Executive Summary

This report presents a detailed business plan for producing and selling mrhb detection system. Mrhb is a newly developed, drowsy driver detection system. The product targets customers in the enterprise and consumer market segments. These include businesses and car owners. Mrhb will be produced in China by a contract manufacturer and sold in Saudi Arabia and other countries by independent distributors.

The market for drowsy driver detection systems is expected to grow at an average annual rate of 7% in the next five years. The growth will be supported by improved economic performance in the global economy. However, competition is expected to increase as more firms join the industry. The business will make a loss in the first year due to high establishment costs and low sales. However, it will make high profits from the second year. Growth in profits will be supported by high sales and cost-efficiency.

Company Description

Mrhb Car Safety Ltd is a newly established company in Saudi Arabia. The company focuses on developing and selling drowsy driver detection systems to companies and car owners. The company’s flagship drowsy driver detection system will be referred to as mrhb. The vision of the company is to be the leading manufacturer of high-quality drowsy driver detection systems in Saudi Arabia.

The company’s mission is to reduce road accidents through effective drowsy driver detection solutions. The company has successfully developed a prototype of its drowsy driver detection system. Mrhb is plugged on the car’s dashboard to detect drowsiness using a sensing device that measures various physiological variables (Parmar, 2008). These include the rate of breathing, blinking of the eyes, and electrocardiography. If the system detects drowsiness, it issues an audio-visual warning to the driver immediately (Vedachary, 2013). Specifically, an alarm rings with a message that reminds the driver to stay alert. Additionally, a picture of a cup of coffee appears on the system’s screen as a reminder to the driver to take measures to avoid drowsiness. Currently, the company is looking for a manufacturer to produce the product.

Industry Analysis

Industry Size and Growth Rate

The global drowsy driver detection industry was worth approximately $230 billion in 2013. Nearly 80.6 million units of the system were produced and installed in cars in 2013 (Marvik, 2014). The industry is expected to grow at an annual average rate of 8.6% in the next five years. Similarly, sales are expected to grow by at least 7% in the next five years (Connolly, 2012). However, the growth in sales will vary by region. North America and the Asia-Pacific region are expected to experience the highest growth rate in sales in the medium-term due to increased car sales (KPMG, 2014).

Industry Structure

The drowsy industry is characterized by high competition in Saudi Arabia and other major markets such as Europe and the US. The factors that shape competition include buyers’ low switching costs, high threat of substitutes, high threat of backward integration, and product differentiation (Riches, 2014). Buyers are interested in buying detection systems that are cheap and easy to use rather than expensive and sophisticated ones. There are numerous substitutes for drowsy driver detection systems, which increase competition due to their low costs and simplicity. Some vehicle manufacturers such as Volvo produce their own drowsy driver detection systems (backward integration), thereby increasing competition.

The industry is highly fragmented. The top four largest companies control less than 15% of the market (Riches, 2014). The main players in the industry include Volvo, Ford Motor Company, Hyundai, and Mercedes. These companies have economies of scale in the production and distribution of drowsy driver detection systems. They also control the distribution system since they are original car manufacturers.

Success Factors

The main factors that determine the success of the incumbent firms include access to cutting-edge technologies, road safety regulations, and access to the distribution system. Companies such as Volvo and Ford are able to increase their market shares easily because they use advanced technologies to produce high-quality products at a low cost. Furthermore, companies that have effective distribution channels are able to increase their sales easily (Czinkota & Ronkainen, 2012). For instance, small manufacturers succeed by collaborating with independent retailers to sell their products. In countries such as the US and Canada, where vehicles must have driver assistance systems, the manufactures of drowsy driver detection systems enjoy high sales. However, in Saudi Arabia, where the systems are not mandatory, manufacturers have to convince the public to buy their products.

