The size of the U.S. gross domestic product in the third quarter of 2018 was approximately $18.7 trillion. The growth is smaller than it was in the second quarter, declining from 4.2% to 3.5%. However, both values are significantly higher than the average growth of the economy since the 2009 recession, which is described as subpar. Both 3.5% and 4.2% are considerable improvements over the 2% rate displayed on average.

The factors that helped increase the nation’s GDP are the increased spending by both the government and the population. Defense outlays grew at a 4.6% rate due to an agreement reached in February that enabled the allocation of approximately $300 billion above the limit set in a 2011 law. Furthermore, the unemployment rate fell to a considerably low value in September, increasing the average household income and enabling a higher flow of money via taxes and purchases. However, the sales performance of numerous firms has been weak, and they have been unable to meet revenue projections. Furthermore, stocks have been falling in the time shortly before the article’s publication, despite their earlier growth.

The government has been increasing its spending over the past year, which has assisted in expanding the nation’s GDP. This move contrasts earlier federal policy, which limited money use to cover the deficits caused by the economic crisis. The previous Democratic administration chose to concentrate its attention on eliminating the weaknesses in the budget over improving the nation’s overall GDP through spending money that the government did not possess. However, the deficits have mostly been addressed or eliminated, and congressional Republicans have been introducing and promoting policies that take a more active approach to the formation of the nation’s economy, which resulted in increased spending and the resulting GDP growth.

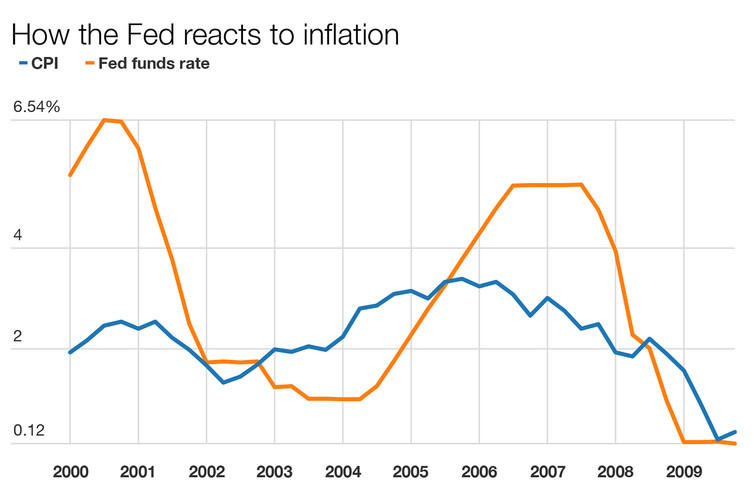

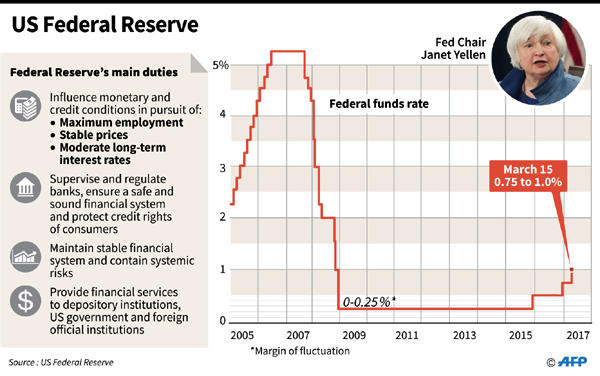

The Federal Reserve projects growth rates of 2.5% in 2019 and 2% in 2020, which is lower than the current growth figures. The prognosis is consistent with the opinions of numerous other analysts, who believe that the growth will slow in the future. The Fed is expected not to push its rates significantly higher due to the current inflation rate being lower than the Fund’s target 2%. The Fed changes its rates in direct proportion to the changes in inflation and economic growth. Therefore, this approach could help stocks and would mean that the economic growth and inflation rates should remain stable in the absence of other significant influences.

The stock market is called a wild card for the economy in the article. This notion is used because the market tends to reflect the state of the nation’s growth, but can undergo unexpected changes and significantly affect the state of the economy. For example, a high performance of stocks may encourage household owners to spend more than they would usually consider the optimal amount, which could have severe adverse consequences for the economy if the market starts declining. Similarly, a weak stock market leads people to spend less, adding to the stagnation of the situation. Furthermore, the stock market tends to be forward-looking due to the long-term nature of shares and bonds, and its state often predicts the economic situation in the near future.