The internet-based marketing research survey was initiated with a view of understanding the various factors that affects the usage of mobile banking in Saudi Arabia. The conjoint study utililized a quantitative research design and subjects were drawn from the selected banking institutions.

To ensure reliability and validity of study results, the questionnaires for the survey were duly filled by the Heads of Product Development and Marketing or their assistants of the selected banking institutions. The results were both interesting and insightful. The study was clearly able to uncover some of the challenges that continue to bedevil the sector, which is invariably at its infancy stage in many countries across the world.

These challenges include socio-cultural and religious barriers, age and market segmentation, security fears, lack of effective communication and marketing strategies, inability to break through the zone of being related to simple transactions, and failure to offer authentic banking experience.

However, the study revealed that mobile banking is ripe for takeoff, and may indeed overtake other banking channels such as branch and ATM due to its numerous tangible benefits that will serve to catapult the sector to success and dominance.

Some of these benefits include accessibility, high marketing potential, high penetration levels, better performance, convenience, lower charges, among others. These benefits and challenges will direct the future of mobile banking in Saudi Arabia

Introduction

Background

The design, development, and production of mobile handsets have revolutionalized civilizations across the world in ways that can only rival the invention of the wheel in the 19th century. Not only has the device served as an engine for growth, but it has made life easier, convenient and more comfortable. Intra and cross-boarder communications can now be done within the comfort of the living room, and business deals are sealed using the convenience of mobile telephony (Laukkanen 127).

Indeed, the use of mobile telephones has penetrated every single aspect of our social lives, whereby the devices have been personalized to offer the greatest satisfaction to users while serving their communication needs. The introduction of sophisticated mobile telephony with multipurpose and multimedia functions is reminiscent of the 1950’s, when the first color television set hit the markets; everybody was mesmerized.

But while many studies have been conducted on the social impacts of mobile telephony on communities around the world, data on how the device has affected business enterprises, specifically banking institutions in the Asian market, is still loosely aggregated.

Within the last couple of decades, new technologies have been cropping up every so often, requiring banking institutions to take a stand on whether to incorporate them in their operations or wait until later.

Currently, it is perfectly right to say that “mobile banking is that technology” (Costanzo 33). Some financial institutions have already expended considerable amount of money to evaluate innovative ways through which they can utilize the devices for banking purposes, while others are waiting with baited breadth to see how it works out.

Still, many marketers and financial experts are in agreement that conducting banking transactions using mobile telephony presents a huge potential for growth. According to Stewart, the chances of mobile banking surpassing any other transaction conduits within the next few years are real (17).

In many financial institutions, the commonly used delivery or transaction channels include Branch, Automated Teller Machines (ATM), and on-line banking. Even though mobile banking has the potential to surpass the named transaction channels in market growth due to high penetration levels, “only 10% of financial institutions currently offer a mobile banking service” (Stewart 17).

Many of the financial institutions are not at ease with the cost implications involved in rolling out the technology coupled with an uncertain market base. However, in the 21st Century, the customers have assumed the role of requesting the mobile services from their banking institutions, inarguably forcing the management to make tough decisions on the investment (Costanzo 33).

This clearly reveals that customers are opening up to the technology, having realized its value and potential benefits to the banking industry. Experts are of the opinion that many financial institutions yet to endorse mobile banking will reach their breaking point sooner than they actually anticipate due to the many opportunities for revenue generation offered by the service (Costanzo 35).

Not only has mobile banking achieved monumental success in offering financial transaction services, but bank operators can also use the service to generate extra revenue through charging for services such as sending SMS alerts to customers notifying them of their low bank balances. Consequently, the competitive pressure lies in the multifaceted nature of mobile banking

The Study Context

The swift pace of acceptance of modern mobile phones in the Middle East has generated prospects for fresh and innovative mobile services. According to Mallat et al, mobile banking services have shown some of the greatest potential for growth although they are still marginally adopted in Asia, and indeed in the whole world (42).

Indeed, within the Middle East context, the extensive penetration of mobile networks and the individualized nature of mobile telephones have increasingly made mobile solutions appropriate for a multiplicity of financial services. Mobile financial services has also gained steam due to the general stability of information and communication technologies in the region coupled with encouraging experiences received though the use of m-commerce payment services (Mallat et al 42).

The era of mobile banking in the Middle East has matured. The region has surged in mobile telephony usage to become the second fastest expanding mobile phone market globally, after Africa. By 2006, penetration had already surpassed the 50% mark, and an estimated 150 million mobile handsets already in circulation (Blain para. 1).

An estimated 70% of the entire connections in the Middle East have been concentrated in the Islamic Republic of Iran, Turkey and Saudi Arabia. By 2007, the average market penetration for mobile phones in the three countries stood at 67%. This represents an enormous potential for growth for mobile banking services in the region. The market is evidently there as over two thirds of the population has access to a mobile handset.

Saudi Arabia

With a population of 28.6 million as at July 2009, Saudi Arabia is undoubtedly the second largest mobile phone market in the Middle East, representing an estimated 15% of the entire connections (Blain para. 5). In 2008, comparative figures reveal that Saudi Arabia had an average of 114.7 mobile handsets per 100 individuals.

The United Arab Emirates led in the region, with 173 handsets per 100 people, and Qatar came second, at 150.4. By 2006, 79.5% of Saudi’s population was already using mobile phones (BMI 23). This reflects a huge potential for growth in mobile financial services.

Due to the large volume of people with mobile handsets in Saudi Arabia, the device can be successfully used as a channel to offer various value-added services such as mobile advertising, banking, money transfer, commerce, and information services. Indeed, the wide range of services the device is able to offer to Saudi nationals cannot be exhausted. However, mobile banking in Saudi Arabia has been slow in penetration due to a multiplicity of factors, which includes overbearing religious undertones.

Indeed, the Kingdom is still lagging behind in internet banking, the predecessor of mobile banking, with projections showing that although 73% of the financial institutions have an active website, only 25% of the websites have the capacity to offer full banking services (Jasimuddin para. 1).

Problem Discussion

The world has become increasingly intertwined by means of telecommunication channels and computers, giving rise to faster, cost-effective, innovative, and dynamic ways of doing business. The use of m-commerce in general and mobile banking in particular has taken the world by storm in the last couple of years.

The latter is increasingly finding appeal across all age categories in need of banking services, and experts in the banking industry are predicting a scenario where today’s working young adults are likely to bypass online banking and go unswervingly into the confines of mobile banking, a trend that has already been experienced in Japan (Stewart 18). However, the growth of mobile banking has neither been consistent nor linear as some nations are yet to embrace the technology despite its many tangible benefits.

