Introduction

As a business and economics undergraduate, I appreciate the importance of developing relevant skills in order to succeed in the labor market. Subsequently, I participated in an internship program at NCB Capital, which is a newly created independent investment company of the National Commercial Bank of Saudi Arabia, for two months from June 2014 to July 2014. The objective of joining the internship program was to gain relevant skills and competence on investment products such as mutual funds, asset management, and other banks’ operations, hence closing the gap between the workplace environment and schoolwork. Subsequently, I participated in an internship program at the NCB Capital.

During the internship, I was positioned at the Private Division (eastern province) under the supervision of Ms. Sana Al-Jabr (Relationship Manager). In order to be effective in executing the assigned duties, I was required to read and understand different documents such as the credit approval memorandums [CAM], credit programs, rules governing the opening of bank accounts, and general operational guidelines in Saudi Arabia. I also prepared unofficial report showing the progress in the customers’ current accounts, mutual funds, and stock portfolio as requested by the relationship manager.

The purpose of this paper is to illustrate the various issues encountered during the course of my internship at NCB Capital. The report is organized into a number of parts. The first part is an overview of NCB Capital, which entails the company’s background, vision and mission, organizational chart, organizational competitive and marketing strategies, and SWOT analysis. The second section is the technical part, which covers a reflection on the projects undertaken, problems handled, methodological used, limitations, finding, and the implemented solutions. Thirdly, an evaluation of the internship experience, a summary of the findings, and recommendations are provided in the third and fourth sections respectively. The final section outlines a conclusion on the internship program.

Company background

The National Commercial Bank [NCB] was founded in 1953 in the Kingdom of Saudi Arabia through a royal decree. The firm was established through general partnership between two major currency houses in the KSA, which include the Salem Bin Mahfouz Company and Salehand Abdul Aziz Kaki. The NCB’s headquarters are at Jeddah, Saudi Arabia. NCB has undergone extensive restructuring since its inception. For example, in 1997, the firm’s structure changed into a joint stock company. However, the firm’s shareholding was changed in 1999, whereby its ownership belongs to private Saudi investors, the General Organization for Social Insurance, and the Public Investment Fund (NCB Capital, 2014a).

The firm has developed an optimal market position in the Saudi finance industry, which has risen from investment into product and service innovation. NCB is one of the pioneers in the Islamic finance and banking industries, as evidenced by its effectiveness in introducing new financial products into the market. For example, the company has established real estate finance, auto finance, mutual funds, and different types of Sharia-compliant financial products.

Moreover, the firm is committed to developing competitive advantage through innovation, as evidenced by its investment in effective and efficient technologies such as mobile banking and ATMs. NCB has established over 10,750 point-of-sale terminals. Consequently, the firm’s commitment to financial product and service innovation has improved the bank’s ability to meet the financial needs of over 3.5 million customers.

In an effort to develop its competitive advantage, the NCB has expanded into different regions across the KSA. According to the company’s annual report, NCB had established over 512 branches in the KSA by the end of 2013. Furthermore, the firm has also expanded into the international market by establishing branches in Bahrain, Singapore, the United Kingdom, Seoul, and Beirut. The firm has a total human resource base of over 9,631 employees, which enables it to be effective and efficient in serving its broad customer base.

NCB appreciates the importance of efficient business operations. Subsequently, the firm’s operations are divided into a number of business segments, which include investments, wealth management, consumer finance, business banking, and Islamic retail banking. The NCB Capital is the main business unit that deals with investment. NCB Capital operates a mutual fund that is designed in accordance with the customers’ needs. The unit has become the leading mutual fund provider in the KSA. Furthermore, NCBC has diversified its fund by incorporating the Sharia-compliant mutual funds. NCBC has been granted the right to deal with diverse investment banking and asset management products in the KSA by the Capital Market Authority. In addition to the above activities, NCBC provides other services such as custody, underwriting, arranging, advising, and securities’ management (NCB Capital, 2014a).

Vision and mission

In the course of its operation, NCB Capital intends to position itself as the global leader with regard to the provision of financial investment products. In an effort to achieve this vision, the firm is committed to diversifying its financial products in addition to penetrating new markets.

