Abstract

The report evaluates the National Express Company’s performance using various valuation metrics available for company evaluation. Additionally, it explores the risks faced by the company and the measures that the company has put in place to minimize the effects of these risks. This is done through an analysis of the company’s annual report and other information on the company available on its website. The report also briefly describes the company’s financial standing with regard to its financial documents. The annual reports about the company reveal that it is in a positive growth trend only slow down by the recent economic recession. It reveals strong pillars and strategies upon which the organization’s management is structured. In addition, the reports note that the company has adequately assessed its risk and taken appropriate measures to counter them where possible. However, its major risks are external and thus the company has adopted cost reduction measures while at the same time maintaining efficiency and value provision. In essence it focuses on customer value improvement and increment of shareholder value.

Company introduction

Founded in 1972, National Express Group plc is a United Kingdom based Transport Company listed in the London Stock Exchange and additionally a constituent of FTSE 250 Index (National express group, 5). With its head quarters in Birmingham, the company operates buses, coaches, rails and tram services within the United Kingdom, US, Canada, and Spain. Its brand us a product of bringing together of express bus and coach services by the National Bus Company (NBC). Often its formation has always been has been termed as a branding and management exercise rather than a complete overhaul. This is attributed to the fact that the individual companies retained operations of their respective services. Some of the company’s operations are summarized below;

Moving into privatization of airports, the company also purchased the East Midlands Airport, Bournemouth Airport among others which were later sold to Manchester Airports Group in a bid to concentrate purely on bus and rail operations. This was done at a cost of £241 million. Its operations in Australia however succumbed to financial collapse which led to it losing is rail franchise to the state government (National express group, 12).

The company has been subjected to several management takeovers since its inception the first being the management buy out in 1988 as a result of its privatization. Later in1991, a new group took over management following its deteriorating financial performance as from 1990 (National express group, 5). This paved way for its floating on the London Stock Exchange in 1992 accompanied by a remittance for acquisition of new passenger transport business. Additionally, in mid 2009, the company sold off its subsidiary travel London to Ned Railways for £32 million

Dividend valuation model

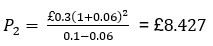

Noting that the company experienced a 6% growth within the year with a current dividend of £0.3 per share expected to grow at rate with a rate of return of 10% the calculation of the dividend will be as such (Pamela 48)

However when the dividend growth model is used the calculations take the form below:

Where

Hence

23.877

23.877 The calculations are based on the assumption that the dividends grow at constant rates throughout the value of shares of the stock represent the growing cash flow present value. The present value of the common stock thus represents current value of all the future dividends which as witnessed is unique as a result of the constantly growing dividends.

Net asset value

Based on the simple calculation model for net asset value it represents the different between the assets and the liabilities as indicated in the book.

Net asset value = Total assets – Total liabilities

Total asset value, 2009 is £2437.9m while total liabilities were £1595.6m.

Net asset value of the company = £2437.9m – £1595.6m = £842.3 million.

The company’s book valuation can thus be put at £842.3 million. However, it is important to note that this value is non representative of the complex business entities as it fails to take into account many aspects that contribute to the company’s status.

Shareholders value analysis

![]()

![]()

= £4.47m

Thus is indicative of the value that the company returns to its shareholders (Carol 12).

Free Cash Flow Models

As mentioned earlier the free cash flow is calculated as shown (Derrick 56).:

Operating income (EBIT) = Revenues – Cash Costs – Depreciation Expense

EBIAT = EBIT – Taxes, where taxes = (tax rate) (EBIT)

FCF = EBIAT + Depreciation Expense – CAPEX – Increase in NWC

For national express this translates to the following;

281.3 + 5.5 -32.3 – 74.3 – 8 – 48.8 – 0.5 +2.6 = 125.5

The diagram below undertakes a comparison of the free cash flow from the previous year as compared to the current year

Despite the economic crunch, it is evident that the company’s free cash flow increased by a considerable margin meaning that the company has much more money to spend in its operations. This increase is attributed to the discontinued operations which brought more income to the company despite lowering the company’s asset value.

Financial overview

The 2009 financial year saw the company make several milestones regardless of the various challenges and obstacles in its way. Most notable was its successful debt reduction by a significant £521.9 million to £657.9 million from the previous £1,179.8m (National express group, 38). However, despite having set a target of £100 the company surpassed it to attain an incremental cash generation of £200 million. Additionally, the company managed to cut its costs by £50 million per surpassing its target of £40 million (National express group, 43). The success was attributed to among others, the successful £375 million Rights Issue which ended in December 2009. Notable also is the successful implementation of debt reduction refinancing through the successful launch of an oversubscribed £350 million seven year Sterling bond beginning January 2010 (National express group, 47). It’s completed exist from the east coast franchise also elimination of a non-profitable franchise thus reducing unnecessary costs. Its success despite economic crunch may also be attributed to the strong growth in revenues shown by the UK Coach and the resilience of its company’s performance in Spain. The newly appointed Group CEO has been keen on a strategy that offers margin improvement, cash generation and selectively value adding growth trends.