Trends in the Industry

The main trends in the industry include acquisitions, innovation, and the regular introduction of new products. Car manufacturers have acquired most startup companies in the last five years. This strategy helps car manufacturers to ensure a steady supply of high-quality drowsy driver detection systems at a low cost (Grewel & Levy, 2011). Manufacturers are investing heavily in research and development in order to achieve product innovation. This leads to the frequent introduction of differentiated products. For example, Volvo’s drowsy driver detection system senses drowsiness by monitoring road signs, the use of the accelerator paddle, and movement of the steering. By contrast, Ford’s system mainly monitors lane departure to detect drowsiness.

Industry Lifecycle and Its Attractiveness

The industry is at its growth stage. In the last three years, demand for drowsy driver detection systems grew significantly due to product awareness. Although the prices of the systems have been decreasing due to rising competition, manufacturers are still able to enjoy high-profit margins of up to 25% (Connolly, 2012). Major producers continue to invest in marketing initiatives such as advertising to improve their sales.

The attractiveness of the industry is illustrated by its rapid growth rate, which is expected to continue in the long-term. Demand will continue to rise as the public learn about the effectiveness of drowsy driver detection systems. As a result, car manufacturers will be forced to provide the system as a standard vehicle component. This will result in a significant increase in demand in the future (He, 2013). In addition, rising concerns about road accidents in emerging markets in Africa and Asia is likely to increase demand. This means that there are several growth opportunities in the industry (Drummond, Ensor, & Ashford, 2010).

Market Analysis

The company will serve customers in the enterprise and consumer market segments. In the enterprise market segment, the company will target transportation companies and businesses that use cars and trucks frequently. In this segment, behavioral variables such as price sensitivity benefits sought, and usage rate will be used to identify customers. Specifically, the company will target business that are interested in using their vehicles regularly while ensuring safety at a low cost. The enterprise market segment has a huge growth opportunity due to its large size. In Saudi Arabia alone, there are nearly 315 large transportation companies. Moreover, several businesses use trucks and buses to transport their goods and staff respectively. The transportation companies are likely to buy the drowsy driver detection system to improve the safety of their passengers, drivers, and goods.

In the consumer market, the company will target the middle class and people who are above the age of 50 years. The middle class are likely to buy the drowsy driver detection system because of their high purchasing power. Moreover, the middle class is associated with a low risk lifestyle (Kazmi, 2007). Thus, they are likely to be interested in a device that minimizes road accidents. The people who are above 50 years have a high chance of falling asleep while driving because of their age. This means that they are likely to buy drowsy driver detection systems.

Buyer Behavior

Price sensitivity is high in the enterprise market segment where companies are interested in low cost drowsy driver detection systems in order to reduce their operating costs. In the consumer market segment, price sensitivity is low among the middle class. However, it is high among the low income-earners who are above 50 years (Kayed & Hassan, 2011). Mrhb will be introduced at a price of SAR 500. Since this price will be at least 10% less than the industry average, customers in all market segments are expected to afford it.

Competitor Analysis

The competitors can be classified into two categories namely, original equipment manufacturers and specialized producers of drowsy driver detection systems. In the original equipment manufacturers category, the main competitors in Saudi Arabia are Ford, Hyundai, and Mercedes. These companies limit opportunities for sales since most of their vehicles are fitted with drowsy driver detection systems at the factory.

Among the specialized producers, the main competitors are Tata Elxsi (based in the US) and Bosch Automotive Technology (based in German). These companies have a strong brand image and customer loyalty due to their ability to provide high quality products. However, importation costs reduce the competitiveness of their products in Saudi Arabia (Johnsons, 2012).

Substitutes

The main substitutes include adaptive cruise control systems, coffee, and mobile phone alarms. An adaptive cruise control system helps in regulating the speed of the vehicle in order to avoid hitting an object as it moves. However, it cannot help a drowsy driver to avoid an accident if there is no object in front of his or her car that will prompt the system to reduce the car’s speed. Coffee is cheap and helps the driver to stay awake as he drives. Mobile phone alarms remind drivers to stay awake as they drive. However, their limited battery life and inability to detect drowsiness makes them ineffective.

