Introduction

Beijing Mobike Technology Co., Ltd. launched Mobike, also referred to as Meituanbike, a station-free bicycle-sharing service with its headquarters in Beijing, China. It is the largest bicycle-sharing provider in the world based on the count of bicycles, rendering Shanghai the busiest bike-share metropolis in the world. Meituan, a Chinese online start-up, purchased Mobike in April 2018 for US $3.4 billion (Chong, 2018). However, the future of Mobike is uncertain, though, because not much has changed at the company since Meituan bought it; this is because the company’s profit model is still up for debate. Therefore, a risk and mitigation analysis is necessary to comprehend the sector’s investment goals. Hypotheses are made to value a firm that is not listed on the financial markets. Table 1 illustrates the financial prediction made concerning an investor’s involvement in the company.

Table 1: Coarse risk analysis towards financial loss in the bike-sharing industry

Risk Analysis

It is critical to understand what hazards might result in business risks and how users see these risks in the bike-sharing sector. To start, this chapter offers a framework of basic risk analysis to demonstrate the present and future risks to the firm. Second, taking into account the findings of stakeholder assessment will gratify the low-risk firm by exceeding the requirements of investors and regulators. Therefore, to address the needs of the interested parties, an optimum product analysis is required. The risk evaluations performed by Mobike are summarized in Table 2 below.

Table 2: Assumption and Hypothesis Analysis

Rationale for the Assumptions:

- The tax rate is assumed to be 25% since the entity’s taxable income is medium.

- The discounted rate is assumed to be 10% since the initial investment of US$ 644,800,000 at a 10% discounted factor over three horizon years implied the cash flow would be US$ 95,850,000 each year.

- The Perpetual growth rate is assumed to be 3% considering the low historical inflation rate and the history GDP growth rate.

- The EV/EBITDA Multiple is 0.4x considering that the premise of a comparable company study is that identical businesses will have comparable valuation multiples.

- The other assumptions made are based on the transaction dates and details of instructions provided for the company.

Risk Identification

It is feasible to presume that the left side of the bow-tie diagram by using the potential effects from the right side of the diagram to determine related risks and threats for vulnerabilities. Numerous incidents or near-misses, including traffic jams, theft, vandalism, and accidents, constitute risks and dangers for bike-sharing companies. For instance, according to estimates of the city’s needs, Guo Jianrong estimated that 1.5 million shared bikes are well over the city’s capability (Jing, 2017). This implies that one bike will be shared by many individuals per day.

Risk Mitigation

Dockless shared bicycles are an ingenious invention that might be seen as a step forward from regularly shared bikes. It may be created by doing a demands study, functional evaluation, and design, creating a prototype, and validating it before releasing it on the market. The dockless bike-sharing is thought to be in the experimental stage, given the multiple models with varying elements and functionalities that are now available, which can be inferred from its many functionalities and empirical modifications in the two years since its inception. By choosing an optimum product, the majority of the hazards, including accidents, traffic jams, risk deposits, theft, and vandalism, may be reduced. Therefore, one of the key prerequisites for obtaining a low-risk company is an optimized product.

Market Analysis

An examination of the market might reveal information about current competitors and potential clients. 1) Industrial analysis, which evaluates the overall industry structure in which one operates, is one of the main elements of the market study. (3) Competitor evaluation, which determines the enterprise counterparts and assesses their advantages and disadvantages. (2) Target market analysis, which recognizes and estimates the clients the company will be pursuing for sales. In order to evaluate this, a SWOT analysis is used.

SWOT Analysis for Mobike

Strength: With a market share of 56.56% in 2017, Mobike is still the second-largest provider of bike-sharing services. Additionally, Meituan may help Mobike get more users if the two were integrated. Furthermore, this brand is well-known in China, and now that it is part of Meituan, Mobike no longer demands client deposits, which is the primary factor in consumers’ selection (Cadell, 2017). As a result, Mobike can continue to grow these consumers’ allegiance.

