Binding price ceiling

The forces of demand and supply in the market determine the prevailing market price. This is the equilibrium price. However, there are instances where market conditions do not regulate prices. These are instance when government comes in to set either minimum or maximum prices.

This is especially when government feels that the market prices will exploit either consumers or suppliers. Price ceiling is a scenario where the government sets maximum price at which sellers must sell goods and services. The essence of setting binding price ceiling is to a minimize consumer exploitation (Baumol & Blinder 2011).

Market for rental accommodation

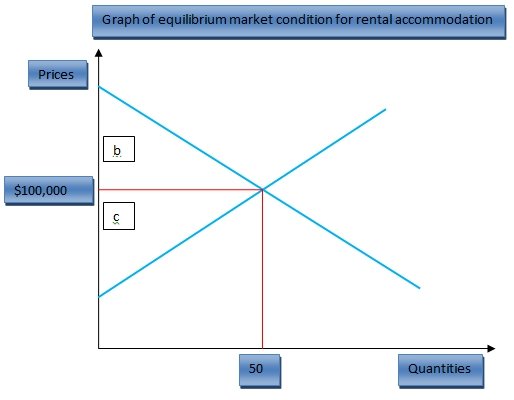

Before price ceiling, the forces of demand and supply set the equilibrium prices for rental accommodation. In the short run, the supply for rentals is inelastic. However in the long run, it is elastic (Bernanke & Frank 2003). The diagram below shows market for rentals in the long run.

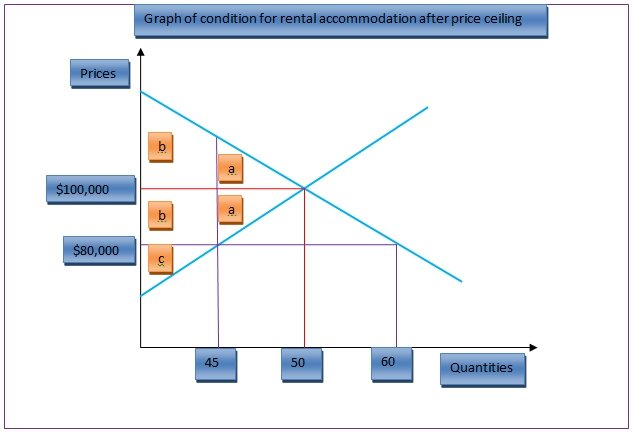

In the diagram above, the equilibrium price is $100,000. The equilibrium quantity demanded is 50 units of rentals. Area b shows consumer surplus and area c shows producer surplus. Imposition of binding price ceiling changes the equilibrium condition as shown below (Federal Housing Finance Agency 2012).

After imposition of a price ceiling, the equilibrium price changes to $80,000. The quantity demanded is 60 units while the quantity supplied is 45 units. Therefore, there is a state of disequilibrium in the market. After price restriction, area bb show consumers’ surplus. Area c shows producer surplus. It is clear that that the producer surplus has declined. Consumers’ surplus has increased.

Black market

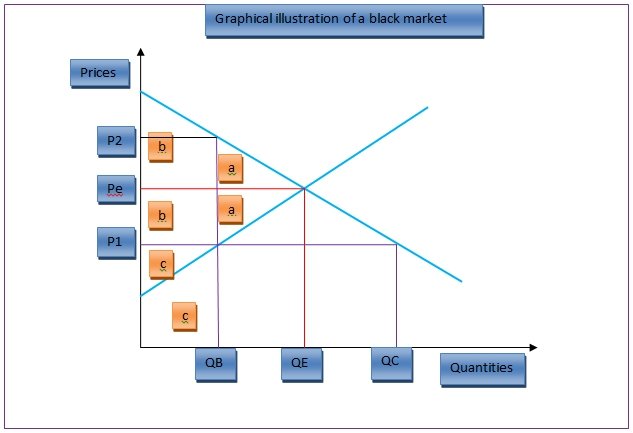

Black market sells goods at prices different from those approved by relevant authorities. Few manufacturers and many retailers characterize the market. In most cases, it is not possible to trace the manufacturers. Also, it is impossible to control black market. Price ceiling with or without rationing gives rise to the black market (Tregarthen & Rittenberg 2008). The diagram below illustrates a black market.

