Introduction

Businesses are established with the intention of making positive returns to shareholders. But this is not guaranteed, since there are numerous challenges that those business organizations face as they operate in the wider environment (Jain & Haley, 2009). Many forces have combined to make the business environment in modern world complex and sometime uncertain, which has forced companies and businesses to initiate strategies that are superior in responding to the market needs. Therefore, today, many businesses are involved in developing diverse market orientations that give business managers opportunity to analyze, plan and implement strategies within the local markets and outside markets in which the businesses operate.

To succeed in this new dynamic business environment, businesses will require having in place, marketing planning strategies that perfectly capture the nature of the business environment while at same time responding to customer needs and wants in the most appropriate way. Marketing plans envisioned should be effective and efficient in nature to enable the company chart successfully through the murky and turbulent waters of modern business environment. The plan should integrate the goals and objectives of the business in the widest perspective. At the same time, the marketing planning should have foundation in the vision, mission, and goals of the business, and be able to give proper outline on how well to achieve set goals ands objectives for the business (Hamper and Baugh, 1990).

Market Overview

Market trends

Banking and financial institutions demonstrate greater potential for growth even as the wider market faces some challenges. As early as 2010, it was established that about 40% of UK banks had increased their business volumes and opportunities and only 9% had witnessed decline in their growth volumes (BBC News Business, 2010). At the same time, the research conducted by CBI during the same year indicated that, since 2007 banks have been on the upward move, a fact that is likely to continue into the future (BBC News Business, 2010). On overall, majority of banks continue to report positive profits even though some regulations and restructuring initiated in the banking sector has been blamed for slow growth rate unlike it had been projected before.

Lloyds Banking Group has been growing and expanding innovative products (Lloyds Banking Group, N.d). This is especially after its merger with TSB Group. The bank’s efforts remain largely centered on innovation, and its products are diversified in numerous markets in the country and around the world (New York Times, 1995). These products the company has diversified in various products and markets in an attempt to grow and increase its share in the market. Therefore, the wider market trend in the banking sector shows that relative growth is going to be recorded although it may not be the exact figure or rate hoped for due to numerous stifling issues emerging in the sector. Nevertheless, to respond appropriately, many banks have beefed up their marketing strategies with emphasis on research, innovations and unique products development that resonate well with the market.

Market growth

Moreover, as the current market trend reflects growth, Lloyds Banking Group actively participates in innovating, designing, and implementing innovative strategies with regard to customized products and services that address and satisfy consumer needs (Standard and Poor, 2010). Market growth for banking services is promising as evidenced in CBI report of 2010 (BBC News Business, 2010). This aspect can further be linked to Lloyds continued growth through numerous diversifications: investments, underwriting of securities, portfolio management, and in insurance businesses.

Therefore, market trend for financial industry is likely to remain dynamic and full of potential opportunities as globalization, consolidation, deregulation and diversification in the industry remain the order of the day in the new modern world. The bank has diversified in many products and markets in UK and around the world. Due to its numerous brands, Lloyds Bank has transcended its services in different regions of the globe that include USA, Europe, Middle East, and Asia. In wider perspective, Lloyds Banking Group plc exhibits potential for growth, and this can be reflected in its vision and mission. Banking industry is growing as more needs for banking products and services are needed. The market is promising and growing in many parts of the world.

Marketing Mix

In analyzing market overview for Lloyds Banking Group plc, key aspects to be investigated include market mix-4Ps; market trends; market growth and the size of the market. For a long time, marketing approach in different sectors hinges on 4Ps of marketing that include product, promotion, price, and place (Smith and Taylor, 2004). As a result, Lloyds Banking Group financial services can be analyzed in the four (4Ps) of marketing. With regard to products, Lloyds Banking is home to numerous innovative financial products that include retail banking products, wholesale banking products, wealth and international products, and insurance products (University of Cambridge, 2011). As a result, the company has diversified products in form of personal loans, savings, mortgages, credit cards, and social banking products. Moreover, the bank is actively involved in treasury, corporate markets, asset finance market, real estate, and equity markets.

The second P concerns promotion. Lloyds Banking Group plc actively promotes its products and services through numerous marketing channels in accordance to market target and needs. On overall, the bank employs effective integrated marketing communication (IMC) techniques in its promotion activities (Lloyds Banking Group, N.d). This has seen the bank utilizing numerous channels including print, electronic, and broadcast media in advertising and promoting its products to large groups of customers.