Organizational chart

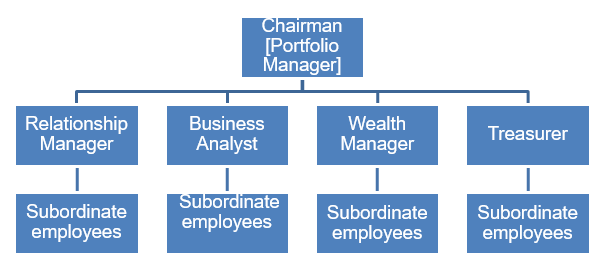

The type of organizational structure adopted has a significant impact on the degree of interaction between the various internal organizational stakeholders such as the employees. Consequently, it is essential for organizational leaders to implement an effective organizational design. NCBC has adopted a flat organizational structure in order to ensure effective and efficient flow of information amongst the various divisional heads. The figure below illustrates NCBC’s organizational chart.

SWOT analysis

An organization’s operations are subject to the changes emanating from the internal and the external business environment. However, it is imperative for organizational managers to implement effective strategic management practices to deal with the market dynamics. NCBC has positioned itself optimally in the Saudi Arabian financial services industry due to its effectiveness in nurturing its strengths and improving on its weaknesses. Furthermore, the firm is focused at exploiting the prevailing market opportunities and managing the posed threats. The chart below illustrates a summary of the firm’s strengths, weaknesses, threats, and opportunities.

Organizational marketing strategy

The type of marketing strategy adopted plays a fundamental role in determining an organization’s ability to penetrate a given market. Thus, it is essential for an organization’s management team to conduct a thorough market research in order to make effective decision on the choice of marketing strategy. The market research should focus on understanding the prevailing market trends. NCBC intends to attain a significant market share in the assets and wealth-management market segments. Consequently, the firm has adopted a comprehensive marketing strategy, which entails the market expansion strategy. The decision to adopt the market expansion strategy arises from the recognition of potential gap within the global investment [asset and wealth] market segments (NCB Capital, 2014b).

The firm has divided its market expansion strategy into two components, which include increasing the sales of the existing and new investment products. NCBC is committed to increasing the sales of its current investment products amongst the current and potential customers. Furthermore, the firm has taken into account foreign markets as a potential source of its increased sales for the existing products by diversifying into the GCC markets.

NCBC has also incorporated new product development in its market expansion strategy. The firm invests in extensive market research in order to identify potential market opportunities that can lead to the development of viable financial investment products. The market research enables the firm to gain insight on how the existing products can be refined in order to address the market needs of new market segments.

Moreover, the firm has ventured into new market segments through product line extension. In an effort to increase its market presence, NCBC has identified a potential market opportunity in other regions of the world such as the European Union and the Middle East and North Africa [MENA] region. In 2013, NCBC announced its decision to market its financial products in the European Union through the NCBC Investment Management Umbrella Public Limited Company, whose operations will be based in Ireland. NCBC has introduced new funds, which include the NCBC GCC Equity Fund and the NCBC Saudi Arabian Equity Fund through this new platform. The firm’s decision to penetrate the European Union market arose from the need to achieve long-term capital growth.

Organizational competitive strategy

The business environment has undergone remarkable evolution over the past decades. One of the major sources of evolution relates to the high rate of globalization. Subsequently organizations are competing on a global scale. NCBC appreciates the importance of developing competitive advantage in order to survive in the contemporary business environment and to improve its performance efficiency. In an effort to achieve competitiveness, NCBC has adopted the focus strategy as its core competitive strategy. Dirisu, Iyiola, and Ibidunni (2013) argue that the “focus strategy concentrates on a narrow segment and within that segment attempts to achieve either cost advantage or differentiation” (p. 271).

The firm’s decision to adopt the focus strategy arose from the need to achieve competitive advantage through product differentiation. Thus, the firm has considered the consumer’ investment needs as its core area of operation. Moreover, the choice of the focus strategy as a source of competitiveness has arisen from the need to develop a broad product portfolio by tailoring its investment portfolio products to the customers’ needs.

NCBC’s ability to differentiate its investment portfolio successfully has been necessitated by its competence with regard to development of financial products. For example, the firm has a well-experienced human capital base with regard to asset and wealth management. Dirisu, Iyiola, and Ibidunni (2013) emphasize that the process of developing business strategy should take into account its core capabilities, resources, and skills that constitute its core competencies. Subsequently, a firm can differentiate its investment portfolio in such a way that it meets the customers’ demands. Its focus strategy has played a fundamental role in increasing the firm’s ability to market its products to individual and institutional customers. Furthermore, the focus strategy has played a fundamental role in improving the level of customer loyalty.