For instance, the growth in mobile phone banking services in the Saudi Kingdom is yet to equal the corresponding growth in the mobile phones industry. A multiplicity of factors exist, which can inexorably hinder or enhance the uptake of mobile banking in Saudi Arabia yet no conclusive studies have been undertaken to identify these factors. It is this gap of knowledge that the study sought to fill.

Study Objectives

The general objective for this particular study was to evaluate the factors that affect usage of mobile banking in Saudi Arabia. The study aimed to accomplish this objective by undertaking a critical evaluation of a cross-section of the banking institutions in the Kingdom, with a view of understanding the underlying factors as to why the technology is used or not used in the banking fraternity. The following were the specific objectives:

- To come up with the reasons behind the slow uptake of mobile banking in Saudi Arabia

- To evaluate how mobile banking has been used to market financial institutions in the Kingdom

- To evaluate government, legal and institutional guidelines on mobile banking in the Kingdom

Research Questions and Hypotheses

The study was guided by the following research questions and propositions

- How has the marketing scenario changed since the introduction of mobile banking in Saudi Arabia’s financial sector, specifically banking institutions?

H1: Marketing and advertisement costs has gone down, enabling financial institutions that are actively engaged in mobile banking to save on costs - Has religious orientation played a role in the uptake of mobile banking in Saudi Arabia?

H2: The Saudis are conservatively religious, and are hard to open up to new products and services offered in the market - What are the major factors enhancing uptake of mobile banking in Saudi Arabia?

H3: Convenience and personalized services are the key major factors enhancing uptake of the mobile banking technology

Value of Study

The value of this study cannot be underestimated. Analysts have continually projected that mobile financial services presents the next frontier for growth in the banking sector (Stewart 17).

In addition to providing a convenient and personalized channel for conducting financial transactions, mobile banking offers the capacity to provide for other revenue generating avenues for banks such as charging for reminders. In the US, where mobile banking technology has taken root, 85% of the top 20 financial institutions offer either one or several mobile banking products and services (Stewart 18).

This reveals how mobiles devices can be used as engines for growth in the banking sector. The study therefore came up with a body of knowledge, espousing the various factors that can be used to market mobile banking to the Saudi nationals. This body of knowledge can be used by banking institutions in their attempt to market the product to their customers. The study also filled the information gap that existed on the role of religion in marketing particular products such as mobile banking

Study Delimitations

Apart from the usual difficulties of time and financial resources, challenges arose in attempting to come up with a balanced sample group via internet protocols since there was no opportunity to make physical contact. This limited the scope of the study.

Some banking institutions included in the sample lacked or had inadequate background information on mobile banking since it is a relatively new concept in Saudi’s financial sector.

Still, some banking institutions included in the sample were unwilling to divulge information on mobile banking experiences, arguing that the technology was in their strategic plan for 2010, and therefore could not disclose information. This presented difficulties for the researcher

Review of Related Literature

Introduction

This study sought to evaluate the factors that affect usage of mobile banking in Saudi Arabia, either positively or negatively. The increasing ownership and use of programmable information and communication devices such as the mobile phones, personal digital assistants (PDAs), and others, have been credited for the immense expansion of mobile commerce and mobile banking technologies.

These hand-held “devices are effective for authorizing and managing payment and banking transactions, offering security and convenience advantages compared to online payment via PCs” (Herzberg 53).

In the US, about 85% of the top 20 financial institutions are known to offer their customers either one or more products via mobile banking (Stewart 18). By definition, Mobile banking, also acknowledged as SMS Banking or M-Banking, basically entails the provision and performance of banking and financial transactions with the assistance of modern mobile telecommunication appliances such as mobile phones or PDAs by means of Short Message Service (SMS), Mobile Browser, or Client downloads (Laukkanen 125).

Through the use of these tools, an individual holding an account with a bank offering mobile banking is able to access such services as account enquiries, account transactions, stock market transactions, bill payments, and accessing customized information, including advertisements.

Trends in Mobile Banking

The arrival of the Internet brought new and exiting ways of transacting business globally. However, mobile banking is a relatively new experience, but with the required potential to be the market leader in transaction channels in a few years to come. In 2007, TowerGroup Consultancy, located in Boston, estimated that the US had just over 1 million clients of mobile banking products (Walford para.1).

However, due to its convenience, personalized services, and enhancement of client experience, the number of individuals using the technology has drastically shot up in recent times.

According to experts, SMS technology offers the most unproblematic alternative since it has the capacity to reach large numbers of customers, and does not necessarily need web access. Consequently, the use of the messaging service is undoubtedly the bread and butter of mobile financial transactions.

In Japan, Mobile banking has found a huge following among young adults, fresh from college, to a point where it has surpassed online banking (Stewart 18). Currently, mobile banking penetration level in the US stands at 6.5%, but drastically going up (White 58).

In the Middle East in general and Saudi Arabia in particular, the mobile banking trend is slowly gaining steam after huge spasms of minimal activity and inactivity. Indeed, most financial institutions that had implemented mobile banking once it rolled out did so with a long-term view since the rate of adoption was expected to be low (White 26).

In a 2009 worldwide survey to extract the views and attitudes on mobile banking in all the continents, 60 % of respondents in the Middle East said their financial institutions offered mobile banking services against 71% in Latin America and 31% in North America (Cocheo para. 2). This clearly reveals the phenomenon is gaining speed in the Middle East.

In the study, 27% of Saudis admitted to using mobile handsets to make banking transactions and payments against a meager 3% in North America. Indeed, a massive 66% of North Americans argued they were not at ease with using mobile devices to make banking transactions.

This notwithstanding, “a projected 30% of US households will bank using their mobile phones in 2010” (Mobile Marketing Association1) These statistics are useful indicators that mobile banking is increasingly asserting its influence in banking institutions globally (Cocheo para. 6).

Selected attributes on Mobile Banking

Mobile Banking and Marketing/Advertising Potential

According to Mobile Marketing Association, some mobile banking functions such as SMS offers massive marketing potential for many products and services retailed by financial institutions (2).

SMS has the capacity to penetrate the market segment, and reach millions of customers within a split second. As such, financial institutions can effectively use mobile banking to market their own products and services on offer such as interest rates alerts, types and nature of accounts, the kind of services offered, and physical location, among others.

Indeed SMS technology offers the most unproblematic alternative for marketing products since it has the capacity to reach large volumes of people who may not be necessarily connected to the internet. Consequently, it can be effectively used to reach out to the rural illiterate and semi-illiterate masses.

Indeed, there exists a multiplicity of practices and activities that banking institutions can engage with their customers through a mobile handset to further their competitive advantage and market their products and services to a large volume of customers using the least costs. A normal SMS is relatively affordable, easily understandable, less ambiguous, and has the capacity to reach a large audience (Mobile Marketing Association 2).

