Introduction

Just like social and political development, economic development is also one element of the more comprehensive notion of development. This is the reason why many economists refer development as an assignment and a procedure. As a procedure or process, development implies various tasks done in different sectors of economy to improve the status quo of underdeveloped, developing, rising and recently industrialized countries.

On the other hand, development as an assignment or project implies the premeditated strategies aimed at improving the country’s national economic growth. In the recent times, developing countries such as Bangladesh have made deliberate changes in national agenda by shifting from free trade concepts to globalization projects. The main aim of a globalization project is to encourage economic development, which will enhance national productive capacity.

However, to achieve high productive capacity, countries must enact polices aimed at enhancing agriculture, increase labor and investment opportunities, improve living standards, and trim down poverty rates. Through borrowing from domestic and international financial institutions like IMF and World Bank, Bangladesh has managed to improve in key sectors of economy. (Hossain 1-3).

Economic Development in Bangladesh

Although there have been major economic improvements in literacy, birth control, poverty diminution and infant mortality the country has failed to tackle inequalities arising from wealth and income, improve infrastructure and energy supply. In a World Bank report released in 2007, Bangladesh has the capacity to achieve gross national income of US$875 if only it enhances its industrial base, competes in global markets and carry out metropolitan economic development.

Nevertheless, the country will not achieve this unless it operates under sustained growth rate of 7.5 percent. The major setback surrounding Bangladesh’s slow economic growth lies in political havoc, global economic changes and natural hazards. The country has failed to achieve its projected annual growth rate amid laying economic plans.

In 1991, Bangladesh government engaged in financial reforms and trade liberalization in order to attract foreign investment. Additionally, it initiated programs aimed at empowering the poor financially to start small medium enterprises for poverty eradication.

By 1996, the country had achieved a growth rate of 5.5 percent. The 1999 floods and rise in gas and electricity prices saw the economy drop to a growth rate of 5.3 percent. At the dawn of the 21st century, Bangladesh embarked in monetary expansion coupled with borrowing from domestic banks and financial institutions like IMF and World Bank. The government used finances from IMF to pay wages and deploy infrastructure paramount to jumpstart economic development.

The roles played by World Bank and IMF cannot be underestimated. In fact, the World Bank has initiated many projects in Bangladesh aimed at economic development. Microfinance institutions in Bangladesh rely on funds from World Bank to reach out poor people in the society. (Holmes, Farrington, Taifur, and Slater 3-13).

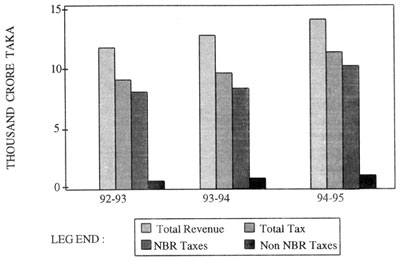

Bar Graph Representing Tax in Total Revenue

Microfinance

The economic development of Bangladesh will largely depend on how much the country invests in microfinance to reduce poverty levels and initiate infrastructural development. As a leader in rice production, microfinance credits will assist poor people to start small businesses and participate in development. World Bank statistics indicate that Bangladesh in the country with highest number of microfinance borrowers.

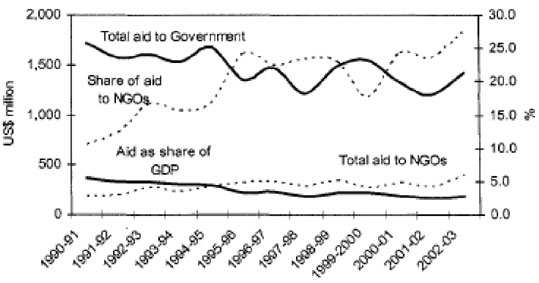

In Bangladesh, non-governmental organizations play a major role in offering micro-credits to people who will then invest in small medium enterprises. Through World Bank and other financing bodies, non-governmental organizations in Bangladesh have increased their operations all over the country thus, setting the runoff for economic development.

In most cases, the trade-off period between sustainability and outreach provided by World Bank gives these NGOs short trade-off periods hence allowing micro-credit beneficiaries more time to develop. The World Bank believes that the established micro-credit programs can be the best avenue of economic development and accountability to donor resources.

For a country like Bangladesh with poor financial markets, the preamble of microfinance is indeed a financial novelty aimed at starting financial markets. Started in 1970s, microfinance has been vital in revenue generation to low income earners. Currently, many people who do not have bank accounts can access microfinance from non-governmental organizations, which will help them start small business enterprises.

Thus, microfinance is all about establishing easier financial solution that will enable the poor people reach credit and savings easily. World Bank research shows that poverty-stricken Bangladesh citizens cannot get credit form local banks, as they are unable to meet the expected collateral. This leaves bank credits to rich Bangladesh citizens hence, economic stagnation.