Job history

During my internship at NCB Capital, I undertook a number of tasks and projects. The table below illustrates the daily tasks undertaken over the two months.

Table 1; Daily tasks during the first month of the internship.

In addition to the above daily tasks, I undertook a number of tasks during the second month as illustrated in the table below.

Conceptual framework

The contemporary labor market has undergone remarkable changes over the past few decades. Organizations are increasingly demanding an effective and efficient labor force in order to attain business excellence. Saks and Haccoun (2010) are of the opinion that human capital is a fundamental component in organizations’ pursuit for sustainability. This aspect underscores the importance of students possessing adequate and relevant skills in order to succeed in the modern labor market. Apprenticeship training is one of the avenues through which students can develop relevant skills and competence.

Mohrenweiser and Uschi (2010) argue that some of the specific skills required in order to achieve organizational excellence cannot be attained through general-purpose education. Lerman (2014) asserts that internship or on-the-job training is an effective mentoring method that equips students or new employees with relevant skills.

The significance of developing relevant skills has motivated some countries to appreciate the importance of improving their workforces’ skills through apprenticeship training. For example, Mohrenweiser and Uschi (2010) argue that the ‘increase in the returns to a college degree and other skills experienced in the OECD countries over the past 20 years has added the sense of urgency to concerns regarding skills” (p. 112). Higher learning institutions are increasingly integrating internship programs into their structured learning programs.

The internship programs aim at providing students with a meaningful learning experience. Despite the jobs done during the internship being menial, students are in a position to understand specifics of the respective field, profession, or job (Dustmann & Uta, 2012).

Moreover, internship provides students with an opportunity to apply the theories learnt in the classroom in a real work environment. The internship programs are effective avenues through which students gain adequate skills that enhance their ability to work in such a position in the future. Saks and Haccoun (2010) assert that internship programs enhance the students’ ability with which they make decisions regarding their career path. Therefore, internship programs contribute towards the students’ personal development efforts. Furthermore, internship programs are beneficial to the organization offering them and the students’ institution. This trend has arisen from the change in employers’ behavior, whereby they are increasingly inclining towards students with real world experience during the recruitment processes.

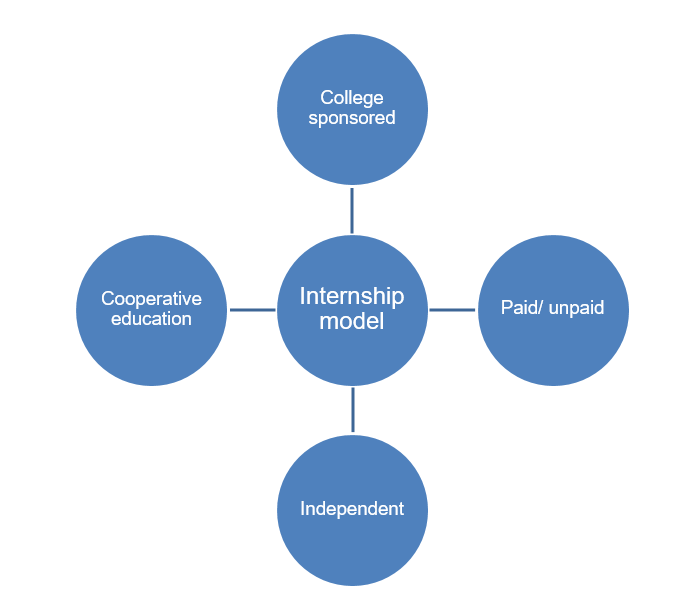

Different models of internship have been developed based on duration, remuneration, and schedule as illustrated by the figure below. The duration of internship program varies and it can last for a month or more than a year. The internship program may be full time, part time, paid, or unpaid. Furthermore, the internship program may be a key requirement in achieving academic qualification in higher learning, which means the students gain points that are added to the their average academic points.