Advantages of Mrhb

Mrhb is better than its substitutes because it can detect drowsiness and provide timely warning to the driver. Unlike mobile phones, mrhb does not require regular charging. In addition, it is more convenient to use than coffee, which requires the driver to stop at coffee shops while travelling.

Marketing Plan

At the launch of the product, the main issue will be to create brand awareness in Saudi Arabia. Establishing an efficient distribution network is also a major issue that will be dealt with. In the first year of market entry, the first objective will be to gain at least 8% of the market share. The second objective will be to realize SAR10 million in sales. In the second year, the first objective will be to increase market share by 10%. The second objective will be to increase sales by 10%. The third objective will be to make a profit of SAR 500,000. In order to achieve these objectives, the company will employ the following marketing mix.

Product

The company will focus on incremental innovation to improve the competitiveness of its product. Innovation will be achieved through research and development initiatives (Ansoff, 2007). The company will also collaborate with lead users such as truck drivers to develop high quality drowsy driver detection systems. Innovation will enable the company to differentiate its product. Consequently, the company will overcome competition by attracting and retaining new customers (Kotler & Keller, 2011). Differentiation will also enable the company to build a strong brand image that will be known for quality, affordability, and reliability. The resulting improvement in brand loyalty and customer satisfaction will facilitate rapid market penetration.

Price

In the first two years of market entry, the company will employ the penetration pricing strategy in order to gain market share. This will involve selling the drowsy driver detection system at a low price in order to attract customers. The resulting increase in sales volume will enable the company to increase its market share and to make a profit. From the third year, the company will embark on competitive pricing to sell its product. This will involve setting prices that are comparable to those of the competitors in the industry. This pricing strategy will improve the company’s profits in the medium-term (Kazmi, 2007). In addition, it will eliminate price-based competition that is likely to occur if all companies embark on cutting their prices.

Place

Mrhb will be distributed using a three-level distribution channel. The first distribution channel will involve using direct sales to market the product. In this case, the sales team will visit prospective customers such as transportation companies to convince them to purchase the product. This strategy will enable the sales executives to utilize their product knowledge and experience to close large deals. The second channel will be online distribution platforms such as Amazon.com, eBay.com, and Alibaba.com. The online distribution channel will enable the company to reach customers outside Saudi Arabia at a low cost (Zimmerman & Blythe, 2013). The third channel will include wholesalers and retailers of car accessories. The company will collaborate with retailers with extensive market coverage to reach as many customers as possible.

Promotion

The marketing communication mix that will be used to promote mrhb include advertising, public relations, discounts, and event sponsorship. Adverts will be posted on print and electronic media to create brand awareness (Dominici, 2009). A famous speed car driver from Saudi Arabia will be used in the adverts to endorse the product. This will help in attracting attention and enhancing brand credibility. Public relations will be used to influence the public’s attitude towards the product. The resulting improvement in brand image will boost sales. Customers who are able to make large purchases will enjoy trade discounts of up to 5%. The company will also sponsor one car race annually to create brand awareness.

Management Team

The management team consists of five professionals with expertise and experience in different areas. The team includes the CEO, finance manager, sales manager, technical/ operations manager, and human resource manager. The CEO has expertise in finance and business process engineering. The sales manager has expertise in sales, product development, and marketing. The finance manager is a qualified accountant and financial analyst. The human resource manager has exceptional skills and experience in staff management and talent acquisition. The technical/ operations manager has expertise in mechatronic engineering and business management. His expertise will help in product development.

Operations Plan

Business Location and Facilities

The company’s headquarters and warehouse will be located in Riyadh, Saudi Arabia. The equipment and facilities that will be needed to manufacturer mrhb include a production plant, a warehouse, and trucks to transport the finished product. Since the company does not have a factory, it will outsource the manufacturing process.

