Research Proposal

Introduction

Within the Saudi Arabian context, the corporate or institutional investors are faced with lack of investment options to invest their surplus in lucrative as well as liquid investment vehicles. The investment options available to the investors do not meet all the requirements attached to standardized money market funds. Even the investment options available do not meet the needs of the corporate treasurer.

Under such circumstances, liquidity funds offer themselves as one of the best investment options for the investors. Considering the availability of different investment opportunities in Saudi Arabian capital and money market and the associated limitations, liquidity funds may provide as one of the best alternatives to the corporate and institutional investors. In this context, this research will assess the suitability of liquidity funds as an investment tool in the context of Saudi Arabia, by undertaking qualitative interviews with the professionals associated with investment portfolios.

Liquidity Funds – an Overview

Liquidity funds represent financial instruments, which channelize the investible surpluses by undertaking to invest in diversified portfolios. These portfolios consist of different money market instruments ensuring superior levels of current returns to the investors. The funds entail low cost and they are operated in a secured way to guarantee the safety of the investments as well. An efficient operational cash management characterizes the liquidity funds. Specialist “liquidity fund managers” carry out the planning and execution of investments and the managers take into account the different investment needs of the clients.

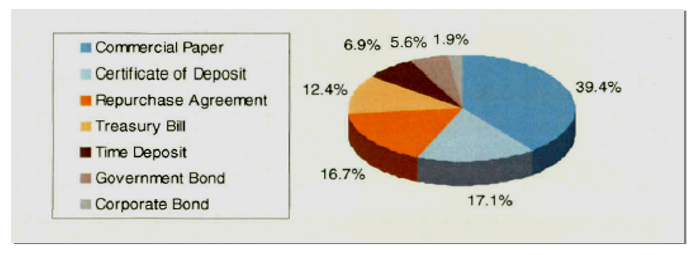

Liquidity funds are structured in the same way as that of a corporate entity with a board of directors to regulate the conduct of the affairs of the fund. A liquidity fund takes the form of an open-ended umbrella unit trust. The resources of the fund are invested in various sub-funds. The following figure indicates the typical sub funds making up a liquidity fund.

Liquidity funds are more suitable for those investors, who are keen on the security of their capital, and would like to have daily access to their funds (Global Liquidity, 2011). It is also suitable for the investors who are expecting a competitive risk adjusted yield on the funds invested. Liquidity funds will present a suitable investment tool for various types of investors like banks, large corporations, investment banks and institutions, banks and trusts who are desirous of maximizing the returns on the cash held by them, without being exposed to higher level of risks. Several benefits such as risk limitations and holding superior class of assets may accrue from investment in liquidity funds. These distinct advantages of liquidity funds make the investments suitable for the investors in Saudi Arabia

Saudi Arabian Economy – an Overview

While pursuing the research on the suitability of liquidity funds as an investment tool in Saudi Arabia, it is important to consider the peculiar features of the Saudi Arabian economy, which have strong influence on the movement of money markets within the economy. The Saudi Arabian economy like the economy of any other oil-producing countries is significantly dominated by oil revenues, which predominantly set the overall pace of the economic activities in the country. It also largely affects the movement of capital and money markets within the economy. Despite the growth in the contribution of non-oil sectors to the economic growth, oil revenue continues to be major contributor.

One of the important factors affecting the movement of money market in the Kingdom is the fact that most of the oil revenues accrue directly to the government. This has an implication in that the domestic money supply is largely related to the government expenditure rather than the flow of international funds. The fiscal policy of the country is influenced by the large proportion of oil revenue, which leads to limited control of monetary authority over the monetary aggregate. This has its influence on the avenues available for investments.

Since the Saudi Arabian economy is an open economy, there is a large impact of external financial factors such as foreign interest rate on the economic activities, which affect the investment opportunities also. “Several empirical studies(6) related to the Saudi money market reveal that the foreign interest rate, particularly U.S. interest rate, and the movement of the Riyal’s exchange rate, especially against US dollar, have a significant impact-on the Saudi money market (i.e. demand for money, supply of money and Riyal interest rate)” (Al-Bassam, 1999). This research will consider the impact of these macroeconomic factors while pursuing the research inquiry.