Technical part; reflection on actual projects undertaken and problems handled, and method

During the apprenticeship program, I undertook a number of projects, which played a fundamental role in gaining competence on various issues associated with the asset and wealth management. First, I was charged with the responsibility of helping customers to open new accounts. Additionally, I was required to compile unofficial report such as the CAM as requested by the relationship manager and other departmental heads. Another major project entailed reviewing the various rules and regulations that govern the operations of financial institutions in the KSA as stipulated by various regulatory agencies such as the SAMA and the Capital Market Authority.

In order to ensure that my presence at NCB Capital was of additional value to the organization’s performance, I was required to undertake extensive reading on the company’s operational practices. Therefore, I undertook a comprehensive analysis on the various strategic management practices that the firm integrates during its daily operations. This goal was achieved by reviewing voluminous documents stipulating the directions and guidelines that investment companies in the KSA should observe. Moreover, gaining knowledge on the organization’s operation was also achieved through extensive training on the various financial information management technologies that the firm has implemented in its operations such as the FACTA management system.

Considering the NCB Capital’s intention to invest in the global market in order to achieve an optimal market position, I was required to understand how the organization takes into account the prevailing market opportunity. For example, by assessing the stock price movement in the Saudi Arabian stock exchange market in comparison with other stock markets such as the US and GCC countries.

Methodology used

Internship programs aim at enhancing the intern’s new knowledge, competence, and skills. The methodology incorporated during a particular internship program has a remarkable impact on the intern’s ability to gain from the internship process. Moreover, it is imperative for the organization offering the internship program to provide interns with an opportunity to undertake the assigned tasks and responsibilities effectively and efficiently. In line with this argument, NCB Capital management team incorporated an effective qualitative methodology. The choice of this design was to gather sufficient data that would enhance the ability to gain new skills and enhance the knowledge gained.

Some of the techniques adopted in imparting knowledge to the intern entail conducting literature review on the various aspects associated with the organization’s operation. Voluminous documents were read in order to gain optimal understanding on the various aspects that the organization takes into account in its operation. Some of the documents reviewed include the Company Law and the rules governing the operation of investment companies as stipulated by SAMA. Furthermore, the review also entailed evaluating the most effective investment strategies adopted by investment companies.

Another methodology that was incorporated during the internship program entails mentoring. As an intern, I worked closely with my supervisor and other departmental heads. This aspect played a fundamental role in receiving knowledge and skills on how to deal with various work-related issues.

Moreover, I observed as my co-workers undertook various tasks. For example, through observation, I gained knowledge on how to fill some investment forms and monitor real information on stock price movement through various mediums such as the television and computer networks. In addition, the internship program also took into account both on-the-job and off-the-job training. Off-the-job training entailed participating in training conferences outside the organization. Subsequently, I had an opportunity to gain knowledge on the prevailing industry dynamics.

Findings

A number of findings can be deduced from the internship program. First, a wide range of investment vehicles from different investment companies characterizes the investment market. This aspect provides investors with a wide choice of investment products that they can consider in their investment processes. Despite this aspect, the choice of investment portfolio amongst investors varies due to differences in the degree to which they are risk averse. Some investors are more risk averse than others.

Investment companies such as NCB Capital provide investors with expert advice on how to construct an optimal investment portfolio. Additionally, they also specialize in developing financial investment products such as bonds and mutual funds. However, their ability to provide customers with investment products that contribute to wealth maximization is subject to the extent to which they understand the prevailing market dynamics.

As an intern at NCB Capital, I established that the firm is focused at developing optimal financial products that enhance its clients’ ability to maximize their returns on investment. Furthermore, NCB Capital’s ability to provide customers with optimal investment services also emanates from its commitment to continuous and new product development. This goal has been achieved through adoption of effective competitive and marketing strategies. Subsequently, the firm has been in a position to penetrate the global financial instruments’ market.

Another major finding during the internship relates to the significance of understanding the prevailing market dynamics in organizational strategic management. Changes in the external environment have a remarkable impact on an organization’s performance. NCB Capital undertakes a continuous evaluation of the market trends in order to make an optimal investment decision. Additionally, I developed a greater understanding on the significance of adhering to the rules and regulations as outlined by various industry regulators such as the Capital Markets Authority and the Central Bank. Failure to adhere to the set rules and regulations may increase the cost of compliance in an organization. For example, the organization may be penalized heavily in addition to losing market reputation.