Supply Chain Relationships

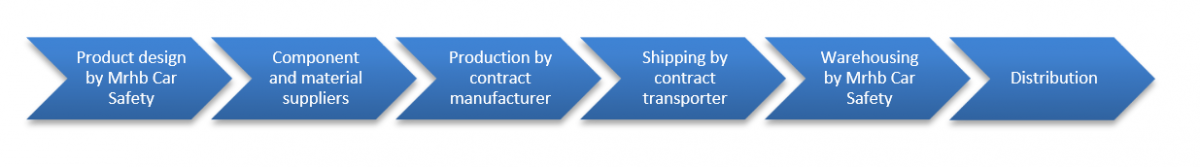

The supply chain activities are summarized in figure 1. Mrhb Car Safety has already designed the product. The next step will be to identify suppliers of various components and raw materials that will be used to manufacture the product. A contract manufacturer will produce the product in China. China has been chosen because of access to cheap labor, advanced technologies, and proximity to Saudi Arabia (Bagad, 2008). After the production, a shipping company will be hired to transport the products to the company’s warehouse in Riyadh. The company will use medium-sized trucks to transport the product to distributors in Saudi Arabia. Independent car accessory dealers, the company’s sales team, and online sales platforms such as Amazon.com will distribute the product.

Relationships

The company will maintain a strategic partnership with members of the supply chain in order to achieve long-term success. The aim of the partnership will be to enhance the commitment of the supply chain members who the company will depend on to produce and distribute its products. The company in consultation with its partners will coordinate of the supply chain activities. Online business-to-business platforms will be used to share transaction information in order to improve the efficiency of the supply chain (He, 2013).

Product Design and Development Plan

The main achievement in the product development process is the completion of the design stage. A prototype has been designed for demonstration purposes. Several tests have shown that the product is effective and can be manufactured at a low cost. Currently, certification and mass production are the main issues that have to be addressed in order to get the product to the market. The product has to be certified by the Saudi Arabian Standards Organization (SASO) before being launched in the market. The company has presented the prototype to SASO for testing. It has also presented all supporting documents to prove its compliance with SASO’s standards. Mass production will begin after certification.

The main challenge that the product is facing is certification in countries such as the US and the UK where quality standards are very high. Failure to complete the certification process is a great risk since it will deny the company access to various markets. Another challenge is the lack of knowledge concerning how the product works. This might force the company to train distributors on how the product works to improve sales.

Financial Projections

Sources of Funds

The company will require SAR 17 million to launch its operations. The founding shareholders will contribute SAR 12 million, whereas the remaining SAR 5 million will be obtained from a venture capital firm and a commercial bank in Saudi Arabia. The SAR 17 million will be used to manufacture the product, establish the company’s headquarters, and to distribute the product. It will also be used to finance marketing activities.

Assumption Sheet

The growth of the drowsy driver detection systems’ market will be supported by the expected improvement in economic growth in the developed and emerging markets. Developed countries such as the US, the UK, and France are expected to achieve an average economic growth rate of 2.5% in the next three to five years (Rabobank, 2012). In emerging markets such as India, China, and South Africa, GDP growth will average 5.5%. In Saudi Arabia, the economy is expected to grow by at least 3.5% in the next five years (IMF, 2013). The expected strong economic growth will improve the demand for drowsy driver detection systems in the next five years.

The company will double its sales force from two to five personnel by the third year. It will also increase expenditure on advertising by 10% annually. These initiatives are expected to boost sales from the second year. The company is launching a new product that lacks brand awareness, but has a high growth potential. Thus, in the first year sales are expected to be low, whereas costs will be high. However, sales are expected to grow at a rate of 10% from the second year.

Pro Forma Income Statement

The pro forma income statement indicates that the company will make a loss of SAR 141,600 in the first year. The loss is attributed to the high establishment costs and low sales in the first year. From the second year, sales and cost of goods sold are expected to increase at an annual rate of 10% and 5% respectively. As a result, the company is expected to breakeven in the second year. Overall, profits will increase from SAR 562,574 in 2016 to SAR 2,076,837 in 2019 due to increased sales and improved cost-efficiency.

