Introduction

Background

For over a billion people worldwide, mobile phones have become an increasingly important device. The mobile phone industry is a long-range, portable electronic device used for mobile communication that uses a network of specialized base stations known as cell sites (Rebello, 2006).

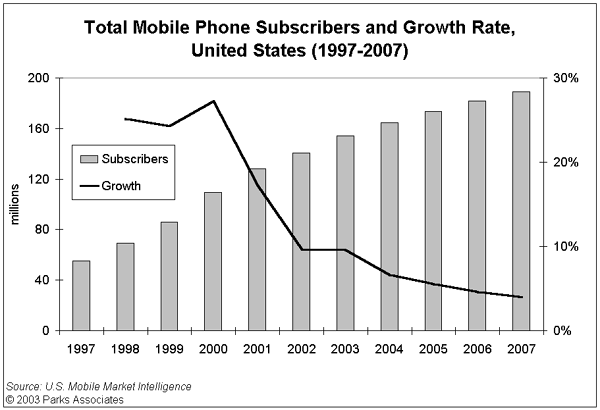

The economic recession caused a lack of motivation among mobile phone consumers in North America to replace existing devices. Indeed, across the mobile world, end-users with a mind to upgrade their devices appeared to be waiting for a greater selection of next-generation mobile terminals from which to choose (Pastore, 2006). The market is extremely tough and there is tremendous uncertainty over the new phones, features, and services.

On the other hand, India’s mobile phone market is one of the most promising and fastest-growing in the world. India will soon become equal to China due to the country’s booming economy and rapid growth that will make its market for mobile handsets double between 2005 and 2010 (Internet Time, 2007). India emerged as the world’s sixth-largest market in 2005 in terms of mobile phone subscribers and will become the second-largest in 2010 (Rebello, 2006).

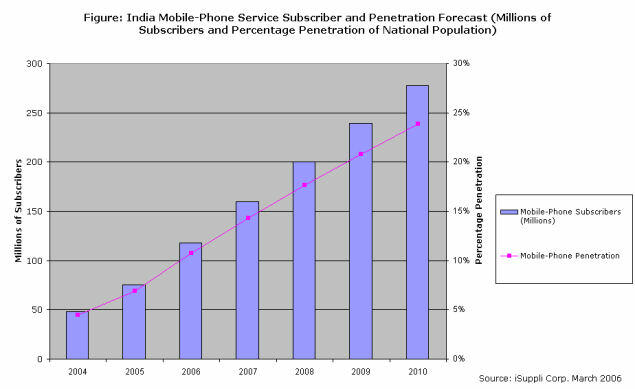

David Taylor指出,“他們都是市場的主要推動力量”。India’s mobile-phone subscriber base grew 47% in 2005, reaching about 75.3 million subscribers by the end of the year, up from 48 million at the end of 2004. The monthly average was 6 million new users, the total number of mobile phones was 135 million and it is anticipated that the subscriber base in India will rise to 450 million in 2010, which will mean a cellular penetration rate of 23.9% of the nation’s population (Electronic Business, 2006). In particular, India is one of the current mobile phone markets in developing countries which was driven sales growth sharply. The country is equally important to recognize the opportunities within the country created by the increase in consumers suddenly loaded with disposable income.

Purpose of the study

With India’s competitiveness expanding, a huge barrier to global trade is falling. This provides a great opportunity for global mobile phone companies to tap into India’s market. Focusing on India’s market is one effective way for mobile phone companies to get more income. The purpose of this paper is to examine strategies of entrants that are interested in developing their businesses in India and to provide an overview of the strategies that successful mobile phone companies utilized in India’s market. Based on this research, entrants will have a better understanding of how to capitalize on India’s growing market. Also, this study will provide possible suggestions for marketing mobile phone products in India.