The program also led to the identification of the different financial products that investors can consider in developing their investment portfolio. For example, a study on the Saudi stock exchange market showed that the investment products are categorized in accordance with the sector such as the telecommunication, manufacturing, retail, petrochemical, insurance, and energy companies. Additionally, the internship led to an understanding on the various brokerage series offered by the local brokerage firms such as online trading, tele trading, VIP lounges, and personalized trading.

Limitations

In the course of executing the roles and responsibilities assigned, I was required to undertake extensive reading on diverse aspects associated with the organization’s operation. Despite gaining extensive knowledge on the organization’s operation, I was required to observe high ethical standards by keeping some of the company information confidential. Therefore, the extent to which I discussed the company’s confidential information was limited to the co-workers.

Evaluation of the internship experience

The internship program has played a fundamental role in improving my skills, knowledge, and competence on diverse issues by participating in the process of analyzing different projects. Moreover, I had an opportunity to observe how different workplace tasks are performed. Therefore, I envisioned myself working in such job positions and how I would deal with the issues faced. Participating in the program was a perfect opportunity to gain knowledge on the operation of various institutions charged with the responsibility of monitoring financial investment activities in Saudi Arabia. For example, I gained knowledge on the operations of the Saudi Arabian Monetary Agency.

Through the internship, I was in a position to appreciate the role of the SAMA in regulating money supply within the country through the issuance of coins and notes. Furthermore, the internship program led to a greater appreciation on the role of the Saudi Arabian Central Bank [SAMA] in fostering the country’s economic growth by facilitating investment activities both locally and internationally.

These skills were acquired by comparing SAMA’s operations and that of the US Federal Reserve System, which is its equivalent. Participating in the internship program provided me with a perfect opportunity to apply what I had learnt in classroom in the workplace environment. Thus, I was in a position to gain hands-on experience on the operations of regulatory authorities in the KSA such as the SAMA. The knowledge and skills gained will be critical in bridging the gap between the practical working environment and the classroom theories.

During the internship, I was positioned under the NCBC’s Relationship Manager, Ms. Sana, as my supervisor. However, I was required to maintain a good working relationship with other departmental heads such as the Treasury Division, Business Analyst, and the Wealth Manager. Thus, I was in a position to appreciate the importance of developing an effective internal organizational communication. The internal communication system has a significant influence on the extent to which the various departments maintain an effective working relationship. The reporting relationship provided me with an opportunity to interact with the various departmental heads. Consequently, I gained relevant skills and knowledge on the operation of investment companies.

Through the internship, I developed a great appreciation on the importance of developing adequate statistical skills in order to excel in analyzing the trend of investment markets. The internship provided me with an opportunity to gain experience on the application of various software such as Microsoft Excel in preparing clients’ reports and analyzing the trend market performance. For example, the internship provided me with an opportunity to apply various computations that were learnt in college such as the par value, maturity date, yield, and market price, which are some of the core features of a bond.

These skills will play a remarkable role in improving the effectiveness and efficiency with which I make decisions on the most effective securities to consider in the process of constructing an investment portfolio. During the internship, I was required to assist customers in understanding various issues associated with their investment portfolio by preparing unofficial report on their investment portfolio.

As an intern at NCB Capital, I was required to execute the various tasks and responsibilities assigned by the various departmental heads despite being under the direct supervision of the Relationship Manager, Ms. Sana. By working in the Treasury Division, I gained adequate skills and knowledge on the various investment products that investors can integrate in order to maximize their investment returns.

The program provided me with an opportunity to gain first-hand experience on the degree to which investors are risk averse in making their investment decisions. Knowledge on the degree of risk averse amongst investors in Saudi Arabia will play a remarkable role in improving the effectiveness with which I will provide consultancy services on how to minimize the risk associated with a particular investment portfolio. Through the internship, I developed a broader appreciation on how knowledge on investment can be implemented in order to reduce the risk of price movement. Thus, I will be in a position to integrate effective skills that will ensure adequate protection to the investors’ funds through price movements.

The modern investment environment has undergone remarkable evolution, as evidenced by the high rate new investment products are being developed in order to meet the prevailing market demands. Participating in the internship program was an effective source of knowledge on the various Discretionary Portfolio Management strategies that can be implemented in order to improve the effectiveness with which a particular investment fund achieves long-term growth. The strategies will enable investors to be effective in selecting the investment company from which to purchase their investment portfolio. This goal will be attained by gaining competence on how to select investment companies whose investment vehicles such as equities have a high probability of attaining high dividend payouts. Subsequently, I will be in a position to provide investors with the various strategies that they can integrate in constructing an optimal investment portfolio.

