Purpose of This Business Plan

This business plan is to provide vital information to potential investors or lenders such as projection of revenue, profit, and capital requirements for decision making. The failure rate for small businesses is extremely high, often because the entrepreneur underestimated the amount of capital that would be required. The Cash Flow Statement in the form of will shows the cash position of our company.

The management decisions will have long-term effects and it is important that they should be based upon a true understanding of the past with a logical estimate of the future. In the business of AT & T Sync phone, detailed knowledge of the business and its environment will be possessed by perhaps finance and administration managers. It is likely that there will be a host of factors that could adversely affect the company’s future or, alternatively, which could be exploited if the company was prepared in advance to take advantage of them.. The main purpose here is not to consider forecasting at length but to relate it to budgeting. Basic problems will be highlighted and two major areas of forecasting them considered, i.e. sales and production.

Projected Net Sales and Net Income

The duty of a company manager doesn’t end in ensuring that his/her company produces some high-quality products/services, but also includes the burden of apportioning the right prices to the costs to the point of break-even. The product prices depending on the primary purposes of the organizations: whether to make a lot of profits or to serve the society justifiably.

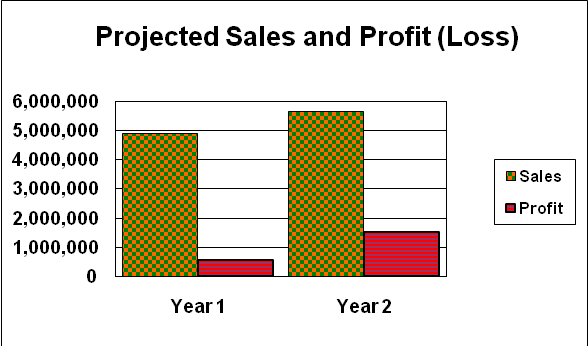

Sales increased from year one to year two as shown by the chart above. The profits also increased as the sales increased. This means the increase in profits was due increase in sales not the charge of gross profit margin.

Basis for Financial Projections

Sales projections: Sales have been projected to be 500,000 units in the first month which will increase at a rate of 1850 per month and 6,122,100 units in the first year. This will bring revenue of equivalent to $ 10,713,675 at unit prices of $ 1.75. Cost of sales AT & T Sync phone will be $1.34 per unit. This will be 76.6% of the revenue generated in the first year. Cost of sales will consist of all cost that brings AT & T Sync phone into the consumable state.

Payroll:-As of right now, the AT & T Sync phone production unit doe not need more than 50 employees. Also, the AT & T Sync phone is not going to yield massive profits in the first few years. When the brand starts to grow and make profit then he will be able to generate enough money to be independent.

Depreciation expense: The depreciation is charged at 20% on straight line. That is 110,000/20% which is 22,000 per year.

Insurance Expense: Insurance costs will be paid by the earnings of the business. Fire, theft, injury, liability and other coverage are needed. So far no particular insurance company has been selected but this cost is estimated to be 150 pounds per year for building. This cost is an estimate.