The third P concerns price. Deregulation in the financial sector in the country has largely freed the banking sector from shackles of administered price structure. As a result, pricing remain a strategic tool for most banks including Lloyds Banking. Lloyds pricing structure is done in accordance with market realities; here, asset-liability price strategy is normally used. Nevertheless, the bank has to selectively adopt different pricing models in accordance to different markets that it operates.

The fourth P is the place, where Lloyds Banking Group plc has diversified its products and services in numerous markets across UK and Scotland. Moreover, the bank continues to strategically position its products in potential markets across the world such as USA, Asia, Europe, and Middle East (Lloyds Banking Group, N.d). In all these various markets, Lloyds Banking presents its products as the best, catering for each consumer’s needs in the most unique way.

Analysis of Bank Situation

Financial summary

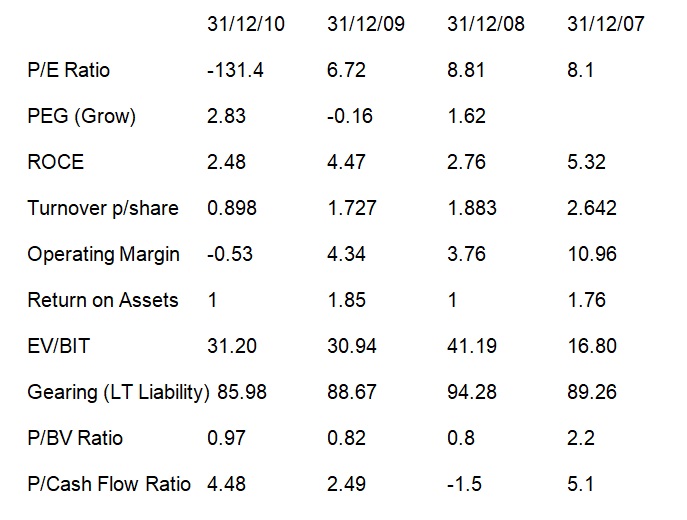

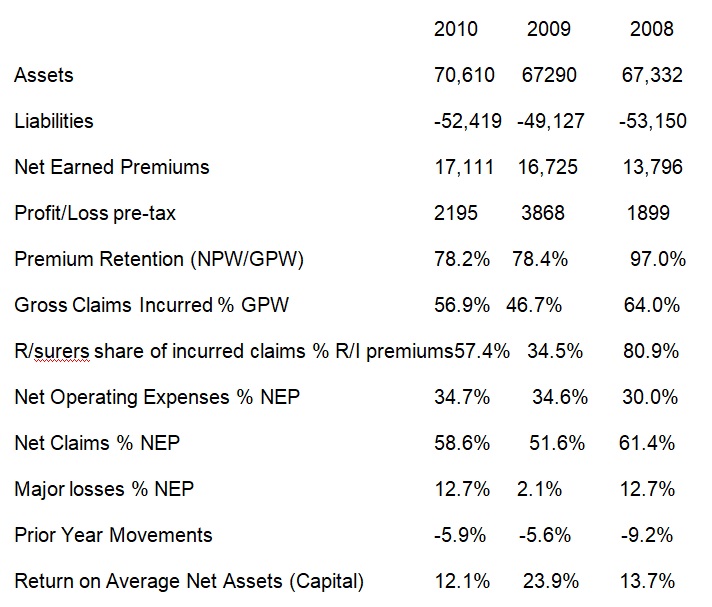

Since it was established through acquisition and merger in 2009, Lloyds Banking Group Plc. continues to experience success especially when analysis of its growth and financial progress is conducted (Financial Times 2011). The aspect of growth in the bank can be linked to happenings of 2010, where the bank witnessed growth of about 5% in its net insurance claims. The growth of the bank has strong attachment to the bank’s values and strategic plans, which the management team, directors, and workforce of the company pursue with enthusiasm and high motivation (Lloyds Banking Group, 2011). Nevertheless, financial growth for Lloyds is largely pronounced in the retail-banking sector where the bank continues to establish strong presence and control.

Some quick purview into financial performance of Lloyds shows that, the bank witnessed 6% decrease in income in the wholesale banking unit, and this is linked to the reduced net interest (Lloyds Banking Group, 2011). On the other hand, the bank also realized some gains in wealth and international, recording 4% increase. Furthermore, the insurance sector for the bank recorded an increase growth of 3.4% (Lloyds Banking Group, 2011). As expressed in the financial statement for the year 2011, it can be deduced that Lloyds Banking made some gains in terms of growth as compared to the previous year (2010). As the market trend for the overall banking industry shows future growth, it is necessary to state that Lloyds Banking is likely to continue on its growth path, especially in line with its strategic plan framework, which acts as a strong blueprint for the company.

