Executive Summary

Businesses now are more global than they could have ever been. And with every passing year, competition between different organizations in different countries is becoming ever more intense. For consumers, this is great as this could put pressure on prices that benefits everyone. But for business people and employees, it could create a strong need for ever-increasing efficiency, innovation, and effective deployment of limited resources, to remain competitive.

For firms to deploy their resources effectively, they need to understand how global competition could come into action. One vital facet of this new development could be the understanding of how business conditions in one country differ from those in another country.

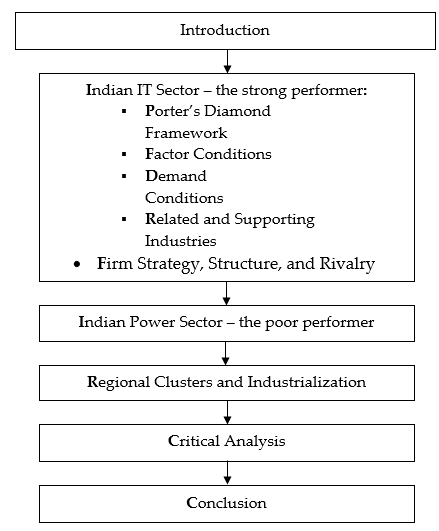

This is quite what “Porter’s Diamond” is all about. At one end, this seems a subject suited only to the boardrooms of large multi-national conglomerates. However, on the other end, this is an issue that all firms, and all individuals, need to consider as they ponder about how they’ll succeed in this fast-changing world. (Mindtools 2002) Figure 01 below provides an overview of the structure of this assignment.

In short, this essay presents just a framework or structure which examines topics like globalization and, and ultimately how Porter’s Diamond Framework could depict the performance of organizations in international markets.

Selecting the IT sector as a ‘strong’ performer and the Power sector as the ‘poor’ performer in India, this paper attempts to show this comparison in light of Porter’s theories. the With the current economic and political situation of the world fluctuating rapidly, and mixed luck of failures and success stories in some global businesses, this becomes all more difficult – but still, one could draw some conclusions with a general understanding of how the “Porter’s Diamond” framework could identify, and then compare and contrast the important areas of competitive strength and weakness and in addition how the concept of ‘Regional Clusters’ could explain the competitive advantage of a nation in a particular business sector.

Introduction

In an era of globalization, the very concept has opened up newer vistas of trade and business all over the globe. Opening up of economies has now tilted the balance in favour of market forces, which is helping the consumer in a way by providing quality goods and services at reasonable prices. Moreover, with the advancement in Information and Communications Technology (ICT), global distances could tend to become smaller while the world is gradually seen as a global village. It was since the early 1990s when the term ‘Globalization’ became a catch phrase as it started entering into all walks of life even in developing economies (Bracken, P. 2004).

Globalization has been in existence for quite a while. Now countries prepare strategies to make the best possible use of liberalizing their economies. If the growth of the economies is an indicator then the South Asian region is the happening place. China and India in particular are the countries on the target maps of many companies for a variety of reasons. According to a report published in ‘The Economist’ in 2006, India’s curries can be even hotter than the fieriest of Chinese hotspots.

In view of revalidation of the Indian Information Technology (especially the Business Process Outsourcing growth story) and driven by a maturing appreciation of India’s role and growing importance in global services trade, the country aspires to attain an export target of US $60 billion by 2010 (NASSCOM 2007). The Tata Group of India recently took over the rein of Jaguar Land Rover which could never have been possible without this amount of openness through globalization (CBC, 2008).

Thus for comparison, India has been selected as an ideal place to analyze Porter’s Framework. Being a booming economic country for several years, India has developed many of its business sectors that are all worth analyzing (Factbook, 2008). India is also one of the key constituents of the BRIC (emerging markets) report for the economy, trade, politics and military affairs. Business sectors like Textile, Autos, Agriculture, IT etc. have all been prominent helpers in the GDP of the country, however, IT has been selected as the strong performer in this paper due to several reasons that are mentioned below. On the other hand, the weak performer has always been the Power sector with its many woes discussed later. Let’s begin with the analysis by first taking a look at the IT sector.