Pro Forma Balance Sheet

The company will be worth SAR 17,716,462 at the end of the first year. From the second year, the value of the company is expected to increase rapidly due to increased sales and profits. Nearly 95% of the annual profits will be retained to expand the business.

Pro Forma Cash Flow Statement

The pro forma cash flow statement indicates that the company will have adequate cash to finance its operations. In the first year, the cash balance will be only SAR 2,716,800 due to the expected loss and high operating costs. However, the cash balance will increase from SAR 7,475,791 in 2016 to SAR 10,499,034 in 2019 due to the expected increase in cash generated from sales and a slow growth in operating costs.

Ratio Analysis

Key financial ratios are summarized in table 1. The company’s gross profit margin is expected to increase from 0.18 in 2015 to 0.32 in 2019. This means that the product will have a high profit margin of up to 32% in the fifth year. Similarly, the net profit margin will increase to 0.18 in 2019. This indicates that the business is highly profitable. The current ratio indicates that the company will be able to meet its short-term debt obligations using its current assets (Dlabay & Burrow, 2007). Thus, the liquidity of the business is strong. The debt-to-equity ratio indicates that the company will not be debt-ridden. Specifically, debts will account for less than 18% of shareholders’ equity. Overall, the financial projections and ratio analyses indicate that the business is viable.

Table 1: Financial ratios.

References

Ansoff, I. (2007). Strategic Management. New York, NY: McGraw-Hill. Web.

Bagad, V. (2008). Managerial economics adn financial analysis. New York, NY: McGraw-Hill. Web.

Connolly, C. (2012). Driver assistance systems aim to halve traffic accidents. Sensor Review, 29(1), 13-19. Web.

Czinkota, M., & Ronkainen, I. (2012). International marketing. New York, NY: McGraw-Hill. Web.

Dlabay, L., & Burrow, J. (2007). Business finance. London, England: Oxford University Press. Web.

Dominici, G. (2009). From marketing mix to e-marketing mix: Literature overview and classification. International Journal of Business Management, 4(9), 17-20. Web.

Drummond, G., Ensor, J., & Ashford, R. (2010). Strategic marketing. London, England: Oxford University Press. Web.

Grewel, D., & Levy, M. (2011). Marketing. New York, NY: McGraw-Hill. Web.

Hariss, L., & Rae, A. (2009). Social networks: the future of marketing for small businesses. Journal of Business Strategy, 30(5), 24-31. Web.

He, N. (2013). How to maintain sustainable competitive advantages: Case study on the evolution of organizational strategic management. International Journal of Business Administration, 3(5), 112-120. Web.

IMF. (2013). Country report: Saudi Arabia. Washington, DC: International Monetary Fund. Web.

Johnsons, M. (2012). Attracting and retaining customers in a competitive market. Strategic Direction, 28(1), 17-20. Web.

Kayed, R., & Hassan, K. (2011). Saudi Arabia’s economic development: Entrepreneurship as a strategy. International Journal of Islamic and Middle Eastern Finance and Management, 4(1), 52-73. Web.

Kazmi, S. (2007). Marketing management. London, England: Sage. Web.

Kotler, P., & Keller, K. (2011). Marketing management. London, England: Palgrave. Web.

KPMG. (2014). Global automotive executive survey. Web.

Marvik, P. (2014). Global advanced driver assistance systems market size, key players, region, competitive strategies and forecasts to 2020. Web.

Parmar, N. (2008). Drowsy driver detection system. Toronto, Canada: Ryerson University. Web.

Rabobank. (2012). Country report: Saudi Arabia. Eindhoven, Netherlands: Rabobank. Web.

Riches, I. (2014). Automotive advanced driver assistance systems: Challenges and opportunities. Web.

Vedachary, S. (2013). Implementation of the driver drowsiness detection system. International Journal of Science, Engineering and Technology Research, 2(9), 1751-753. Web.

Zimmerman, A., & Blythe, J. (2013). Business to business marketing management. London, England: Sage. Web.