Introduction

Marks & Spencer (hereinafter referred as M&S) is one of the leading retailers in UK. M&S was established about one hundred twenty five year ago. In UK alone, M&S is having a record of twenty –one million satisfied customers. Further, it is having foreign operations in more than forty one countries. It is having about 2,000 suppliers and employs about 78,000 employees. M& S controls about 11.2 percent market share in retail clothing and about four percent of UK food market.

Since M&S brands are registered with the consumers over the past 125 years, it never attempted to compromise its quality. However, M&S has endeavored to enhance their value by not compromising their quality even during the recent economic downturn. M&S is the leading clothing retailer and during the year 2010, its market share in UK remained at 11.2 %. M&S food business has shown good improvement in the year 2010 by stressing to their brand values, quality, innovation, service and trust. Both M& S direct business and its International business witnessed a dramatic growth of 27% and 5.7% respectively in the year 2010.

Year 2009 was a crucial and critical year to M&S. To overcome recession, M& S invested in price to retain its customers, minimised their costs and administered their balance sheet and its cash flow tightly. Even during the recession, M&S was able to announce adjusted profits of £604 million in 2009 and was able to minimise its debts to £2.5 billion.

To retain its brand name and its loyal customers during the recession, M&S offered substantial discounts, which made its UK gross margin down by 170 bps in 2009, which was lower at 41% as compared to the year 2008.

However, M&S sales were soared by 3.2% to £9.3bn in 2010. A mixture of happenings like an improvement in market scenarios and M&S initiatives assisted them to accomplish an increase in UK sales of 2.9% with a robust performance in all provinces of their business.

Marks & Spencer Operational Activities During 2010

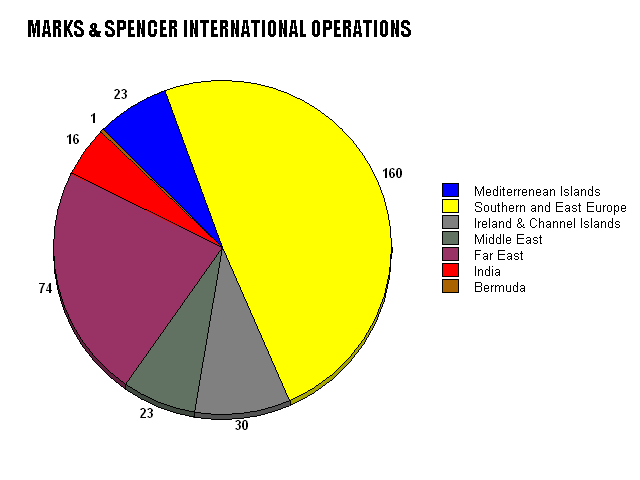

In 2010, M&S‘s International business increased by 5.7%, which symbolises about 10.2% of the aggregate of M&S group’s revenues. During the year 2009/10, M&S spotlighted on increasing their partnership in Eastern and Central Europe and in India. During the year 2009/10, M&S had invested in their operational potentials, ending in an efficient product offer, tailored to cater the necessities of specific markets and thereby constructing a stage for future growth. Presently, M&S have 327 stores in forty one provinces in UK with mean square footage of its international stores of about 11,129 sf. Further, M&S international business replica is made up of wholly –owned and partly owned franchises and subsidiaries. M& S is investing heavily on its operational efficiency which can be considered as a key to establish a strong platform for its operational growth,. Through its network, M&S is transferring its products by making enhancements in their supply line installations more competently and quicker. Instead of supplying its global stockpile from UK, M&S is now supplying its merchandises, which is in excess of twenty-one percent of its merchandises from its four global hubs in Singapore, Sri Lanka, Istanbul and Hong Kong.

M&S has the long range plans to expand its international business from 15 % to 20% of its group total revenue within five years and during the year 2009/2010 M&S spotlighted on four chief elements to assist them to accomplish this namely:

- Expanding its Eastern and Central European partnerships.

- Establishing sustainable business in China and in India.

