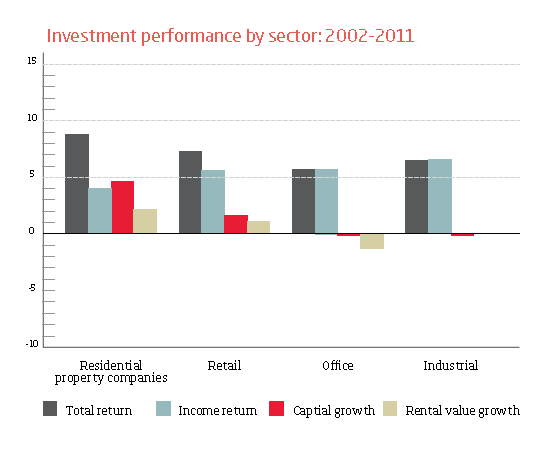

Residential properties give higher returns than commercial property. Residential properties had total returns of about 9%. The retail sector had 8%, office sector 6%, and industrial sector 7% between 2002 and 2011 (Morrison 2012, p. 19). Residential property gave total returns of 11.3%, 8.2% capital growth, and 2.9% income returns in 2011. Residential property also reported 98% occupancy rate for rental property that charged between £250 and £3,000 per week (Morrison 2012, p. 20). Residential properties provide a better opportunity compared to commercial property (see exhibit 1).