Market

Recognizing that the key driving forces in transport business are the economic growth and employment, the decline in Spain and UK’s by 3.6% and 3.2% respectively led to a reduction in discretionary and business travel thus affecting the performance of the long distant operations including coach and rail. Additionally, given that employment determines the travelling trend in urban areas, the increased rate of unemployment in West Midlands negatively affected the UK bus services (National express group, 48).

In Spain, the sudden growth halt in GDP in 2008 with official unemployment rates shooting up by 20%, the impact was likely to be felt in terms of market. This is noting the fact that that the regional coach operations are primarily dependant on the migrant laborers who form the major passenger class. The urban operations however, remained protected given the existing concession agreements. Forecast by the company indicate that with economic recover well on course, passenger volumes for the coaches are expected in take an upward increase in 2010 (National express group, 49). This is taking note of the fact that in 2009 cost reduction played a major role that limited the recession’s impact on the company. Both in Spain and the UK, cost management is increasingly taking the forefront focus in a bid to counter the changing customer patterns. Spain for instance successfully reduced the operating distance by 5%.

Competitors

Competition for National Express Plc. is a reality. Among its areas of operation subject to competition include the intercity passenger Railroads, transport services, rail services, and commuter railroads. Though, there are a number of competitors to its operations, its major competitors include First Group Plc., GO-Ahead Group Plc. and Stage Coach Group Plc. First group claims increased stake in the London deregulated industry of bus and train services. It also operates the first capital connect the great Western as well as the Transpennine rail franchise across the UK. Its annual passenger carriage is approximated at 285 million. This claims a good stake within the market. Go-Ahead Group provides both bus and train services in the UK and ranks amongst the leading transport providers within the kingdom. Stage coach Group Plc. offers both bus transport and rail services in North America and the UK, pitting it against National Group Plc. in two major markets. 85% of its sales originate from the UK market.

Company’s future prospects

The future prospect of National Group Plc. is characterized with both positive events and negative events. Aimed at expanding its market grip the company has placed increased focus on acquisition that could see it explore newer markets. A key take over prospect is the looming acquisition of Deutsche Bahn with national express having already purchased 68,275 ordinary shares with an average price of 218.06p.

In another twist of events, the company is expected to exist its east coast rail operations with the Dft set to take over control. This is likely to pace way for a takeover by a competitor which could further threaten the company’s position. Among those expected to bid for this concession include its major competitors mentioned early and in addition Arriva and Virgin Trains are also expected to lay claims fro the railroad. In general, the company’s future operations are characterized with a number of take –over’s and acquisition as will be deemed appropriate at the given time. National Express currently faces an increased likelihood of going back to its initial operations which was limited to coach and bus services.

Risks and Uncertainties Faced By the Company and Its Management

External risks

The External risks faced by the company include the existing economic conditions, contractual risks, competition, cost of fuel, political and regulatory changes in the countries of operation.

Economic conditions

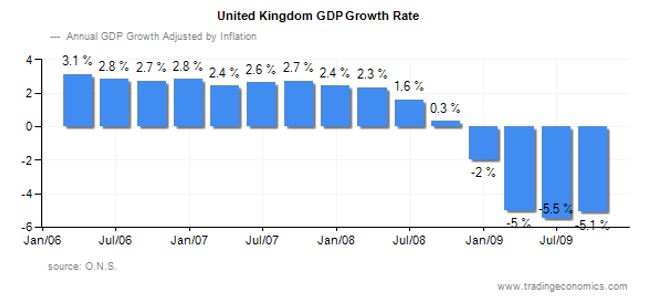

The company’s operations are adversely affected by the prevailing economic conditions at any given time. This was witnessed in the recent regional economic recession that saw its operations slow down leading to a decline in revenue growth for the company (National express group, 52). Dating back to 2006, the UK economy has been on constant positive growth. Similarly the company’s’ revenue has registered a marked growth alongside the economic growth. However, the economic recession resulted into a decline in GDP growth in the UK. This decline was likewise accompanied by a decline in revenue of the company. Though it may not be conclusively asserted that the economic growth is directly proportional to the company’s revenue growth, it is evident that there exits a correlation between the two. In its annual report, the company asserts that the performance of its operations in the UK bus, UK rail and Spain have been historically considered to have a correlation to the GDP and employment within its operational areas (National express group, 53).

