Introduction

Over the past two centuries, a big gap between the rich countries and the poor countries has been consistently observed (Baulch and John 10; Glaeser et al. 120; Heckman 40; Leuz, Dhananjay and Peter 520; Syme 500; Becker 390). Economists have always been concerned with conducting studies that aim to understand economic disparities among countries across the world. Many factors like geographical and social factors have been shown to contribute to differences in economic strengths among countries. The rich countries are mainly located in temperate regions which are within the latitudes between 23.5N and 66.5N and between 23.5S and 66.5S. For example, in 2005, Canada, with the latitude of 60, had a GDP per capita of 36653.9 and the United Kingdom, with the latitude of 54, had a GDP per capita of 33982.91. On the other hand, the poor countries are mainly located in tropical zones, which are within the latitudes between 23.5S and 23.5N. For instance, in 2005, the GDP per capita of the Central African Republic, with a latitude of 7, was 532.32 and that of Indonesia, with a latitude of 5, was 3224.12. This means the difference in GDP per capita between the poor and the rich can be as big as 69 times. Also, according to Gallup, Sachs, and Mellinger (1999), GDP per capita in Africa (a tropical region) was only 8% of that in Western Europe (a temperate region) in 1992. It seems there is a relationship between a country’s economic growth and physical geography. The real question is “How does physical geography affect a country’s rate of economic growth over the long run?”

This paper analyzes how latitude affects a country’s rate of growth over the long run. The study hypothesized that countries with higher latitude have higher economic growth while countries with lower latitude have lower economic growth. This would be an important project because if a clear relationship between latitude and long-run economic growth is found, the tropical countries can try to find ways to solve problems related to their geographical locations and adjust their economies accordingly. The study used Gallup, Sachs, and Mellinger’s “Geography and Economic Development” (1999), Mellinger, Sachs and Gallup’s “Climate, Water Navigability, and Economic Development” (1999), and Masters and McMillan’s “Climate and Scale in Economic Growth” (2001), among other previous studies to support the project.

Literature Review

Gallup, Sachs, and Mellinger (1999) hypothesized that differences in physical geography could greatly affect a country’s economic development. The researchers tested the hypothesis by examining whether the differences in income levels and income growth had an impact on the differences in transport costs, disease burdens, agricultural productivity, and other factors such as population density. All these factors are related to physical geography. Long distances from core economies could imply that countries in the tropics have poor access to international markets for their products. For example, a country that is landlocked could have most of its fresh agricultural products go to waste because it could take a lot of time to reach international markets. Also, it could imply that most of its products are sold locally, fetching lower prices than those in international markets. The researchers found that there was a clear relationship between the prevalence of disease, especially malaria, as well as the productivity of agriculture in tropical zones, and the low economic growth rate. Diseases have been found to negatively impact the economies of countries across the world. Some tropical diseases like Malaria have high mortality and morbidity rates. A country characterized by high morbidity rates could imply that most of its citizens fall ill many times in a year. Citizens who are unhealthy do not participate in activities geared towards building national economies.

Masters and McMillan (2001) introduced a new variable, frost frequency, to define the tropical and temperate countries. Frost could be beneficial in eliminating pathogens implicated in agriculture and human health. It has been shown that pests and other crop pathogens greatly hinder countries from realizing agricultural sustainability. Human pathogens have also been found to lead to high cases of morbidity (Dalmazzone 25). More importantly, the tropics have much less winter frost (most of the tropics are frost-free) than the temperate zones. As a result, Masters and McMillan hypothesized that the differences in exposure to seasonal frost could lead to different Long Run (LR) economic growth rates. Using worldwide data collected between 1960 and 1990, they discovered that, firstly, population density and cultivation intensity are positively correlated with frost frequency but negatively correlated with frost–frequency squared. Secondly, there was a correlation between economic growth and the frequency of frost up to five days. These results are consistent with the fact that the proper amount of frost (five days) kills pathogens that could affect crops, but too much frost renders the weather too cold for agriculture purposes. Therefore, countries in temperate zones have lower cases of crop pest infestation than tropical countries. This could imply that the countries in the temperate zones have higher agricultural productivity than tropical countries. In addition, it could imply that countries in temperate zones have lower morbidity rates than tropical countries. Hence, much of their population could be engaged in meaningful economic activities during the year unlike in the tropical countries where a good number of citizens fall ill many times during the year. Also, tropical areas’ economic growth appears to rely more on gains from specialization and trade. Specialization in agriculture and trade positively correlates with the growth and stabilization of world economies.

