Customers

Masters Swimming Western Australia (MSWA) provides swimming services to all interested adults and children. The organization has made it easy for people to join various swimming clubs to offer members flexibility. For instance, participants are offered a wide variety of opportunities and take part in various competitions.

The organization has the Swimming WA group, which targets teaching children under the age of eighteen years to learn swimming, achieve high performance, and enhance pathway focus (Gildon, n.d). Moreover, Masters Swimming Western Australia offers swimming coaching, competitions, and training to people with all forms of disabilities. Thus, the customer segments are divided depending on age, geographical location, or membership subscription.

Geographical Segment

As the name suggests, MSWA operates within Western Australia. Despite the vast size of the territory, the population density in the state is low, which creates limited opportunities to attract a larger audience. The organization has several affiliated clubs in Perth, Albany, and Bunbury. The population there is quite diverse, with approximately 15% of people aged 65 and a large proportion of those aged 20-39 (30.6%) (Australian Bureau of Statistics, 2021). It seems that there are no specific problems that may affect the market segmentation in geographical terms, except for the large area with limited opportunities for communication.

Consumer Profiles to Target

MSWA should objectively understand that the market is competitive with many organizations consumers may choose for their swimming activities. For example, the main competitors are organizations arranging team sports activities, non-affiliated clubs, and swimming WA, which delivers community events. Therefore, it is important to distinguish several target groups: competitive members, sandgropers, and recreational swimmers. Such categorization adequately depicts the customers by their shared characteristics.

Competitive members are those who wish to participate in competitions at province-wide and national levels. Sandgropers are Western Australians who are also interested in participating in competitions but especially enjoy swimming in open water. Their main characteristic is that they swim longer distances than pool swimmers. Nevertheless, they also need swimming pool facilities for training sessions. Thirdly, recreational swimmers who swim for recreation and relaxation play a significant role in MSWA. These swimmers usually visit pools with their friends or family members and do not need highly complex and structured training as competitive swimmers.

MSWA has maintained projects that aim at these different consumer segments. For competitive swimmers, MSWA (2021) created High-Performance Clinics, which run from January 2022 and are intended for professionals who want to improve their techniques and tactics for competition season. For those who are less qualified and who cannot be considered professionals but who seek to improve in the future, MSWA has opened Development Clinics. Sandgropers has an online community for organizing events, which MSWA assists. Nevertheless, there seems to be a scarcity of recreational swimming programs. Although some pool activities may be enjoyable for leisure swimmers, new ideas for creating a fun environment for family members can drive improvement.

Data on Sales

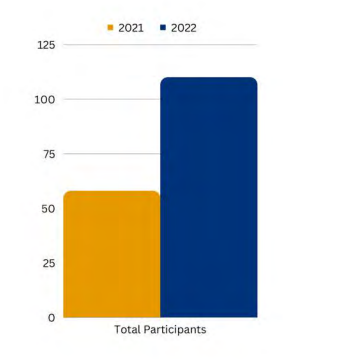

The MSWA is a non-profit organization, although members are required to pay a subscription fee, which is used for workers’ remuneration, amenity maintenance, and organizing activities. The implication is that the sales made are primarily informed of subscription fees by members. Over the last five years, members have grown tremendously across all the regions. For instance, the Couch 2K program, which was launched, doubled the number of graduates (See Figure 1).

Interestingly, the company’s vision is to be the leading swimming organization within the community. In the financial year 2021-2022, the company could sell five events to its 1912 registered members (MSWA, 2022)—the sales of some programs performed poorly. For example, the Thru Perth only had 170 entries, far fewer than those registered in 2020 (MSWA, 2022). Therefore, the company realized growth in some of its activities while there was a significant decline in others.

Growth

The organization’s growth over the past five years has significantly been positive, although not to the expected projections due to the COVID-19 epidemic. The recreational industry was one of the hardest hit by the issues of lockdown and quarantine. However, after people received the vaccines and the rate of infections subsided, there was an exponential increase in people seeking to exercise for physical and mental wellness. Hence, many people joined swimming for different reasons, including health, socialization, competition, and fans.

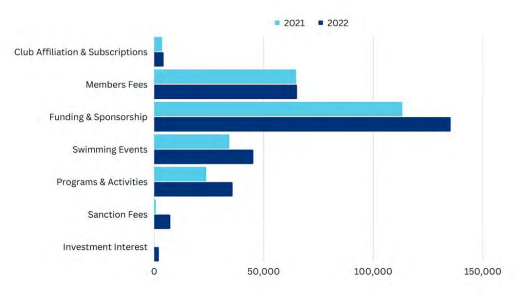

As is seen in Figure 2, in 2022, factors such as social media channels, members’ fees, funding and sponsorships, and swimming events in MSWA’s scope have increased (MSWA, 2022). The growth of people in social media directly corresponds with the growth of subscribers. Noteworthy, most people who finally join the organization as either swimmers or coaches get to follow on social media after doing online searches. The implication is that the high number of subscribers directly reflects the company’s growth.

Market Share

Despite being relatively new, the MSWA has many members compared to other private organizations that provide swimming services. The competition in the market is high, but MSWA attracts more members due to its cost-leadership and differentiation strategy. Moreover, the organization encourages members from marginalized populations such as the LGBTQI, people with disabilities, children, and senior citizens. Having diverse categories of members and working within a large geographical setting is essential. As it was described earlier, the market can be segmented into competitive members, sandgropers, and recreational swimmers. As it is evident from official documents, MSWA tries to engage more professional competitive swimmers.

The company can achieve this thanks to the significant expenses of employing high-quality professionals. Such an approach increases the company’s total market share, granting a competitive advantage. The number of people registering at MSWA has been increasing for the last five years. However, the COVID-19 pandemic affected this growth in the years 2019 through 2021. Then, in 2022, more activities were launched, which attracted many people (MSWA, 2023). The implication is that the MSWA is the leader as determined by the market share. In other words, the organization will maintain market stability through a unique loyalty program.

References

Australian Bureau of Statistics. 2021. Snapshot of Australia. Web.

“Curtin University: Sue Gliddon Executive Officer – Masters Swimming WA.” Curtin University, n.d.

MSWA. 2019 Annual Report: Masters Swimming Western Australia Corporation. Canberra: Masters Swimming WA Inc.

MSWA. 2021 Annual Report: Masters Swimming Western Australia Corporation. Canberra: Masters Swimming WA Inc.

MSWA. 2022 Annual Report: Masters Swimming Western Australia Corporation. Canberra: Masters Swimming WA Inc.