During the two months’ internship period, I had an opportunity to learn the various products and services that NCB Capital deals with in its operations. This aspect provided me with an opportunity to understand the difference between the various conventional and Islamic finance investment product. For example, I understood the difference between bonds and sukuk investment products. As a business and economics student, I had developed sufficient background information on the various types of investment vehicles such as bonds that individual and corporate investors can integrate in constructing effective long-term investment portfolios. However, through the internship program, I gained additional knowledge on the various elements that are taken into account in developing the bonds.

Challenging experiences encountered

Internship programs aim at equipping students with an opportunity to learn new issues. Thus, I was cognizant of the likelihood of experiencing different challenges. One of the challenges experienced during the course of the internship relates to difficulties in differentiating the various divisional heads such as the Business Analyst and the Relations Manager in the process of compiling the Credit Approval Memorandum [CAM].

In order to deal with this challenge, I conducted a comprehensive study on the organization’s structure in order to understand the roles of the various departmental heads. This aspect played a fundamental role in appreciating the prevailing reporting relationship. Moreover, I also recognized the importance of seeking assistance from my supervisor and co-workers by fostering a good working relationship, which led to the development of an effective feedback mechanism. Collaboration is a fundamental component in enhancing an organization’s operational efficiency. This assertion arises from the view that an organization can improve information sharing amongst the diverse internal stakeholders. Consequently, the likelihood of achieving synergy is improved considerably.

Some of the activities undertaken during the internship entail extensive reading of various documents. In some instances, I was required to read confidential information regarding the firm’s operations and strategic plans. Subsequently, maintaining a high level of confidentiality regarding the organization’s operation was a key requirement. Furthermore, I was required to undertake extensive reading on documents that contained information, which I found to be entirely new. In order to be effective in executing the duties assigned, I was required to pay intensive attention on the documents. Another major challenge encountered was differentiating the conditions for delivery on each expiry date for each structure of the three product structures learnt.

In a bid to be effective in implementing the duties and responsibilities assigned, I was required to develop a comprehensive understanding on the various DPM strategies that the organization has adopted. These strategies include basic investment strategy, investment strategy for growth and income, investment in mid-cap equity, and investment strategy in pure equity. However, understanding the four DPM strategies was challenging due to their complexity. Additionally, the strategies were new aspects with regard to investment. In a bid to deal with this challenge, I conducted a comprehensive literature review on the strategies in order to gain a bet understanding on their application in the real business environment.

Summary of findings and recommendations

This report illustrates that one can acquire numerous benefits through an internship program. The two-month internship program at NCB Capital has been very instructive. First, the program has provided me with an opportunity to enhance the theoretical knowledge gained in the classroom. For example, the workplace environment provided an opportunity to apply the skills and knowledge gained in the classroom.

Additionally, I have gained adequate skills that will be of great help in my personal and career development. The internship program has been a great source of information on the core aspects that employees should take into account in order to succeed in the workplace. For example, through the internship, I developed a greater appreciation on the importance of collaborating with co-workers in order to be effective in executing the tasks assigned. Additionally, the internship led to improved recognition on the importance of ensuring that an organization operates as a unit in order to achieve the desired synergy.

During the internship, I was assigned different tasks and responsibilities. Some of the responsibilities were new, which means that I had to undertake extensive reading in order to achieve the desired results. This aspect was a unique opportunity to develop my competence. Through such reading, I gained wide knowledge on various aspects associated with investment. For example, the readings equipped me with knowledge on observing different aspects that influence the quality of an investment portfolio. Subsequently, I will be in a position to provide expert advice on how to construct an investment portfolio that will enable clients maximize their wealth.

The decision to participate in the internship program will play a fundamental role in enhancing my competitiveness in the labor market. This assertion arises from the view that I gained additional skills that cannot be acquired in the classroom or mentorship from the various departmental heads that I met. The various departmental heads have developed sufficient experience over the years on the prevailing labor market trends. Therefore, the interaction was a source of expert advice on how to succeed in the contemporary work environment.

