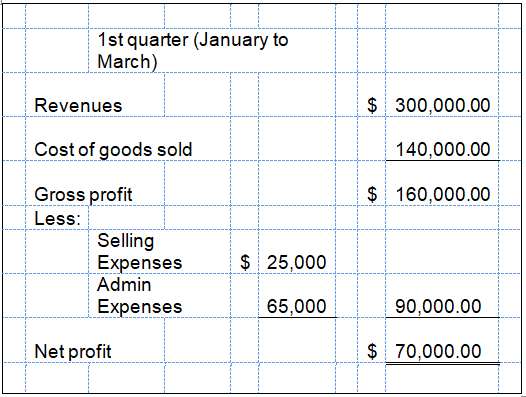

With the $500,000 investment, the entity will generate favorable investment reports (Stickney, 2009, p. 904). The first quarter financial performance projection, as shown in Figure 1, vividly indicates the company is projected to generate $300,000 revenues. The company is projected to generate $ 160,000 gross profit. The company is projected to produce a $70,000 net profit.

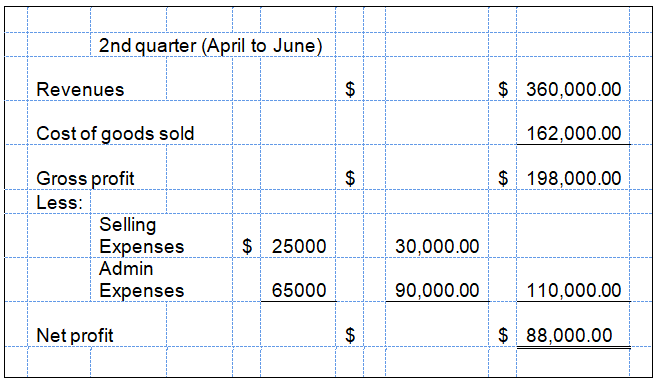

With the investment, the company’s generate higher financial performances. Figure 2 shows the entity’s projected revenue amount is $360,000. The company is projected to generate a higher $ 198,000 gross profit. The company is projected to produce a higher $88,000 net profit.

The investors will surely generate dividend income from their $500,000 investment. Investors will be happy to see the company pay investor dividends (Bernstein, 2010, p. 4). Dividends crop up only if the company generates net income.

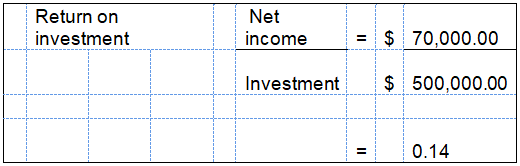

During 2013, Figure 3 shows that the $500,000 investment will generate $70,000 net income during the months of January, February, and March. The company should strive to increase its net profits during the next quarter, April to June. Figure 3 shows the company’s first quarter financial reports will generate return on investment amounting to 14 percent financial statement analysis ratio.

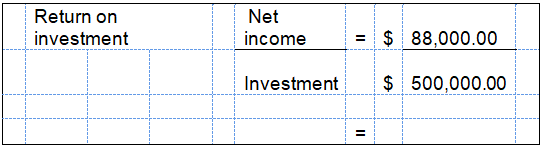

The first quarter ratio will persuade the investors to invest more funds into the fried chicken business. If the company generates a net loss financial operating performance, the investors will be forced to divest their fried chicken investments. The company’s second quarter return on investment, as shown in Figure 4, shows that the same $500,000 investor fund will produce $88,000 net income during the months of April, May, and June.

The company should continue to increase its revenues further up the revenue trend line. The company must focus on advertising its products in order to increase its net profits during the next three months of July, August, and September.

Figure 4 shows the company’s second quarter financial operating reports indicate that the company will generate a return on investment amounting to the higher 18 percent financial statement analysis ratio.

The second quarter ratio will significantly encourage the fried chicken company’s investors to invest additional funds into the fried chicken business. Because of the favorable ratio, more investors will be enticed to invest their scarce financial resources into the New York-based fried chicken business.

Concluding the above discussion, the company will focus on determining the feasibility of generating increasing profits in the fried chicken restaurant market segment. Advertising the restaurant’s fried chicken products will persuade current and prospective customers to visit the restaurant.

The advertisement will help increase the company’s current month’s revenues. In turn, the revenue increase will augment the company’s net profit amount. The research shows that the financial reports generate favorable business operation outcomes. Establishing a food store in New York will meet the local residents’ demand for high quality fried chicken food products.

The store will supply the high quality fried chicken menu choices to current and prospective New York customers. The net profit results will translate to returns on the investors’ funds.

In turn, the business outcome will encourage the current and prospective investors to pour more financial assets into the proposed fried chicken restaurant business, “American Fried Chicken”. Indeed, the New York-based fried chicken company will be established to ensure the investors will get their five year return on investment amounts.

References

Bernstein, W. (2010). The Four Pillars of Investing: Lessonsfor Building a Winning Portfolio. New York: McGraw-Hill Press.

Schlosser, E. (2012). Fast Food Nation. New York: Houghton Mifflin Harcourt Press.

Stickney, C. (2009). Financial Accounting. New York: Cengage Learning Press.

Wenderoth, M. (2009). Particularities in the Marketing Mix for Service Operations. New York: Grin Press.