Importance of the study

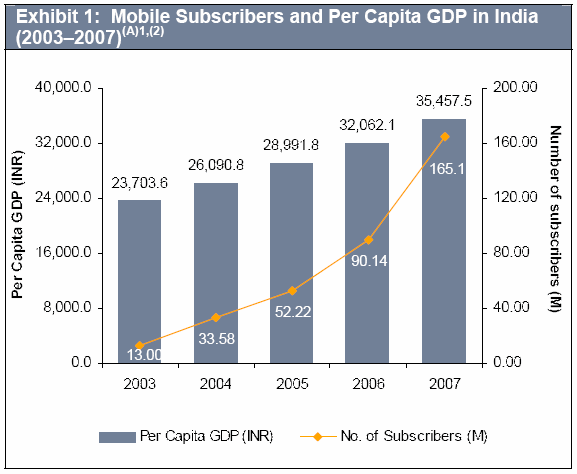

India grew at a faster rate than China for the first time in new mobile phone connections and the country was set to expand more than three times as fast as China in 2007. The number of mobile connections in India more than doubled to 142.2 million and that figure is expected to expand 48% to roughly 211 million by the end of 2007 (Dusan, 2008). Furthermore, India’s mobile phone adoption is being boosted by the rising financial fortunes of a large portion of the population. The nation’s Gross Domestic Product (GDP) is expanding at an 8% annual rate that improves the economic situation for millions of Indian consumers (Rebello, 2006).

India’s market cannot be ignored with more than 1.12 billion people (CIA, 2007). To have great success in the new market, the entrants need to adjust their strategies to India’s market needs. As a result, identifying and understanding India’s environment and Indian customers’ needs are the most important elements for entrants to enter into India’s market successfully. This research paper will provide a detailed analysis of other successful mobile companies’ strategies that had a stable market share in India’s market, which could help entrants to set up an effective strategy to meet the needs of India’s mobile phone users.

Statement of the problem

Motorola has become the second-largest mobile phone company in handset sales in India with a market share of 14%. Market leader Nokia has a market share of upwards of 60% (Mobile Pundit, 2006). Samsung has revamped its distribution and organizational structure, aiming to double its market share in the mobile handset market to over 18% by the end of 2008 (The Financial Express, 2008). Therefore, the issue of this paper would be what entrants should do to reach at least 25% market share in India’s mobile phone market.

Assumptions

This research is based on the assumption that producing lower-priced mobile phones in India may have at least a 25% market share for entrants if the nation’s GDP keeps growing in the future. India is one of the leading economies in the world as per the present statistics. The growth of the mobile phone market in India is due to the supply of low-cost mobile phones in India. Even a low-income group of people in India can afford a mobile phone due to this reason. The GDP increase of India will again boost up the economy of the country. As a result, the per-capita income of the nation will also show considerable improvement. When this happens more population in the country will be able to afford mobile phones. Thus the nation’s GDP growth will contribute to better market opportunities for mobile phone companies.

Critical questions

Critical question #1: What is the growth potential of mobile phones in India?

Indian mobile phone sector is a very potential market. The mobile phone companies have been making huge profits by their operation in India. The market potential is such that it is the fastest-growing mobile phone market in the world. One of the major success factors of mobile phone companies in India is the acceptability of low-cost mobile phones by the people of the nation. The mobile phone companies are competing at an accelerated pace to grab more and more market share. “Vodafone is working on a mobile phone that would launch for $25 in India.” (Vardy, 2007).

In the initial stages of the launch of mobile phones in India, it was considered a luxury product by the people. Those times even incoming calls were charged by the companies. But later on when competition hiked the companies started introducing exciting offers for the customers whereby more and more people started owning mobile phones. Thus even a person below the income group of $125 a month was able to afford mobile phones.

Both handset prices and connections are available at cheaper rates in India. The number of mobile phones added every month in India is six million, which is the fastest rate when compared to other parts of the world. “Two hundred fifty million people now have mobile phones in India. The government expects that number to double by 2010.” (Pasricha, 2007). Since India has a population of several billion there is still a lot more to be tapped. If the companies can penetrate the rest of the market it would be of greater benefit to the companies. Most of the mobile phone market in India is in urban areas. The vast untapped market in India is in the rural parts of the country. The potentiality lies in the factor that the majority of the population of the country resides in rural areas.

The people of the country consider mobile phones as an enhancement to their personality. People have widely started using mobile phones for internet banking, emailing, and many other purposes. Therefore in India, mobile phones are for more than just calls.