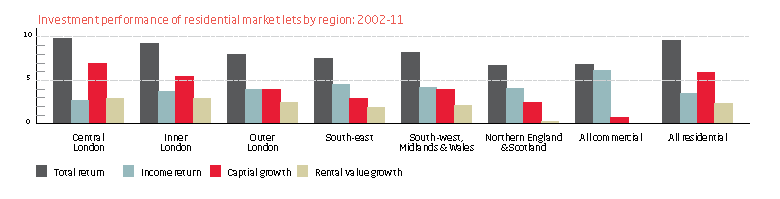

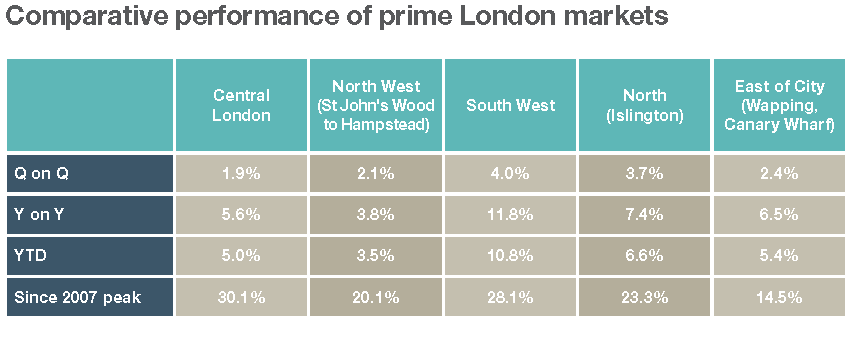

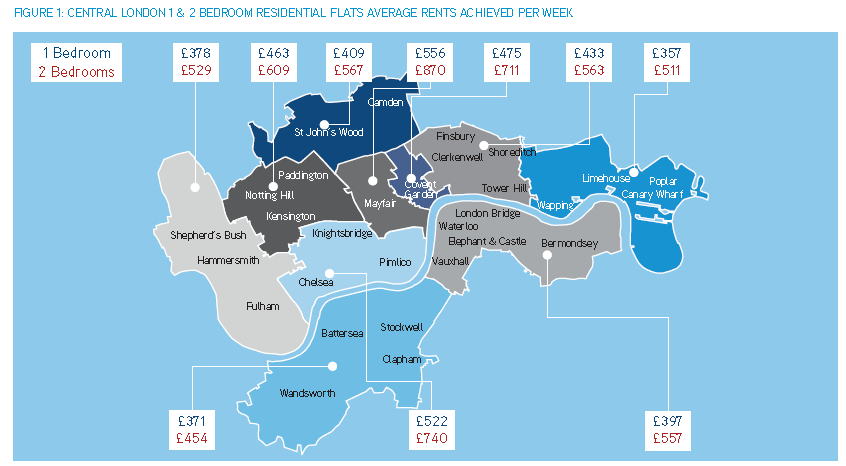

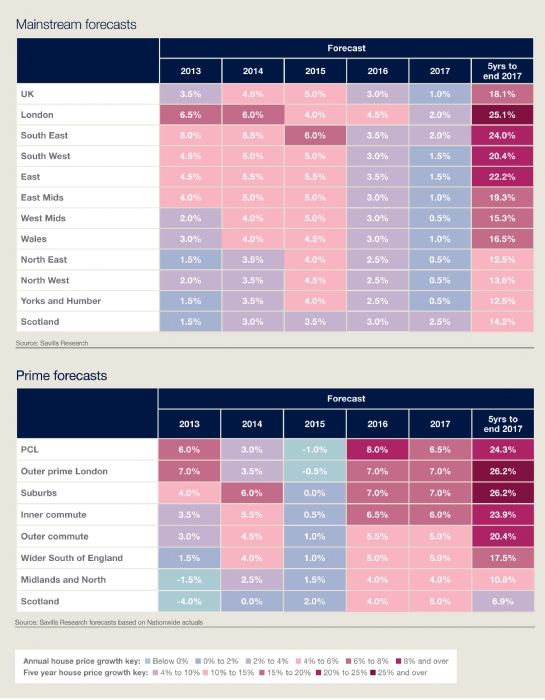

South West London and Central London have been chosen because they represent areas with the highest capital growth rates (Savills World Research 2013, p. 1). The regions are likely to have high capital gains (see exhibit 3 and 4). South East and North London are chosen to be used for comparison. Aldsgate and Beckenham are chosen because they are areas with a high turnover rate. Aldsgate has 12.5% turnover rate, and Beckenham 15.5% (Property values in East Central London 2013). Reselling property in these areas may be easier than other regions in London.

The market prices of property in Central and South East London are considered to be higher than the real income growth. It poses the risk of prices collapsing after the housing boom. Workers within these areas may find it favorable to move out of these regions and seek employment elsewhere. However, the house prices in these regions are expected to rise for a decade (Cost of homes forcing buyers out of London and the south east, research suggests 2013). Many workers yearn to purchase houses before the prices rise further.

The prices are driven by demand from foreign investors. Foreign investors accounted for 60% of sales between 2010 and 2011 (Heywood 2012, p. 30). Investors from the Far East represent a big proportion of the investors. Most of the investors are from “Hong Kong followed by China, and then China” (Heywood 2012, p. 31).

Foreign investors from Asia have a high demand for newly-built houses. Housing associations and the local government built 44% of the new houses in London in the year 2011/2012. It is much higher compared to an average of 25% for England in general (Heywood 2012, p. 18). These houses are built to increase affordability. 71% of the houses built in London are classified as affordable compared to 51% in England. Resale of property may be much easier in London than other parts of England.

The median income in 2012 was £643 per week and house rent was £275 per week for a 2 bed house (Heywood 2012, p. 21). It makes about 43% of weekly income which may be considered affordable for a person earning the median income.

Most houses in London are flats which need a surveyor to check their interior condition. They are valued on a per square foot basis (Hobson 2012, p. 17). The cost per square foot in Bayswater W2 is about £1,000 for a flat that has not been refurbished. The price is about £1,500 per square foot in Kensington W8 (Morley 2013, p. 10).

Apartments within flats have a lower price compared to detached houses. Most detached houses are selling for values above £600,000. The best choice for a person looking to invest £500,000 is likely to be in a flat. Apartments in flats may have lower prices while fetching a rental charge that is equal or higher than detached houses depending on their interior design. Most detached houses are old and may need refurbishment.

Stamp duty is expected to be charged at 3% for transfer of ownership on property valued at £250,000 and over. It is 4% for those valued at £500,000 and over (Morley 2013, p. 10). Income tax on rental income is charged at 20% for income between £0 and £32,010. It is 40% for income between £32,011 and £150,000 (Income tax the basics 2013). Capital gains tax is charged above £10,600 Annual Tax Exempt (Capital gains tax rates and annual tax-free allowances 2013).