These are major selling points for any product or service. Through horizontal telecommunication convergence, mobile banking can take advantage of these attributes to generate more revenue through acting as advertisement agents for other organizations wishing to market their products and services using the platform (Stewart 21). In essence, “efficient mobile payment solutions facilitate the sales of mobile content and generate more traffic for mobile networks” (Mallat et al 45).

Convenience

Mobile banking is convenient in nature since it can be used anywhere at any hour of the day or night provided the user has access to a mobile device. According to Herzberg, these devices have revolutionalized banking transactions by presenting customers the convenience and security desirous of their banking experience (53).

The author argues that “convenience [of mobile handsets] can result from using their communication capabilities when paying for goods and services, whether on foot or in cars, planes, or trains, and authorizing transactions at remote servers of banks, brokerages, and merchants” (54).

In mobile banking, customers can also view bank balances, transaction histories, and retrieve payment receipts at their own convenience, and without having to waste time visiting the banking halls. According to Mallat et al, mobile financial services are deemed significant by users due to their inbuilt time and place independence (42).

Security

Herzberg alludes to the fact that the security features contained in mobile banking are revolutionary, and are major sources of motivations for millions of people who depend on the mobile device for banking purposes (54). The author stresses the fact that most conventional channels of electronic authorizations such as ATM and credit or debit card transactions are subject to failure by being compromised.

Online banking can also be easily compromised by hackers due to minimal security systems. Also, using a smart card hooked up to a computer can not in any way guarantee security since the computer may probably be infected by a virus, activating it to send wrong information to the smart card. All the above scenarios are enough precedents for fraud and corruption.

More importantly, security has been proposed as one of the fundamental drivers for the growth of m-commerce and mobile banking. However, the next generation mobile devices, usually with sophisticated features such as built-in color display and key board, have functional capabilities and technical solutions for curtailing hacking, and hence stopping fraud.

However, a significant number of customers are not comfortable with the idea of conducting financial transactions using a mobile device. In case the device is stolen, all what is needed is a Personal Identification Number (PIN) for the thief to gain entry into your finances.

Reasonable Costs and better performance

By far, mobile banking is the cheapest type of conducting financial transactions in recent times. In the US, an average SMS supporting 160 characters is charged $0.03 (Costanzo 34). Not only does mobile banking appeal in terms of costs, but it has an easy-to-use interface that is best suited for uncomplicated requests such as account balance enquiries and requests for personal banking information (Talbot 48).

In Mobile banking, individuals are not subjected to the rigorous procedures of opening a bank account as they would when dealing with branch channel. Indeed, all what is needed is to open a fully functional account on a mobile handset.

Unlike in branch banking whereby customers have to meander through queues and intense heat to be served, requests are processed within seconds after the signal is received in mobile banking. The location of the customer does not matter either as long as there is network receptivity and the customer has the required type of mobile device for particular applications (Mallat et al 44).

Generally, all phones support the SMS application – the most used in mobile banking. It is therefore safe to argue that mobile banking has the obvious advantage of superior performance as customers spend minimal time performing financial transactions.

Level of Penetration/ Coverage

Worldwide figures suggest the rate of mobile devices uptake has more than quadrupled in the last couple of years. According to a new UN report, an estimated 60% of the world’s population has access to a mobile phone. This is equivalent to 4.1 billion people (Bhatti para. 1).

Such a high penetration rate can not only assist nations to further their economic agenda, but it can also be harnessed by private institutions such as banks to expand their customer base by reaching out to the millions of subscribers using this telecommunication technology.

This is the essence of mobile banking – the capacity to reach millions of people in diverse locations around the world due to high penetration level of mobile devices. An estimated 70% of the entire connections in the Middle East have been concentrated in Iran, Turkey and Saudi Arabia. By 2007, the average market penetration for mobile phones in the three countries stood at 67 % (Blain para. 1). According to the revelations above, it is safe to assume that the backbone on which mobile banking is founded has already been secured.

Adoption of Mobile Banking

Despite the many advantages presented by mobile banking in the modern era, the rate of adoption in many parts of the world has remained predominantly low. For instance, although most leading banking institutions in Europe offers the services, only 5% of individuals with SMS and internet enabled phones use them at present (Ensor et al para. 1).

The clientele of mobile banking services in many parts of the world, including the US, Europe, Asia, the Middle East, Latin America, and Africa tend to be homogenous – “young, technology-savvy males with above-average incomes who already bank online” (Ensor et al para 1).

Generally, customers use their mobile devices to perform simple transactions lack balance checks, account withdrawal and deposit histories, and SMS alerts. Non-users argue that Mobile banking has no quantifiable benefits, while others are taken aback that such a service exists. This reveals the weaknesses of the strategies used to market mobile banking to potential customers.

A significant number of people cite security concerns. In this perspective, according to Ensor, the solution is for banking institutions offering the service to undertake aggressive campaigns and widen awareness for simple, cost-effective, and timely mobile banking applications among young, enterprising, and technology-savvy adults. The figure below reveals how Mobile banking is limited in scope.

The Saudi Arabia Experience

It is difficult to come up with comparative figures on mobile banking in the Middle East in general and Saudi Arabia in particular. This is one of the factors that shaped the objectives of this research – to come up with insightful data that can be used by industry-wide experts in directing mobile phone activities in the country. What is known for now is that mobile phone usage in Saudi Arabia have drastically increased over the last couple of years, with 79.5% of Saudis already using mobile telephony by 2006 (BMI 23).

That notwithstanding, the rate of technology uptake in the provisions of financial services has not been that promising. Undeniably, the Kingdom is still lagging behind in internet banking, the predecessor of mobile banking, with projections showing that although 73% of the financial institutions have an active website, only 25% of the websites have the capacity to offer full banking services (Jasimuddin para. 1).

An attention-grabbing aspect of Saudi banking, and indeed the Middle Eastern banking is Islamic banking. According to the teachings of Islam, no Muslim is allowed to receive interest accruing from bank deposits. According to Islamic banking principles, such funds are centralized within a financial institution and then the resources are used to fund a community project or any other form of investment (Saudi Arabia para. 3).

The returns accrued from the investment are then shared out according to input. Such a system may have considerable ramifications on the growth of mobile banking in the country. According to this document, a considerable number of banks “…provide mobile banking facilities for outlying villages and remote areas” (para. 5).

Methodology

Introduction

The objective of this particular study was to evaluate the factors that affect the usage of mobile banking in Saudi Arabia. To meet the stated objective, comprehensive methodologies grounded on the basic tenets of a marketing research were formulated for purposes of collecting the requisite data that could be sufficiently used to answer the study’s basic research questions while assuring unsurpassed reliability and validity.

According to McQuarrie, a marketing research can be described as the methodical collection, recording, and analysis of information or data about issues or phenomena relating to marketing of goods or services (26). This chapter describes the design for the market research survey, the theoretical framework, and the analysis of the study population and sample size. The techniques used to collect data, and issues of validity and reliability are also mentioned in this chapter.