On overall, the financial summary for Lloyds Banking during the half-year period of 2011shows that, the bank witnessed reduced non-core assets to 162 billion pounds, which represented reduction of about 31 billion pounds (Lloyds banking Group, 2011). Excellent progress was witnessed in the wholesale banking, with about 25 billion pounds being issued. In addition, growth was witnessed in customer relationship deposits by about 3%, which is the reduction witnessed in the non-core asset (Lloyds Banking Group, 2011). At the same time, the underlying profit before tax, excluding liability management increased by 36% to 1,340 million pounds as compared to the previous year (2010) of 988 million pounds (Lloyds Banking Group, 2011).

Mission Statement

Lloyds Banking Group operates and conducts its activities under a strong influence of vision and mission statements (Lloyds Banking Group, 2010). The vision for the bank acts as the guiding philosophy for the institution. As a result of strong vision, the company continue to be one of the biggest financial institutions across the world through market diversification, discovery of new opportunities, mergers and acquisition, and innovation of exemplary products (Lloyds Banking Group, 2010).Today, based on vision of becoming market leader and best institution in financial services, the bank has been able to undertake many initiatives and opportunities that have been aimed at giving it competitive market edge over the competitors.

In the recent times, the bank has initiated some changes that aim at ensuring the vision of the bank is achieved. For instance, the bank has made a number of internal appointments to strengthen its management team (Lloyds Banking Group, 2010). The organization structure of the bank has further been modified into a flatter one, which is more agile, close conduct to the customers and other stakeholders. Also, ingrained in the bank’s vision is a broad but specific mission statement, which has been formulated on the basic objective of serving a huge number of financial clients. For instance, the mission of the bank is to serve about 40 million clients who have diverse financial needs, and in order to achieve the mission, the bank aims at establishing unique role and position in the wider society (Lloyds Banking Group, 2010). As a result, mission acts as the daily objective and guidance framework that the bank aims at succeeding and not failing.

SWOT Analysis

Analyzing both internal and external environments of business entity is necessary, especially in formulating strategic plans and formulating objectives of growth, competitiveness, and sustainability in the market (Griffin, 2011). In the case of Lloyds Banking Group, the following aspects are analyzed, forming the basis of SWOT Analysis for the bank.

Strengths

Strengths of Lloyds Banking Group are manifested in a number of aspects. First, the shareholding by the UK government (40%) in the bank has ensured the security equity for the bank remains stable, which gives the bank an edge in exploring and exploiting numerous and diverse markets (Lloyds Banking Group, 2010). The company specializes in four main business areas that continue to draw strength for the company. Key areas for the company’s growth include: retail banking that encompasses mortgage markets, wholesale and life, pension and insurance, and wealth and international (University of Cambridge, 2011). At same time, Lloyds Banks has initiated numerous mergers for a long time, which has enabled the bank to competitively operate under numerous brands in various markets. Such prominent brands include; The Bank of Scotland, Halifax, Trustees Savings Bank, Lloyds TSB, Scottish Widows, Clerical and Medical and Cheltenham, and the Gloucester (University of Cambridge, 2011).

Weaknesses

The weaknesses of Lloyds Banking Group can be associated to its increased loan charges and other fees, which may be associated to financial underperformance in the recent times. At the same time, given that the government has massive shares in the bank, it is likely that changes in treasury policy framework is likely to affect the activities of the bank, specifically as economic dynamism continues to increase in the country (Treanor 2011). Moreover, it can be observed that the bank’s potential secured performance is below its potential capabilities. It relies heavily on the wholesale funding at the expense of other funds avenues (Lloyds Banking Group, 2010).

Opportunities

Opportunities for Lloyds Banking Group can be associated or linked to growing market potentials, increasing information, and partnership in the industry, and the role of technology (Lloyds Banking Group, 2010). For instance, analysts predict market growth and expansion in financial sector an aspect that is likely to see growth of Lloyds activities (BBC News Business, 2010; Welfens 2010). Moreover, the bank can expand its activities through the community banking initiatives, which are likely to see the penetration of the bank into all sectors of the society (Lloyds Banking Group, N.d). Further, the international market opportunities appear to be live and promising and yet sparingly exploited. This is likely to see the bank extend and establish its brand in the competitive sector market ahead of other players.