India is featured by a higher rate of consumerism which is one of the major reasons for the flourished mobile phone market. “Dominated largely by Nokia with a total market share of 59%, followed by Samsung (13%), and Motorola (7%) respectively, Indian mobile handset market is currently catering to 45 million subscribers. (June 2005).” (India to become a global hub for mobile phone makers, 2005). A subscriber base of 278 million is expected by the year 2010 in India which would account for 23% of the nation’s population. India emerged as the world’s second-largest mobile phone market in the world in 2007 from the sixth position in 2005.

It can be seen that the growth potential of mobile phones in India is very higher. The above table will give a clear idea about the expected market for mobile phones in India. To make better use of this potential, mobile phone companies should introduce better quality low-priced mobile phones in India.

Critical question #2: What are the expectations of the customers from the mobile phone companies?

The expectations of customers from mobile phone companies can be well studied by understanding clearly the success of Nokia in the Indian market. Indian government first opened its telecom sector for private companies in the year 1994. Different multinational mobile phone companies started entering the Indian market after recognizing the market potential. Nokia succeeded in the Indian market as they were able to make early investments before other major companies. The Indian customers expect higher quality products. Nokia was able to deliver this to Indian customers. To further improve the quality Nokia has set its own Research and Development lab in India.

So the mobile phone companies who enter India should try to focus more on quality. It can be achieved by adopting the strategy of Nokia.

Method of inquiry

The data used in the analysis is qualitative and quantitative secondary data obtained from several sources, as further described below. The sources of the data are indicated in the References section of the paper. The data is derived from the Internet and journals related to the top five mobile phone companies’ strategies in India’s mobile phone market.

The analysis of the data was performed by selecting the appropriate data relevant for each of the two alternative solutions. Since it would have been difficult to collect primary data, and since the outcome would have been beyond the scope of this paper, secondary data was selected. Since the topic of this paper is a mobile phone industry in India issue, the reliance of this analysis was primarily on quantitative data from several relevant mobile phones journals.

The data was then analyzed based on the previously set decision criteria for the selection of the best alternative. The outcome of the analysis for each of the alternative solutions was then examined and contrasted. The results were summarized in a decision matrix, where each criterion that was met for each alternative solution was assigned with a positive number of 1 and each criterion that was not met, received a 0. The alternative solution, which met most of the important criteria, and therefore received the highest score, was then chosen.

Criteria

The average selling price, Indian average income, and the cost of mobile phones would be the criteria for this study to analyze which alternative (providing lower-priced or high-quality mobile phones) would be appropriate for mobile phone companies to enter into India’s mobile phone market.

If a mobile phone company sells mobile phones at a lower price, the company would attract more customers. A high-quality mobile phone includes more technological equipment, such as a camera, mp3, and mobile radio/TV. The selling price of high-quality mobile phones would be higher than lower-priced mobile phones. Therefore, pricing would be one of the criteria in this study to find out which suggestion is the best for mobile phone companies to draw India’s customers to purchase their mobile phones.

Indian average income is also one of the most important criteria for this study to figure out if entrants should produce low-priced or high-quality mobile phones to attract Indians to purchase their products. In addition, Code Division Multiple Access (CDMA), and Global System for Mobile Communications (GSM) mobile phones have become popular for Indians. Providing these extra services would add more cost for mobile phone companies when cooperating with local (Indian) companies. Mobile phone companies would consider the cost of producing their mobile phones to get more benefits in India’s mobile phone market.

Alternatives

There are two alternatives for entrants to enter India’s mobile phone market. First, mobile phone companies, which are entrants into India’s market, could produce a lower-priced mobile phone to attract Indian customers. The second alternative would be that entrants who enter India’s market may also develop the product’s quality to draw Indian customers.

Limitations

Examination of India’s mobile phone industry research reveals two limitations. One, many of the annual reports cited in the paper were publications outside of the United States. The second limitation is the fact that information cited in this paper was obtained from online sources which could be inaccurate.

