Kohl’s Corporation, founded in 1962, as of September 26, 2012, it operated 1,146 stores in 49 states. It is headquartered in Menomonee Falls, Wisconsin.

Kohl’s Corporation operates department stores in the United States. Its stores offer private, exclusive, and national branded apparel, footwear, and accessories for women, men, and children; soft home products, such as sheets and pillows; and housewares targeted to middle-income customers. The Kohl Company offers services such as online shopping in their online shopping platform.

Assumptions

As shown below, a conservative approach has been taken and we will assume that sales will grow at constant rates of 2.25% over 2013 to 2017. The effective tax rates and the total asset turnover of 51.31% and 3.93% are predictable.

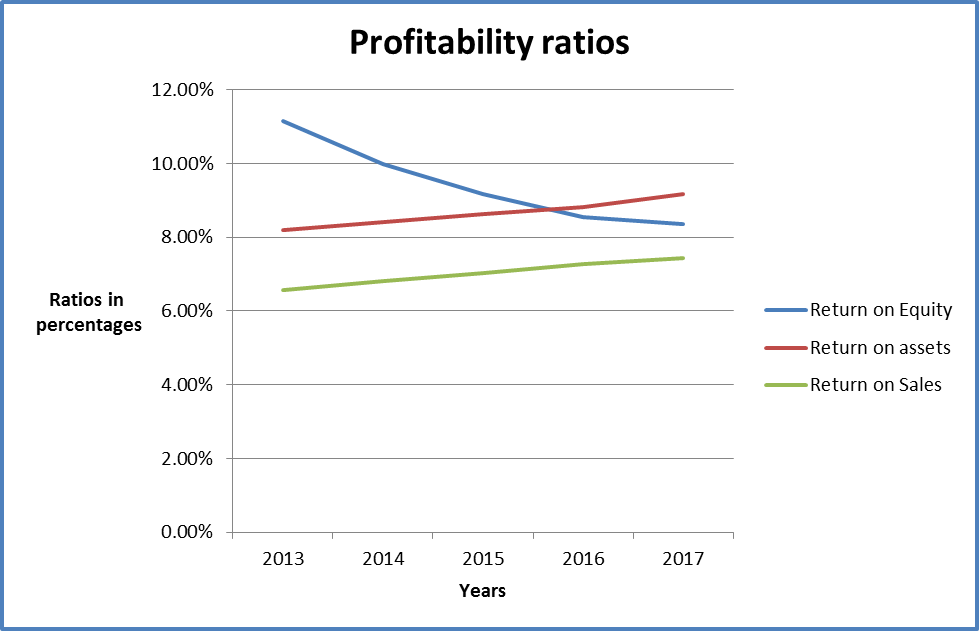

Profitability ratios

Profitability ratios give an indication of the earning capacity of an entity. The ratios measure the effectiveness of a company in meeting the profit objectives both in the long run and short run. The ratios show how well a company employs its resources to generate returns. Commonly used profitability ratios comprise of gross profit margin, operating profit margin, net profit margin, the return on asset ratio, and the return on equity (Gibson 2010). The table below summarizes profitability ratios for Kohl’s Corporation for the period of forecast.

From the calculations above, return on equity of the corporation is declining over the years. This can be attributed to the increasing value of the shareholders’ equity over the forecast period. It can be deduced that the increase in net profit is not large enough to offset the value of increase of shareholders’ equity. However , return on assets and return on sales are increasing. This could imply that the organization can manage costs and use assets efficiently to generate sales in the future years. The trend for the profitability ratios is shown in the graph below.

