Introduction

Mergers and acquisitions are sometimes a worthy undertaking for businesses. When Kraft foods acquired Cadbury it became the worlds largest confectionary, food and beverage manufacture with operations in almost 160 countries of the world (Cadbury 33-41).

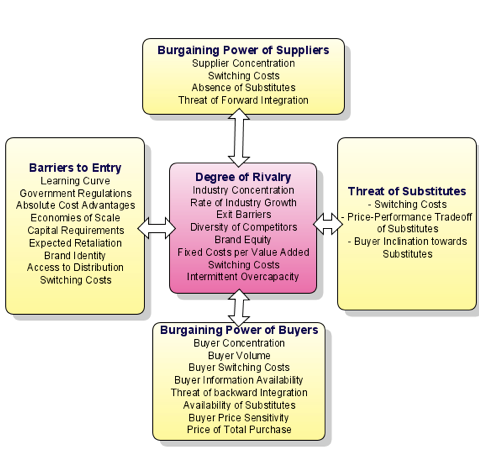

Mostly, business executives when formulating, implementing or monitoring strategies usually use the porter’s model to determine their business move so that they can move their business to industries that are highly attractive. It is with the same technique that Cadbury and Kraft use to make sure that every business move of theirs is justified and highly logical because it is dangerous to make business decisions that lack weight.

Once top managers land in the industries which seem most suitable it is up to use their management skills to ensure that they coordinate their business ambitions for other organizations with lower level managers through communication. Communication is therefore a very important part of business especially when companies are very large company’s operating in numerous countries.

When Kraft took over Cadburys for $ 19 billion it was clear that the top management of Kraft Foods had sufficient data indicating that the business move would be a lucrative venture that would take Kraft’s dominance in that industry to another new level (Lieberman & Krantz 2010). Kraft decided to re-evaluate its business model and gather new opinions from its entire workforce with an aim of carrying out business re-engineering management practices so threat the company’s takeover of Cadbury would be a smooth and fruitful one.

The top management was highly optimistic and therefore even forecasted that their overall coasts would also fall by close to $ 675 million thereby making it very necessary to take over Cadbury and increase its market dominance in the confectionary industry(Odih 233-240). The company intended to utilize every resource and even human resource expertise from managers of Cadbury so that the company could enjoy business and realize its strategic goals (Riley np).

A balanced score card approach allows managers evaluate their strategic moves from both a financial and non financial angle, making it one of the most appropriate techniques used by managers to ensure that strategy is continuously evaluated

Figure 1: Kraft expected its cost structure to reduce by $675m after taking over Cadbury.

Porters five force model

Kraft industries before taking over Cadbury and entering into business in many other regions had taken into consideration the attractive and competitive nature of the industry, considering that the industry has been growing at a rate of 15% making the industry quite attractive considering that the industry is currently valued at over $ 113 billion annually.

Both Kraft and Cadbury have been in the industry for over 100 years making them very stable companies that own one of the strongest brands and even in some countries this brands are part of culture.

Threat of new entrants – Barriers are placed by existing companies and regulatory authorities to prevent new entrants from causing abnormal profit flows for existing companies some of the threats including government policies, exploiting cost advantages, access to distribution, capital requirements.

In this case, the Confectionery industry is known to be very capital-intensive and dominated by the world’s greatest industries that have been in existence for many years.

Although the British government opposed the taking over of Cadbury, Kraft food’s management strongly believed that by taking over Cadbury then their company could penetrate into previously impossible regions such as India and Brazil. Making this venture this venture and take over a good and worthwhile which would help ensure a futuristic long run business opportunity for Kraft foods.

Kraft foods knew by taking over Cadbury then the company will have enough facilities to enjoy all types of economies to scale and that Cadburys brand identity would be a big asset especially where Cadbury had over 14% markets share in the bubble gum and candy market globally. In summary the acquisition of Cadbury would have made Kraft strong and even competitors like Nestle leave alone new comers would have to struggle to keep up with Kraft foods in the market.

Intensity of competitive rivalry among existing firms– firms within the same industry always compete for the available market this can be through powerful competitive strategies, innovation, structure of industry costs, switching costs, degree of product differentiation and so on (Odih, 236).

There are many participants in the confectionary industry and every company uses aggressive strategies to ensure that it acquires and dominate a significant market share. After acquisition of Cadbury then Kraft became the largest confectionary company in the world.

Cadburys core competency and technologies in this industry together with human resources were transferred to Kraft making it more likely that the competitive nature of this company would even become stronger. Kraft’s main idea behind the acquisition was to make sure that the company would capitalize on the 15% annual growth of the industry and have more stakes in the $ 113 total worth of the industry through revenue growth (Lieberman & Krantz np).

Kraft’s overall expectation was that with the Cadbury brand under its wing then the its main competition would be less brutal to them because Cadbury would be used as a brand to attack other brands and make the industry competition more instance due to the good brand image that Cadbury had.

