Urbanization can be described as the process in which there is high percentage of people living in urban regions. Even though there are different views about the meaning of the term urban, it is agreed that two significant rapid urbanizations exists.

The first urbanization occurred in 19th century due to industrialization (LEDC) and the second is still transforming since 1950s due to immigration (MEDC) (Martine 54). Some claim that in 1900 just 4% of the global population lived in urban areas and statistics have increased to 44% in 1990 (Martine 54). There is an expectation that by 2025, there will be 60% of the population in urban areas.

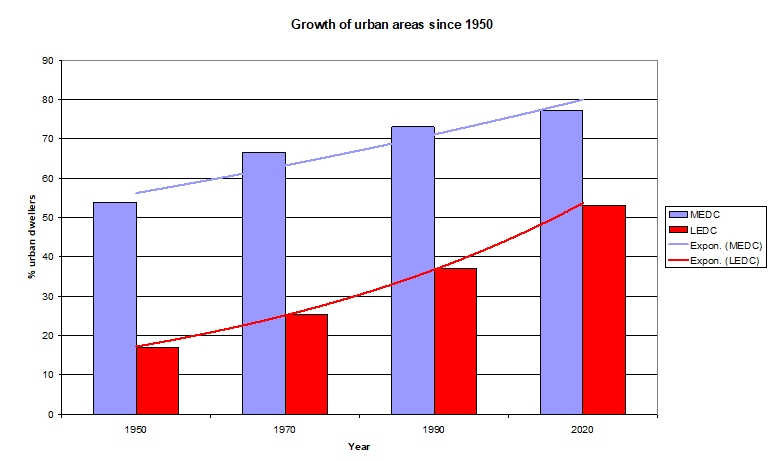

Figure 1 below shows the growth of urban areas. The figure 1 shows that LEDCs are facing a more exponential raise in number of population in urban areas, while MEDCs are facing a linear increase. This type of LEDC urbanization growth occurred in 19th century.

Figure 1: Urbanization in MEDC and LEDCs (Martine 54).

Literature Review

Population in Mexico

Mexico can be classified as LEDC. As from 1960s, it has undergone increase in urbanization, population growth, and industrialization. The growth in population is due to reduced mortality rates and better health care services in Mexico. The growth of urban regions has been facilitated by the growing population and rural-urban migration.

The population of Mexico stands at 105 million, where around 21% reside in urban areas of Mexico. Since 1960, the population figures have increased around 6 times (Kulcsár and Curtis 38). Even though statistics show that around 9.8 million people live in urban areas, these statistics does not consider the expansive nature of the city itself.

When taking into consideration the actual state of urbanization in Mexico, everyone must bear in mind the Mexico City Metropolitan Zone (MCMZ), which is approximated to be 7,800 km2 (Kulcsár and Curtis 38) includes the Federal zone (Mexico City proper) as well as 55 municipalities. The number of people living in MCMZ is approximated as 21 million.

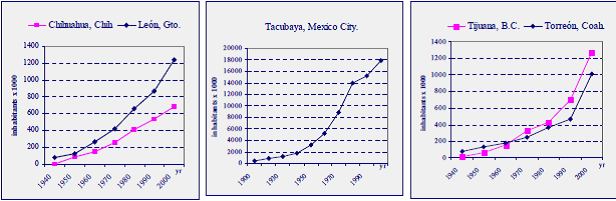

Figure 2: Population growth rates in some Mexico cities (Martine 55).

Economy of Mexico

Free market economy that exists in Mexico is derived from services, agriculture, modern and traditional industries which are owned mainly by private sectors. Mexico’s GDP is approximated to be US$860 billion, which are contributed by services (65%), industry (28%), and agriculture (7%) (Martine 57).

The trade agreement between United States and Mexico has supported greatly the importation and trade of commodities in Mexico to U.S. The high reduction in value of the Peso in 1996 was facilitated by the growing trade between both countries. In some of LEDCs, the allocation of wealth is uneven, with the top 20% of returns earners making up 53% of income (Martine 57).