The main reason of introducing microcredit is to empower poor citizens to generate personal revenues in line with World Bank’s policy of minimizing poverty levels. In most cases, these micro credits target Bangladesh citizens who do not own land together with women. From World Bank statistics, about 90 percent of people in Bangladesh who receive micro credits are women. (Khandker 263-286).

With microfinance, women engage in informal activities characterized by low market demands and returns. Through this, women generate revenue that discourages poverty hence, economic development. The idea of microfinance roots from the World Bank policies and the millennium development goals.

In order to reach industrialized state, both underdeveloped and developed countries must look for ways of ending poverty and the best way to do this is through introduction of microfinance. Today, Bangladesh is a leader in microfinance thanks to initiative starters, Grameen Bank. Supported by World Bank, Grameen Bank became the first financial institution in Bangladesh to offer micro credits to low income earners.

On realizing its importance to economic development, Bangladesh people and non-governmental organizations became the first to support the initiative. This is because; Grameen Bank offered collateral free microfinance with up to 50 weeks maturity period and weekly reimbursement. Furthermore, Grameen Bank did not restrict its loan into financial sectors but instead, allowed people from every sector to reach micro credits and empower themselves economically.

For instance, farmers could go for an agricultural credit, businesspersons go for cooperative credit and consumers settle on consumer micro credits. With time, Grameen bank became a very successful financial institution especially in microfinance. This challenged many organizations and later started offering micro credits to low income earners in Bangladesh.

Today, there are as many as organizations offering microfinance solutions to poor people aimed at eradicating poverty, fostering family planning, providing affordable health care, and empowering women economically. For example, if women fail to access land, they can opt for micro credits, which will empower them to participate in informal income generating activities like horticulture and betel leaf agriculture. (Marilou 41-48).

World Bank Impact on Child Labor in Bangladesh

World Bank policies on child labor have been imperative in setting out economic development agenda in Bangladesh. The prevailing social and economic realities in Bangladesh have made child labor an accepted thing. Until the intervention of World Bank, UNICEF and International Labor Organization, child labor has been domineering in Bangladesh. The poor families largely rely on child labor to generate income for survival.

Interestingly, the rich merchants in Bangladesh enjoy employing children as they pay them less wages. In a move aimed at ending this vice and enhance economic development, the World Bank provides a framework policy of awarding micro credits to low income earners, which will empower families and stop depending on child labor. Child labor denies children the right to get education and participate in other activities like leisure and play.

World Bank data shows that about 5 million children aged between 5 and 14 engage in active child labor with only 25 percent attending school during part-time. In addition to this, rapid urbanization has made children move into urban areas in search for job opportunities. However, when they fail to secure such opportunities, they turn into criminal gangs.

Those who are lucky enough to secure jobs in garment, sugar, leather, pharmaceutical and steel factories, work for at least 28 hours and leave 222 taka equivalent to US$3.3 per week. This is according to International Monetary Fund. The International Monetary Fund and World Bank have been imperative in providing funds to organizations and banks and encouraging land less people to borrow and invest in business opportunities.

In its report, World Bank found out that 40 percent of household who borrow micro credits have their children completing school without necessarily engaging in child labor. The World Bank has initiated projects for such as BEHTRUWC aimed at building free learning centers in poor regions to discourage child labor. (UNICEF Bangladesh 1-5).

Child Labor Statistics in Bangladesh

Source: International Labor Organization.

The Impact of World Bank Loans on Water Availability in Bangladesh

The World Bank has pumped in many resources and funds in Bangladesh aimed at initiating water projects. In a move aimed at economic development in Bangladesh, the World Bank seeks to assist Dhaka Water and Sewerage Authority with US$100 million to initiate water projects in rural and urban areas in line with Bangladesh’s six-year economic development strategy.

For instance, small towns and rural areas that did not have access to this important basic commodity can now smile thanks to the Bangladesh Water Supply Program Project (BWSPP), which has connected water supplies into citizen reach. However, this could never have been a reality had it not been World Bank funding.

With a funding of US$40 million from World Bank, the Bangladesh Water Supply Program Project aims to supply water to rural areas and small towns in line with the millennium development goals of 2015. This project is just a continuation of yet another World Bank funded project, Arsenic Mitigation Water Supply Project. Additionally, the project aims at providing pathogen-free and arsenic-free water to reduce chances of water-borne diseases. (World Bank 1).

Trade liberalization policy and its impact on the Bangladesh Economy

Trade liberalization and structural modification programs in Bangladesh are integral programs aimed at setting Bangladesh economy on track. Aimed at pumping money into the agribusiness sector, the program will streamline the sector in order to become sustainable.

Trade liberalization is imperative to poverty eradication and economic development. Developing countries such as Bangladesh depend on agriculture as the backbone of economic development. For instance, 52 percent of Bangladesh citizens engage in agriculture for sustainability.