- Speeding up development with its franchise associates.

- Prolonging to find out new business opportunities.

M&S Global business replica has facilitated it to perform well whole of intricate international economic environment even when individual markets have been affected.

During the year 2009/10, M&S have introduced 4 new stores in India and for M&S, India is a significant market as it is having a population of 1.2 billion, and its GDP (economic) growth stood at 7.2%.

Marks & Spencer franchising operations now vouch for about 31% of its aggregate of its international sales. Through its franchising partner namely Fiba, M&S is able to expand its business operations in Russia, Ukraine and Turkey and during 2010, M&S has opened a standalone food store at Hong Kong also.

M&S under the Project 2020 initiative has established a clear plan to deliver long –run sustainable growth, mainly by establishing a more efficient supply chain and IT infrastructure. Of late, M&S has invested in improving the aged, twenty year old systems that strengthened the business. During the year 2010, M&S has started to hasten the speed of actions to basically change the style of M&S commercial dealing. In the year 2010, M&S has spotlighted on its supply chain, instituting new information systems and enhancing their commercial operations.

As a supply chain reforming initiative, M&S has made good growth in 2009/2010 and had achieved a saving of £35m by grouping some of its warehouses and thereby introducing a variety of efficiency projects.

M&S objective is to minimise its energy consumption by 35% sq ft by 2015, which would help its suppliers poignantly to minimise their environmental effect and widen their action on climate change to find more means to associate its employees and customers associated.

Key Financial Performance Indicators of M&S for the Last Two Years

Comparison of Financial Performance between Marks & Spencer and the Next Group Plc UK

One of the M&S main competitors is the Next Group Plc UK. Next Group is dealing in the distribution of merchandises in home products, clothing, accessories and footwear. Next Group is carrying out its business operations through the three chief business channels: Next Retail which is the chain super market stores that operate throughout UK and in Eire. Next Group is also carrying out its business through the transactional website and through a direct mail catalogue through its Next Directory. Its international operation is carried through its Next International division. Next Sourcing is engaged in sourcing companies branded products and designs. One another division namely Ventura offers customer service management. One of the Next Group Plc namely Lipsy offers its own trademarked young women apparels through web, retail and wholesale channels.

In the following section, an analysis of various financial performances of both M&S and Next Group Plc is made through analysing its various financial ratios.

Analysis of Profitability Ratios

ROA

The higher the ROA, the more profitable the company is. M& S ROA is declining from 12.5% in 2007 to just 7.07 in 2009. Further, if one compares it with its competitor Next Plc also, M&S ROA is not encouraging. This also implies that M&S is not employing its assets productively. M&S should give more attention to improve its profitability in the near future.

ROE

ROE indicates how successfully a company is employing the shareholder’s funds to earn revenues. If the ROE is too low, it presents that there will be some trouble later. M& S ROE is declining from 47.1% in 2007 to 25.06 in 2009. Further, if one compares it with its competitor Next Plc also, M&S ROE is not encouraging.

Liquidity Ratios

Quick Ratio

It reflects the ability of the company to repay its current obligations. It is an analogue way of arriving at the Current Ratio, but with keeping out the inventories-an element in the current assets with least liquidity austerity. Often, it is a more pertinent calculation. Again, the worth of Quick Ratio which is more than 1 is typically anticipated, but it differs from business to business. Though M&S quick ratio has improved over years, its competitor Next Plc Quick ratio is more vibrant.

Current Ratio

It is a formula representing how much current liabilities of a business is safeguarded by current assets. To certain magnitude, if the ratio is more than 1 (optimistically) more than 1.5), for any company, it will be construed as a good one , but higher Current Ratio may connote that current assets have not been utilised entirely. The figure indicates that M&S had how much money in short-term resources to service every pound of its current debt. Though M&S current ratio has improved over years, its competitor Next Plc current ratio is more vivacious.

Net Current Assets % TA

This ratio mirrors about a company’s net current assets as a percentage of its total assets. Thus, M& S is having about -12, 64 % as liquid current assets of its total assets and this is not a good indicator of M&S short-term liquidity.