Structure and land use of Mexico City

The Federal zone of Mexico City has created key zones of population structures which have emerged since 1970s (Teresa 56). The key zones are discussed below.

Urban nuclear zones

These are districts situated in the middle of the urban zone where it is dedicated for offices, cultural functions, and as industrial area. Traditionally, it had huge population but people have migrated to other parts of the urban areas. Residential buildings are not found here and the housing in this zone is assigned for other functions like administration and commercial purposes.

Rural Urban Fringes

The rural regions are situated in the southern and eastern part of the Federal zone where these regions have minimal but distinctly growing population. The growth of population was due to, mostly, improved agricultural practises and also the growth of residential zone and tourism.

Intermediate Urban Zones

Intermediate regions are metropolitan where it has undergone rapid increase in its population for the last 40 years, both as ordered and disordered squatter settlements (Teresa 56). Such regions have maintained various rural features in relation to agriculture, but their contribution into the Mexico’s economy is at a minimum. These regions have been located in undesirable or advantageous lands, for example in ravines and along the lakes; these areas are vulnerable to flooding and mud slides.

Origin of urbanization in Mexico

Urbanization in Mexico is as a result of two main causes: relocation and increase in population. There are some factors which triggers these main causes of urbanization. Employment is one of the factors of which it activates the rural-urban migration. Agriculture in Mexico rural areas have been declining since 1950s. As we have seen in the statistics of figure 1 above, agriculture has been contributing only 7% to GDP (Barney 152).

Urban areas therefore have the highest number of job opportunities. After the government took control of the rural lands, the agricultural practises and production declined. After the liberalisation of the Mexico’s economy, land has developed into a commodity. The intention for the expropriation of the rural land is to develop urban housing in the past many years.

Through expropriation of these lands, the possibility of growth in agriculture has lessen and through utilizing the land for housing and other services, the original known rural region is directly changing into urban in one way. Not all of these rural areas have been converted into urban but the government has isolated some of these regions into natural reserves so that they can maintain the nature of the rural areas.

Nonetheless invasions of such regions by the unlawful inhabitants have changed the nature and motive of some of these districts. The expropriation of rural areas have brought about many people to be landless and hence migrate to the urban areas to look for jobs and even into the nearby U.S, with most people trying to enter illegally (LaRosa and Mejía 122).

Morphology of Cities

Through studying the Mexican city system, it can be noted that there is a certain difference from the United States and European urban systems. Mexico cities are considered to have morphological urban structures which are common in Latin America. This type of urban system are mainly caused by some factors like culture, level of revenues, automobile possessions, accessibility of long-term loans for businesses housing sectors and other issues which are exclusive to Latin America.

The key form of urban morphological which many people are using to express Latin American urban was generated by Griffin and Ford (398) and afterwards revised by Larry Ford (438) to add some factors like the growing industrial park which were not added in the previous form. Nevertheless, these models are not without their critics.

Martine (24) disapproved the first Griffin and Ford form and the Larry Ford method saying that it is very comprehensive and not justifying the large quantity of different land use which is located in entire Latin American urban. In the case of urban morphological forms, the one which are found in Latin America can be seen as a division of the urban morphology of the developing countries.

The cities which are in Mexico and United State border, even though they are greatly manipulated by nearness of the U.S, it has adapted to the system of Latin America urban. Those in United States often consider that the Mexico cities which are in the border are a distortion of the United States cities.

This view is fully false. The effects of the Mexican urban policies, economic system, and the point that a large number of these urban cities were established in the colonial era before the creation of this U.S. and Mexico border have positioned a permanent Mexican impression of such urban cities’ structures.