Threats

Threats for Lloyds Banking Group come from increased competitor activities, and this can be linked to deregulation taking place in the industry (Lloyds Banking Group, 2010). The smaller institutions are embracing partnership with large institutions, a situation that results in competitors diversifying their products, offering lower-priced services, and increasing their capital base for further expansion. Furthermore, the financial crisis witnessed in recent past has affected the banking industry greatly, as more investors shy away, and confidence in the industry continues to reduce (Organization for Economic Co-operation and Development, 2009). As a result, market niche and size for the bank has and continues to record some levels of reduction (Treanor, 2010).

Competition Analysis

Banking industry is highly competitive, a situation that has seen smaller banks devise market-dynamic strategies or opt from the market. In some cases, competition being witnessed in the industry has led to numerous mergers and acquisitions by large banks in an effort to establish competitive market force (). As a result, Lloyds Banking Group is not immune to competition from key players such as the: Barclays Bank, Royal Bank of Scotland, and HSBC Bank (The Guardian, 2011). UK financial and banking sector is largely controlled by four major players identified above and Lloyds is one of them. As competition increasing, different players have discovered the need to remain innovative and performance-oriented in the market.

To achieve these, key marketing strategies are being employed by numerous players and these strategies include: acquisition, mergers, market diversification, cost reduction, organization restructuring, adoption of excellent technologies, and constantly updating to the dynamics in the market (Lloyds Banking Group, 2010). Therefore, to have an upper hand in this competitive environment, Lloyds Banking Group is establishing itself uniquely as place that value research and development hence incubator for innovative products and services (Lloyds Banking Group, 2010). At the same time, the bank is speedily moving towards establishing and managing effective customer relationship management with emphasis on responding appropriately to customer queries, and developing products tailored to customer needs (Lloyds Banking Group, 2010). Furthermore, through its acquisition and strategies, the company aims to create large capitalization base that can enable it navigate the competitive environment more appropriately.

New Product Idea: Social banking

Majority of United Kingdom banks have concentrated on commercialized banking, an aspect that has led to majority of them to serve corporate, groups, and wealth individuals at the expense of the marginalized. Lloyds Banking Group appears to be unique in many ways. For instance, the bank is transcending its presence in global world, establishing presence in Asia and Middle East where majority of citizens are poor and rely on inadequate income. Addressing the needs of these multiple but potential customers requires the bank to innovate and design the most appropriate banking strategies that will appeal and attract majority of its customers in Asia and Middle East (KPMG, 2006). At the same time, Lloyds Banking Group is moving into new markets that are largely characterized by cultural-value system and where the essence of community is strong. Due to this social banking could be a new marketing idea the bank could exploit its benefits (Olaf and Sven, 2011).

Given the characteristics of commercial banking that largely fulcrums on the profit-motive tendencies and their style of operation tend to exclude majority of people with insecure income, it is perceived that penetration and growth within the Asian and Middle East region may be a big problem if commercial banking is solely adopted as the main strategy. Therefore, in adopting commercial banking in the regions, Lloyds Banking Group may end up increasing its losses, since transaction costs will be numerous, and high rates of loan delinquency and defaults will be prevalent. To successfully penetrate and endeavor itself to the majority of customers in the regions, Lloyds Group needs social banking idea that appear to be innovative alternative banking practice that caters for needs of majority of average income earners in the regions.

In order to effectively carry out this business development opportunity, Lloyds Banking Group needs to carry out needs assessment of each market and subsequently establish budget needs that each market require. For instance, the bank given its international strategy requires allocating about 30% of its budget on product research, innovation and development. This will provide enough resources to ensure the bank is able to continuously participate in innovating products that fit well with each market it exploits in the international market. At the same time, to ensure social banking succeed as the new market idea for the bank, there is need to ensure packaging of products is done effective with individual customer needs integrated in product development. This is important whereby the company while promoting and enhancing its penetration strategies in the new markets, will at same time be able to promote dignity, self-respect, and social recognition of customers it acquire. Through this the bank will be able to acquire, create, preserve, and ensure customer loyalty through empowerment activities that are associated with social banking goals.

Lloyds Group Market Objective and Strategy

Lloyds’ activities for a long time have demonstrated that, the company harbors ambition of growth and sustainability, while making meaningful profits for its shareholders (Anonymous, 2008). As a result, the bank strives to make strong presence in the financial market through creation of unique and excellent competitive edge over its competitors. However, even as the bank strives to achieve this broad objective, Lloyds Group realizes that its customers, both existing and potential ones, hold the key to success of the bank, and therefore, it has to design and innovate products that address individualized customer needs. The bank has been able to achieve these through its unique marketing strategies that incorporate: product diversification, international expansion, effective customer relationship management, and use of efficient technology (Lloyds Banking Group, 2010). Emphasis is specifically attached to customer relationship management strategy. The company promotes its marketing goals through the need to create sustainable and long-lasting customer base that is loyal and at same time obtain products and services that satisfy their needs and desires (Lloyds Banking Group, 2010). As a result, the company aims to preserve its reputation through devising effective risk management strategies that are implemented to ensure and enhance customer security is realized.

