Executive Summary

Lenovo Group Limited is a Chinese second-largest vendor of computer hardware and electronic products, headquartered in Beijing and Hong Kong, China, and Morrisville, North Carolina, United States. The company trades in PCs, notebooks and other PC+ products. The company enjoys a larger market share in China (31.7% as at 1Q11).

On the global arena, in the fiscal year-end 2011, the company got whooping US$ 29.57 million in revenues, having elevated it to its current position. To this end, both its brand name and research team are the reason behind its successes.

The company enjoys better marketing strategies that give it an edge on other players in the industry, and together with a sophisticated products’ portfolio, Lenovo remains competitive. This makes it a sought-after company that any country would not hesitate to give a green-light to invest in to harness the benefits that include employment opportunities, infrastructure growth, tax revenues, among others.

Company Description

Lenovo Group Limited, the world’s second-largest vendor of computer hardware and electronic products, traces its roots back in Beijing, China. Headquartered in Beijing and Hong Kong, China, as well as Morrisville, North Carolina, United States, the company significantly came into the limelight thanks to the acquisition of IBM PC operations.

This propelled its market share six years down the line in the year 2011, to topple Dell behind Hewlett-Packard (HP) as the second leading PC merchant in the world. In terms of revenue collection, as per the fiscal year-end March 31, 2011, Lenovo Group Limited gained whooping US$ 29.57 million with nearly half of it having been generated locally.

With respect to percentage unit sales as at the fiscal year-end 2011, Lenovo Group Ltd. had 13% of market share vis-à-vis 12.1% to Dell’s market share, consequently relegating it as the third-largest behind the former universally. To enhance its operations, Lenovo is supported by a workforce of 27,000 people around the world. To keep abreast with the ever-evolving world, behind this workforce, there exists a research team based in China; Japan; France, Paris; Singapore and the US.

Its merchandise includes “tablet computers, personal computers, mobile phones, electronic storage devices, servers, workstations, smart televisions and IT management software.”

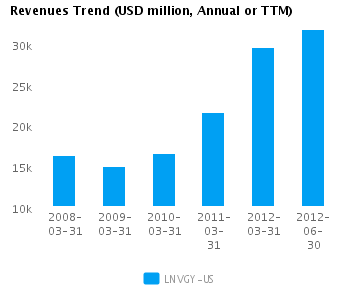

The future prospect of Lenovo is to rapidly grow marketwise and profitably above other players in the industry. To have an edge on its competitors, Lenovo provides its clients with the state-of-the-art PCs coupled with an unrivaled ownership experience. To this end, Lenovo has realized a steady growth in revenue as attested by the graph in appendix I. By June 2012, the revenues reached a new height of US$ 37.6 million.

Its growth in revenue for the past 3 years relative to its peers has been amazing, 27.2% versus 6.6% respectively. The future seems brilliant for Lenovo as the market envisions a higher “long-term growth prospect giving it a better than peer median PE ratio of 18.6.” As such, its growth projections are considered superior than its peers’. To save its competitive advantage over its rivals, its strategies are built around its strengths as well as the market opportunities open for grabs.

Company’s International Strategy

Lenovo Group Limited generates its revenues from the sales of PCs and electronic appliances all over the world. A big chunk of its revenue (nearly 95%) is skewed towards notebooks and desktop computers with the former having sold significantly higher after the acquisition of IBM in the fiscal year 2006/7.

Its main strategic focus is to ensure that all the integral parts of the organization work in tandem to achieve a common goal. To this end, Lenovo aligns itself along four core strategic initiatives vital in the implementation of the key aspects of its strategy.

To this front, Lenovo strategizes on the successful worldwide expansion in transaction business model to market it further as a global player in PC industry with respect to SMB (small and medium business). Moreover, cost-effective supply chains and efficient delivery are other strategies that Lenovo prides itself on since this has greatly improved its serviceability.

Lenovo products are sold all over the world with China’s market accounting for a lion’s share (31.7% of Chinese PCs units during the 1Q11). According to Gartner’s research, Lenovo momentarily ousted HP at the helm of global PC shipments in the 3Q12 (the third quarter of 2012). This could be attributed to the aggressive marketing campaigns aimed at boosting its brand name recognition.

To keep it competitive in the market, Lenovo constantly develops novel and user-efficient PCs, suitable for various purposes due to efforts and developments of its research team based in China, Japan, France, Singapore and the US. The rationale of the decision to choose these regions as its center of research is partly because of resource availability, and partly because of the ease with which a new technology penetrates the promising market.

Besides its technological innovative approach in a quest to maintain its market share and further expand it; Lenovo faces competition from its rivals like HP, Dell Inc. and Acer Incorporated. However, after several attempts in the year 2011, Lenovo managed to topple Dell Inc. (approximately 43 million units) to become the second-largest vendor worldwide, selling approximately 47.6 million units (refer to appendix II).

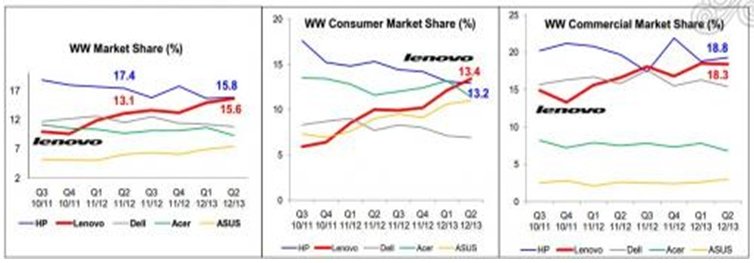

With respect to the company’s strength, Lenovo prides itself upon a strong brand name coupled with an enormous market share. Ranked the second after HP with an upward inclining trend (Appendix III) in the recent past, Lenovo shows a tremendous capability for advancement owing to its superior reputation on “high quality, high end products inherited from IBM.”

