Introduction

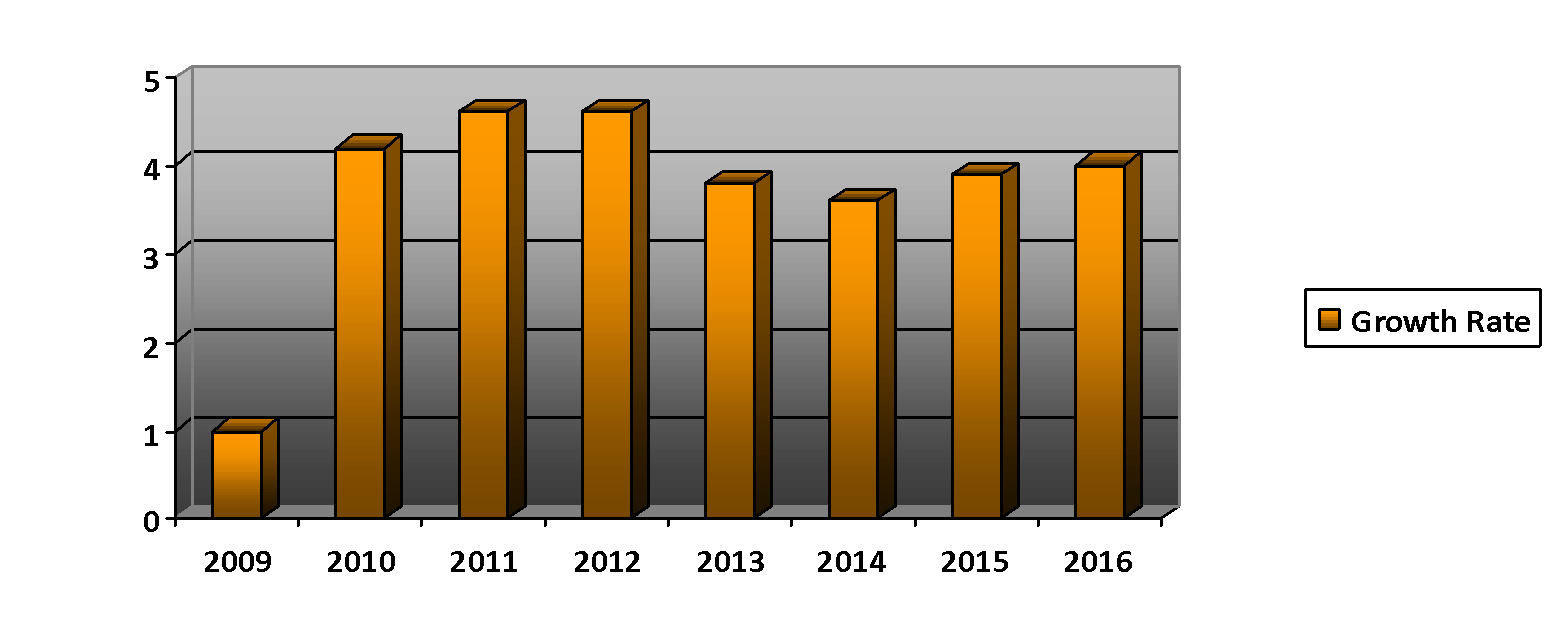

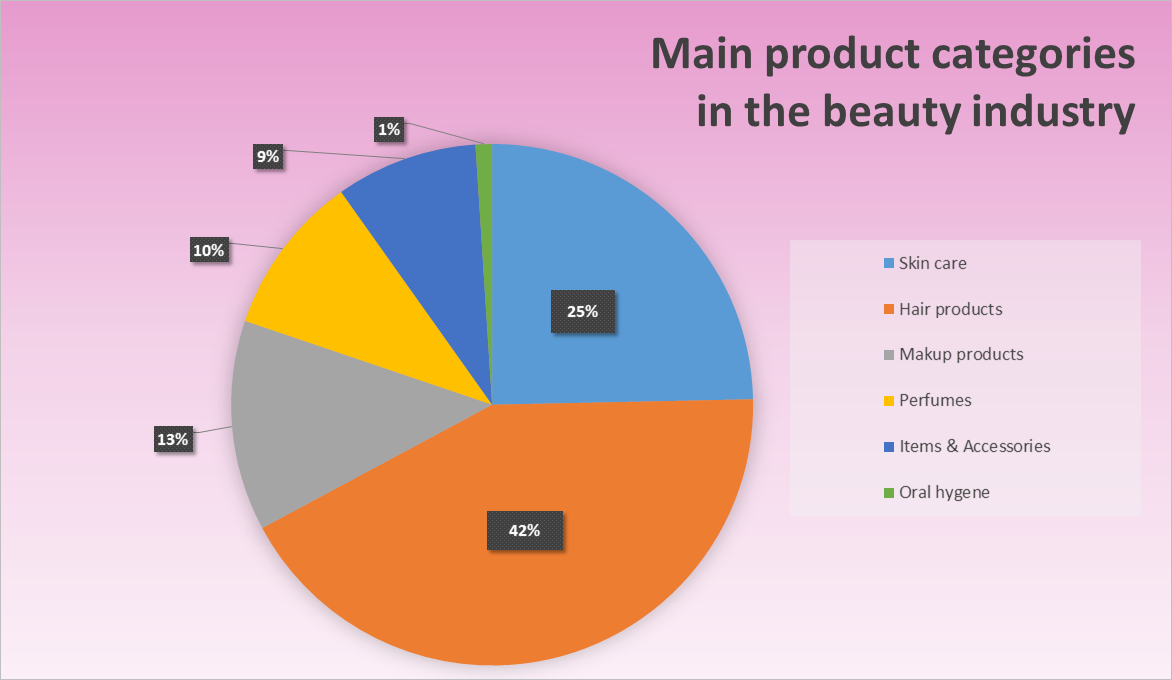

The modern beauty industry is characterized by an extremely dense market space and continual growth largely supported by various product line expansion, product proliferation, and diversification strategies used by companies to meet consumer needs and increase profitability (Tournois, 2014). In 2016, the global cosmetic market grew by 4% compared to the previous year (“Cosmetics industry,” n.d.). Nowadays, it comprises multiple categories, whereas skincare, haircare, and makeup products are the largest ones (“Breakdown of the cosmetic market worldwide,” 2017).

To succeed in this intensely competitive environment, brands use a great number of marketing techniques and strategic methods. It is possible to presume that in different market segments, these approaches significantly differ from each other. Compared to cosmetics presented in the mass-market, luxury beauty products “boast superior standards in terms of both packaging and quality” (Nagasawa & Irisawa, 2011). The emphasis on these values is core to product promotion campaigns for such brands as Chanel, Bobbi Brown, Yves Saint Laurent. However, to understand how