Mellinger, Sachs and Gallup (1999) also hypothesized that countries in temperate zones have better LR growth than tropical countries. Using Geographic information systems (GIS) data on a global scale, the researchers discovered GDP per capita and the spatial density of economic activity measured as GDP/km2 were high in the near temperate zone: it accounted for 8% of the world’s inhabited land area, 23% of the world’s population, but 53% of the global GDP. Moreover, the GDP densities in the near temperate zone were on average 18 times higher than in the far temperate zones. The authors provided two reasons to explain why tropical zones fair so badly. One of the reasons is that tropics have higher levels of infectious diseases than temperate zones. This could imply that higher morbidity rates in tropical countries negatively impact human economic activities. Secondly, most of the landlocked tropical countries incurred higher costs in transporting products than coastal region countries. This could imply that landlocked countries spend much of their earnings to transport exports and imports, thereby reducing their long-term economic gains.

In summary, a correlation between income and physical geography has been found, and it can be caused by factors such as transport costs, disease prevalence, agricultural productivity, frost, and distance to navigable waterways. Still, some of the relationships, for example, the relationship between LR economic growth and latitude are not clear. The aim of this study was to use the linear regression method to prove the hypothesis that countries with higher latitude have higher economic growth, and countries with lower latitude will have lower economic growth. If the hypothesis would be supported by data to be analyzed, then it would be concluded that latitude has a great impact on the economic performances of countries across the world. If the hypothesis would not be supported by data collected and analyzed, then it would be concluded that latitude does not correlate with the economic performances of countries.

Data and Methods

GDP per capita was chosen as the dependent variable. The explanatory variables were average saving rate, population growth rate, education, and most importantly, latitude. Data on GDP and population dynamics were obtained from the Penn World Table. For the average saving rate, the consumption share of output was used. The two categories of data were also provided by the Penn World Table. For education, the data were from UNESCO. For the latitude, a sample size of 111 countries was taken from the World Fact Book in the Central Intelligence Agency. They were based on the locations provided in the Geographic Names Server (GNS), which were kept up by the National Geospatial-Intelligence Agency on behalf of the US Board on Geographic Names. The absolute value was chosen because it was indicative enough to isolate tropical zones from temperate zones.

Table 1: Variables and Key Data.

Besides using the growth rate of GDP per capita and the latitude to assess the relationship, population growth, average savings, and education were chosen as control variables to substantiate the findings related to GDP growth rate and the latitude.

Results

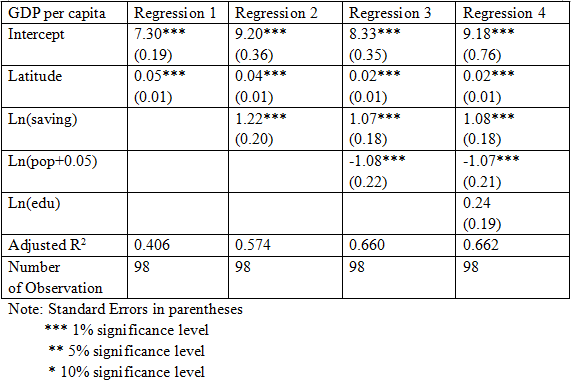

Linear regression was conducted four times to show how the addition of control variables affected the relationship between latitude and GDP per capita. Firstly, regression was done for natural logarithm of GDP in relation to the latitude of the sampled countries in degree. Secondly, regression was done for logarithm of GDP in relation to the latitude of countries sampled in degree. Thirdly, regression was done for natural logarithm of GDP per capita on the latitude of countries in degree, the natural logarithm of average saving rate, and the natural logarithm of population growth rate. Fourthly, regression was done for the natural logarithm of GDP per capita on the latitude of countries in degree, the natural logarithm of average saving rate, the natural logarithm of population growth rate, and the natural logarithm of education as a percentage of GDP. For the population variable, the value +0.05 was used as the standard deviation, assuming the data points were very close to the mean. The following were the study results:

Regression Results

The results of the regression analysis indicated that the adjusted R-Square increased from 0.325 to 0.662, which implied that as more variables were added, the model could become more accurate. The R-Square value showed how close variables were related in the study. R-Square values closer to 1 could mean that variables are much related to each other than those with values closer to zero (0). The significance level of ln(saving), ln(population), and latitude all proved to be 1%, which means that all of these variables had the predicted effect on GDP. However, the coefficient of ln(edu) is insignificant.

The model I use is the following:

In the model,

are the coefficients on the explanatory variables and ∈i are the error term.

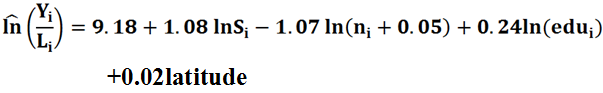

Using linear regression results, the following regression model was obtained:

This model showed that if other variables were held constant, and if countries were 1 degree closer to the equator, GDP per capita could grow by 0.02% more slowly. This could indicate that the more tropical a country is located, the lower its economic growth will be. On the other hand, the far a country is from the tropical regions the higher its economic growth.