Overview of the paper

This research paper provides an overview of how to reach at least the 25% market share in India’s mobile phone market. In addition, the research will discuss the challenges that entrants may have in India’s market.

- Chapter Two, Literature Review, discusses the main issue which includes two critical questions. The information in the literature review is obtained from the Internet. The information concerns the mobile phone industry in America which is a saturated market (Bremner, 2007).

- Chapter Three, Methodology, describes the method of this paper to be used and evaluates methods utilized in this paper. The required data is identified along with the location of the data at the end of this chapter.

- Chapter Four, Data Analysis, discusses the presentation of secondary data and analyzes secondary data collected for the research.

- Chapter Five, Conclusions and Recommendation, presents conclusions, which are drawn from the study, and demonstrates a solution for the research problem.

Literature Review

Introduction

In North America, mobile phone sales were somewhat depressed by the economic recession, which caused a lack of motivation among consumers to replace existing devices. Indeed, across the mobile world, end-users with a mind to upgrade their devices appeared to be waiting for a greater selection of next-generation mobile terminals from which to choose (Pastore & Network, 2002). Mobile phone companies would not be easy to survive in America’s mobile phone industry. One of the suggestions for mobile phone companies to get more profits would be focusing on producing their products in developing countries, such as India.

The population of India is growing at a higher rate than China and some states in Africa. This growth rate in the population is accompanied by the growth in the economy, which is supported by the prevailing democracy in the country (Lakshman, 2007).

India’s mobile telephone market has grown at a tremendous pace in the past five years, from 13 million subscribers in 2003 to almost 165 million in 2007, registering an annual growth rate of approximately 88.7%. The widespread adoption of mobile telephony remained unparalleled in scope to other segments of the Indian telecom sector, driven by the ever-increasing population of users who chose cell phones (“A study of the Mobile Value Added Services (MVAS) market in India,” 2007).

Moreover, Nokia’s 2000-2007 annual report, one of the top five mobile phone companies, showed that the company got more profits in India compared to producing mobile phones in other developed countries. Although the net sale in India was low in 2001, India’s mobile phone market had increased aggressively from 264 am to 3684 EURm during 6 years. Recently, India is the second country to make large profits for Nokia in its 10 major markets.

10 major markets, net sales, EURm.

Therefore, India’s mobile phone market has grown at a rapid pace in the past several years. For a multinational company to be able to succeed in the production of mobile phones in India, the company needs to have a good strategy that will enable it to achieve at least 25% of the market share in India.

Critical Questions

When it comes to the selection of a strategy for entrants to reach at least 25% of India’s mobile phone market, several variables need to be taken into consideration. The most important ones are the average selling price, Indian average income, and the cost of mobile phones. This research paper examines the most important factor in the pricing of mobile phones’ decisions. Since India’s mobile phone continues explosive growth, mobile companies need to consider what kind of mobile phones would attract Indians to purchase their products; therefore, the company is presented with two possible alternative solutions to achieve at least 25% market share in India, and also could survive in this competitive mobile phone industry.

- Mobile phone companies, who are entrants into India’s market, could produce a lower-priced mobile phone to attract Indian customers.

- Entrants who enter India’s market may also develop the product’s quality to draw Indian customers.

Alternative 1: Mobile phone companies, who are entrants into India’s market, could produce lower-priced mobile phones to attract Indian customers

As per the current statistics, India is the most potential and emerging market for mobile phones. The major reason behind this phenomenon is that the population of India can afford mobile phones unlike other countries such as the US. The major mobile phone companies supply mobile phones at an affordable rate in India. Another existing situation in the country is that the people exchange/replace handsets frequently. They are very much passionate about purchasing new models. “Almost 75 percent of consumers surveyed in India and China, and 67 percent in South America has also upgraded their mobile phones more frequently than any other technology.” (Abhishek, 2005).

“Mobile phone companies are taking cheap handsets and life-time prepaid services to India’s hundreds of millions of low-income earners in a bid to expand market share and maintain their break-neck rates of growth.” (India to be world’s No. 3 in mobile phone users, 2006). Price reduction is one of the major strategies that mobile phone companies adopted in India. The growth potential in India is not only the result of low-priced mobile phones but also the low-priced services provided by the mobile service providers in India. India is one of the countries where the lowest call rate prevails.