Motivation for the Research

The treasury manager of a corporate undertaking or the fund manager of an investment institution is always faced with the dilemma of allocating the existing financial resources to earn reasonable rate of return. At the same time, there is the responsibility to ensure that the funds are available at short notice, in case of an eventuality to meet any urgent financial liability. This calls for choosing investment vehicles, which are not only lucrative but also liquid.

The association of the researcher with the analysis of various investment opportunities acted as the motivation to conduct the research, as the liquidity funds offered both liquidity and return for the corporate and institutional investors. However, liquidity funds are not operating widely in the Saudi Arabian context, although they have established their significant presence in the money markets of developed countries. The unavailability of liquidity funds in a large scale, (which in the opinion of the researcher would meet the requirements of the corporate and institutional investors) as investment vehicle in Saudi Arabia, added to the interest in the study of it suitability to Saudi Arabian market.

Problem Statement

Although there has been steady progress in the investment options in the Kingdom of Saudi Arabia, the investment tools available are not wide enough to ensure both liquidity and return to the investors. A number of factors influence this situation. In this context, the corporate and institutional investors find it difficult to park their funds for temporary periods and earn out of such investments. The product offerings in the available investment areas like real estate, commodities and private equities, there is only limited product offerings. The markets are in their early stage of development. There is rapid growth of the debt markets.

Even in the face of growing requirements of long-term funds, the capital markets of Saudi Arabia stands apart from the other established capital markets. In the developed capital markets, bonds serve as an effective source of corporate funding and investment vehicle for the institutional investors. This major asset class for the institutional investors is totally missing in Saudi Arabia. The relatively young stock market does not offer a wide range of regional investment opportunities to the investors.

In addition, because of the recent global financial crisis, the money markets and capital market of Saudi Arabia have been severely hit affecting the sentiments of the institutional and corporate investors. This situation has led to the necessity of finding appropriate alternative investment tool. This research will assess the suitability of liquidity funds as a major investment tool in the context of Saudi Arabia.

Research Hypotheses

Assessing the suitability of liquidity funds as one of the major investment tools for corporate and institutional investors in Saudi Arabia is the central aim of this study. In the process of achieving this aim, the research will attempt to achieve the following other objectives.

- To study in depth the money market conditions in the Saudi Arabian economy to explore the available investment opportunities and vehicles

- To study the characteristics and peculiarities of liquidity funds to offer themselves as attractive investment tools

- To explore the potential merits and demerits of adopting liquidity funds as an investment tool in an emerging economy like that of Saudi Arabia

The proposed research will test the following hypothesis by engaging appropriate research design and method.

H1: Liquidity funds offer a versatile investment opportunity to the corporate and institutional investors in Saudi Arabia for ensuring return and liquidity

Research Methodology

This research has been undertaken to assess the suitability of liquidity funds as an investment tool in the context of Saudi Arabia. In order to achieve its objectives, this research proposes to use qualitative semi-structured interviews among the chosen finance professionals and funds managers of investment banks. Denzin and Lincoln (1998) state the researcher is independent to engage any research approach, so long as the method engaged enables him to complete the research and achieve its objectives.

Even though quantitative survey might prove useful for collecting the required data and information, qualitative interview method is better in view of the fact that a majority of the samples may not have the basic understanding of the intricacies of investment in liquid funds and its application to an effective portfolio development. Qualitative research method is also referred to as a ‘naturalistic’ research (Bogdan and Biklen (1982); Lincoln and Guba (1985); Patton (1990); Eisner (1991).

According to Marshall and Rossman (1995), the qualitative research is based on collection of data from different sources and the data already collected forms the basis for reporting the findings of the study and making recommendations. Yin (1984) identified different sources like “archival records, direct observations, interviews, and observation of the participants,” for data collection to conduct qualitative research.