Weakness: As a result of the bike’s superior quality and price, Mobike has advantages over its rivals. A bike costs roughly $200 on Mobike, but less than $30 on Ofo (Cadell, 2017). Additionally, the quality of the motorcycles does not significantly influence consumer decisions. As a result of the project’s high expenses, it would take longer to recoup the investment.

Opportunity: Mobike has the option of enhancing the bike’s composition and structure, which would lower the price of production and upkeep. Because Tencent is funding Mobike, it has the potential to become a part of the larger ecosystem of digital companies like Tencent and Meituan (Ma, 2018).

Threat: Governmental Rules: This year, at least 58 local governments have penalized bike-sharing providers by imposing limits on the number of bikes that may be distributed. The market share of Mobike might be increased by new rivals like Hellobike, which is backed by Ant Financial, a subsidiary of Alibaba. Last but not least, the cost of replacing damaged or vandalized bikes is uncertain and raises Mobike’s expenses.

Enterprise Value Analysis

An economic matrix termed enterprise value (EV) reflects the market worth of the entire company after accounting for stock and unsecured creditors. EV provides an estimate of a company’s valuation. Didi Global Inc. would be utilized for comparative company analysis (CCA) to assess the market capitalization of Mobike because the majority of its direct rivals are not listed on stock exchange platforms. CCA is a procedure used to assess a company’s worth using the criteria of rival companies in the same sector and of comparable size. The premise of a comparable company study is that identical businesses will have comparable valuation multiples, such as EV/EBITDA. The CCA based on the report for December 2018 for Didi Global Inc., the sole listed business in China’s bike-sharing sector, is shown in Table 3 below.

Table3: Comparable Company Analysis

The enterprise value of Mobike was obtained from Table 3 as the preferable or appropriate valuation multiplier and the enterprise value of its nearest rival, Didi Global Inc. Since it demonstrated a more similar enterprise value to those estimated by Meituan-Diaping (US$3.4 billion) in April 2018, EV/EBIT was used as the appropriate valuation multiplier in this instance. As a result, it was determined that the enterprise value was US$3.224 billion.

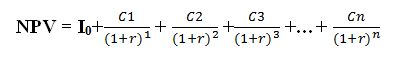

The Net Present Value of the Corporation was determined using the Discounted Cash Flow as a second valuation to determine the enterprise value. The total present value of all the cash flows that follow from investing compensates for the investment’s net present value (NPV). This approach was used because it may provide investors and businesses an indication of how valuable investment is planned. It is an assessment that may be used for a range of capital ventures and projects when it is possible to predictably anticipate future cash flows. In the case study, since the cash flows are easy to understand, it is possible to modify the forecasts to produce a number of different conclusions. Users can utilize this to take into consideration various forecasts that could be made. Hence, a positive NPV results in an investment initiative being expected to generate a greater return than its cost of capital, which would enhance stakeholder ownership. The NPV is determined by:

Where: I0 is the initial investment

C1, C2, Cn is the project cash flows arising from years 1, 2,,, n r is the cost of capital or obligatory rate of return.

Table 3 displays the outcomes of the monthly turnover using the DCF and NPV. The information was derived with an initial investment of US$ 644,800,000 at a 10% discounted factor over three horizon years, anticipating that the cash flow would be US$ 95,850,000 each year. Two points were taken into consideration while determining the estimated yearly cash flow estimates. First, the permanent growth rate was set at 3% since the business as a whole had a cost of sales of around 75% and a net profit margin of 12% at the end of December 2017. Second, the objective minimum ROCE to gain a 20% interest in the firm determined the cash flow for the investment, which resulted in an initial investment of US$644,800,000.

Excel formulae were used to calculate the NPV, which came out to a positive value of US$1,445,928,000, which is seen as a good enough firm to invest in. It is challenging to predict the amounts of cash inflows and outflows over the course of a project; therefore, it is important to carefully assess whether investing 20% of cash flows is suitable. Although this challenge is not specific to any one type of investment assessment approach, it is an issue with investment appraisal as a whole.