For the correlation of the four explanatory variables, it was found that latitude had a positive relationship with saving rate and education, but had a negative relationship with the population growth rate. The following were the results for the explanation offered:

The results provided no surprise because the average saving rate and education were positively correlated with latitude. This was reasonable because a country with higher latitude could have a higher GDP per capita, which could allow people to save more and have higher levels of education. On the other hand, latitude was negatively related to the population growth rate, which was also predictable because a bigger population growth rate could mean a bigger economic burden and consequently a lower GDP per capita. If a country’s citizens have high levels of education, it could imply that they are equipped better to control vital systems and/or sectors in the economy. Well-educated individuals have better chances of improving economies than uneducated persons who rarely understand economic dynamics. In fact, developed countries are where they are today because they emphasized education among their citizens (Nelson and Edmund 70).

Conclusion

The study hypothesized that countries with higher latitude could have higher GDP per capita growth compared to the countries with lower latitude. The regression results demonstrated that when countries were 1 degree closer to the equator, GDP per capita grew by 0.02% more slowly, which meant that the more tropical a country was located, the lower its economic growth. The results correspond well with the discoveries of Gallup, Sachs and Mellinger (1999) which found that locations and climate affected income levels and income growth. The findings of Masters and McMillan (2001) that the tropics’ lower economic growth than the temperate zones is related to the fact that the tropics have much less winter frost were also supported. In addition, the results supported the revelations of Mellinger, Sachs, and Gallup (1999) which showed that GDP per capita and the spatial density of economic activity were high in temperate zones and regions within 100km of the ocean. The current study provides more evidence to prove that a country’s economic growth is closely related to its geographic location. However, the results are only based on GDP per capita in 2005. What would be done next is to cover more years to assess whether the results are consistent.

If studies in the future prove consistency, then it would be concluded that countries’ economic performances are determined by geographical locations. It has been suggested that scientific phenomena should be confirmed through continuous and closely monitored studies. Also, the observations in this study could not explain why Hongkong and Singapore, two tropical regions with lower latitudes, have higher GDP per capita, while Russia, a country with very similar latitude as Canada, has a much lower GDP per capita. Hongkong and Singapore are special because they have benefited greatly from their specific locations and have been able to generate large volumes of trade with China and other countries. Countries that can initiate and sustain trade ties with core economies have excellent economic performances. On the other hand, counties that are conservative about their trade with foreign countries rarely perform well economically. Such counties could lag behind other countries on the world map (Borensztein, Jose and Jong-Wha 120). For Russia, it could be explained by factors that are unrelated to physical geography but affect long-run economic growth significantly. For example, Russia has been a communist country with a planned economy for many decades while Canada has always had free-market and democratic systems, which have proved to be beneficial to economic growth.

Works Cited

Baulch, Bob, and John Hoddinott. “Economic mobility and poverty dynamics in developing countries.” The Journal of Development Studies 36.6 (2000): 1-24.

Becker, Gary S. “Nobel lecture: The economic way of looking at behavior.” Journal of political economy (1993): 385-409. Web.

Borensztein, Eduardo, Jose De Gregorio, and Jong-Wha Lee. “How does foreign direct investment affect economic growth?.” Journal of international Economics 45.1 (1998): 115-135. Web.

Dalmazzone, Silvana. “Economic factors affecting vulnerability to biological invasions.” The economics of biological invasions 1.1 (2000): 17-30. Web.

Gallup, John Luke, Jeffrey D. Sachs and Andrew D. Mellinger. “Geography and EconomicDevelopment.” International Regional Science Review 22.2 (1999): 179-232. Web.

Glaeser, Edward L., JoséA Scheinkman, and Andrei Shleifer. “Economic growth in a cross-section of cities.” Journal of Monetary Economics 36.1 (1995): 117-143. Web.

Heckman, James J. “Policies to foster human capital.” Research in economics 54.1 (2000): 3-56. Web.

Leuz, Christian, Dhananjay Nanda, and Peter D. Wysocki. “Earnings management and investor protection: an international comparison.” Journal of financial economics 69.3 (2003): 505-527. Web.

Masters, William A., and Margaret S. McMillan. “Climate and Scale in Economic Growth.” Journal of Economic Growth 6.3 (2001): 167-86. Web.

Mellinger, Andrew D., Jeffrey D. Sachs,and John L. Gallup. “Climate, Water Navigability, and Economic Development.” CID Working Paper No. 24 (1999). Web.

Nelson, Richard R., and Edmund S. Phelps. “Investment in humans, technological diffusion, and economic growth.” The American Economic Review 56.1/2 (1966): 69-75. Web.

Syme, S. Leonard. “Social and economic disparities in health: thoughts about intervention.” Milbank Quarterly 76.3 (1998): 493-505. Web.