Porter’s Diamond Framework

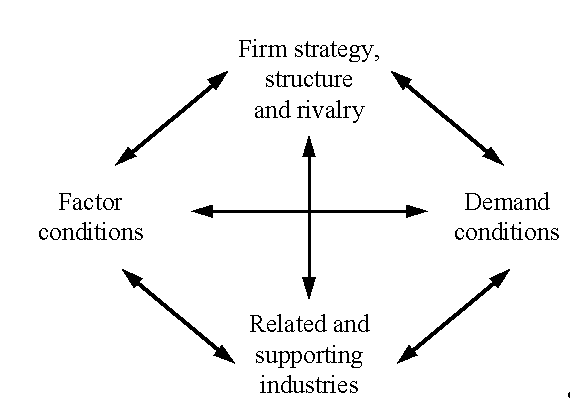

To test the competitive strength of nations, Michael Porter came out with a framework known as Porter’s Diamond (Figure 02 below). This model is also quite useful in analyzing why some industries within a country are more competitive than others (Porter, M.E 1998). In fact, even before the publication of this book, Porter’s theories were taken into account for the national reassessment in countries like New Zealand. His ideas have greatly influenced the policymaking in many countries including India.

Porter states that competitiveness has become a central preoccupation of governments and industries in every nation, particularly in the context of globalization and liberalization. Porter’s diamond does make sense even in the Indian IT industry growth. Thus for this paper, this model is being used as the basis of comparison.

Indian IT Sector – the Strong Performer

The Asia Pacific region in general and the South Asian region, in particular, is being discussed and debated at almost all international forums (Goliath, 2005). Huge market size, IT sector competencies, quality manufacturing at very economical labour costs, and impressive GDP growth figures are key performance indicators for India today. Moreover, India’s growing influence in international affairs could also be one of the factors which are attracting investors from all over the world. The huge pool of English language speaking people in India and the strength of its IT sector, in particular, are the key performance indicators that have made India a much-desired destination for BPO (Business Process Outsourcing) and IT related services.

According to recent research carried out by (NASSCOM 2007a), India is a relatively strong performer in international markets in the IT sector. Though India remains largely a rural and agriculture economy, the industrial and services sectors too are growing faster.

This could be well ascertained from the following facts:

- The IT sector’s contribution to GDP in FY 07 was 5.2% up from 4.8% last year (NASSCOM 2007a).

- Merrill Lynch expects that in near future the outsourcing companies are likely to treble the amount of money they spend on IT outsourcing. The bank comes out with the finding that Indian software companies are going to be the main beneficiaries of this hike (Band, J. 2003).

- The US has been a major trading partner of India accounting for about 22% of India’s total merchandise exports and the software industry is a significant contributor to such exports (Data Monitor 2005).

To compare and contrast the competitiveness of the IT sector in India with say the power sector (discussed later), one could use Porter’s diamond framework as follows:

Factor Conditions

During the pre-liberalization era, India used to be a big exporter of skilled manpower. But today they are witnessing a huge gap in the demand and supply ratio of skilled manpower, as far as the IT sector is concerned. Estimates point out that there will be a need for around 2.3 million IT professionals by 2010.

Furthermore, in Asia, where China is a leader in most fields, India seems to surpass China’s capability due to its lower entry barriers with the growing service industry and English as the common business language which makes communication better and faster than China. Also, the democratic setup of India has been found more favourable to business prospects than the Chinese brand of communism. (Shister, N. 2005)

Demand Conditions

A few years ago, the Indian IT market was small but very demanding. IBM and similar IT giants had moved out since they felt that their intellectual property was not adequately protected. This was a window of opportunity for Indian firms attracting many people with high-quality MNC experience (Ghosh, G. 2005). In today’s technology-driven society, the role of IT has become of paramount importance.

As IT is gradually maturing and presenting a paradigm shift, the infrastructure has acquired a business character. Therefore, almost all industrial sectors have demands for IT services. Since the domestic industries to are a big market for these services, therefore the demand conditions are quite ideal for the IT sector. In addition, the Indian IT sector caters to an international clientele spanning across all the continents and almost all major industrialized countries.