In the diagram above, a trader operating in a black market will buy quantity of goods amounting to QE at price P1. Therefore, area cc shows the total he will pay. He then sells the goods at P2 making a profit of area bb. In such a market set up, the seller gains since he is making exorbitant profits from the excess demand while the buyer looses because he pays more than the equilibrium price.

Effects of price ceiling

Price ceiling causes acute shortage in supply of the good or service. This is because, at prices below the equilibrium price, the product looks unattractive to the producers. On the other hand, demand will rise. This is because the low prices attract buyers. This results to long queues at shops and discrimination by sellers. Therefore, there is distortion of equilibrium condition. This is because it makes quantities bought and sold to fall below the equilibrium. This creates inefficiency in the economy (Wessels 2006).

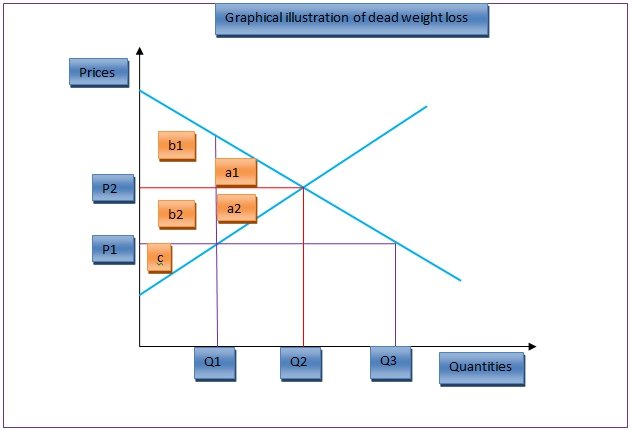

A price ceiling leads to loss in welfare of both producers and consumers. This is often known as dead weight loss. The diagram below illustrates dead weight loss

Before setting the price ceiling, area a1 and b1 shows consumer surplus and area a2, b2 and c shows producer surplus. After setting the price restriction, area b1 and b2 shows consumer surplus and area c shows producer surplus. This indicates reduction in welfare of the producers. Besides, area a1 and a2 is not attributed to any player in the market. Therefore, it represents a lost welfare. This area is known as dead weight loss. Therefore, price ceiling results to loss in welfare (Wessels 2006).

Allocation technique available to the government

Given the high demand against reduced supply, government must find a way of allocating the available supply. For instance, government can ration the supply. Administratively, this can be achieved by giving coupons sufficient to buy the available supply. Distribution of these coupons can either be equally or based on a various attributes such as sex, number of dependants and marital status (Mankiw 2011).

Options available to owners

In the absence of government monitored allocation techniques, owners of rental properties use various techniques to allocate the rental accommodation facility. A common technique is the policy of first come first serve. In this method, allocation is on the basis of luck. Those who know how to use the principle of first come first served gain most. However, this system makes customer to rush and create long queues.

The landlords can also allocate the scarce rental accommodation on the basis of who they know. This can be based on religion, regular customers and race among others. This approach is known as seller’s preferences. This approach leads discrimination. This also leads to inequitable distribution of rental accommodation (Melvin & Boyes 2010).

Reference List

Baumol, W & Blinder, A 2011, Economics: Principles & Policy, Joe Sabatino, USA.

Bernanke, B & Frank, R 2003, Principles of microeconomics, McGraw Hill Companies, USA.

Federal Housing Finance Agency 2012, Supervision and regulation. Web.

Mankiw, G 2011, Principles of microeconomics, South Western Cengage Learning, USA.

Melvin, M & Boyes, W 2010, Microeconomics, Joe Sabatino, USA.

Tregarthen, T & Rittenberg, L 2008, Principles of microeconomics, Flat World Knowledge, Inc., New York.

Wessels, W 2006, Economics, Baron Educational Series, USA.