Research Design

The marketing research employed a quantitative research design to evaluate the factors that affect the usage of mobile banking in Saudi Arabia. In most occasions, the aim of a quantitative research design is to evaluate the association between an independent variable and a dependent variable, and is therefore either descriptive or experimental (Hopkins para. 1).

This study made use of a quantitative research design since the subjects – banking institutions operating in Saudi Arabia – were measured once through conjoint analysis. According to McQuarrie, a conjoint analysis is a tool used in market research to evaluate how individuals value and perceive different characteristics that make up a distinct product or service, in this case mobile banking (102).

Its main objective is to evaluate the limited number of characteristics that are most significant on an individual’s choice of a product or service. It is noteworthy to state that this study utilized internet survey technique to gather the required data needed for purposes of answering key research questions.

According to Sekaran, a survey has the capacity to gather requisite information needed to assess association between various variables by way of self-report since the study subjects can respond to the questions posed using technology protocols such as the internet, VOIP, or email (76).

Theoretical Framework

A theoretical framework, according to Sekaran, “is a conceptual model of how one theorizes and makes logical sense of the relationship among the several factors that have been identified as important to the problem” (p. 87). It must map out and connect the various interrelationships that exist between different sets of variables or phenomena perceived to outline an indispensable constituent to the situational dynamics under study.

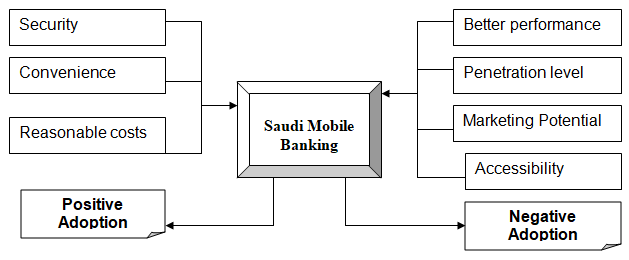

Based on the objectives of this particular study, the mobile banking sector in Saudi Arabia became the dependent variable, while a multiplicity of factors such as security, convenience, reasonable costs, better performance, level of penetration, and marketing potential formed the independent variables. Consequently, a conceptual model aimed at guiding the study was structured. It is depicted by the figure below.

The Target Population and Sample

The target population for this market research was limited to financial institutions offering banking services in Saudi Arabia. It is imperative to note that the survey did not limit itself to any particular region of the Kingdom since it was internet-based. Sekaran posits that a target population is inclusive of all components – subjects, articles, objects, and animals – that meet the set criteria for inclusion in a research study (85).

In this perspective, the researcher employed the services of Google online to come up with a list of 80 banking and financial institutions operating in the Kingdom. Using the rule of the thumb, 50 banking institutions were sampled from the list, and requests sent via email to their respective heads of customer care enquiring their interest to take part in the survey. 10 banks declined, but the others gave a positive response.

Before the invitation letters were dispatched via email, the researcher had developed a rubric for use in selecting a sample that will exhibit a good understanding of the issues at hand. To be selected for the study, all subjects, in this case banking institutions, must have operated in Saudi Arabia for a period not less than 5 years.

No limitation was put on the types of products and services offered by the banks. But to meet the standards for selection, the banks were expected to be open to all age categories, not to particular segments or age-groups. Lastly, the banks were expected to give a guarantee that the online questionnaires were to be duly filled by the heads of product development or their assistants in the respective banks

Data Collection Tools

Primary data for the internet survey was done through administration of online questionnaires while secondary data was collected through a critical review of related literature. According to Sekaran, a questionnaire is basically a printed self-report exclusively employed to generate information or data obtained through written responses (102). Questionnaires are best suited to collect data in studies revolving around descriptive quantitative research designs as they are exhaustive in response and easily understandable.

Questionnaires are also able to attain high response rate, take minimal time to complete, guarantees anonymity to the identity of respondents, and present an insignificant chance for prejudice since they are offered in a consistent manner. Consequently, the data or information obtainable through the administration of the questionnaire to subjects is more or less comparable in nature and scope to that acquired by a key informant interview (Sekaran 104).

Secondary data for the study was gathered through a critical review of related literature. The review of literature was necessarily imperative since the research was interested in evaluating a relatively new concept in the market – mobile banking. According to May, the practice of reviewing relevant literature forms a good source of data as it “…represents a reflection of reality” (182).

Reliability and Validity

Reliability can be defined as the rate of consistency or uniformity with which the tools used to collect data are able to measure the variables or phenomena that they are intended to measure (May 108). The questionnaire developed for the purposes of collecting data through online protocols exposed outstanding consistencies in the way the respondents understood and responded to the questions.

Ample guidance on how to fill the questionnaire had been dispatched beforehand to the subjects to curtail chances of data collector’s error. This ensured reliability of data collected. The bank representatives in the internet survey were also reassured on their own privacy online, enabling them to offer full-length information.

Validity describes the rate or degree to which a particular data collection tool is able to measure or assess the phenomenon or variable that it had been set to measure (May 110). Accordingly, the questions included in the data gathering instrument had been thoroughly researched to ensure their capacity to measure the intended objectives in the most effective and consistent manner.

The questions were set based on the review of related literature to ensure validity. Also, the questionnaire was set using simple language to ensure the questions were understandable to the subjects. This ensured clarity in response, and hence boosted validity. Subsequently, the results arising from this study can be generalized to the study population.

Data Analysis

After the questionnaire were sent back from the field via email, quantitative data was cleaned, coded and entered into SPSS, a statistical software package. The data were then analyzed through descriptive statistics such as frequencies and cross-tabulations to enhance effective interpretation of results.

The techniques of choice modelling were used to direct the process of harnessing the data into meaningful interpretations. According to McQuarrie, choice modelling endeavours to mould the decision-making procedures of a person or a segment of a population in a particular context (154). Afterwards, the resulting frequencies and percentages were harnessed, interpreted and presented in various forms, including text and figures developed using Microsoft’s Ms Excel.

Qualitative data generated by the unstructured questions were coded and analyzed using qualitative content analysis to assist in quantifying emerging features, trends, and concepts. Sekaran explains qualitative content analysis as a statistical procedure utilized to methodically code and analyze answers that were given in either verbal or written communication to facilitate the quantitative measurement of variables.

Results

Introduction

This particular study was interested in evaluating the factors that affect the usage of mobile banking in Saudi Arabia. The results were both insightful and interesting, and provided significant information and data that can be used by service providers, marketers, and mobile device manufacturers in a concerted effort to penetrate different market segments of the society.

Mobile banking had experienced a low adoption rate, not only in Saudi Arabia, but also in other countries such as the US, Britain, Canada, Italy and France (Ensor et al 2). However, by the turn of the new decade, the market had started to warm up to this new banking channel, with the affluent working, technology-savvy young adults forming the largest proportion of the consumers of the new technology.