From the analysis of the entire cities in Mexico and the border cities system, it can be noted that they are just the same as in the central part of Mexico. Within the Texas border, main cities reflect on the cities system of Saltillo and Monterrey in several factors because of the influence of growing industrialization, especially because of the progress of rising figures of maquiladoras and the affluence of these regions when match up to other regions of Mexico and the closeness of the U.S (Kulcsár and Curtis 36).

Irrespective of the resemblances of border cities to other cities in the Latin America and Mexican cities, major dissimilarities exist which put the urban cities of Mexico as a unique difference among the Latin American structures. The closeness of United State border to such Mexican cities have promoted the growth of maquiladoras at a greater level above other regions of Mexico, therefore supporting higher demand for employees and raised inner migration to the border cities.

The increasing growth of population has generated a fast development in the housing areas, especially in the growth of considerably large regions of shanty areas on the environs of these cities. This growth has been highly improved by policies, transport, and other structure developments set up by the Mexican government to take the benefits of the areas’ position in comparison to the U.S. over a long period of time.

Problems of urbanised Mexico

There is an increase in urban areas at an approximate of 3 to 10% annually in Latin America (Teresa 56). There are limited areas in the urban cities in which this population must live. Sufficient residential areas and infrastructure services may not be offered for all the people migrating to urban areas.

In Mexican urban areas, the people moving into these cities from other parts of the country are increasingly required to reside in poor areas of the cities. The type of housing found in these regions is informal squatters system, with inadequate or no basic services.

The economy of these Intermediate Urban Zones (as discussed above) is based on services which may be shown by huge population of hawkers in towns. Most of the people are no longer having the capacity to provide basic needs for themselves in these zones. The inequality of wealth allocation is clearly seen in urban regions, where the nuclear zone have more advantage to the global trade but this is not distributed efficiently using the social structure to the regions in the periphery.

The effect of this inequality in the urban areas in Mexico can be noticed in the intermediate housing zones, where essential services such as water, roads, and security are very poorly managed or in some parts often not present. Not more than 25% of provided water goes through potabilization and treatment of water is not always done (Teresa 56).

Most households do not receive pipe servicing daily. Just a fraction of solid wastes is collected and around 30% of solid wastes are not under hygienic states. Over a third of toxic wastes produced in these regions are unaccounted for. Availability of water is a common issue and around 2.4 million city residents are lacking drainage and 4.6 million are under foul sewers (Martine 232).

The income inequality, which can be evidently noticed in the simply contrasting environs of Mexico City, underlines the economic difficulties experienced by the urban at present. While the high population of the poor are found in the rural areas, a World Bank research carried out in 2005 approximated that 12% of urban population of Mexico was very poor, with 42% of the population categorized as relatively poor (Martine 232).

Around 45% of the urban economy is considered to fall in the informal sector, comprising street vendors, service employees, and other traders in the city, who do not have a permanent job and their income are not subjected to tax (LaRosa and Mejía 45). The informal employees are not under the health coverage.

Benefit system and welfare state is not provided to the unemployed people whom they mostly live in intermediate urban zone and they cannot afford to pay for themselves. Some services are available in the urban areas but most of the residents are not in the position to pay for them.

The Mexico government have implemented a social safety net program, commonly known as Oportnidades, which emphasizes on the poor regions of the city and rural areas. These programs have improved the situations in the rural areas and have done less for the intermediate urban zones in the latest years.

Intermediate urban zones have transportation problems and occurrence of violence and crime is at a higher rate. The pollution in Mexico’s urban areas has been considered as one of the worst, although the government has implemented some programs over the last 15 years which is starting to have effects.

Some of the factors which bring about air pollution are from motor vehicles which are in towns. Roads, water, and rail are the only means of transportation for the supplies which are taken to the northern part through land from other parts of Mexico and from South America, hence making some cities as chokepoints. Industries also have contributed to pollutions in the urban areas (LaRosa and Mejía 46).