Porter states that “A country can achieve national advantages in an industry or market segment if home demand provides clearer and earlier signals of demand trends to domestic suppliers than to foreign competitors. (Porter, M.E. 1998)” Therefore, the Indian IT sector is bound to write a success story.

Related and Supporting Industries

This factor definitely loses its value in a digital world, where for bits and bytes, the cost of moving 1 meter is the same as moving them 10,000 miles. The Business Process Outsourcing (BPO) sector in India is one big consumer of Indian IT products and services. Many MNCs like HSBC, IBM, and Dell etc. have shifted their call centre services to India in recent years. The IT sector has found good support for its services due to this and lately, Microsoft and Cisco are expanding their Indian bases enormously.

All such issues have gained the confidence of many MNCs giving a boost to the foreign direct investments (FDIs) in India thus propagating key industries like retail, media and movie making, graphics and animation, packaging and not forgetting the call centre industry. Lately, the car manufacturing boom has struck India which has icing on the cake with the launch of the US$ 2,500 NANO car from TATA. Supergiants like Reliance and TATA along with the IT services’ companies like Wipro, Infosys, Satyam and the likes are reaping rich returns with their strategies aimed at leveraging on the IT industry boom in India.

Firm Strategy, Structure, and Rivalry

There are a large number of IT companies in India like Tata Consultancy Services (TCS), Wipro, Infosys, Satyam, Zensar etc. Everyone knows there is cut-throat competition in the IT industry, both for clients and employees. Many of these IT companies have been able to bring in a professional approach to strategic management (Daft, R. 2002). This also underlines the crucial changes that have taken place in the field of management and managing styles.

The pressures on today’s Indian managers go well beyond the techniques and ideas traditionally taught in management courses (Daft 2002). The Indian IT industry needs to manage the businesses not only in India but at a number of overseas locations. This is a challenge since hiring the right global expertise to do this at rising inflation and standards of living in the region makes it more difficult.

Thus from the above discussions, it is quite apparent that under the BRIC chain of emerging markets, the Indian IT industry has a big role to play. The BRIC concept has been playing an increasing part in both global equity and emerging market funds ever since the concept emerged about three years ago (Levene, T. 2007). Also, the Porter’s Diamond Framework has shown briefly how the Indian IT industry could be vibrant in the near future. The following section takes up the non-performing power sector in the Indian markets.

Power Sector – The Non-Performing Sector

It is true that India is a powerhouse of IT talent, but some of this sparkle goes missing when the power sector in India comes into the limelight. It requires determination and zeal for political leaders to make power available to all the areas within a country as it has its own particular set of optimal factor conditions. This calls for major reforms’ process, whence the government of India appears to be aware of the matter and accordingly plans are being made to have continuous power throughout the year by 2012. The Ministry of Power has set for itself the targets like:

- Sufficient power to achieve GDP growth rate of 8%

- Reliable power

- Quality power

- Optimum power cost

- The commercial viability of the power industry

- Power for all

To compare and contrast the competitiveness of the IT sector in India with say the power sector (discussed later), one could use Porter’s diamond framework as follows:

Related and Supporting Industries

One major reason for the loss of electricity is the pilferage during (T&D) transmission and distribution. This sector, having much scope, has not been able to attract many investors from domestic as well as from foreign counterparts. Some past experiences could be highlighted like the Dabhol power project in the state of Maharashtra which was not executed due to political bickering and other disputes with the Maharashtra State Electricity Board. Thus all the related industries are not supporting the cause of the Indian government to have enough power to sustain its massive population.

Demand Conditions

The demand for electricity and power is always high as it is a necessary thing for humans to survive nowadays. Without adequate power, a normal person cannot live without lights, industries and machines can’t be run, the business can’t be done etc. Thus the demand for power will always remain high and there is nothing anybody can do about it.

Factor Conditions

Generation of power and electricity is not an issue in India due to the vast use of coal, oil, nuclear and hydroelectric power plants though out the country. The factor that is letting the entire industry down is the distribution and transmission of power. As mentioned above, pilferage is the single most threatening which the whole country is bent upon.