Of the 50 banking institutions selected for the study, 10 turned down the request citing administrative and business concerns. It is therefore essential to note that this market research study attained 80% response rate. The statement of results from the field data will be presented in this section, followed by a broad discussion of the results based on the study objectives and propositions.

Statement of Results

72% of all the banks included in the study offered some form of mobile banking product, while 40% of those who didn’t said they were piloting the service, anticipating rolling it out in the near future. Only 25% of those who didn’t offer the services felt that it offered no tangible benefits to Saudis, with another 20% of the banks lacking mobile banking arguing that it was quite difficult to sell the concept in the Kingdom due to religious connotations.

The statistics reveals a multifaceted interplay between socio-cultural values and the channels of marketing, discussed comprehensively in the analysis section. Generally, over two-thirds (67.8%) banks have been transacting business in the Kingdom for the last 30 years.

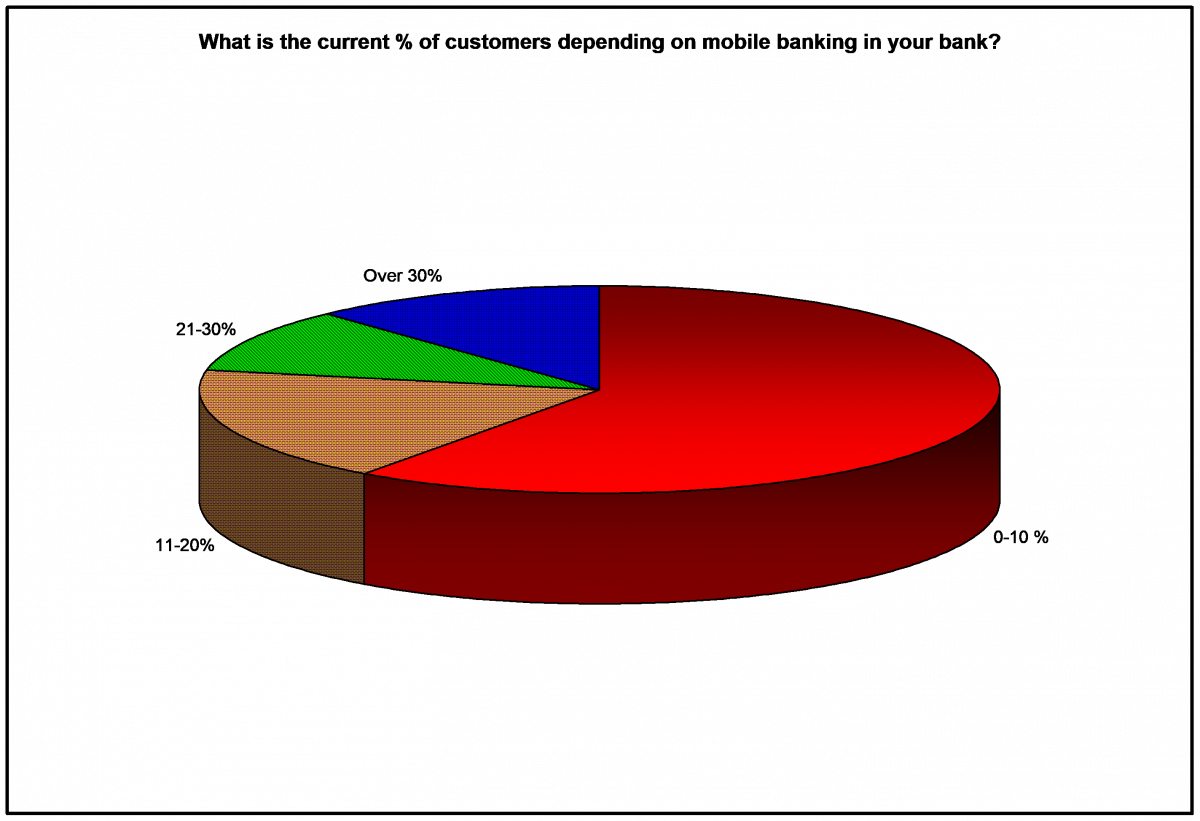

Uptake of the technology was however an issue of concern for many banking institutions, with only a partly 12% of them reporting that over 30% of their customers depended on mobile banking.

Many heads of product development taking part in this particular study could not really understand the situational and marketing dynamics behind the slow uptake of mobile banking in the Kingdom as over half (54%) said they had conducted intensive campaigns to market the product through print and electronic media yet the rate of adoption remained relatively low.

Majority of the banking institutions were in agreement that less than 10% of their clients depended on the new technology. The rest of the distribution is revealed in the figure below.

In the conjoint analysis, a clear relationship existed between the age factor and mobile banking. When requested to accurately indicate the ages of customers with mobile banking accounts through documentation, it was revealed that over 80% of mobile account holders were below the age of 30.

Only 5% of the customers with mobile accounts were above 40 years of age. This again points to the need for marketers to consider the age factor while marketing their products and services so that they do not expend limited organizational resources marketing products and services to the wrong segment of the market. The statistics appeals more to the dynamics of market segmentation.

