Background

Saudi Arabia is a country with a high level of GDP and business development opportunities. However, its economic system also has several serious drawbacks, including dependence on a single product, oil, as well as legal and organizational restrictions, which impede the rapid growth of entrepreneurial companies. At the same time, the financial capabilities of many residents are conducive to starting a business. For this reason, private investors should be extremely selective by providing financial support to young entrepreneurs, since the risk of losing profits is high, and the choice of investment options is wide.

At the same time, entrepreneurs are faced with the problem of lack of financial resources due to high competition, low levels of state, and foreign direct investment. Although the new government programs are aimed at correcting this shortcoming and stimulating the development of small and medium-sized businesses companies, the changes require considerable time to become effective. For example, vision 2030, initiated by the government, makes it clear only by name that it takes another ten years to implement the program, but in practice, these steps may take even more years. In recent years, Saudi Arabian entrepreneurs have received only 2% of the available financing (Al-Akkad 3). Therefore, entrepreneurs should rely only on their financial capabilities and fundraising skills.

In addition, the level of foreign direct investment has also remained low in recent years. One of the reasons for this situation is the Kingdom’s complicated legal policy and lack of transparency in the conduct of business. A complex approach to interaction and numerous obstacles often force inverters to choose more open and transparent countries for cooperation.

Another more important reason is the assassination of Jamal Khashoggi, a Washington Post journalist and Saudi dissident, in 2018 in which forced investors to reconsider their plans to finance business in Saudi Arabia (Ellyatt). Although the level of foreign investment has gradually grown to $14.4 billion in the first half of 2019, the Kingdom needs to make a lot of effort to achieve a record $39 billion in 2008 (Ellyatt; “New Report”). Consequently, entrepreneurs have few opportunities to find financing for their projects, while competition remains high.

Therefore, the government of Saudi Arabia has to make efforts to increase both domestic and international investment flows. The most attractive conditions for investors in any state are fresh profitable ideas, as well as understanding by entrepreneurs of the business mechanisms and their vision. A business person who can offer an investor a plan that matches his or her desire, as well as consistently and correctly present a way to implement it, receives financing. The education and training of start-up entrepreneurs is the primary goal of the government, in addition to creating a positive environment, since, in this case, businessmen themselves will be able to attract foreign investment in the state.

Consequently, the main goal of this study is to conduct research to determine the main gaps in the educational programs of entrepreneurs in the field of investment. The results of the research will help to improve the education system and direct it towards achieving practical results. However, the determination of the gaps is a way of the identification of the main problem. Thus, the proposition of this study is to justify the necessity of curriculum adjustment for entrepreneurs to improve engagement with investors.

Problem statement

Almost any business requires external investment for its launch and the first months of operation. However, an entrepreneur who, for the first time, is faced with the need to seek and engage investors most often do not know all the aspects and nuances of this procedure. In addition, often aspiring entrepreneurs have great ideas; however, the lack of experience and knowledge does not allow them to accurately present their project to people who can provide financial support and even write a competent business plan. Thus, many exciting projects fail only because of a lack of funding and knowledge to attract investors.

On the other hand, the shortcomings of entrepreneurs also hurt investors who cannot see a profitable idea because of its vague idea. People who invest their money in business want to minimize risks, so they often choose less risky but designed projects. This approach helps them to increase their profits and avoid scammers, as a tempting but vague offer can only be a trick. For this reason, investors are also interested in the professional growth of entrepreneurs, as their ability to present their project will help make the right investment.

Thus, this study examines the problem of inconsistency and lack of knowledge of entrepreneurs with investors’ expectations. According to Al-Akkad, business people must understand the principles and decision-making mechanisms that investors use (4). Consequently, the lack of in-depth knowledge and understanding of these processes impedes obtaining funding. For this reason, literature research, as well as practical research, will be used to identify knowledge gaps for entrepreneurs, as well as their impact on attracting investment.

Significance of the Study

Education is a central element for the development and proper functioning of any state. As noted by Alessa and Hussain, “Such [knowledge] society contributes to the sustainability of the development process and the establishment of a competitive economy” (1158). Consequently, the education of entrepreneurs must be appropriate for practice so that the market economy of Saudi Arabia brings profit to the state and its citizens.

The importance of this study lies in the fact that it brings knowledge of economic investments into the theoretical and practical base and identifies gaps in the educational programs of entrepreneurs. In academic discourse, this approach will help determine the most critical aspects of the current investment climate in Saudi Arabia. In addition, the model used in this study can be used for other fields of science or other states.