However, the introduction of World Bank and IMF liberalization and de-collectivization programs in agribusiness has brought some changes in household economy. Moreover, the Bangladesh’s involvement in international trade is a step in the right direction and one towards reduction of poverty and economic development. Those who live in rural areas are the major beneficiaries of this program and accounts 59 percent of Bangladesh citizens living below the poverty line.

For example, the input and output of market-oriented alterations, tariff restructuring, and the reshuffle of export and import reforms have set the pace for economic development. Additionally, the introduction of static trade policy and fiscal policy has increased household economy by 50 percent. Thus, market liberalization will open new avenues for Bangladesh’s economic development. (Hossain 1-11).

World Bank Policies and their Impact on Women’s Economic Status in Bangladesh

Women are the most affected group in Bangladesh economy. Composing the majority with no means of generating money, the World Bank sought to invest microfinance programs in order to empower them. However, through World Bank programs, the economic status of women has risen by 39 percent.

In fact, women are the most beneficiaries of microfinance credits in Bangladesh. Majority of them do not own land and the only option left for them is to borrow money from organizations, which will enable them operate informal activities. Through micro credits provided by World Bank and other financial institutions, idle women are now productive.

As of now, women participate in many socio-economic activities, which enable them to raise families without any difficulty. Micro credit renders have so far invested in women US$ 1.4 billion, employed 70, 000 people (20 percent women), and empowered economically 7.2 million Bangladesh women. (Goetz and Sen 1-8).

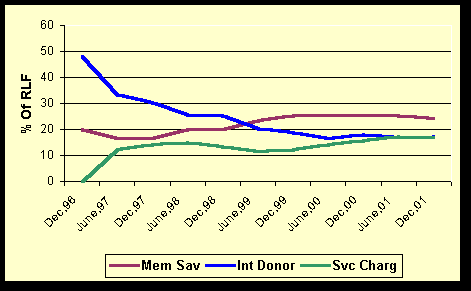

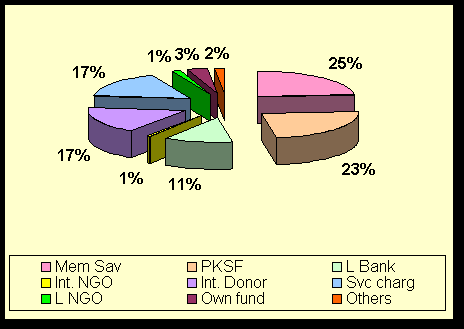

Sources of Funds and Financial Sustainability in Bangladesh

Conclusion

Bangladesh has made significant moves towards economic development amid challenges like slow economic reforms, lack of government owned enterprises and poor energy supplies. Furthermore, Bangladesh still lags behind in terms of foreign trade and its absence in foreign markets is a blow to economic development. Currently, the government has embarked on building an infrastructural base for foreign investment. Moreover, the recent liberalization of capital markets is a step towards economic development.

The availability of foreign aid from World Bank, IMF and other development partners will see Bangladesh achieve economic targets by the year 2015. According to World Bank, the reduction of foreign dependence by 10 percent, 18 percent export growth that amounts to US$10.5 billion, and 25 percent increase in remittance will see Bangladesh’s economy grow by 6.5 percent in 2010.

On the other hand, the efficient utilization of microfinance witnessed so far, has increased household economy hence reducing poverty levels. Nevertheless, the government together with domestic microfinance institutions should develop non-financial and financial products to empower all social groups and jumpstart economic development.

Works Cited

Davis, John. NGOs and Development in Bangladesh. 2006. Web.

Goetz, Ahmed, Sen, Gupta. Who takes the credit? Gender, power and control over loan use in rural credit programmes in Bangladesh. Working paper: Institute of Development Studies. Brighton: University of Sussex. 1994. Print.

Holmes, Rebecca, Farrington, John, Taifur, Rahman and Slater, Rachel. Extreme poverty in Bangladesh: Protecting and promoting rural livelihoods London: Overseas Development Institute. 2008. Print.

Hossain, Mian. Poverty Alleviation through Agriculture and Rural Development in Bangladesh. Centre for Policy Dialogue, 39, 2004, 1-11.

International Labor Organization. Baseline Survey on Child Domestic Labor in Bangladesh. 2006. Print.

Khandakar, Muzharul. Micro-Finance-Bangladesh. 2010. Web.

Khandker, Sayma. Microfinance and Poverty: Evidence Using Panel Data from Bangladesh World Bank Economic Review, 19 (2), 2005, 263-286.

Marilou, Jane. Microfinance in Bangladesh: Emerging Policy Issues. Dhaka: The University Press Limited. 2007. Print.

UNICEF Bangladesh. Child Labor in Bangladesh. 2010. Web.

World Bank. Projects- Bangladesh: Bangladesh Water Supply Program Project. 2004. Web.