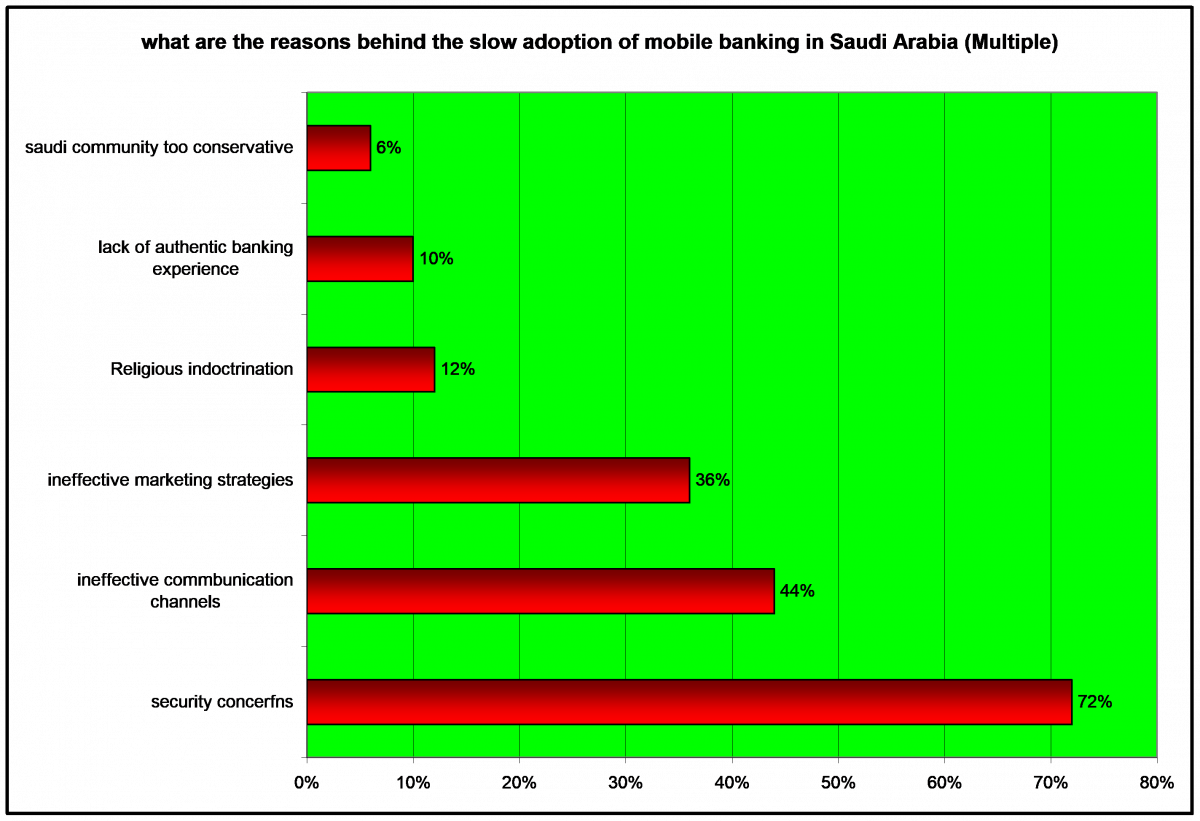

Security issues topped the reasons why these new technology had failed to break the ice in Saudi Arabia as it was cited by an overwhelming 72% of the banking professionals who took part in the internet survey. According to the review of related literature, security concerns topped the list of concerns as to why the market had failed to respond positively to mobile banking technology despite its many benefits.

Lack of effective communication channels between the banks and the customers was also an issue of major concern to 44% of the professionals taking part in the survey since they felt that banking institutions were not working overboard to market the technology despite the usual production of pamphlets, which customers never cared to read even after picking them.

Lack of effective and aggressive marketing strategies to boost the product in the local market scene was selected by 36% of the banking professionals as the major reason why the adoption level for mobile banking had been slow.

These two revelations points to the need for banking institutions to have effective marketing and communication strategies. Religious indoctrination and failure to offer authentic banking experience were selected by 32% and 26% of the subjects respectively. The rest of the distribution is captured in the figure below.

An overwhelming 88% of the banking professionals whose banks had already initiated mobile banking services felt that the technology had more potential of marketing the products offered by their respective banks than any other financial transaction channel on offer so far.

68% of the respondents whose banks did not offer mobile banking services agreed with their counterparts that mobile banking has the most capability of marketing other products offered by banking institutions judging by the high penetration of mobile handsets in Saudi Arabia.

Only 8 % of the entire sample felt that customers never cared to read advertisements messages sent directly into their phones by banking institutions. However, the general understanding was that mobile handsets were becoming important mediums for advertisement, and as such, they could be effectively used by financial institutions to market their range of products and services to their customers

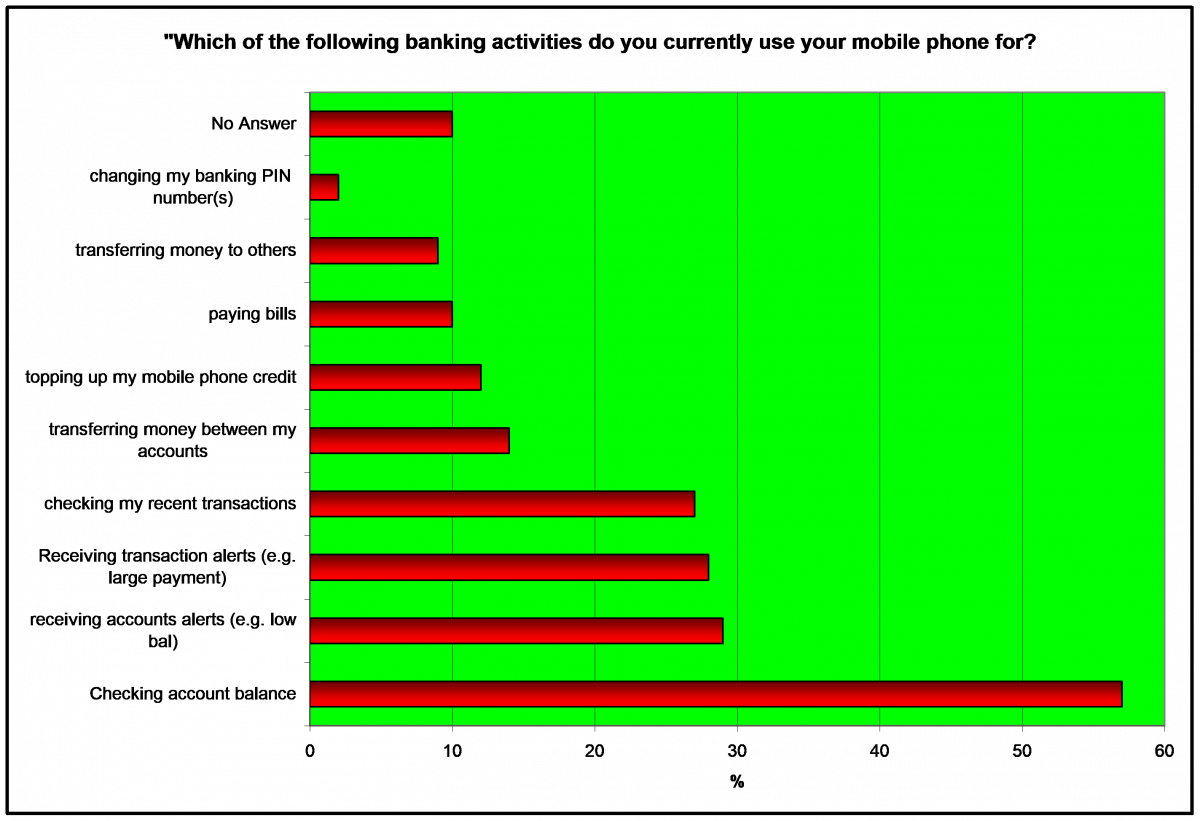

According to the study findings, mobile banking in Saudi Arabia is used to perform uncomplicated financial transactions such as requests for bank balances (64%), requests for transaction histories (46%), airtime loading (38%), alerts on large payments or bank deficits (36%), and paying bills (24%).

This coincides with the scenario depicted in the review of related literature that mobile banking has not mutated into a serious channel of banking although all indicators suggest that it is headed to become the preferred mode of banking in the future.