Moreover, the workforce maintained from IBM notebook faction injects the necessary experience giving it an edge on new players in the industry (especially, in US market). Concerted efforts aimed at reducing its marginal costs have seen Lenovo introduce an in-house manufacturing. As such, Lenovo braces itself up for price wars better than its competitors do.

One of Lenovo weaknesses is attributed to the fact that it is a relatively new company in the global arena. Consequently, it faces an uphill task in its quest in trying to penetrate foreign markets. Additionally, the existence of fake products limits its growth in market share. Moreover, its initial marketing strategy biased within China’s market was not beneficial since it would have found it difficult to retain sustained growth rate in acquired market segments.

A glimpse of the short-term strategies brings to the fore the need to improve global supply chain to further reduce its costs to enable the company to realize a greater profit margin. This is achievable through bringing industry experts on board to further curtail the losses through driving manufacturing optimization.

A focus on the long-term strategies brings to the fore the company’s projections of further investing in building “its core competencies, product innovation, branding and new PC+ segments, including mobile internet and digital home (MIDH), balancing expenses and revenues to drive long-term sustainable profit growth.” This will be achieved through its ‘Protect and Attack’ strategy which focuses on exploring new markets, while protecting the ‘mature markets.’

Company’s Marketing Approach

Lenovo products are sold worldwide, with China, its domestic market, accounting for a greater market share (31.7% as at 1Q11). On the foreign front, the US leads other market segments including Europe, the Middle East and Africa, among others. Significantly, it is worthy noting that Lenovo momentarily has advantage over HP in total PC shipment in the 3Q12. This is attributed to the customers’ changing preference ditching traditional PCs in favor of the more sophisticated Lenovo tablet devices developed due to its powerful research team.

With its research team strategically headquartered in potentially promising market segments, Lenovo ensures quicker penetration of technological innovations. Additionally, the decentralization of headquarters around the world enhances its ability to reach out to the multitude.

To enhance its brand name internationally, the company uses global events, such as Olympics, Space contests, e.g., NASA and National Football Leagues (NFL) for market campaigns. To distribute products worldwide, the company uses middlemen including wholesalers, agents and retailers.

Company’s Logistics Approach

With the main facilities in Beijing; Morrisville, North Carolina, and Singapore, and with research centers in Japan, China and the US, the main goal is to reach out to the regions’ enormous population quickly and efficiently.

These regions are good market segments for its middle and high-end products because people can afford them. Furthermore, these countries have stronger currencies and are economically stable and technologically advanced to support company’s growth. In terms of resources, these regions have the necessary human as well as economic resources to enhance its development.

Company’s Human Resource Management (HMR) Approach

Lenovo recognizes the essence of attracting as well as retaining excellent employees. In line with this philosophy, the company boasts of its formal, clear and performance-aided remuneration package covering its top brass management personalities. These incentives come as performance bonuses, retirement benefits and allowances.

The company focuses on its shareholders’ interests, giving a 21-days notice, prior to an annual general meeting, and taking the members’ contributions’ into consideration. The company enhances sustainable business practices along four fronts including environment, employee health and welfare, global supply chain and corporate social investments.

Analysis

On allowing the company to set up its operations, the host country gains a couple of benefits that include employment opportunities to the local residents. The locals are highly motivated owing to the company’s remuneration policy which helps improve on the living standards of the citizens as a result. The host country should not shun company’s intentions to invest in the same, appealing to environmental hazards, because the company is environmental cautious.

Furthermore, the member country will experience all the first-hand technological innovations as soon as they are released to the market. With the high revenues ranging to billions, the host nation stands to gain either directly through tax revenues or indirectly through the other sectors of economy, e.g., infrastructure. Also, the host nation benefits from relatively cheap products thanks to a shorter supply chain.

However, with a better remuneration package, the hosting nation can risk widening the gap between the rich and the poor. Lenovo-employed members will assume a higher social class increasing the living standards and hence causing class conflict and segregation.

Recommendation and Conclusion

On weighing the options studied in the analysis above, the benefits outweigh the risks. As such, I would allow the company to invest in the country since the locals will enjoy employment opportunities, among other benefits. Vitally, with the company’s enormous revenues, the host nation will get an opportunity to directly gain astronomically through tax revenues.

Bibliography

Chao, Loretta. “As Rivals Outsource, Lenovo Keeps Production In-House.” The Wall Street Journal 4, no. 21 (2012): 34-40.

Kobie, Nicole. “Lenovo targets European market with ex-CEO of Acer.” Thomson-Reuters Magazine, January 2012.

Little, Lyneka. “CEO of Lenovo Gives $3 Million in Bonuses to Employees.” ABC Magazine, February 2011.

Owen, Fletcher. “Lenovo passes Dell to become world’s No 2 PC maker.” MarketWatch Magazine, April 2012.

Zhijun, Ling. The Lenovo Affair. Singapore: John Wiley & Sons, 2006, 15.

Appendices

Appendix I: Lenovo revenue trends from 2008-2012.

Appendix II: Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2011

Table 1

Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2011 (Units)

Appendix III: Lenovo market share trends vs. its competitors