At the same time, identifying gaps contributes to the correction of university curricula. Therefore, in the future, entrepreneurs with higher education will be able to effectively use their skills to attract investment, including foreign ones. This change contributes to the development of the economy and business sector of Saudi Arabia. Therefore, this study is significant to the scientific world, as well as business practices in Saudi Arabia.

Research Questions

This study aims to identify deficiencies in the education of entrepreneurs and their impact on attracting investment. Therefore, the central question is: Why is there a need to improve training programs to better engage entrepreneurs and investors? However, the answer to this question requires a detailed analysis and review of more specific problems, which are the causes for improving the quality of education. Therefore, the research questions are:

- What aspects of project presentation are most important for investors in the decision-making process?

- How does a lack of one or more presentation elements affect decision making?

- What issues are Saudi Arabian entrepreneurs studying in finance and business management courses?

- What questions does Saudi Arabian entrepreneurs’ training programs do not cover?

Answers to these questions will help to get a general picture of the education of entrepreneurs and their interaction with investors. Consequently, an analysis of these components will help explain the need for training programs in Saudi Arabia. At the same time, answers to specific questions will be used for their immediate modernization and improvement.

Objectives of the Study

This study identifies three objectives that will help reveal its topic. All of them directly related to the central issue of research and can be achieved through a review of the literature and practical research. The objects are to prove the need for changes in training programs, determine the impact of knowledge lack on attracting investment, and identify gaps in educational programs for entrepreneurs in Saudi Arabia.

Entrepreneurs in Saudi Arabia face a high level of competition, so they need to make every effort to attract investment in their project. In addition, a large number of business people do not have the financial or technical capabilities to determine the main strengths of their projects or to use the services of compiling business programs (Alessa and Hussain 1156). At the same time, the lack of knowledge does not allow these entrepreneurs to use their own resources. For this reason, educational and training courses should provide the necessary amount of information to enhance the relationship between entrepreneurs and investors. Therefore, the purpose of this study is to determine the correlation between a lack of knowledge among entrepreneurs and the need to improve programs through practical research.

However, solving the problem also requires identifying the essential elements of education that will need to be changed and improved. This step helps to build new curricula and recommendations for educational centers and universities. Thus, another objective of the research is the specific shortcomings and problems of educational programs for entrepreneurs in Saudi Arabia.

Theoretical Frameworks

The basis for this study is the knowledge and skills of entrepreneurs, which are necessary to attract investors. For this reason, it is necessary to study the literature to determine the specific skills required to get investment. These skills will form the basic set of topics needed for study in training and educational programs for entrepreneurs. Thus, the main competencies that entrepreneurs need for attracting investors are leadership and managerial experience, an understanding of the technical details, and communication talent.

Although a good business idea is the foundation and the most attractive factors for investors, leadership, and managerial qualities are more critical. This feature exists because there can be many profitable ideas, but only a confident manager can successfully implement them (Mason, Botelho, & Zygmunt 519). Al-Akkad notes that potential investors pay considerable attention to the personal qualities of an entrepreneur, business model, and management team (134). In addition, an important aspect is the entrepreneur’s understanding of the technical details of the project, which will help him or her write an adequate business and financial plan in stages. This requirement is logical, since a vague business plan demonstrates a lack of understanding of processes and increases the risks associated with unexpected costs. Therefore, entrepreneurs should have enough knowledge to provide investors with all the details regarding the project in the right and logical.

Moreover, one of the essential skills of a successful entrepreneur is the ability to build communication with investors. Communication allows a business person not only to explain and demonstrate all the beneficial aspects of their project but also to establish trusting relationships with an investor (Al-Akkad 135). In addition, a talent for negotiation can help an entrepreneur keep the investor’s attention, even if his or her project has a vague business plan or understanding of financing. If an entrepreneur interested investors with the idea and personal qualities, they can give him time and advice to correct technical errors, in other words, a second chance. Also, even at the initial stages of a project, a business person can find useful contacts by using his abilities, which will later help him or her find financing. According to novice entrepreneurs, they have a much higher chance of success if they are part of a business network before the start of the investment search process (“How To Communicate”). Therefore, high communication skills play a crucial role in attracting investors.