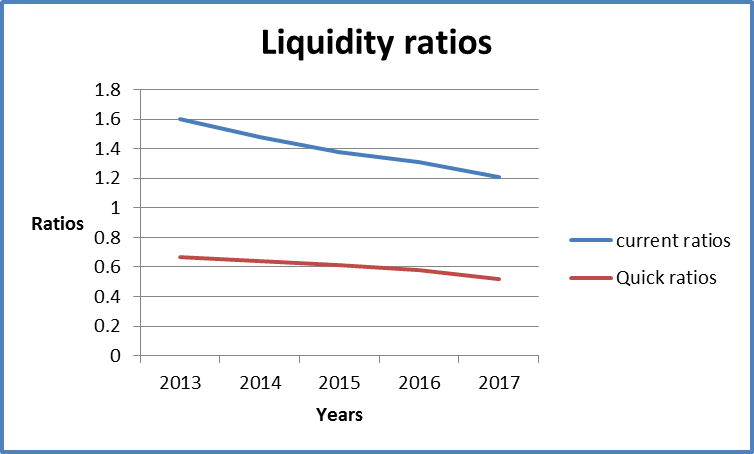

Liquidity ratios

Liquidity ratios show the ability of an organization to maintain positive cash flow while satisfying immediate obligations, that is, the availability of cash to pay current debt. The common ratios used to analyze liquidity are current and quick ratio (Lasher, 2011). It is necessary to maintain optimal liquidity ratios since either low of very high ratios are not favorable. The table below summarizes the liquidity ratios for the Corporation.

Current ratios for all he years are greater one. This implies that the organization is able to meet current obligations using current assets. However, the corporation cannot meet current obligations using quick assets. Both current and quick ratios declining over time. It is a bad indication since it shows that the company will be facing difficulties in paying current liabilities over the period of the forecast. The trend of profitability ratios is shown in the table below.

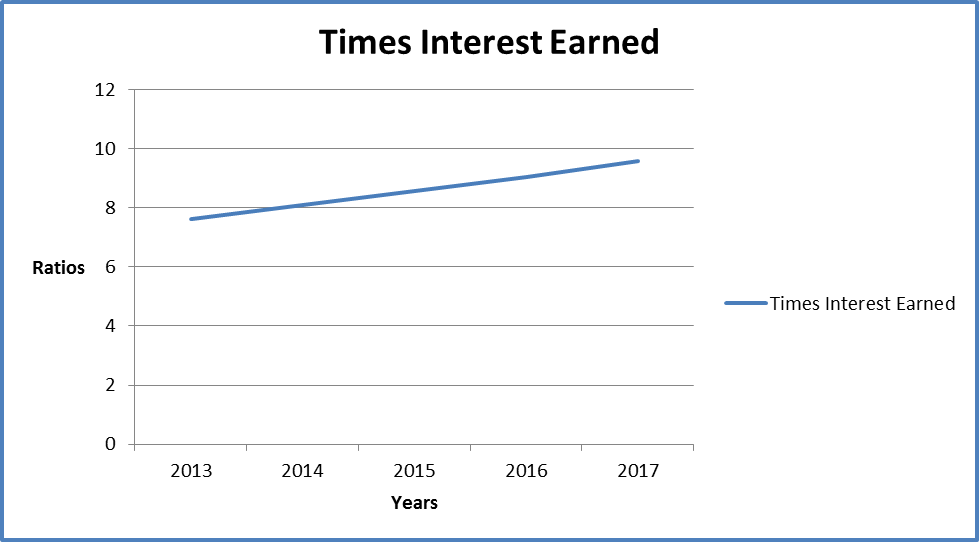

Solvency ratio

Solvency ratios measure the ability of the Corporation to repay the long term debts. A commonly used ratio that is used to measure solvency of a company is the times interest earned ratio.

From the table above, times interest earned ratio for the period are high and increasing. The ratios are favorable since the indicate an increasing ability of the company to pay off long term debts. The trend for the ratios is shown in the graph below.

Efficiency ratio

These ratios show the level of activity in a company, that is, how well a company manages resources to generate sales (Bragg, 2006). Turnover ratios are the most commonly used to measure efficiency as shown in the table below.

Inventory turnover ratio for the years is constant and low. The ratios indicate that the corporation reorders stock only three times in a year. This shows a very low level of activity of the organization.

References

Bragg, S. (2006). Financial analysis: a controller’s guide. New Jersey: John Wiley & Sons, Inc.

Gibson, C. (2010). Financial reporting and analysis: using financial accounting information. United States of America: South-Western Cengage Learning.

Lasher, W. (2011). Practical financial management. USA: South Cengage Learning.