Figure 2: Kraft food’s expected revenues to grow and have more stake in the industry’s $ 133 billion after taking over Cadbury.

Threat of substitute products or services-consumers can opt to go for substitute products if quality is better, price is relatively friendly, or the cost of switching is favorable. But chocolates and confectionary products do not have many substitutes and children around the world always involve them in the art of impulse buying chocolates and other confectionary products.

This meant that Kraft would be better positioned and would therefore expand their business prospects by selling confectionaries to many parts of the world considering that the culture of eating chocolates has no direct substitutes.

The bargaining power of customers-the bargaining power of buyers depends on the number of buyers within the industry who purchase from the available suppliers, differentiation of products, and the profit margin of buyers especially if they are resellers, switching costs that are associated with switching brands and the importance quality and service to the buyers (Odih, 234).

By providing high quality and highly differentiated products and the large number of customers demanding their products as compared to its competitors Cadbury and Kraft Food is therefore able to charge higher prices for the various brands of chocolates and other confectionaries under their belt.

With the ability to charge premium prices for high quality products then the company’s management knew it would be easy to maximize revenue streams and also position themselves as high quality products making it quite hard for other participants within the same industry compete with their brands such as Kraft Dinner, Oscar Mayer, Philadelphia, Maxwell House, Nabisco, Jacobs, Côte d’Or, Milka, LU, Vegemite, Cadbury, Trebor, Poian.

The bargaining power of suppliers-Suppliers who provide raw material can determine the profitability and viability of an industry by setting prices of implements which in turn affect the profit margins. The concentration and number of suppliers affect their bargaining power, the importance of the industry to them, the ability of suppliers to integrate forward and the role of quality and service in the industry.

Kraft through Cadbury is able to use multiple sourcing techniques that enable the company get raw materials for manufacturing their products from many sources therefore making it more cheap and giving the company more leverage when it comes to bargaining this makes it possible for the company to keep costs at a low and revenues streams can be maximized.

Communication

Multinational corporations usually require very effective means communication especially if the parent company wants to maintain control over other companies under its control (Cadbury 88). If communication is poor then a company may often delink itself from its corporate strategic goals therefore injuring the performance of the company both financially and non financially goals.

Kraft, the parent company of Cadbury, usually prefers to alow managers to make important business decisions on a well informed basis and therefore the company uses a direct means of communication where the company provides the managers with the necessary strategic information and then encourages managers to make business decisions that are logical and factual in line with the strategic goals of the company (Odih, 233).

Managers within the company get their communication from the top executives who are in direct link with the corporate headquarters in Chicago.

Although them managers enjoy a high degree of autonomy while making decisions they are only required to act within the guidelines of the information that is handed to them by the top executives of the company who are in direct contact with the corporate headquarters. When corporate managers receive the information it then trickles down from the highest to the lowest level employees through official channels such as memos, letters, email and departmental heads (Wheelen & Hunger 76).

The advantage of using a direct means of communication that is more official enables the employees within the organization carry out their duties with more confidence because when there many centers of power and communication then massages may end up being confusing and ambiguous.

Balanced Score card approach (BSC)

The balanced score card approach is used by managers and strategists to evaluate, monitor and justify any corrections in strategy within organizations (Wheelen & Hunger 56). The advantage of a balanced scorecard approach is that it uses both financial and non financial measures to determine strategic success of an organization, by comparing input of various process and output.

BSC is a highly effective strategic performance management tool that enables managers takes a critical look on how appropriate corporate, business and functional strategy was to the organizations. The BSC approach allows manager to review strategy by taking an in-depth look at how the organization performed especially when it comes to financial parameters, customer parameters; internal business processes parameters and learning and growth parameters of the organization.

It is this approach that is used by the management of Kraft and Cadbury to evaluate how the organization performed strategically (Wheelen & Hunger 212-223). The outcome of this process that is used by top management to justify the need of carrying out any strategic changes in the company within various functional areas.

A table representing some of the BSC parameters that are used by Cadbury and Kraft to measure strategic performance.

Works Cited

Cadbury, Deborah. Chocolate Wars: The 150-Year Rivalry between the World’s Greatest Chocolate Makers. London: Public Affairs, 2010. Print.

Lieberman, David & Krantz Matt. ‘Is Kraft’s $19B Cadbury buy a sweet deal? Buffett has doubts.’ Usatoday.com. 2010. Web.

Odih, Pamela. Advertising and Cultural Politics in Global Times. Advertising and Cultural Politics in Global Times. New York: Ashgate Publishing, Ltd, 2010.Print.

Riley, Jim. ‘Kraft’s Cadbury takeover triggers management exodus.’ Tutor2u.net. 2010. Web.

Wheelen, Thomas & Hunger David. Strategic Management and Business Policy. New Jersey: Prentice Hall, 2002. Print.