Conceptual Definitions

This study examines educational programs for entrepreneurs to attract investors; therefore, the basic concepts for studying also lie in this area. The main concepts are skills and knowledge in the field of entrepreneurship, training programs for obtaining them in general, and determining the investment attractiveness of the project. For their revealing, a literature review and other scientific studies on the topic of investment and entrepreneurship will be used.

Operational Definitions

This topic requires an integrated approach to the study that defines its based research methods. The first stage will be the study of educational programs for entrepreneurs, which will be conducted by exploring curricula. Further, questions for interviewing respondents will be compiled based on the data obtained, and the accuracy of the wording will be checked. The next step will be to send out questionnaires and interview participants by using a quantitative data collection method, as well as systematize data with statistical tools. The results of the analysis will be used to compare and determine the presence of gaps in educational programs and their specific aspects.

Hypotheses of the Study

A preliminary study of the literature and obstacles of entrepreneurship in Saudi Arabia revealed a number of problems. For this reason, the following hypotheses will be verified in this study.

- H1. The lack of relevant knowledge and practical skills to attract investors hinders the development of business for first-time entrepreneurs.

- H2. First-time entrepreneurs gain theoretical knowledge that does not have a practical application for attracting investors.

- H3. First-time entrepreneurs do not have the practical skills to meet the expectations of investors.

- H4. The curriculum of entrepreneurs does not meet the requirements for obtaining investors for financing.

Study model

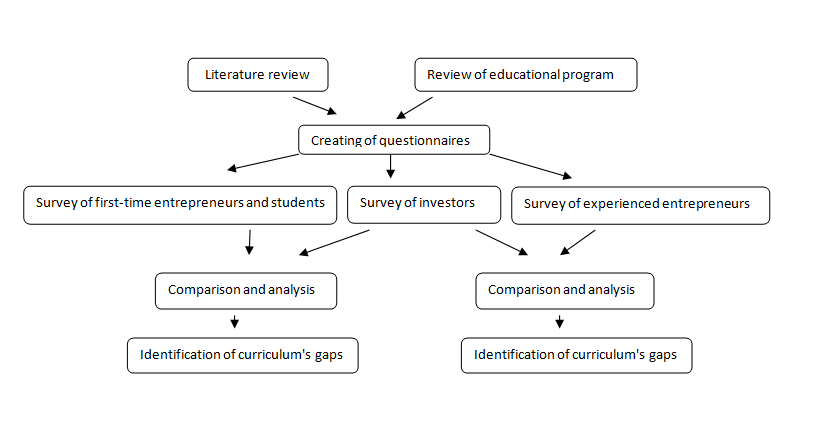

A literature review and a survey of three different groups of participants are aimed at testing the various hypotheses of this study. The correlation of the results of different questions will help to consistently research all issues and answer the main question of the study. For this reason, the model of this study has a multi-level structure (Figure 1).

Methodology

Studying this topic requires an integrated approach to the research as it involves several parties. Consequently, the main training programs will be considered, and several different surveys that involve various groups of respondents will be conducted to check the hypothesis. Groups of participants will be divided into investors, entrepreneurs with experience in attracting investors and start-up entrepreneurs. Online surveys will be sent to prominent Saudi entrepreneurs and investors, as well as graduates and senior students of entrepreneurship education courses. The sampling will be random; however, students and first-time entrepreneurs will make up the largest part of it, approximately 100-150 people, as they are easy to attract through educational institutions. At the same time, experienced entrepreneurs will consist of about 50 people, and investors only 20-30, since they are a fairly small group in Saudi Arabia.

The first step will be a review of the literature and training programs of major educational centers in Saudi Arabia. The analysis will highlight the main topics that entrepreneurs study in the course of financing and business management to attract investors. Further, certain topics will be the basis for a questionnaire to determine their suitability and relevance in practice. Thus, the questionnaire for investors will include the categories of questions included in the training programs of Saudi Arabia, as well as additional aspects defined in the theoretical framework of the study. Respondents will define the importance of knowing and practicing each aspect by entrepreneurs to get financial support. The respondents will have a choice between answers in the range of “strongly agree” – “strongly disagree.” The questionnaire for start-up entrepreneurs will be organized in the same way as for investors; however, the main question for them will be: “Do you have knowledge in this topic that you could apply to attract investments?”. Response options will range from “Definitely yes” to ” Definitely no.”