The topography of Mexico City is a huge factor where the environs of the city are mountainous which does not allow the pollutants away from the city. Water pollutions from industrial waste and inadequate sanitation measures cause many diseases in the urban areas daily. Homes in the urban districts frequently have insufficient or no sanitation, resulting to health issues, adding to the entire irregularities in the water distribution in Mexico urban areas.

Solving the problems of urbanized Mexico

The major problems of Mexico cities should be tackled with effective strategies if these growing issues are to be handled and managed in a sustainable manner. The government should establish effective housing plans, especially improving the standards of housing in the shanty regions of the cities.

The Mexico government are in collaboration with World Bank to deal with some of these concerns, even though Mexico should deal with some of these problems internally and not only depend on the assistance from international bodies. Through supporting urban agriculture, residents living in outside urban areas would become less dependent on services to offer a livelihood (Kulcsár and Curtis 157).

These approaches are being established in Mexico City and some other governmental plans are being implemented to solve the issues of urban growth through offering family planning awareness.

There are some of the strategies which Mexican have implemented to adapt rapid changes which comes with urbanization growth. Some of these approaches are raise cash income, safeguard human capital and food security, safeguard security of the families and assets, and socialization diversification. The residence has established market for their commodities to gather for customers and meet their income target.

Some families have substituted expensive foods like meat with cheaper foods like beans and eggs to safeguard food consumption. Health issues in urban areas are in an increase and because of low income from majority of the Mexico urban population, they may decide to stay ill in order to reduce expenses.

Due to increase of violence and crime in the Mexican towns, the residents have implemented some strategies to protect their families. For instance, some call the police if there is any incidence of crime or violence and return home early. Some of these strategies have effects on their working hours (and as a result reduced wages) and community socialization.

The studies of adaptive approaches of the Mexicans to respond to the rapid changes in urban areas in Mexico cities indicated that families have created new forms of association to take the benefit of opportunities or reduce susceptibility. Mexicans allow their needs to direct their activities which, to some degree, were generated by the poor urban surrounding itself.

Conclusion

This paper illustrated the current trends concerning urbanization in Mexico, including urban structures and migration within Mexico. It demonstrated that the country is distinguished through its high degree of urbanization than some countries in Africa and Asia.

The fast urbanization and development of range of cities which attracted huge population from within and outside the country mostly occurred in 1930 and later in 1970, and was associated with the industrialization development and the beginning of capitalist methods of production in some parts of the country (Barney 55). Rural-urban migration was the major factor which contributed to the Mexico urban growth.

Mexico urban areas are not the only urban areas in the world which are presently experiencing these challenges, several cities are facing intense population growth, generating overpowering demands on essential needs like transportation, water supply, housing, employments, and other services offered by the government.

Due to continuous rapid growth in cities, they cause overwhelming urban arrangement challenges in addition to opportunities to set up the effective programs which could have international implications. Internal migration is a common practise currently in Mexico and has become difficult to measure. Few findings from studies indicate the complexities in the approximation of new dimensional movements in both the small administrative regions and in districts.

Works Cited

Barney, William. A companion to 19th-century America. Hoboken: John Wiley & Sons, 2006. Print.

Ford, Larry. “A New and Improved Model of Latin American City Structure.” Geographical Review 86.3 (1996): 438-441. Web.

Griffin, Ernest and Larry Ford. “A Model of Latin American City Structure.” Geographical Review 70.4 (1980): 398-423. Web.

Kulcsár, László and Katherine Curtis. International Handbook of Rural Demography. New York: Springer, 2011. Print.

LaRosa, Michael and Germán Mejía. An Atlas and Survey of Latin American History. Chicago: M.E. Sharpe, 2006. Print.

Martine, George. The new global frontier: urbanization, poverty and environment in the 21st century. London: IIED, 2008. Print.

Teresa, María. Land Privatization in Mexico: urbanization, formation of regions, and globalization in ejidos. New York: Routledge, 2004. Print.