Contractual Risks

The company having noted various business associated risks, secures most of its business through contract winning and acquiring of concessions for instance is the North American School Bus operations and other contracts in Spain and with the UK rail (National express group, 44). Notable though is the fact that contracts present an inherent risk with regard to contract bidding given that assumptions made in the bidding process might ultimately prove incorrect which could have adverse effects on the operational results of the group’s financial condition. The group aims at minimizing such risks by remodeling of their contracts to enhance risk sharing by the contract awarding bodies.

Competetition

Given its multinational operations, the group is exposed to competition pressures from other transportation means as well as other operators offering services similar to its own. For instance, while the company focuses purely on bus and coach services, its long distance operations are under constant competition with airline services. Competition is often associated with various pressures including pricing and service provisions which ultimately impact on the performance of the group financially (National express group, 53). The group has however undertaken a comprehensive management strategy for competition related risks. Such include a combination of improved service quality and fair pricing.

Fuel costs

The company’s operations are largely dependant on fuel. Fuel costs are thus of primary concern to the company especially considering the fluctuating prices globally. Fuel costs are in form of diesel for buses and coaches and gas oil and electricity for rail operations. Fuel costs pose a risk due to its volatility resulting from economic, politic and climatic conditions. Notable is the fact that fuel costs contribute to a significant percentage of the group’s costs and in some instances the costs cannot be passed to the consumers thus cutting down on the company’s profits (National express group, 53). To counter this, the company has put in place mechanisms including fuel swaps and entering into purchase contracts. The group has several fuel price swaps in place (National express group, 107).

Political and regulatory changes

The effect of various laws and jurisdictions cannot be ignored in analysis of the company’s risks and uncertainties. Such laws include jurisdictions which regulate its safety procedures, specifications of tools and equipment, contract agreements, employment relations, and environmental concerns among others. Most risk emerges from the costs associated with changes in political and regulatory bodies with regard to public transport businesses (National express group, 111). However, the company in an attempt to mitigate such risks maintains close contacts with the various stakeholders in a bid to ensure that they well understand the economic advantages gained from the business and the consequent repercussions should impracticable legislations be passed.

Internal risk

Unlike external risks, internal risks are more of the company’s own making and additionally, the company can take measures at ending the risk fact rather than simply adopting measures aimed at protecting itself from such. Internal risks include threat of legal actions, increment in net debts, threats posed by double running investments, insurance and related claims and other financial risks.

Threat of legal actions

The termination of DfT’s East Coast Franchise in late 2009 poses a legal challenge to the company. Should the actual outcome of the net asset settlement be less than anticipated by the company, it could have financial detriment to the company’s anticipated earnings and hence revenue growth (National express group, 108). In addition, the company is still held in negotiations with the East Coast Main Ltd. Regarding the aggregate valuation of different assets transferred. Such a negation could turn into a legal battle in case of negotiation failure. Such are the legal threats that the company may face with regard to its operations, and contractual agreements. The company just like in any other legally challenging scenarios seeks advice of legal professional to explore any possible financial obligations that may be owed to Dft with regard to the EAST Coast Franchise.

Increment in Net Debts and credit risks

In a 40% holding investment at the Inter-Capital Regional Rail Ltd contracted by the Eurostar to provide transport services due to end in December, 2010, concerns have been raised of a possible end of contract settlement. This problem mainly arising from contractual obligations may have the effect of increasing the groups owing amount coupled with an associated cash outflow. To avert this risk, the group has already obtained legal advice and is currently in negotiations with LCR (National express group, 23).

Threats Posed By Double Running Investments

The current heavy investment by the group in its Northern America business aimed at cost savings and improved service delivery has led to reduced profit margin in the North American outfit. Additionally, there exists a possibility of the investment not yielding the much desired cost cuts and improved profits. To minimize possibilities of failure, the company has in place an assurance plan that monitors the project to ensure it delivers its target (National express group, 112). Additionally, various revisions have been occasionally made to cater for any previous oversights.

Insurance and claims

Just like any other company, the group is vulnerable to successful claims of even a series of such which could easily eat deeply into its profit and operations in entirety hence increased cash outflow. To cushion itself against such claims, the company has in place a strong safety culture under a Board Safety and Environmental Committee. In cases where such claims occur, the company has in place a team of professionals handle the claims and look at possible avenues to minimize the group’s costs.