Financial Forecast for Lloyds Banking Group

Financial analysis and summary of Lloyds Banking Group provides some insightful glimpse into how the performance of the company is in regard to its growth strategy. During 2010, the bank realized some level of progress in terms of profitability of the company when it recorded 2.2 billion pounds profit (Lloyds Banking Group, 2010). This was a great improvement since in 2009; the bank had recorded a loss of 6.3 billion pounds (Lloyds Banking Group, 2010). Income growth improved by 3% during the same period which also saw core business sector grows by 7% (Lloyds Banking Group, 2010). Nevertheless, the international businesses declined by 9% and this were partially offset by the growth in the core business (Lloyds Banking Group, 2010). Operating expenses for the company fell by 6% and this situation led to an improvement in underlying cost: income ratio of 4.5% points to 46.2 per cent (Lloyds Banking Group, 2010). On overall, Lloyds Group continues to perform well, a situation that can enable the bank to initiate the new business idea in international markets.

Conclusion

Lloyds Banking Group plc was established in 2009 through merger and acquisition. This opportunity enabled the bank to transform itself into one of the best and leading banks in UK in terms of providing exemplary products and services to its customers. Since its establishment, the bank continues to experience growth, which is further translated into expansion strategies that the bank has adopted, both locally and internationally. Competitive advantage of the bank originates from the four main area of operation the bank has established as its main business units. In these four areas, the bank possess numerous and diversified products ranging from retail, corporate, wholesale, mortgage, pension, real asset, international, and many more. Further, the bank has initiated internet banking, an aspect that shows how technology will be the avenue for future competitiveness for the bank. Nevertheless, the recent financial crisis impacted negatively on the bank, but all efforts have been directed at creating a formidable strategic plan and also enhancing mission and vision of the bank. All these are done in a strategic move to build and position Lloyds Banking Group as the best and innovative bank that customers can invest with confidence and loyalty.

Reference List

Anonymous. 2008. Lloyd’s banks on new Scots name but job losses still possible in ‘detailed review’.Evening Times. (Online). Web.

BBC News Business, 2010. UK banking sector grows at fastest rate since 2007. (Online). Web.

Financial Times. 2011. Lloyds Banking Group plc.The Financial Times Group. (Online). Web.

Griffin, R.W., 2011.Fundamentals of management. OH: Cengage Learning.

Hamper, R. J & Baugh, L. S., 1990. Strategic market planning. USA: McGraw-Hill Professional.

Jain, S. C., & Haley, G. T., 2009. Marketing planning and strategy. OH: Cengage Learning.

KPMG. 2006. Financial services: Banking on innovation-the challenge for retail banks. Audit, Tax and Advisory Report for Innovaro Ltd. (Online). Web.

Lloyds Banking Group. N.d. Company overview. (Online). Web.

Lloyds Banking Group. 2010. Lloyds strategy: 2011-2013. (Online). Web.

Lloyds Banking Group. 2011. 2011 Half-year results: News release. (Online). Web.

Lloyds Banking Group. 2011. Lloyds Banking Group plc: Outcome of strategic review. (Online). Web.

New York Times. 1995. Lloyds Bank merges with TSB Group.(Online). Web.

Olaf, W & Sven, R., 2011. Social banks and the future of sustainable finance. NY: Routledge.

Organization for Economic Co-operation and Development. 2009. United Kingdom: 2009. Paris: OECD Publishing.

Smith, P.R., & Taylor, J., 2004. Marketing communications: an integrated approach. London: Kogan Page Publishers.

Standard & Poor. 2010. Lloyd Banking Group plc. (Online). Web.

Treanor, J., 2010. Lloyds Banking Group: Investors want answers over Erick Daniels bonus.The Guardian, March 03. (Online). Web.

Treanor, J., 2011. Lloyds Banking Group slumps to 3.8 billion pounds loss.The Guardian. (Online). Web.

Telegraph Daily. 2011. Fundamentals for Lloyds Banking Group. (Online). Web.

The Guardian. 2011. Lloyds banking group blocks competition in the sector, warns minister. The Guardian Press Association. (Online). Web.

University of Cambridge. 2011. Profile of Lloyds Banking Group. (Online). Web.

Welfens, P.J., 2010. Financial market integration and growth: Structural change and economic dynamics in the European Union. NY: Springer.