On aggregate, 78% of customers with mobile accounts use Short Messaging Service (SMS) for their financial transactions while the rest use mobile internet or downloadable programs. Two-thirds of the respondents were satisfied that the Saudi kingdom was doing enough to stimulate growth in the industry through offering incentives for growth such as tax breaks.

76% of the banking professionals said they were happy with the Saudi kingdom for allowing the business environment to be guided by the principles of free market economy rather than government interference as it is the case in many Islamic nations. This, according to the banking professionals, had spurred considerable growth in the banking fraternity in general and in mobile banking in particular.

Lastly, majority of the subjects felt that that mobile banking had an immense potential for growth, and it was indeed headed in the right direction. Indeed, 52% of the subjects were positive that mobile banking will overtake other banking channels such as branch, ATM and online services by 2015 due to its capacity to penetrate the most remote areas of the country.

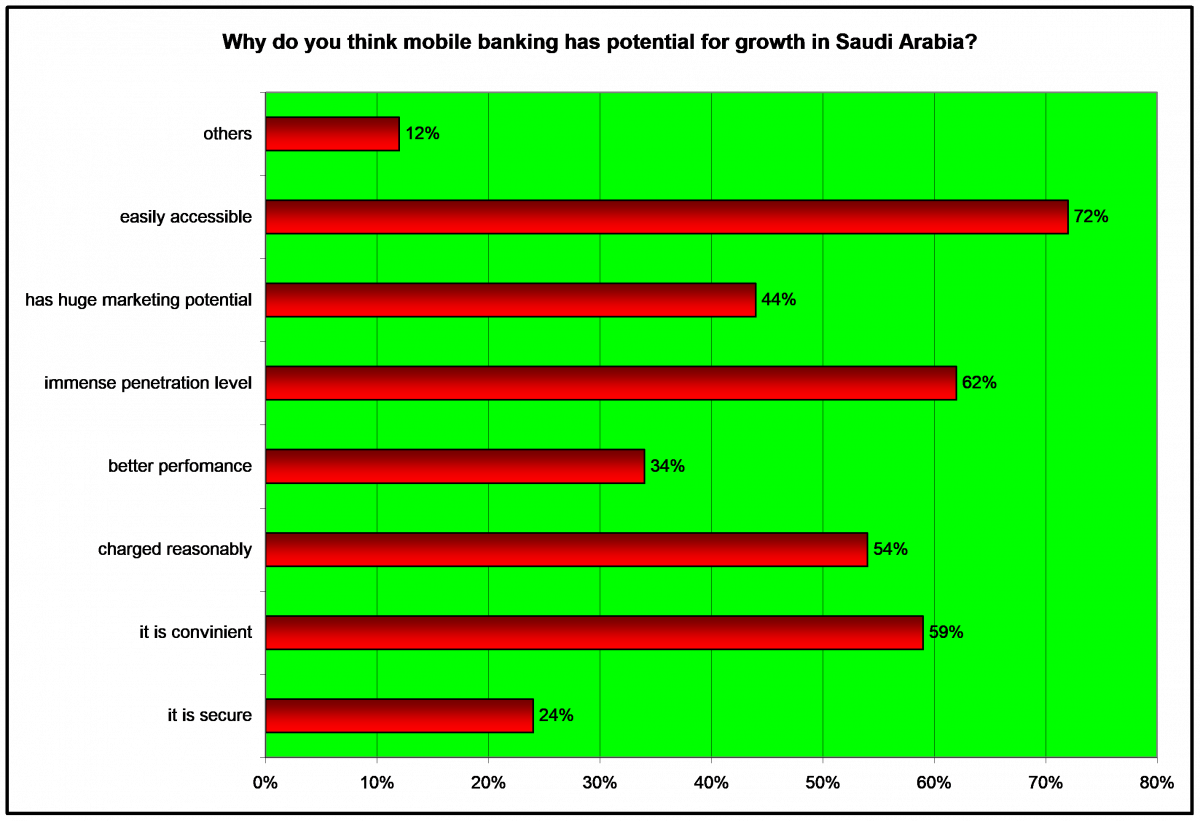

Other factors that will play a significant role in the technology’s projected growth include accessibility and ease of use, affordability, high coverage, convenience and security. The distribution is best captured in the figure below.

Analysis and Discussion

This study had been commenced to evaluate the factors that affect usage of mobile banking in Saudi Arabia. Several issues stood out from the study findings that confounded the argument that Saudi Arabia’s mobile banking sector was ready for take off, but was still been faced by a multiplicity of challenges.

This is expected since mobile banking is a relatively new concept. The researcher had formulated 3 research questions and a similar number of hypotheses to guide the study process. The analysis of the results based on the key study questions is presented below.

According to Allen, the decision of an organization to enter into a new business area is always a challenging one to make due to the multifaceted factors implicated “and the uncertainties of predicting future events” (22). Before entry into a particular market segment, many organizations undertake a critical evaluation of the financial gains expected, and when the economic gains will finally be attained.

In the same vein, only few organizations are willing to invest massive financial resources for long-term benefits. In many countries, including Saudi Arabia, mobile banking is viewed as a long-term investment, expected to churn out profits and assert itself in the market some 5-10 years to come. This is the major reason why many Saudi banks, according to the study results, developed cold feet on rolling out the technology – financial returns were not expected anytime soon.

Influence of social-cultural and religious values in marketing of the mobile banking product; age factor and the dynamics of market segmentation; and security fears have actively played a role in hindering the adoption of mobile banking in the country. Many financial institutions adhere to the principles of Islamic banking, a form of banking that curtails receiving of interests accruing from bank deposits (Saudi Arabia para. 3).

The socio-economic and religious values shape personal values, which in turn affects customer attitudes and behaviour towards a particular product or service (Vinson 44). Consequently, adoption levels for mobile banking in Saudi Arabia will remain low if socio-cultural and religious values practiced imply that the product goes against their own fabric.

According to industry trends, mobile banking is mostly embraced by the affluent, technology-savvy working young adults with incomes that are on the higher end (Ensor et al 2). According to the study results, this was not factored in when conducting advertisement campaigns in Saudi Arabia, and hence the slow take off. Experts are of the opinion that no single organization can actively be able to satisfy the needs and requirements of all customers since the requirements changes with age (“Learn Marketing” para. 1).

In this perspective, a more market-focussed approach may be needed to increase adoption levels. Security-wise, customers are cautious about the prospects of hackers gaining access to confidential financial information. In case of theft, all what the thief needs is a PIN to gain access to the customer’s finances (Herzberg 54).

According to the study results, lack of effective communication and marketing channels between the bank and customers, failure to offer authentic banking experience, and failure to grow past simple financial transactions has also negatively affected the growth of mobile banking in Saudi Arabia. Effective communication and strategic marketing goes hand-in-hand if any product or service is to penetrate a particular segment of the market (Schultz et al 19).