In addition to the above aspects, I appreciated the importance of being independent and ensuring that the tasks assigned are completed efficiently without being supervised. This aspect will be of remarkable assistance in my career progress considering the high rate at which organizational managers are anchoring the employees’ reward system on a comprehensive appraisal program.

Interning at NCB Capital was also fun as I had an opportunity to interact with various stakeholders in the financial services market by participating in conferences organized by NCB.

In summary, one can argue that the knowledge, skills, and competence gained through the internship programs play a fundamental role in improving a student’s competitiveness in the labor market. Therefore, there is a high probability of developing an effective and efficient labor force, hence improving an organization’s productivity. Therefore, internship programs can contribute towards improvement in a country’s economic performance through improved productivity of the labor force.

Therefore, it is imperative for the relevant stakeholders to improve the quality of their labor market through internship. The government and learning institutions can facilitate internship programs via different avenues. First, the government should ensure that learning institutions adopt effective programs that contribute towards bridging the gap between the skills learnt in classrooms and the labor market demands.

This goal can be attained by formulating a policy making it mandatory for organizations to provide students with an opportunity to participate in an internship program. The decision on whether the internship should be paid or unpaid should be left to the respective organizations. In order to motivate organizations to consider internships as a key component in their human resource management, it is imperative for governments to offer incentives such as tax credit to organizations that integrate such programs.

Conclusion

The above evaluation illustrates the prevailing differences between the school curriculum and the real work environment. Despite most governments formulating comprehensive syllabuses to be followed in institutions of higher learning, most of the skills acquired in the classrooms are not sufficient in dealing with workplace requirements. The workplace environment is characterized by numerous and complex tasks that employees are required to execute effectively. Subsequently, it is imperative for an organization to have the right quality of workforce in order to meet the demands of the various job descriptions. Subsequently, the organization’s ability to achieve long-term competitiveness with regard to human capital will be improved significantly.

This report identifies internship programs as a critical component in bridging the gap between the theories learnt at school and the real work environment. Internships enable students to identify the gaps in their practical skills. Participating in an internship program enhances the students’ employability and hence their success in the labor market. Subsequently, it is imperative for organizations and learning institutions to collaborate in assisting students to develop skills, knowledge, and competence that will increase the likelihood of succeeding in the competitive labor market. Through adequate collaboration, there is a high probability of institutions of higher learning improving the students’ skills, hence increasing their alignment with workplace demand.

References

Dirisu, Y., Iyiola, O., & Ibidunni, O. (2013). Product differentiation; a tool of competitive advantage and optimal organizational performance. European Scientific Journal, 9 (34), 258-282. Web.

Dustmann, C., & Uta, S. (2012). What makes firm-based vocational training schemes successful? The role of commitment. American Economic Journal of Applied Economics, 4(2), 36-61. Web.

Lerman, R. (2014). Expanding apprenticeship training in Canada; perspective from international experience. New York, NY: American University. Web.

Mohrenweiser, J., & Uschi, B. (2010). Apprenticeship training- what for? Investment in human capital or substitution of cheap labor. International Journal of Manpower, 31(5), 545-62. Web.

NCB Capital: NCB Capital office. (2014a). Web.

NCB Capital: NCB Capital UCITS funds platform. (2014b). Web.

Saks, A., & Haccoun, R. (2010). Managing performance through training and development. Toronto, Canada: Nelson Education. Web.

Appendices

Appendix 1; LOG BOOK #1

Appendix 2; LOG BOOK #2

Appendix 3; LOG BOOK #3

Appendix; LOG BOOK #4

Appendix 5; LOG BOOK #5

Appendix 6; LOG BOOK #6

Appendix 7; Progress Report

- College of Business

- Internship

- Progress Report -1-

- Student Name & ID:

- Supervisor’s Name:

- Internship Site: NCB

- Section 20

- July 6, 2014

- Progress Report

Introduction & Position Description

NCB (National Commercial Bank) is the first Saudi bank to be licensed in KSA, a real invention that was founded in 1953 by a royal decree, as a general partnership, for the integration of the largest currency houses in the Kingdom: Salehand Abdul Aziz Kaki, and the Salem Bin Mahfouz company. The two businesses merged to form the first Saudi bank legally registered. A few years after of its existence, specifically in 1979, NCB became the first Saudi bank issued mutual funds and have done a lot of innovations in real estate finance and auto finance. Since then, the National Commercial Bank have pioneered towards the development of many Shariah compliant financial services in all his dealings and services provided to more than 3.5 million customers.