these brands develop their competitive advantages, it may be useful to investigate other characteristics the luxury segment has. Which of them stimulate customer interest in premium products and contribute to the overall brand awareness most?

It will be appropriate to start the research with the identification of major psycho-emotional and demographic features of luxury brand consumers.

Main Body

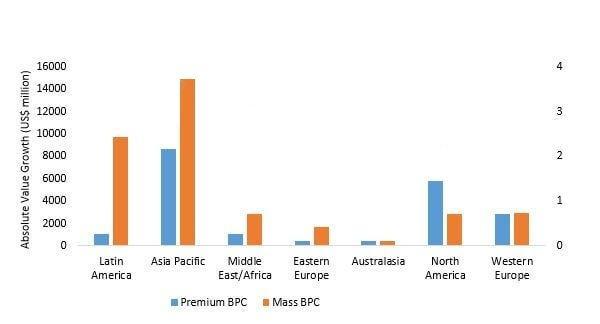

Although not all potential customers n the luxury segment are the same, they still share some common characteristics. Overall, premium beauty items are targeted towards individuals with higher levels of income who value credibility and high quality of products and are interested in the authenticity and uniqueness of the things they buy. In this way, the customer seeks to elevate his or her social status and develop a personal identity and psychological well-being. Luxury cosmetics purchasers can be of any gender and age. It is observed that premium beauty and care products are especially popular in the Asia Pacific region and China, in particular. “Chinese consumers remain the top consumers by country with one-third of the global market” (Bonacina & Mazzucchelli, 2016, p. 4).

