Definition of PPC

The act of manufacturing and producing more of something means less production and consumption of other items. The creation of everything needed (scarcity) is due to the insufficient resources, and the option taken has features of the optimal mix. An opportunity must be considered, and the decision made involves the sacrifice of the alternative. It gets assumed, in economics, that people will always choose the option that will yield them the greatest satisfaction or gain. The financial resources of an item, when measured using the alternative forgone (the sacrifice made), is called its opportunity cost. Graphs can be used to bring out the illustration of the cost, of using resources that are scarce (Dornbusch and Frankel 23).

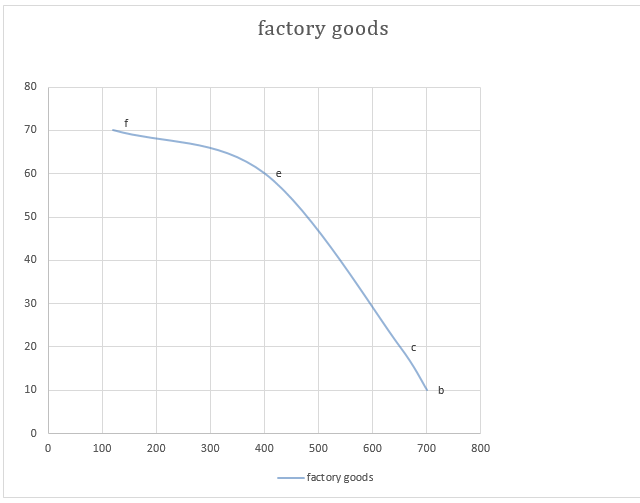

A curve that is used to describe the possibility of production is one that shows the prospect cost of making use of scarce resources for production instead of other goods or services. It shows all the combinations of two manufactured goods given the available resources. When plotted on a graph, the graphs are not the typical straight line but curves. It comes from an assumption that a firm’s resources cannot be correctly occupationally mobile.

The possibility of a nation’s production possibility curve was ever shifting inwards

A nation’s production possibility curve can turn inwards. A curve below the production possibility curve of an economy (assuming the curve was concave to the origin) shows underutilization of resources in the economy. The nation’s resources are not being properly used, or even use of outdated production techniques is being employed (Fare, Grosskopf and Lovell 67).

One factor is the increase in the taxes levied on the use of modernized production techniques and automated machinery. A significant rise in taxes collected on these would mean that firms in that economy would now consider using outdated and inefficient production techniques to avoid the taxes levied on the alternative. Use of these methods of production may lead to the firm not utilizing well, the resources they have or even misuse the same resources. Production would then be little, hence making the curve shift inwards.

Another factor may be inflation. In case of inflation that sees an increase in the cost of resources like raw materials and labor, a firm may be forced to acquire a lower quantity of raw materials (McConnell and Brue 45). It may lead to a lower production and hence the shift in the production possibilities inwards.

An economy attaining points outside the production possibilities curve

It is possible for an economy to reach points outside the production possibility curve. In this case, there is an ability increase for the economy to produce. It can happen when there are changes such as a rise in the labor force which would see an increase in production outputs. An upsurge in the stock of capital goods (factories, power stations, transport networks, and machinery) would also see an efficient utilization of inputs. It would also see an increase in technological knowledge which again leads to increased output through resourceful use of resources and reduced wastage.

Opportunity cost

The concave shape implies curving towards the origin. It stems from the assumption that the resources aren’t correctly occupationally mobile. Points outside the production possibilities curve (to the North East) are unattainable under the present technical know-how. Points inside it are inefficient because the resources do not attain full employment (“Introduction to Economics” par. 1). These resources do not get proper usage. The reasons for the underutilization include its obsoleteness in production methods being utilized (Rasmussen 40).

However, whenever the production is along the frontier, it means that the resources get used entirely. These points along the production possibility curve include B, C, and E. They represent the highest possible outputs of the two products. Output outside the production possibility curve becomes a possibility to produce with the increase in the country’s production ability (Rasmussen 34). It happens in case there are alterations like increases in the labor force, increases in the capital stock. Capital goods include factories, power stations, transport networks, and machinery. Additionally, the growth in the technical knowledge increases the outward shift of the production possibility curve.

For the economy to change from point b to c, this would mean that firm production would have an increased from 10 tons to 20 tons and factory goods production would be reduced by 50tons. Therefore, the opportunity cost of a rising goods production from 10 to 20 tons is 50 tons of factory goods. 50 tons of factory goods production would be given up to produce ten more tons of farm products. It is called the opportunity cost (the cost of an item measured in terms of alternative foregone).

Comparison of a movement from b to c

From the graph, movement from point b to c has a slight difference than the change from e to f. The opportunity cost of increasing farm goods (from 10 to 20 – b to c) is higher than the opportunity cost of growing agricultural products (from 60 to 70 – e to f). It gets achieved by applying the law of increasing opportunity cost. The law sanctions that as you increase the production of one product in a firm, the opportunity cost to produce the additional stock will also increase. The law of increasing opportunity cost is correct, and it shows us that resources are not all the same (Chodorow-Reich and Karabarbounis 10).

In our graph, the two commodities are factory products and farm goods. When the firm decides to increase goods production from 10 to 20, the first resources reallocated to producing the reliable goods are those that were not well suited to producing factory goods. The company takes the best resources suited for the production of healthy products (“Introduction to Economics” par. 1). Hence, the production of factory goods would be slightly affected and so as the opportunity cost incurred.

As the company continues to increase products, for example from 60 to 70, all the resources best suited for the manufacture of agricultural goods would have been reallocated to the firm goods production. But because more resources are needed to produce farm supplies, the company will start reallocating those resources that suit manufacturing of factory goods. Therefore, the factory production will go down more than it went when the company increased farm goods production from 10 to 20. The cost of making more agricultural products is at a loss of more factory goods than with the initial set of reallocated resources.

Works Cited

Chodorow-Reich, Gabriel, and Loukas Karabarbounis. The Cycle under Opportunity Cost of Employment, Cambridge: National Bureau of Economic Research, 2013. Print.

Dornbusch, Rudiger, and Jeffrey A Frankel. Macroeconomics and Protection, Hoboken: Samuel Irving Publishing, 2012. Print.

Fare, Rolf, Shawna Grosskopf, and Knox Lovell. Production Frontiers, Cambridge: Cambridge University Press, 2014. Print.

McConnell, Campbell, and Stanley Brue. Macroeconomics, Boston: McGraw-Hill and Irwin, 2011. Print.

Introduction to Economics 2015. Web.

Rasmussen, Svend. Production Economics, Berlin, Germany: Springer, 2011. Print.