NCB Capital newly created independent investment company of the National Commercial Bank, which takes pride in being the first company independent subsidiary of a Saudi bank, to be licensed by the Capital Market Authority to handle investment banking and asset management in the Kingdom to provide a broad spectrum of services and solutions and investment products. I was positioned at the Private Division (eastern province) under the supervision of Ms. Sana Al-Jabr (Relationship Manager), they basically provide investments designed according to the client’s request, as well as wealth management services to suit individual requirements; this includes both investment advice and brokerage services.

Responsibilities and Tasks Performed

Considering me being an intern at the first weeks, it was a tour between Treasury, RMs, Wealth managers and Business Analyst. My responsibility was doing what I have been asked for by all of them. However, I’m required to discuss and understand all the documents provided such as the CAM (Credit Approval Memorandum), Credit program, Rules for governing the opening of bank account and general operational guidelines in Saudi Arabia. In addition, I prepared unofficial reports that some clients asked the RM’s for to have a clear vision of their current accounts, mutual funds and stock portfolio under the provision of Ms. Sana, who is responsible for the weekly highlights (Sample product attached in the end).

Conclusion

Honestly, being here for almost a month taught me a lot of important things that will help me in the future regarding my career path, introduced me to the work environment, how they perform their jobs and what process do they follow. Adapting with such people is a great opportunity for me to take advantage of their experience and work on applying their advices. Although I might just work on few tasks, but it was new for me, I have studied many things and now it is the time to apply what I learned in real life.

Sample Product

Appendix 8; Progress Report

- College of Business

- Internship

- Progress Report -2-

- Student Name & ID:

- Supervisor’s Name:

- Internship Site: NCB

- Section 20

- July13, 2014

Introduction & Position Description

NCB (National Commercial Bank) is the first Saudi bank to be licensed in KSA, a real invention that was founded in 1953 by a royal decree, as a general partnership, for the integration of the largest currency houses in the Kingdom: Salehand Abdul Aziz Kaki, and the Salem Bin Mahfouz company. The two businesses merged to form the first Saudi bank legally registered. A few years after its existence, specifically in 1979, NCB became the first Saudi bank issued mutual funds and have done a lot of innovations in real estate finance and auto finance. Since then, the National Commercial Bank have pioneered towards the development of many Shariah compliant financial services in all his dealings and services provided to more than 3.5 million customers.

NCB Capital a newly created independent investment company of the National Commercial Bank, which take pride in being the first company independent subsidiary of a Saudi bank, to be licensed by the Capital Market Authority to handle investment banking and asset management in the Kingdom to provide a broad spectrum of services and solutions and investment products. I was positioned at the Private Division (eastern province) under the supervision of Ms. Sana Al-Jabr (Relationship Manager), they basically provide investments designed according to the client’s request, as well as wealth management services to suit individual requirements; this includes both investment advice and brokerage services. Trading equities, Private equities, foreign exchange, interest rates, Funds, Bonds…etc. are terms that are heard and used very often this week.

Responsibilities and Tasks Performed

Completing more than a month now as an intern at NCB has made me become much more familiar with the work types and the work process, where I received permission to have a look on different projects such as (GCC real estate fund, EastGate capital group, Imperial Project and Asia opportunity fund). However, my daily responsibilities as it is mentioned on the previous progress report still remains, and that is doing what I have been asked for, discussing and understanding all the documents provided. Attending all conference calls that I am allowed to attend and maintaining confidentiality is considered a responsibility.

During the conferences, one can hear everyone talk about the bank and all major information are being posed and discussed. In addition, I prepared schedules for a few clients, as an initiative to know to either renew or invest in other places if the product reaches maturity date. In a basic form, mainly my responsibility is to do what my supervisor commands. (Sample product attached in the end)

Conclusion

Briefly, those weeks got me deep into the work environment, the bank and how it operates, watching the Middle Office (RMs and Wealth managers) making the calls, exchanging rates, loaning, trading and confirming transactions gave me an overview of what NCB mainly does, and how clients requests are completed. Showing my willingness and getting engaged in the team and proactive in asking for more projects and responsibilities made me realize how the work in our department is processed and what each member does and is responsible for in the workplace.