Abstract

This paper basically intends to discuss about the portfolio design. A reasonable investment of $10,000,000 is available to invest in the market. The task is to design an appropriate portfolio for this investment. By conducting effective market surveys over the internet and by observing frequent stock ratings on websites, a portfolio has been designed. It is quite an effective portfolio as it is based upon number of factors including risk rates, beta values, stock ratings etc. Recommendations and suggestions have also been given at the end of this paper.

Introduction

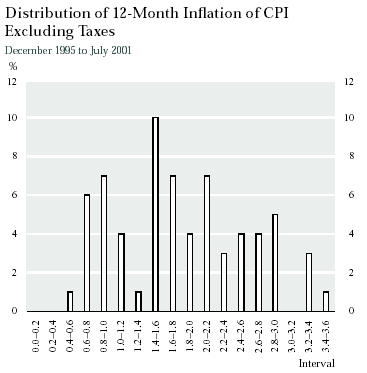

The fluctuation of inflation appears to be minor over time. Based on the data, 2.5% is a fair figure to form inflation. Inflation is supposed to be more conventional over horizons longer than a year when economic policy aims at moving inflation towards the 2% average of the target range (Macklem, 2001). However there is a graph showing the trends of inflation for past few years.

Unemployment

8.5% unemployment rate is obviously awful. It is the maximum rate since 1983, a year that saw huge levels of unemployment, almost 30 commercial bank failures and above 15% of Americans living below the poverty line. But the actual nationwide unemployment rate is extremely bad than the U.S. Department of Labor’s. The reason behind this was the deprived labor market due to which approximately 3.7 million officials were unwillingly working as a part time and were not providing their services as a full time employee.

Portfolio Design Analysis

Overview

Basically, this project is based on portfolio design, the amount which has been released or available to invest in different stocks and companies is $10,000,000. But the ones which have been selected include Target Corp, International Business Machines Corp, Citigroup, Inc, Universal Forest Products, Inc, Centurytel, Inc, Vanguard Capital Value, Saur F-S ZIELV 30C, and The Coca Cola Company. Now, the investment amount is distributed among these companies based on the risk factors, beta values etc involved in the process of selection.

Investment Strategy

This section will basically focus on what was invested in and why. Some of the basic reasons behind investing this amount include time horizon, risk preference, beta values, and many other factors etc. Pie chart is also designed for the purpose of full understanding of the reader that how much amount was invested in which sector or company. Following diagrams will show you the investment criterions.

Findings

This is the portfolio design. Following diagrams will explain about the portfolio design and the percentage amounts being invested in each stock area. These graphs shows that how the invested money was distributed among different stocks in a portfolio. The investments were initiated with respect to the nature of the portfolio of the stocks. In an aggressive portfolio, it was decided to invest the funds by remaining at a balanced level i.e incorporating both long cap and short cap investments. It was a basic need to select the asset class that would provide both safeties to investment as well as maximum growth for the investment.

Therefore, when the entire available portfolios were analyzed, finally we managed to find the above investment portfolio which meets with an ideal asset allocation according to desired preference. Let us now examine all this through a graphical representation:

Recommendation

Well-built portfolio open doors and the weak portfolio close them. Following are some of the recommendations:

- There is no single “right” way to prepare a portfolio, so select the right type of portfolio design for you.

- The point of presentation in a portfolio must be excellent. As usually excellent, attractive and diverse compositions are expected

- Your portfolio should include a variety of stocks to avoid the huge loses from risky ones.

- Manage the portfolio with the help of any reputed investment banker.

- Review the investments once in a while in the light of the options proposed by the fund manager (Elton, Gruber, Brown, & Goetzmann, 2003).

- Make the ultimate investment decision based on the advice of the fund manager from the investment bank.

All of the above mentioned recommendations should be taken into account while making any type of portfolio.

Reference list

Elton, E., Gruber, M., Brown, S., & Goetzmann, W. (2003). Modern portfolio theory and investment analysis. New York: John Wiley & Sons.

Macklem, T.(2001). A new measure of core inflation [Bank of Canada Review], 3– 12.