Financial risks

Maintaining various financial ratios in compliance with its banking obligations is essential for the company. Breach of such covenants would entitle the banks to exercise of certain rights which may include facility cancellation. Such could have material implications on the group’s ability to continue its operations. Various measures have been undertaken in the recent past aimed at improving the group’s financial performance. This includes issuance of bonds and rights. additionally, a robust control and cash monitoring process in addition to forecasting aimed at ensuring adequate facility and covenant adherence. For instance, the group’s liquidity ratio is maintained by the group’s treasury department which constantly engages in such and currency requirements forecast ((National express group, 2009, 103). In addition, during the financial year up to £361.0m of debt was repaid thanks to a successful rights issue. In management of capital risks, the groups is focused on adopting efficient financing structures that will allow it to use its balance sheet strength in achievement of its objectives without risking the shareholder’s value.

Foreign exchange also poses another financial risk to the company given its multinational outlook. Constant variations in currency values affect the company either negatively or positively. Negative effect have financial constraints to the company as such may lead to increased commodity prices. Such price related risks due to foreign exchange are countered by hedging aimed at provision of certainty and reducing yearly price fluctuations. This is achieved through fuel swap and pricing contracts.

Accounting Principles compliance

The financial statement, prepared in accordance with the International Accounting Standards (IAS) as adopted by The Institute of Chartered Accountants in England & Wales (ICAEW) as UK Accounting Standards, give a true and fair view of the state of affairs of the company and its subsidiaries and of the results of its operations and its cash flow and comply with the Companies Act, the Securities and Exchange Rules and other applicable laws and regulations.

The elements of financial statements have been measured on “Historical Cost” convention in a going concern concept and on accrual basis in accordance with generally accepted accounting principle (GAAP) and practice in UK in compliance with the Companies Act, the Securities and Exchange Rules, listing regulations of London Stock Exchange Ltd. (LSE) and International Accounting Standards (IAS) as adopted by The Institute of Chartered Accountants Institute of UK.

Specific accounting policies were selected and applied by the company’s management for significant transactions and events that have a material effect within the framework of BAS-1 ”Presentation of Financial Statements” in preparation and presentation financial statements. The previous years’ figures were presented according to the same accounting principles. Compared to the previous year, there were no significant changes in the accounting and valuation principles affecting the financial position and performance of the company. However, changes made to the presentation are explained in the note for each respective item. Accounting and valuation methods are disclosed for reasons of clarity. The company classified the expenses using the function of expenses method as per BAS-1.

Application of International Accounting Standards (BAS)

The following BASs are applicable for the financial statements for the year under review:

BAS – 1 Financial Statements Presentation

BAS – 2 Inventories

BAS – 7 Statements on Cash Flow

BAS – 8 Accounting Policies, Estimates and Errors Accounting Changes

BAS – 10 Post-Balance Sheet Date Events

BAS – 12 Income Taxes

BAS – 14 Segment Reporting

BAS – 16 Properties, Plant and Equipment

BAS – 17 Leases

BAS – 18 Revenue

BAS – 19 Benefits of Employees

BAS – 21 Foreign Exchange Rates Changes Effects

BAS – 23 Costs of Borrowing

BAS – 24 Disclosures of Related Parties

BAS – 26 Retirement Benefit Plans Accounting and Reporting

BAS – 27 Consolidated Financial Statements and Accounting for Investment in Subsidiary

BAS – 28 Accounting for Investment in Associates

BAS – 33 Earnings per Share

BAS – 37 Provisions, Contingent Liabilities and Contingent Assets

BAS – 38 Intangible Assets

In financial statement prepared by the National Express Plc., It is clearly rested that that the results released are in accordance with the standards set BY International Financial Reporting Standards (IFRS). Additionally, it is noted that all the company’s operations are in compliance with the IFRS and often there is no need for operational changes to ensure compliance. Generally it is stressed that the IFRS has limited effect on the firms operations given the high ethical standards observed by the company in its accounting policies and principles. In auditing the companies accounts a financial framework acknowledged by the existing legislations and standards for financial reporting adopted by EU are strictly observed. The release of the financial report is done in accordance with the Companies Act of 2006, the third chapter, part 16. Auditors have a two some responsibility which is to audit the financial statements produced by the group based on the relevant law applicable in addition to the International Standards of Auditing in a manner compliant to the regulations lad down by the Auditing Practices board standards of ethics for auditors ((National express group 34). In the spirit of maintaining high ethics in preparation of financial statements the following are observed. The report must be in compliance to the companies’ act of 2006 in addition to the IAS regulations.

References

Carol, Bridget. Implementing Shareholder Analysis, Journal of Financial Management, 2, 4 (2003):12

Derrick, H. Free Cash Flow Valuation, Financial Journal, 3, 14 (2001): 56

National express group. “Annual Review and summary financial statement 2009” 2009. Web.

Pamela, Doris. Dividend valuation models, New York: Lapser Publishers, 2008.