It is considered that “beauty products appeal to the emotions and customers tend to choose based on the product image,” yet luxury brands, such as Chanel, usually emphasize the quality of cosmetics and the technology of their production (Nagasawa & Irisawa, 2011). It is observed that consumers are “willing to pay premiums of 20% to 200% for the kinds of well-designed, well-engineered, and well-crafted goods – often possessing the artisanal touches of traditional luxury goods” (Ivančová, 2013, p. 17). Thus, luxury brands offer unique services and items, which meet the psycho-emotional needs of the target consumer group and sell them at higher prices, which put these products in a high-value category.

It seems that the very qualities of the brand have significant value and meaning for luxury cosmetics purchasers. The majority of luxury beauty products are developed by fashion brands, which “capitalizing on public recognition of their brand,” started to offer skincare and makeup items after clothes (Nagasawa & Irisawa, 2011p. 5). These brands include Christian Dior, Sonia Rykiel, etc. However, due to a high level of various luxury brands awareness in public, as well as particular interests of the targeted customer group, these companies often convey implicit messages in their marketing. For instance, Ko and Woodside (2013) state that the most expensive premium-quality items usually do not contain a brand name or a logo on them, while the cheaper and medium-price pieces usually do. It means that implicit brand identification tends to increase with the price (Ko & Woodside, 2013).

For instance, Orlane Creme Royal, with gold as a special ingredient − $360 per ounce − does not have the brand name on its container (only the product’s name is included). In this way, Orlane’s simplified yet sharp design solutions help emphasize the quality and technology utilized in the item’s production.

Nevertheless, many expensive luxury brands, such as Chanel and Yves Saint Laurent, insert their logos in packaging as they help consumers recognize these brands more easily.

Along with logos, luxury cosmetics brands utilize such design elements as color and shape in their packaging strategies. For example, most of Chanel’s makeup color pallets and perfumes are designed in black. At the same time, Yves Saint Laurent predominantly uses golden and metallic tones in product packaging. To support better brand recognition, these design elements are always consistent. Moreover, luxury brands deliberately aim to reflect the sense of product attributes in their designs to help customers assess the value of these attributes (Aidnik, 2013).

Conclusion

In conclusion, it is possible to say that luxury cosmetics branding and pricing together are aimed to convey a psychological message related to product value − things that cost more and look beautiful are assumed to be of higher value. For consumers of luxury beauty products, quality is the most important value and, therefore, brands should be able to communicate this attribute to them through marketing practices and packaging, in particular. When nice packaging and high-quality goods merge, consumers are willing to pay more. Thus, by focusing on these value categories, the luxury brand can succeed.

References

Aidnik, S. (2013). The effect of cosmetic packaging on consumer perceptions. Web.

Bergdorf Goodman. (2017). Web.

Bonacina, R. & Mazzucchelli, M. P. (2016). Keep calm and care about your customer: The luxury and cosmetics financial factbook. Web.

Breakdown of the cosmetic market worldwide from 2011 to 2016, by product category. (2017). Web.

Cosmetics industry − Statistics & facts. (n.d.). Web.

F is for fall collection: Chanel fall 2012 makeup and nail polish sneak peek. (2012). Web.

Ivančová, A. (2013). Is it about money or marketing? – International marketing strategies in the luxury cosmetic industry – Exploratory multiple case study of Chanel, Guerlain and La Mer. Web.

Ko, E., & Woodside, A. G. (2013). Luxury fashion and culture. Bingley, England: Emerald Group Publishing Limited.

Micallef, N. (2017). Reimagining growth in the global beauty industry. Web.

Nagasawa, S., & Irisawa, Y. (2011). Luxury strategy of beauty products by Chanel. Web.

Perfume market: How perfumes became a mainstream element of the cosmetics industry. (2016). Web.

Tournois, L. (2014). Too many products? Reaching the next billion customers of the beauty market. The Journal of Business Strategy, 35(5), 3-13.

Yves Saint Laurent Beauté to open at Ion this weekend. (2012). Web.