Financial strategy

Mortgage provides interest rates that are lower than long-term and short-term loans. The financial strategy is to finance the project with the largest percentage of mortgage available. The best available deal is offered by Capital Fortune. It is an 85% mortgage offered at a 6.8% rate.

Prestige Finance offers long-term loans from £75,000 up to £500,000. It is paid within 3 years to 25 years at a rate of 8.1% (Compare long-term loans 2013). Mortgage obtained at Skipton Building Society has an overall rate of 5.20% per annum (Best mortgage deals 2013). An 85% mortgage from Capital Fortune is offered at an average rate of 6.8% per annum (85% Buy to let remortgages 2013). The New Buy Scheme which was launched in March 2012 is the first to offer 95% mortgages on properties valued up to £500,000 (Colliers International 2013, p. 2). The best debt deals have difficulty in meeting the qualification because they are offered from society schemes. The investment takes the 85% mortgage from Capital Fortune. It is combined with 15% equity from the owner.

Amortization assumes a debt from the 85% mortgage finance from Capital Fortune which is issued at 6.8% annual interest rate. Interest and principal are charged an annual amount of £35,814 which represents an amount of £2,984.5 a month. At the end of the 10th year, £317,008.96 remains as the principal. An early payment rate of 4.6% is charged when the remaining balance is paid early. It was supposed to be completed at the end of 25 years.

The discounting rate used is 9%. It incorporates the cost of debt and the inflation. The inflation rate in the UK is estimated at around 2.7% between 2012 and 2013 (United Kingdom inflation rate history – 2003 to 2013 2013).

Debt versus equity

One of the benefits of a large share of mortgage compared to long-term loans from a bank is that they are easier to secure. The property acquired may be used as security. Long-term loans may require additional security before they are issued. Long-term loans have a higher rate of interest compared to mortgages. In this case, Capital Fortune offers a 6.8 % rate as the best available option for a mortgage. On the other hand, Prestige Finance offers an 8.1% rate as the best available option for long-term. Other banks offering long-term loans may charge rates above 12% (Compare long-term loans 2013).

One of the advantages of debts over equity is that the owner does not need to provide the entire amount at once. The cost of property and debt repayment is spread over a long period of time increasing affordability. In this case, the owner is required to provide 15% of £500,000 which equals £75,000. It would have taken longer for the owner to save £500,000 before receiving benefits from the property.

One disadvantage of debts is that the interest charged reduces the net income. In the amortization calculations, between £28,900 and £23,314 is spent annually in the 10-year period as interest on the debt. The net income reduces by the same amount annually. Using a bigger percentage of equity would increase net income.

Portfolio Evaluation

Case 1

The first case involves the purchase of two properties in South East London. According to Savills World Research (2013, p. 1), properties in East London have made capital gains of about 6.5% since 2007. Residential Property Focus Q3 (2013) indicate that South East London will have a 24.0% cumulative capital gains from 2013 to 2017. It is second to Central London at 25.1% in a 5-year forecast.

One of the properties is a one-bedroom apartment in Woodlands Court London SE23. It is purchased at £250,000. The average rent in the SE London is £397 per week for a one-bedroom apartment (Colliers International 2013, p. 1). The property gives net returns amounting to £77,200 in the 10-year period. Deductions include a 25% annual service charge, council tax at £1,236.27, 3% stamp duty in the first year, and 9% discounting factor (see exhibit 7). The cumulative net returns are -14.59% in the 10-year period. It gives an average of -1.5% annually. The calculations assume that tax relief (for the first £10,600) has already been used in other sources of income.

The second property in case 1 is also found in SE London. It is on Canonbie Road, Forest Hill, and SE23. It is a one-bedroom apartment in a flat purchased at £250,000. It is found in band B which pays an annual council tax rate of £1,236.27. It is charged a 3% stamp duty in the first year for the transfer of ownership. Annual capital gains are expected at 3.68%. It is a moderate figure which considers Colliers International (2013) and Residential Property Focus Q3 (2013). Capital gains tax is imposed at the end of the period at 18% for the first £34,370 and 28% for the remaining amount (Capital gains tax rates and annual tax-free allowances 2013).