The advertisement campaigning by the service providers and handset companies are other contributors to the booming market. Nokia has launched low-priced handsets in India in the price range of Rs.2000 – Rs.4500. “Though slightly expensive than Reliance, Nokia’s GSM handsets will give consumer the freedom to switch operators by changing the SIM card while in case of Reliance you are the merciful service of ADAG.” (Nokia’s low-cost handset, 2007). Similarly, Samsung and other major mobile phone companies had also launched economic phones for the Indian market.

Alternative 2: Entrants who enter India’s market may develop high-quality mobile phones to draw Indian customers

The major mobile phone companies enter the Indian market with superior quality products. The companies never suppressed quality for the price. “With an established business and expanding brand, Nokia has touched millions of hearts with its exclusive models. Along with quality products, Nokia provides superior customer service and support all over the globe.” (Popular Nokia Mobiles available in India, (2007-2008). Sony Ericsson has always grabbed a good name in the music phones segment. The sound qualities of Sony Ericsson phones are superior to any other manufacturers.

Criteria

The criteria to be adopted for selecting the best alternatives are average selling price, Indian average income, and cost of mobile phone.

Average selling price

Average selling price is an option to be considered to select the best alternative. The average selling price of mobile phones should not go up even if the company produces higher quality products.

Indian average income

The Indian average income is another factor to be considered since it is all about people spending their income on purchasing handsets.

Cost of mobile

The cost of mobile is the third factor to be considered. After all Indian mobile phone market is known for low-cost products.

Evaluate of Alternative

The first alternative can be considered based on each criterion. Since the supply of low-priced mobile handsets is the first alternative the companies should attempt to maintain an average selling price for the mobile handsets. Since the average Indian income is low, the supply of low-priced mobile phones will be widely accepted by the people. The cost of mobile phones will thus be kept at a stable rate. Most of the mobile phone companies in India have started adopting this theory for success. “the product mix of vendors like Motorola and its rival Nokia are increasingly trending toward lower prices as the companies seek to appeal to consumers in emerging markets like India and China.” (Cohn, & Staff, 2007).

The second alternative is to improve the quality of products. The quality of handsets should be improved and it must not cost more than the average selling price of the mobile phones. Quality improvement should be such that the Indian customers can afford the final product. The Indian customers expect very high-quality standards from the mobile phone companies.

Summary of chapter

The major idea that is given in this chapter is the different alternatives available for mobile phone companies to enter the Indian market. The core idea of this chapter is the two alternatives that have been given. The first alternative is that mobile phone companies should introduce low-priced products in India. The alternative is analyzed on certain criteria. Similarly, the second alternative is to improve the quality of mobile phones introduced in India. This alternative is also analyzed based on the given criteria. It can be seen that both the alternatives feature the requirements of Indian customers.

The reason for the boost up of the mobile phone market in India is the availability of low-priced mobile phones. At the same time, the customers give due importance to quality. Therefore, the mobile phone companies should improve the quality of products supplied without increasing the cost.

Analysis

The average selling price

Alternative #1 – The mobile phone companies should introduce low-priced mobile phones in the Indian market.

It can be seen from the literature and other sources that labor and other overhead expenses are cheap in India. “As per a study by PricewaterhouseCoopers (PwC), commissioned by Cellular Operators Association of India (COAI), in the last year, the cost per subscriber for cellular operators has decreased by 27%.” (Technology industry, 2005). This benefit is available for mobile phone companies too. By way of cutting the cost, the companies will be able to introduce lower-priced mobile phones in the Indian market.

Alternative #2 – The mobile phone companies should introduce high-quality, higher-priced mobile handsets in India.

The major reason for an increase in the profitability of mobile phones in India is the availability of low-priced phones. In such a case an increase in the selling price of mobile phones will lead to a fall in profitability. But this is only the present situation. A counterargument for this can be seen in the analysis based on Indian Average Income.

Indian average income

Alternative #1 – The mobile phone companies should introduce low-priced mobile phones in the Indian market.