Firm Strategy, Structure, and Rivalry

Porter argues that domestic rivalry, like any rivalry, creates pressure on firms to improve and innovate (Porter, M. 1990). Having several firms in the power sector may be the option for India to improve the situation. However, there have been many roadblocks when the government has tried doing this. The biggest stumbling block in the deficiency of electricity distribution is the growing population of the country. On one hand, a large population is a boon but at the same time also a bane for India. It is a boon because it presents a huge market of consumers, but the big population becomes a bane when facilities and utilities are to be arranged for their welfare activities, which becomes a huge burden for the government when it desires to supply them with basic amenities.

Regional Clusters and Industrialization

Clusters are the geographic concentration of interconnected companies, specialized suppliers and service providers, firms in related industries and associated institutions in particular fields that compete but also cooperate (Porter, M. 1990). This also results in a reduction in production costs as the transportation costs and labour costs are reduced. When an industry has thus chosen a locality for itself, it is likely to stay there long, because there are many advantages which people following the same skilled trade get from their neighbourhood.

Software technology parks have been set up in areas like Hyderabad, Bangalore, and Pune. These are some of the areas where the Indian government has tried to form clusters to facilitate the IT sector. Industrial cluster policy is followed not only in China but also in many countries from the Far Eastern markets such as Japan, Malaysia and Singapore. Silicon Valley in the US and Bangalore in India are well-known success stories of cities harbouring and nourishing the IT industry. But the three key factors which determine the success of clustering industries are;

- Industrial zones, e.g. Export Processing Zones, Software Technology Parks etc.

- Capacity building (e.g. Handicraft market in India, Cheap toys market in China etc.) and

- Anchor firms e.g. Intel is an anchor firm for computer chips. If it starts its production near an industrial zone, related firms from the host country are bound to start their business in the surrounding areas.

The Indian IT sector has also had a successful experiment in the IT sector. But as far as the power sector is concerned, so far it remains a distant dream. Policy-makers are left with a ‘laundry list’ on which to base simple SWOT-type analyses of their economies, but there is no reliable guide to policy. Developing countries in particular are inadvertently encouraged to pursue policies that might be harmful (Heeks, R. 2007).

Though the power sector reforms started off together with the process of liberalization in the early 1990s, a major portion of the power generation still lies in the hands of the public sector company, while the private players like Reliance Energy are now knocking at the doors of the Indian government to seek permission to get into this sector. In the distribution of power though, there have been some successful attempts in Mumbai and Delhi, the two major metro cities. The power sector, therefore, appears to be poised towards a better future as well.

Critical Analysis

In this new flat world interconnected with fibre optical cables, does Porter’s diamond still hold true? And what is the role of government – here the best example is India, where the IT services industry grew because the government was oblivious to it – how could Porter ignore the same?

‘Government’ and ‘Luck’ are two factors not included in the diamond but they are crucial issues nonetheless. National competition policies, events like wars, terrorism attacks, inventions, oil price rise, currency shifts etc are factors that could change the outcome of the Diamond summary. In the case of India, the government has had a very negative role in terms of economic growth, thanks to British colonial rule, followed by Nehruvian Fabianism, an entrenched bureaucracy (a British legacy) and a fascination with socialist centralized planning. The private sector has reacted to the absence of government hurdles/roadblocks as if it was active encouragement or promotion. On the international stage, India is yet to register itself as a leading force, on account of the kinds of conflicting signals that emerge out of the country.

Rugman is the most popular critique of Porter’s diamond. According to Rugman & Verbeke (1993), Porter’s diamond was myopic and hence was only created for the largest and richest country in the world, the US. “For firms in small countries, such as Canada, the implications of Porter’s diamond are disastrous”. They believe that a firm that is “confined by geography, limited by locationally bound endowments and labour, what competitive future was open to small countries?”

Bosch and Prooijen (1992) in the European Management Journal criticized Porter for omitting the “impact of national culture” from the model. The authors explain that Porter’s diamond stands on the cultural forces and it is because of these cultural differences that different national got erected especially in Europe.