Exit and Return

Internal Rate of Return

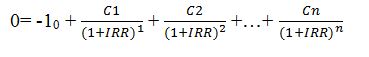

IRR decision rules apply to all independent investment initiatives that have an internal rate of return (IRR) greater than the company’s objective rate of return or cost of capital.

Excel may be used to calculate IRR, and the IRR computed using the NPV estimates was roughly 19%, which was greater than the discounted factor of 10%. If there are no capital restrictions, the investment is appropriate from this perspective. Additionally, a 1.17x forecast of the money multiple returns was made. However, as shown in Table 3, the company’s terminal value at a 3% permanent growth rate is around $1,469.221.429. The underlying equity value at this moment, based on the EV of US$1,445,928,000, was around US$2,040,728,000, resulting in an equity-to-share value of 102.04, which is higher than the market value based on the anticipated cash flows.

Exit Options

There are three exit strategies: secondary buyout (SBO), trade sale, and initial public offering (IPO). IPO and SBO are the most popular exit methods for private equity (PE) organizations, according to the case study. There are only two possible options when dealing with Mobike, which continues to be one of the largest bike-sharing firms on the market. Naturally, an IPO would be the greatest option for investors to leave, since it would allow all investors the choice of when and how many shares they would like to sell (except the original team, Series A, and Series B, who already have over 760 million US dollars in cash) (Chen, 2018). SBO is more appropriate in this situation. According to Wilder (2018), a record high of 38% of PE-backed firms were bought more than five years ago (the normal holding time). Many PE firms are racing against the clock as the fund period stipulated in their LPAs comes to an end due to aged investee companies. The owner will face pressure from LPs to either renegotiate fund renewals or obtain liquidity for their investments because just a 3-year time horizon was utilized by the investor. SBOs might serve as a release valve in these situations since it usually signifies that businesses are considering approaches they may not have beforehand and SBOs can act as a release valve. Considering these findings, the business should be sold after 3 years (2020) for $80 million.

Potential Acquisition

M&A transactions are essential to a company’s financial health. When organic development is impossible, mergers and acquisitions are often a source of external expansion for many businesses. Certain businesses, however, pose persisting threats to their independence. When considering several M&A-related aspects, the Mobike Company’s possible acquisition strategy was looked at.

Rationale for Choosing the Target Company

China-based Didi Global Inc. operates a mobility technology infrastructure as its main business. The firm specializes in ride-sharing and offers a variety of mobility services to customers. China Mobility, International, and Other Initiatives are the three divisions in which the company operates. The firm has a rank of 1594 and is also listed on the stock exchange market. Evaluating Mobike’s operations, enterprise value, market cap, and other purchase criteria are simpler than it would be for a firm that is not public. Additionally, the business is located at the hub of the bike-sharing sector, which has grown over the past several years. Portfolio planning provides a wide range of app-based solutions across the Asia Pacific, Latin America, and other international markets, therefore developing a strong position in the Middle East and Asia. Because the two businesses function in an equivalent sector in a corresponding level of output, a horizontal merger would thus be taken into consideration.

Conclusion

Due to internal efforts and a positive economic trend in the sector, the Mobike Company’s financial situation and general status have been strong in recent years. The acquisition of the second most successful China bike-sharing firm may be feasible given such a strong financial foundation and China’s declining interest rate trend. Moreover, there is cautious risk management, which is seen as a crucial success component.

Reference List

Cadell, C (2017) ‘China’s Meituan Dianping acquires bike-sharing firm Mobike for $2.7 Billion’, Reuters. Web.

Chen, W (2018) Meituan acquired Mobike, the founders are out. Web.

Chong, Z. (2018) The bike sharing company just got bought for $2.7 billion. Web.

Jing, S. (2017) ‘Shanghai tries to limit shared bikes’, China Daly. Web.

Ma, S. (2018) ‘Mobike CEO steps down amid uncertain future for bike sharing’, China Daily. Web.

Wilder, J. (2018) How secondary buyouts became ubiquitous: SBOs as an exit and deal sourcing strategy. Web.