Business Cycles

Fluctuations and cyclical behavior is an observable phenomenon in most socioeconomic processes (Kwasnicki).

Cyclical behavior can be witnessed in other natural phenomena, e.g. calendar cycles, birth and death, seasonal cycles.

Business cycles – sinusoidal fluctuations in the economic activity, according to which a cycle consists of periods of an upward and downward movements, each of which can represent periods of boom, slowdowns, recessions, and etc.

- Types of cycles:

- Minor Cycles – 40 months average, i.e. 3-4 years.

- Major cycles – trade cycles of 2-3 minor cycles, i.e. 7-11 years (Kitchin).

- Observable indicators of cyclical nature:

- Price;

- Volume of Production;

- Volume of Consumption;

- Stock Market;

- Others.

- Proposed causes of the cycles:

- Climate;

- Over-investment;

- Monetary factors;

- Under-consumption;

- Psychological factors (Kwasnicki).

Kitchin Cycles

- Minor cycles in the economic activity named after Joseph Kitchin, a British statistician, who identified the major and minor cycles.

- Kitchin established that major cycles are “merely aggregates of two or three minor cycles.”

- Kitchin referred to the capitalist process as a reflection of the rhythmical movements in mass psychology as the possible explanation of his findings.

- Kitchin cycles were observed and confirmed in cases of interest rates and commercial papers between 1874 and 1913 in Britain, while the same cycles in the US were found to be of 4 years as stated by Mitchell and Burns (Glasner and Cooley 360).

Kitchin Cycle and Inventory

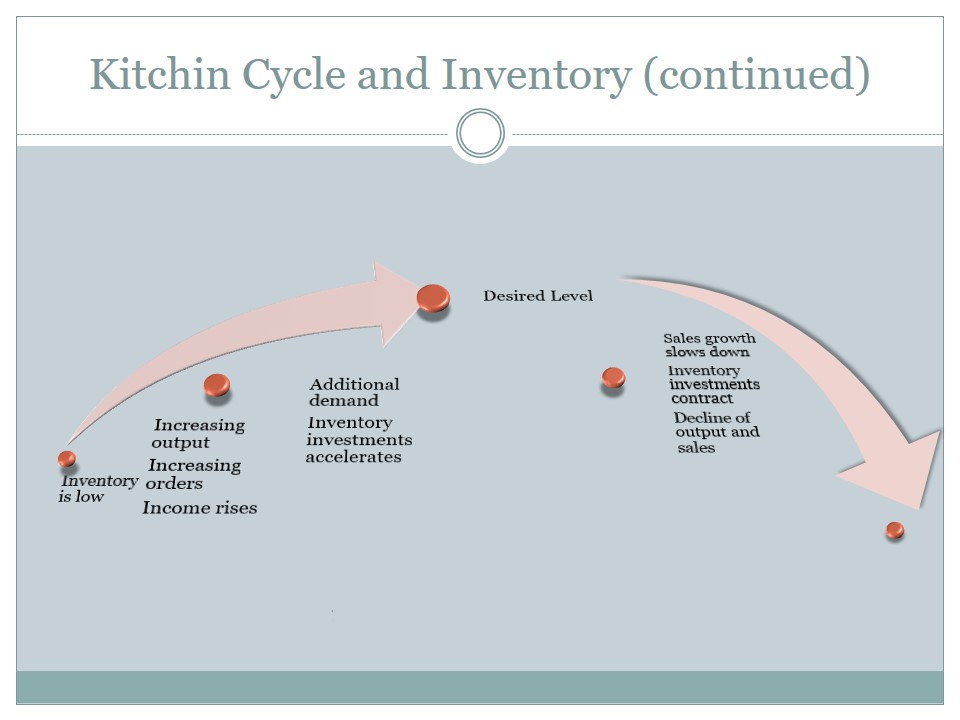

The relationship between the fluctuation of investments and the cycles of economy found a strong relationship between changes in inventory and the cyclical movements of economic activity .

The relationship between the inventory and the upward and downward movements of business cycle can be seen through inventory buildup and inventory liquidation respectively.

Metzler’s Model

- The inventory is an equilibrium.

- Recouping inventory loses implies a cyclical process in a stable economy, i.e. the equilibrium is disturbed.

- The income in the equilibrium is affected by the propensity to consume rather than inventory investments.

- The implications are for the system with sales output lag (Metzler).

- A provided results of a simulation showed that Kitchin cycles appear with investment delay of the order of 0.3 to 0.6 years and the price delay between 0.2 and 0.3 years (Kwasnicki).

Conclusion

The cycle in inventory changes can forecast changes in the economic activity.

Such conclusion can be implemented in predicting the fluctuation of the cycle.

References

Chapman, David. “A Short Primer on Cycles in the Current Market”. 2004. Union Securities. Web.

Glasner, David, and Thomas F. Cooley. Business Cycles and Depressions: An Encyclopedia. Garland Reference Library of Social Science. New York: Garland Pub., 1997. Print.

Kitchin, Joseph. “Cycles and Trends in Economic Factors.” The Review of Economics and Statistics 5 1 (1923): 10-16. Print.

Kwasnicki, Witold. “Are Business Cycles Inevitable?“. 2008. Munich Personal RePEc Archive. Web.

Metzler, Lloyd A. “The Nature and Stability of Inventory Cycles.” The Review of Economics and Statistics 23 3 (1941): 113-29. Print.