Indian customers are now into an era of brands. Indians are becoming more brand conscious. This brand consciousness has made them spend more for purchasing it. The average income of Indians is also at an increased pace. At this stage introducing low-priced mobile phones is not a strategy anymore. But on the other side, there are tremendous opportunities for this strategy. That is the majority of the population of India are middle and lower-income group people who can afford only lower-priced mobile phones.

Alternative #2 – The mobile phone companies should introduce high-quality, higher-priced mobile handsets in India.

The Indian average income is at an increasing pace. With an increase in the Indian average income, people will have more buying power. “Even as salary increases hit record lows in the United States in 2003, Asia saw an overall salary increase with India reporting the highest average pay rise.” (Business, 2003). This situation will make Indian customers buy better mobile phones. The higher cost of mobile phones is not yet a cause of concern among Indian customers. The customers are ready to afford costly mobile phones.

Cost of mobile phone

Alternative #1 – The mobile phone companies should introduce low priced mobile phones in the Indian market

As per the criteria, low-priced mobile phones will have better acceptability in the Indian market.

Alternative #2 – The mobile phone companies should introduce high-quality, higher-priced mobile handsets in India.

An increase in the quality of mobile phones will lead to an increase in the selling price.

Results

From the above decision matrix, it can be seen that the first alternative scores more than the second one. The second alternative has a better score only in the third criteria.

Interpretation of the results

The two alternatives can now be interpreted based on the above decision matrix. The alternative one seems to be more worth the second one in the decision matrix analysis. The alternative one is more feasible in the present scenario of the country based on the average selling price. The companies will be able to introduce lower-priced mobile phones with the present condition in India. But the second alternative scores nothing on average selling price. The reason for this is that the second alternative is all about increasing the selling price of mobile phones.

On the criteria of Indian average income the first alternative scores more than the second one. The average income of the Indian population is at an increased pace. Therefore the people would be able to afford expensive mobile phones. The second alternative scored one on this particular point. But considering the entire Indian population, where the majority of the people fall into the poor category the first alternative scored well.

On the third criteria of cost of mobile phones both the alternatives scores one. When the cost is reduced mobile phones will have better acceptability in the market. Since the second alternative increases the quality of mobile phones there are more chances for the customers to be satisfied.

Conclusion and recommendation

It can be seen from the above analysis and interpretation that the second alternative scored very less compared to the first one. The first alternative is to introduce lower-priced mobile phones in India. This alternative satisfies all three criteria while compared to the second one. It can be seen that purchasing a lower-priced mobile phone is being the preference of Indian customers ever since the introduction of mobile phones in India. All the major mobile phone companies in the world have their presence in India. The companies are aggressively introducing new models in the market in order to withstand the competition. Since production cost is lower in India, producing mobile phones in India is a cost-saving effort for the mobile phone companies. In this way, the companies will be able to introduce lower-priced mobile phones in India and will be able to capture more markets.

Recommendation

Based upon all the above factors the better alternative for mobile phone companies is “to introduce low priced mobile phones in India”

Reference

Vardy, Nicholas. (2007). The mobile Phone Megatrend: Exploring the New Frontier: The mobile phone megatrend: The challenges, seeking alpha. Web.

Pasricha, Anjana. (2007). Voice of America: India’s mobile phone market fastest growing in the world, newsVoAcom. Web.

India to become global hub for mobile phone makers, (2005). CIOL. Web.

Explosive Growth Continues for India’s Mobile-phone Market, (2006). Cellular-news. Web.

Abhishek. (2005). Mobile phones are replaced most frequently, Mobile phones India. Web.

India to be world’s No. 3 in mobile phone users, (2006). ExpressIndia.com. Web.

Nokia’s low cost handset, (2007). Mobile India. Web.

Popular Nokia Mobiles available in India, (2007-2008). Infibeam.com. Web.

Cohn, Michael., & Staff. (2007). Cheap phones hurting vendors: Motorola misses the call, Red Herring. Web.

Technology industry: Operating costs of cellular phones keep falling: PwC report. (2005). Bnet. Web.

Business: Salary increase highest in India, (2003). Web.