Although controversial, the “Diamond Model” still provides a useful basis for making appropriate policy recommendations to foster competitiveness. It concludes that while achieving the required legislative and institutional framework, market liberalization and a stable macroeconomic environment are necessary, but they are not sufficient conditions for ensuring continued economic growth and the achievement of sustainable development. In particular, based on the “Diamond Model” framework, government policies are advocated to attract foreign direct investment with the objective of creating new industrial clusters.

Conclusion

India indeed appears to be on the right track in becoming a knowledge hub and an economic superpower on account of its strong points in the fields of technical training and education. Its large population, which was proving to be a burden for the Indian government, has also become a source of strength for the country. This was because globalization and liberalization policies started the search for consumer societies.

During the initial years, the vast pool of consumers in India could not prove to be of many benefits for the MNCs because the purchasing power of an average consumer was quite less. But the growing number of millionaires in the IT era has lent a helping hand to the average consumer. Now there are more avenues of earning for an Indian resulting in increased spending power and personal disposable incomes.

Therefore, India appears to be working with a strategic vision. There are a number of hurdles to be crossed before the success story actually results in the ‘powerhouse’. Erecting a dependable infrastructure with well-laid roads, reliable power supplies, corruption-free society and hassle-free bureaucracy will definitely help resurgent India in becoming a developed nation. Having a look at some of the policies adopted by the Indian government in the recent past, it appears that the Indian government is aware of the situation and is slowly but steadily in the process of placing its strategies in action.

It is quite understandable that while both the sectors (IT and Power) are vital for the development of the nation, there is apparently something which makes the sectors quite distinct. IT is a relatively new sector than the Power sector has all the ingredients of the modern and professional approach while the Power sector needs to shed the old age weight associated in the form of inefficiency and losses.

This shows how Porter’s Diamond Framework could reinforce the arguments drawn above as well as we accept the fact that there are still some drawbacks to such models or concepts. Nevertheless, these frameworks provide at least a guideline towards understanding similar situations in this real and dynamic world of business. This helps in decision making as well as aligning a company’s global growth strategy with respect to a country’s attractiveness and competitiveness for long term survival.

Bibliography

Alan Rugman & Alain Verbeke (1993). Porter’s Single Diamond Framework. Management International Review. 33:2 Pp. 71-84.

Band, J. (2003) The IT services Outlook-Making the global leaders work for you. Business Insights Ltd. London.

Bosch, F. A.J. V. D. & Prooijen, A. A. V. (1992). The Impact of National Culture – a Missing Element in Porter’s Analysis? European Management Journal. Vol. 10. No.

Bracken, P. (2004) Yale SOM Working Paper No. OB-06, PM-05, OL-19, Yale School of Management. Web.

CBC. (2008). Tata takes over Jaguar, Land Rover from Ford. Web.

Datamonitor (2005). India-Country Profile. Datamonitor NY: USA.

Daft, R. L. (2002). ‘Management’, 5th edition, Thomson Asia Pte Ltd. Singapore.

Factbook, T. W. (2008). India. Web.

Ghosh, G. (2005) Porter’s diamond is not forever. Web.

Goliath. (2005). India looks good for investment, says report. Investment Adviser.

KPMG. (2006). KPMG International Review. Web.

Levene, Tony (2007). ‘Energy offerings from BRIC nations’. Fund Strategy, Centaur Communications, UK.

Ministry of Power, Government of India (2007). ‘Power for All by 2012’. Web.

Mindtools (2008). Shaping your strategy to reflect national strengths and weaknesses. Web.

National Commission on Population (2007). Web.

NASSCOM (2007). NASSCOM Strategic Review 2007. National Association of Software and Service Companies in India.

NASSCOM (2007a). Indian IT Industry: NASSCOM Analysis. Web.

Porter, M. E. (1998). ‘The Competitive Advantage of Nations’. New York: The Free Press.

Porter, M. E. (1990). ‘The Competitive Advantage of Nations’. New York: The Free Press.

Heeks, R. (2007). Using Competitive Advantage Theory to Analyze IT Sectors in Developing Countries: A Software Industry Case Analysis. Information Technologies and International Development 3, pp.3, 5.

Shister, N. (2005). India, the Next China. World Trade, Business News Publishing Company.

The Economist (2006). ‘Too Hot to Handle’. The economist print edition.