Moreover, personal face-to-face interviews will enable the researcher to get pertinent details from the interviewees, as in the case of surveys the samples might have the tendency to answer the questions without any basic understanding. Considering the complexity of the research topic, telephonic interviews were considered ineffective, as the telephone interviews may take longer time and there is the potential danger of misinterpreting either the questions or answers. Therefore, the current research will employ qualitative semi-structured interviews. The number of interviews will be decided based on the availability of the professionals and managers for interviews and in any case, the number of interviewees is likely to be between 25 and 30.

Collection of Primary Data

The interviews will be conducted using the draft questionnaire containing questions on the perceptions of the respondents on the use of liquidity funds as investment vehicles in Saudi Arabia. The interview will be conducted in the respective offices of the professionals out of the working hours at times convenient for the interviewees. The interview questions will pertain to the effectiveness of liquidity funds as an investment tool and the barriers in adopting them in the Saudi Arabian context. The interview will also touch the relative merits of liquidity funds.

Collection of Secondary Data

According to Al-Mashari, Zahir & Zairi (2001), because of “lack of methodological research constructs” it becomes important that an in-depth review of the relevant literature is undertaken. Therefore, an extensive literature review will be attempted using professional journals and other research publications containing articles on liquidity funds and its application as a successful investment vehicle. The research will review the theoretical contributions of various scholars and researchers for arriving at the theoretical foundation for the research.

Data Analysis

Since the information gathered is qualitative in nature, there will be no statistical methods used to analyse the data collected. An in-depth analysis of the factors and their comparison with the theoretical findings will be undertaken to achieve the research objectives.

Clarification of Concepts and Terms

For the purpose of this research, liquidity funds will denote investments in all financial instruments, which are normally comprised in an investment portfolio such as treasury bills, time deposits, government and corporate bonds and other commercial papers.

The setting for the research will be the Kingdom of Saudi Arabia and the scope of the research will include the operation of the liquidity funds within the Saudi Arabian economy; but will cover all the international investment opportunities as they are allowed within the capital market regulations of Saudi Arabian government.

Framework for the Research Report

The research report will be structured to consist five chapters. The First chapter will introduce the background of this research and the objectives of conducting the research. The research hypothesis will be presented in this chapter. There will be the statement of the problem and the significance of the research included in this chapter.

Chapter Two will contain the literature review. This review will form the basis of the theoretical foundations for the research. The semi-structured interview questions will be conducted based on the knowledge acquired out of the literature review.

Chapter Three will describe the methodology used to conduct this research. A review of the various data gathering techniques will be presented along with the strengths and weaknesses. The design of the research instrument and the process of selection of samples will also be discussed in this chapter.

Chapter Four will deal with the analysis of the data collected. The chapter will contain a detailed discussion on the findings of the interview. The discussion relates to all the points covered by the questionnaire and a critical analysis made on the findings.

Chapter Five will be the concluding chapter, which will present a recap of the research and the chapter will present recommendations for future researches. The interview questionnaire used for drawing information from the samples will be presented as Appendix to the research report.

References

Al-Bassam A Khalid, (1999), Domestic and External Sources of Inflation in Saudi Arabia: An Empirical Study, Economics & Administration, Vol 13, No. 1 pp 3-30.

Al-Mashari, Majed; Irani, Zahir & Zairi, Mohamed, 2001, Business process reengineering: a survey of international experience, Business Process Management, Vol. 7 No. 5, p.p. 437-455, © MCB University Press, 1463, 7154.

Bogdan, R C and S K Biklen, (1982), Qualitative research for education: An introduction to theory and methods, Boston: Allyn and Bacon Inc.

Denzin, N K and Y S Lincoln, 1998, Strategies of qualitative inquiry, Thousand Oaks CA: Sage Publications.

Eisner, E W., 1991, The enlightened eye: Qualitative inquiry and the enhancement of educational practice, New York NY: MacMillan Publishing Company.

Global Liquidity, (2011) JPMorgan Euro Government Liquidity Fund Premier Shares. Web.

Lincoln, Y., & Guba, E, (1985), Naturalistic inquiry New York: Sage.

Marshall, C & Rossman, G. B., (1995), Designing qualitative research (2nd Ed.), Newbury Park, CA: Sage.

Patton, M Q., (1990), Qualitative Evaluation and Research Methods (2nd ed.). Newbury Park CA: Sage Publications.