During their marketing campaigns, the financial institutions failed to instil the concept that mobile banking is still a form of banking. As such, many customers want to see the inside of the banking halls to believe that they are indeed transacting business activities. The noise that mobile banking has been unable to break loose from performing small and often insignificant transactions has been reverberated across the world, not only in Saudi Arabia.

From the study, it is clearly evident that mobile banking deals with small transactions such as checking account balances, Receiving accounts alerts, reviewing recent transactions, transferring money between individual accounts, and paying bills. A study conducted in Europe to evaluate the impact of mobile banking in 7 European countries – Italy, Sweden, Netherlands, France, Spain, UK, and Germany – also came up with similar reasons (Ensor et al 6).

On the brighter side, Saudi Arabia’s mobile banking sector has real prospects for growth in the coming years. According to experts, mobile banking is destined to become the preferred marketing channel by 2015 (Stewart 16). In a 2009 worldwide survey to generate the views and attitudes on mobile banking in all the continents, 60 % of respondents in the Middle East said their financial institutions offered mobile banking services against 71% in Latin America and 31% in North America (Cocheo para. 2).

By 2006, an estimated 79.5% of Saudi residents had access to a mobile device, the primary medium used in mobile banking. These statistics reveals a sector of the market economy that can achieve monumental growth if the right mix of ideas and stimulants for growth are all incorporated in the right proportions.

According to the study, some of the positive factors that may affect the usage and uptake of mobile banking in the Kingdom include: accessibility; immense marketing potential; high penetration level; superior performance; low charges; convenience; enhanced security; and market-friendly incentives and regulations by the Saudi kingdom.

Indeed, Herzberg posits that the mobile handsets have revolutionalized banking transactions by presenting customers the convenience and security desirous of their banking experience (53). From the above discussion, it is safe to ague that all the study hypotheses have been proved right.

Conclusions and Recommendations

Conclusions

This study had been commissioned to evaluate the factors that affect the usage of mobile banking in Saudi Arabia. Towards this objective, an internet based market research survey was conducted, using heads of product development of selected financial institutions as the study subjects. The study revealed that although Saudi Arabia had a huge potential for growth in mobile banking, various forces and challenges kept holding the process back.

Some of the most pertinent issues revealed after the initial data analysis and interpretation include: social-cultural values and religion; age factor and the dynamics of market segmentation; security issues; lack of effective communication channels among the banking staff and their customers; inadequate marketing strategies; and failure by banking institutions to offer authentic banking experience to customers

According to the study results, the banking industry in Saudi Arabia is however bound to change drastically in the coming years due to mobile banking. The service has many benefits that can be transferred to customers, which includes accessibility, security functions, convenience, affordability, high penetration rate, and huge potential in marketing.

These are value-added benefits that customers will be able to enjoy in the future if the mobile banking trend moves in the right direction. So far, mobile banking is overwhelmingly used by young affluent adults. It is just a matter of time before the full effects of the technology are felt across the world

Recommendations

Many recommendations can be suggested due to the fact that mobile banking is still in its infancy stage. However, the most important recommendation right now is for the financial institutions to segment the market according to needs and requirements approach.

Advertisements for products and services are a costly agenda for organizations across the world; but they become even costlier if they do not target the right audience since financial resources ends up been virtually wasted. Second, Banks that are already offering the service must step up their campaigns to ensure that all their customers know about the product.

As it stands now, a huge proportion of individuals with bank accounts have no knowledge that mobile banking exists. Third, the Saudi Kingdom should be encouraged to offer more incentives to emerging technologies such as mobile banking and e-commerce, especially when such technologies can be effectively used to spur economic growth and enhance the welfare of mankind.

Future Research Areas

Further research is needed to come up with the reasons as to why customers prefer to perform simple transactions in mobile banking unlike in other traditional banking channels such as branch and ATM. The role of consumer needs and preferences in relation to mobile banking also needs to be clearly understood if the technology is to make any headway. Lastly, the impact of SMS advertising on mobile banking uptake or adoption needs to be evaluated with a view of quantitatively measuring its viability.

Works Cited

Allen, R. W. Factors Influencing Market Penetration. Management Science, 13.1 (1996): 22-35

Bhatti, B. 4.1 Billion Mobile Phone Subscribers Worldwide. 2009. Web.

Blain, L. Middle East becomes Second-Fastest Growing Mobile Phone Market. 2007. Web.

Business Monitor International. Saudi Arabia Telecommunications Report Q3 2006. MarketResearch.

Cocheo, S. Five in Ten like Mobile Banking but wont Pay for it: ABA Banking Journal. Web.

Costanzo, C. Are you Mobile? Community Banker, 18.12 (2008): 32-35.

Ensor, B., Hesse, A., Lussanet, M., Veen, N., & Menke, K. European Mobile Banking: An Inconvenient Truth. Web.

Herzberg, A. Payments and Banking with Mobile Personal Devices. Communications of the ACM, 47.5 (2004): 53-58.

Hopkins, W. G. Quantitative Research Design. 2000. Web.

Jasimuddin, S. M. Saudi Arabian Banks on The Web. Web.

Laukkanen, T. Measuring Mobile Banking Customer Channel Attribute Preferences in Service Consumption. International Journal of Mobile Communications, 5.2 (2007): 123-138.

Learn Marketing. Web.

Mallat, N., Rossi, M., & Tuunainen, V. K. Mobile Banking Services. Communications of the ACM, 47.5 (2004): 42-46.

May, T. Social Research: Issues, Methods and Processes. Philadelphia: Open University Press.

McQuarrie, E. The Market Research Toolbox: A Concise Guide for Beginners. Thousand Oaks, California: Sage Publications, Inc, 1996.

Mobile Marketing Association. Mobile Banking Overview. 2009. Web.

Saudi Arabia. Banks: Where to Manage your Finances. Web.

Schultz, D.E., Tannenbaum, S., & Lincolnwood, IL. The new Marketing Paradigm: Integrated Marketing Communications. McGraw Hill, 1996.

Sekaran, U. Research Methods for Business: A Skill Building Approach, 4th Ed. Wiley-India, 2006.

Stewart, D. Say Hello to Mobile Banking. ABA Bank Marketing, 41.5 (2009): 16-23.

Talbot, D. Upwardly Mobile. Technology Review, 3.6 (2008): 48-54.

Walford, L. Mobile Banking: A Tipping Point. 2007. Web.

White, K. Mobile Banking: Putting your CU in your Members Pocket. 2009. Web.

Vinson, D. E., Scott, J. E., & Lamont, L. M. The Role of Personal Values in Marketing and Consumer Behavior. Journal of Marketing, 58.2 (1996): 44-56.