The two properties in SE which account for a £500,000-investment give a net gain of -£71,462 (see exhibit 7 and 8). The value incorporates a 98% occupancy rate as reported by Morrison (2012, p. 20). The average annual net return is 1.4% below the discounting factor for both properties.

Case 2

South West London represents an area with a high appreciation rate for property. It has been recognized as a place where one can purchase property to hold for capital gains. According to Residential Property Focus Q3 (2013), the region’s appreciation may slow down to 1.5% by 2017. The current capital gains rate is at 10.8% (Savills World Research 2013, p. 1). Kensington and Chelsea represent the highest increase in prices. House prices increased by 20.6% between 2007 and 2010. The prices increased by 15.2% and 17.5% in London and inner London respectively (Heywood 2012, p. 17). The SW capital gains rate has been set at an average of 4.3% within the 10-year period.

In SW London, only a single property is purchased value at £500,000. It is a 3 bedroom semi-detached house at London SW16 2JJ – 27 Knollys Road. It has 1 bathroom and 2 receptions. According to Zoopla, its value has appreciated by £67,852 within a year (Property details for 27 Knollys Road, London SW16 2JJ 2013). It represents a 15.7% appreciation. It rents for £2,190 per month. It is found in council tax band D which charges £1,590.39. A stamp duty of 4% is also charged in the first year. Income tax at 20% is also charged (see exhibit 9).

The net gain from case 2 is -£159,662 after considering a 98% occupancy rate. The average annual rate of return is 3.2% for the 10-year period below the discounting rate.

Case 3

Islington is an area where property prices are appreciating moderately compared to Central and South West London. Savills World Research (2013, p. 1) estimates show that it has a year-on-year increase of about 7.4%. Residential Property Focus Q3 (2013) forecast shows that property within the area may have increases of about 0.5% by 2017. North London has been allocated a 4.1% for the calculations. It is the rental average yield. Its capital gains should be lower than South West and Central London.

Two properties are purchased in Islington that add up to £500,000. One property is at Moorland Court Flat 2, London N21 1JF. It has 2 bedrooms, 1 bathroom, and 1 reception. It is purchased at £250,000. It is found in tax band D which charges £1,403.34 annually. Stamp duty is at 3% and income tax at 20% (see exhibit 10). The house has appreciated in value at a rate of 9.1% from last year. It is rented at a rate of £1,125 per month (Property details for Flat 2, Moorland Court, 59 Springbank, Eversley Park Road, London N21 1JF 2013). It is found in Islington tax band D which charges £1,264.87 (Islington: How much you pay 2013). The other property is found at London N21 1QH. It has 2 bedrooms 1 bathroom, and 1 reception. It is purchased at £250,000. It has monthly rental earnings of £1,165 (Property details for 3 Byland Close, London N21 1QH 2013). It is tax band D charged £1,264.87.

The net earnings from these two investments in the 10-year period are -£139,931 (see exhibit 11). It gives an annual 2.8% rate of return below the required level.

Case 4

Case 4 is an investment in East Central London. The property is found in London EC1A 4JE, Cathedral Lodge 110-115 Flat 7. It is purchased at £500,000. It generates a monthly rental income of £1,506 (Property details Flat 7, Cathedral Lodge 110-115, Aldersgate Street, London EC1A 4JE 2013).

Central London has the highest capital gains between 2007 and 2010 (Savills World Research 2013, p. 1). Zoopla estimates that the value of the property has appreciated by about £48,734 in the last one year (Property details Flat 7, Cathedral Lodge 110-115, Aldersgate Street, London EC1A 4JE 2013). It represents about 10.6% capital gains. Considering that capital gains after 2017 may be about 2%, the average rate for the 10-year period is set at 6%. For these calculations, the rental yield of 4.9% is used for capital gains.

The net gains from the asset amount to -£171,153 (see exhibit 12). Capital gains tax is calculated when the property is resold at the end of the 10-year period. It is not calculated annually because real capital gains are only calculated when the property is sold. The gains represent net returns of 3.4% annually below the rate used as the discounting factor.