The questionnaire for entrepreneurs with experience will contain the same questions, but they will be duplicated in two variations: “What effect did the lack of knowledge in this matter have on obtaining investments” and “What effect did the knowledge on this subject have on obtaining investments”. Answers will range from “Negative” to “Positive”. In addition, interviewers of all groups of respondents will have questions about demographic data, such as age, gender, nationality, education, and business experience. Thus, the collected data will be used to analyze the importance of each of the elements of the project presentation for receiving investments and its presence in the training program for entrepreneurs.

Information will be collected through Google Forms, since this program is convenient for organizing data and is also free. The study will also use the statistical tool SPSS. The main method of data analysis will be an exact chi-square test as it is the most suitable for comparing the responses of all groups of respondents. In addition, a simple linear comparison of the degree of importance of each issue for investors and experienced entrepreneurs, as well as the knowledge of first-time entrepreneurs in this area, will clearly outline the shortcomings of educational programs. Thus, this research method, which combines quantitative analysis of several aspects, will be used to identify the gap in theoretical issues studied by students and the real knowledge necessary to attract investors.

Furthermore, all types of questionnaires will go through several stages to verify their validity and reliability. The validity of the data will be divided into several categories to check the accuracy and relevance of the questions to the purpose of the study, the appropriateness of respondents, and the method of the research (Mohajan 71). In the first case, questions will be tested by small groups of three categories of respondents: first-time entrepreneurs, experienced entrepreneurs, and investors. They will be asked to answer questions, as well as leave comments after each of them to determine their inaccuracies or vague wording. The survey will also contain a question about respondents belonging to a particular group. In addition, first-time entrepreneurs will be asked whether they have been visited training courses, and experienced entrepreneurs will answer the question about the duration of their professional activities. Each respondent also will be able to pass the test only once, and anonymity will reduce the likelihood of emotional responses. The research method will be tested through comparison with data from other similar research, as recommended by Mohajan (76). Thus, the validity of the measurements will be verified.

The reliability of the research method will also be tested to obtain accurate results. For this purpose, the test-retest reliability method will be used (Mohajan 68). A repeat survey will be conducted for respondents who completed the first two months later to confirm their answers. However, for students and first-time entrepreneurs, the question of whether they have learned new information in the last two months will also be included. Thus, a high match index will indicate the reliability of the measurements.

Conclusion

Therefore, the main proposal of this study is to determine the need to adjust training programs for entrepreneurs to increase their interaction with investors. Although the main goal of the study is to justify the need for change, the knowledge gaps that will be identified to confirm it also have enormous theoretical and practical significance. The identified deficiencies can be applied to make recommendations and directly correct curricula. Consequently, the proposal to conduct this study has dual benefits as it points to a general weakness of the business system in Saudi Arabia and to specific elements requiring improvement. The need for this study is explained by high competition in the business environment, especially among projects requiring initial investments, and a low share of funding sources. This situation inhibits the development of the economy in the Kingdom of Saudi Arabia, which in turn affects the flow of foreign investment. Consequently, the modernization of the curriculum for entrepreneurs can break this circle and have a positive effect on the business and investment environment of Saudi Arabia. Thus, the proposal to conduct this study is relevant and useful for theoretical and practical applications.

Works Cited

Al-Akkad, Jamal A. O. Aligning the Appeal of Entrepreneurs to Investors: Why is There a Need for an Optimal Entrepreneurship Training Module in the Kingdom of Saudi Arabia to Better Engage Entrepreneurs with Investors, 2018. Durham University, DBA dissertation.

Alessa, Adlah A., and Shayma Hussain Alajmi. “The Development of Saudi Arabian Entrepreneurship and Knowledge Society.” International Journal of Management Excellence, vol. 9, no. 3, 2017, pp. 1155–1168.

Ellyatt, Holly. “Investors Still Cautious on Saudi Arabia a Year since Khashoggi’s Murder, Analysts Say.” CNBC, CNBC, 2019, Web.

“How To Communicate With Your Investors For Better, Faster Funding.” Forbes, 2017, Web.

Mason, Colin, et al. “Why Business Angels Reject Investment Opportunities: Is It Personal?” International Small Business Journal: Researching Entrepreneurship, vol. 35, no. 5, 2016, pp. 519–534.

Mohajan, Haradhan Kumar. “Two CriteriaFor Good Measurements In Research: Validity And Reliability.” Annals of Spiru Haret University. Economic Series, vol. 17, no. 4, 2017, pp. 59–82.

“The Royal Embassy of Saudi Arabia.” New Report Highlights Record High FDI in Saudi Arabia | The Embassy of The Kingdom of Saudi Arabia, Web.