LT Debt to Equity

Higher Gearing is represented by a larger share of long run debt as compared to the equity of any company. In case of financing terms, long term debt is regarded to be the least costly source.Long term debts are less costly than that of equity financing. However, if too much dependence on long-term debts may result in a dangerous financial position as interest and Installement of long term debt have to be met from cash flows and to be paid whether there is a profit or not which is not in case of dividend.M&S is having a moderate long –term debt as compared to its equity. However, M&S can go for higher long term debt to expand its business operation, to buy out its competitors, to increase its market presence and to improve its international operations, which are more profitable than its UK operations. Its competitor Next Plc is having a high long-term debt, and it should be cautious and should try to bring down to the industry average.

This ratio is a measurement of that evaluates assets provided by the owners, through their capital investment and assets provided by creditors through money lent to the company. M&S is having a moderate total debt as compared to its equity. However, M&S can go for higher debt to expand its business operation, to buy out its competitors, to increase its market presence and to improve its international operations, which are more profitable than its UK operations. Its competitor Next Plc is having a very high debt, and it should be cautious and should try to bring down to the industry average.

This ratio is an indicator of a company’s capacity to pay the interest on its interest-bearing debt, mainly out of its cash flow. For this purpose, earnings before taxes, depreciation, interest and amortisation (EBITDA) will be taken into account. M&S interest covering ratio is strong, and it has the good cash flows to pay its interest commitments on debts. Its competitor Next Plc is having a strong interest coverage ratio than compared to M&S.

Total Asset Management

The figure above shows the money in revenues from every British pound invested in assets respectively. Additionally, the higher the total asset turnover, the better the corporate resources are being well managed. M& S should strive to increase its total asset turnover so that it can keep its pace with its competitor Next Plc.

This ratio indicates how quickly a company turns its sales into cash but also not how quickly a company it collects its receivables from debtors. M&S receivable turnover indicates that its’ collection from debtors is fast and quick as compared to its competitor Next Plc. Further, since M&S is able to tap more cash sales, its finance charges will be at the minimum as it would avail lesser working capital facilities. Next plc should endeavour to improve its receivable turnover ratio so that it can improve its liquidity.

This ratio signifies how quick a company can dispose off their inventories, calculated in terms of the rate of movement of goods into and out of the company. The increased inventory turnover might result from

- Enhanced inventory control systems, which minimises the levels of the inventory and the cost of obsolescence and storage.

- A shift in the sales mix toward clothing and food items that has increased its turnover.

M&S is adopting a sales mix toward food items and clothing, which helps to turnover its inventory more quickly and to increase its profitability. Thus, by offering heavy discounts, M&S is able to maintain a well balanced inventory turnover than that of his competitor Next plc.

This ratio indicates the British pound amount the investors will receive for each £1 of cash flow. If the cash flow ratio is slightly below the industry average, it will indicate that its growth prospect is below average, and its risk is above average or in some cases, both. M& S should strive hard to improve its cash flow per share by increasing its profitability. Its competitor Next plc is having a good cash flow per share and its shows that its shareholders are earning good dividends.

The book value per share indicates the stake of the owner of one share of stock in the net assets of the company. It represents a company’s total assets. It does not represent the market value of a share. M&S book value appears to be strong as compared to its competitor Next Plc.

References

Brigham, E F& Houston J H, Fundamentals of Financial Management, Cengage Learning, New York, 2007.

Cnunaho Tehe, Finance for Non-Finance Managers, McGraw –Hill Professional, New York, 2003.

Corporate Markandspencer.com.Financial Highlights. Web.

Marks & Spencer Annual Report 2010. Annual Report 2010. Web.

Stickney, C P Well, R L & Schipper K, Financial Accounting: An introduction to Concepts, Methods and Uses, Cengage Learning, New York, 2009.

Vance, D. E, Financial Analysis and Decision Making, McGraw –Hill Professional, New York, 2002.