Disposal price

The rate at which the property is disposed is calculated using the capitalization rate. The capitalization rate is the percentage of net operating income as a proportion of the purchase price. R = I/V, where R is the capitalization rate, I is the net operating income, and V is the property value. To obtain the value of V for the year that a property is disposed, the formula V = I/R is used (Greer & Kolbe 2003, p. 372). The formula is applicable in this case because the net operating income in the calculations is considered constant.

Conclusion and recommendations

South East London gives a much higher rate of return -1.46% annually from these calculations. The high rate of return comes from the lower cost of property and lower stamp duty. The weakness in this estimate is that the rental charges are the average for the area. The other 3 cases use the actual rent paid by tenants which are more accurate than using the average of an area. The South East London property may have a lower rental charge than the area’s average because they are old apartments.

The NPV analysis requires that the option with the highest net present value to be chosen. The two properties in South East London have the highest NPV from the 4 cases. They give net returns of -£71462 after loan repayment deduction and other expenses. It has a negative NPV which makes it unviable but the best option among the four cases. The NPV accurately provides the option that will provide the highest positive cash flows. The weaknesses in NPV analysis is that choosing a high discounting factor can result in negative cash flows. A lower discounting factor of about 6% in these calculations may turn some of the negative NPV into positive values.

Equity reversion is a way of ensuring that the correct amount is paid as capital gains tax. The amount charged in the calculations would have been much higher without equity reversion. Equity reversion also indicates the option that provides the highest capital gains. South East London has the highest equity reversion value which makes it the best choice.

Reference List

Best mortgage deals 2013, Web.

85% Buy to let remortgages 2013, Web.

Capital gains tax rates and annual tax-free allowances 2013, Web.

Colliers International 2013, ‘Central London Residential Market’, Central London Residential, Winter, pp. 1-4.

Compare long-term loans 2013, Web.

Cost of homes forcing buyers out of London and the south east, research suggests 2013, PropertyWire, Web.

Council tax billing and how to pay 2013, Web.

Greer, G & Kolbe, P 2003, Investment analysis for real estate decisions, Dearborn Real Estate Education, Chicago.

Heywood, A 2012, London for sale? An assessment of the private housing market in London and the impact of growing overseas investment, The Smith Institute, London.

Hobson, S 2012, E-guide: Buying & investing in London property, Casis Media, London.

Income tax the basics 2013, Web.

Islington: How much you pay 2013, Web.

Morley, J 2013, Homes & Property, Web.

Morrison, D 2012, ‘A guide to investing in prime London residential property’, Property Week, pp 1-23.

Property details Flat 7, Cathedral Lodge 110-115, Aldersgate Street, London EC1A 4JE 2013, Web.

Property details for Flat 2, Moorland Court, 59 Springbank, Eversley Park Road, London N21 1JF2013, Web.

Property details for 3 Byland Close, London N21 1QH 2013, Web.

Property details for 27 Knollys Road, London SW16 2JJ 2013, Web.

Property values in East Central London 2013, Web.

Residential Property Focus Q3 2013, Web.

Savills World Research 2013, Market in minutes: Prime London residential markets, Savills World Research, London.

United Kingdom inflation rate history – 2003 to 20132013, Web.

Appendices

Exhibit 1: Residential property returns compared with commercial property

Exhibit 2

Exhibit 3: capital growth

Exhibit 4: capital gains by region

Exhibit 5: Average rental rates

Exhibit 6: 5-year forecast

Exhibit 7: Case 1

Exhibit 8: Case 1 NPV estimates

Debts service is half of the sum of value from year 1 to 10 paid as interest and the half the 4% interest for early payment.

Exhibit 9: Case 2

Exhibit 10: Case 3

Debts service = (263,507.67/2) + (0.4*330359.36/2)

Exhibit 11: Case 3

Exhibit 12: Case 4

Exhibit 13: Amortization assumes a debt from 85% mortgage from Capital Fortune which is issued at 6.8% annual rate