Executive Summary

Scope, Aim, and Topic of the Report

This report examines the internationalization process in the context of marketing and successful entry using Porter’s Five Forces and the Uppsala model. Nestlé’s Indian operations in the processed food sector are examined. The aim is to assess the firm’s internationalization process in the Indian context. The topic is to evaluate Nestlé’s international expansion and marketing practices and strategies for India.

International Business Selection

The selected international business is Nestlé, a Swiss multinational corporation that markets diverse packaged food products, including pet care, coffee, and confectioneries, among others. It controls 45% global market share in instant coffee (Nestle 2018c). It has operations in over 189 countries (Nestle 2018c).

Data Collection Sources and Analytical Methods

The report utilizes secondary data drawn from 15 diverse and reliable sources. They include Statista, MarketLine, Euromonitor International, the Nestlé website, and OECD, among others. Two analytical methods are used in this report: Porter’s Five Forces and the Uppsala internationalization model. The two frameworks give insights into Nestlé’s internationalization process and the attractiveness of the Indian market.

Findings

The main findings include the Uppsala framework is relevant to Nestlé’s international expansion journey and the macro-environmental forces in India range from moderate to low. Its first international move was to the UK and Germany before expanding to the US and later Asia. The initial step of Nestlé’s internationalization is exporting its brands followed by joint ventures and the establishment of a local factory.

Recommendations

Based on the analysis of Nestlé’s internationalization process and macro-environment variables specific to India, three recommendations are made: the firm should use a multi-domestic strategy to increase its local responsiveness, invest in products targeting the majority youthful population and establish a strategic unit in India to develop products that appeal to local tastes and preferences.

International Business Project Report

Scope of the Report

Internationalization is a key feature of firms seeking competitive advantages at the international level. Phenomenal developments in communication and favorable cross-border trade relations have encouraged more companies to go global. The chosen strategy or issue that is the focus of this project report is international marketing, a key dimension of the internationalization process. It enables a firm to leverage its assets, managerial capacities, experience, and brands to offer unique value in each of its markets (Teece 2018). This report examines the internationalization process from the perspective of the coordination of marketing activities globally from the parent company and the establishment of production facilities to streamline regional supply chains.

The chosen industry that this report focuses on is processed food (fast-moving consumer goods). Players in this sector manufacture and sell food and beverages such as bottled water, infant formula, cereals, premium coffee, and sweetened drinks, among others (Takashima 2016). Firms operating in the food manufacturing industry often tap into existing relationships with their foreign suppliers and distributors to internationalize. The estimated combined shipment of food by these companies in 2014 was $6.05 trillion, a two-fold increase from the 2001 value (Takashima 2016). Thus, the industry has existed phenomenal growth in international activities over the past decade, making it an ideal case study for this report.

The selected company from which the data will be collected is Nestlé, a multinational firm that operates in the processed food industry. Henri Nestlè founded this multinational enterprise in 1867 in the Swiss city of Vevey to sell instant infant formulas (Nestlé 2018a). Later, the company expanded its product portfolio to include condensed milk (Milkmaid) and chocolate following its merger with Anglo-Swiss Milk Company (Nestlé 2018a). Currently, Nestlé’s primary activities entail drinks (premium coffees such as Nescafe and Milo), dairy products and ice creams, chocolate, sweets, pet care, and culinary preparations, among others (Nestlé 2017a). It also offers innovative beverage/food solutions through its Nestlé Professional service. Outside the food segment, Nestlé offers cosmetic products and pharmaceuticals.

Nestlé has a broad product portfolio and a strong global presence in its industry. The company sells over 10,000 brands in 189 countries worldwide (Varma & Ravi 2017). Further, it operates local production facilities and research stations in 80 nations (Varma & Ravi 2017). Its multinational strategy comprises cooperation between its different strategic business units (SBUs) drawn from six regions. These market zones include the European market, the Americas, Asia, Africa, Oceanica, and Middle East (Nestlé 2017a). Each SBU focuses on a particular product. The intended geography or region in which Nestlé’s international business activities will be explored is Asia, an emerging and strategic market for this company.

Specifically, the report will derive information from Nestlé’s Indian subsidiary. The firm’s revenue from its operations in India grew by over 9.2% in the 2012-2013 financial year, representing a 4.6% increase in profits over the same period (MarketLine 2015). Its earnings from other Asian countries have also been impressive, fuelling Nestlé’s investment in the region.

Aim of the Project Report

Nestlé’s history is characterized by intensive internationalization activities. This multinational corporation has pioneered multiple innovative products and solutions that have seen it gain wider customer acceptance. For example, Nestlé was the first company to come up with the Nespresso concept, a superior-quality portioned coffee developed for optimal convenience (Matzler, Bailom & Kohler 2013). The product revolutionized customer experience globally. This report aims to assess Nestlé’s international marketing activities related to its internationalization process in Asia (India).

Topic of the Report

Consistent with the above aim, the topic of this report is assessing Nestlé’s international marketing activities related to its internationalization process in Asia (India). Success in overseas markets is anchored on the expansion of strategic activities and tactics that a firm employs and the favourability of the external environmental forces. An international marketing strategy is required to achieve global competitiveness. In recent years, the international business sphere has seen a rapid increase in cross-border collaborations, including mergers and acquisitions, strategic partnerships, and joint ventures (Dutta, Malhotra & Zhu 2016). Marketing practices and sales are recognized as an indicator of the efficacy of cooperation.

Despite the inherent risks in any internationalization effort, firms continue to pursue cross-border collaboration as a means to gain greater competitiveness and market share. Global expansion and investment are core corporate-level strategies of Nestlé. The firm markets 10,000 brands in over 189 economies globally (Varma & Ravi 2017). Its strong presence in the global marketplace can be attributed to globalization. Intense competitive pressure and declining domestic demand force corporations to explore multiple channels and opportunities for international growth (Murmann, Ozdemir & Sardana 2015). Understanding Nestlé’s international marketing (entry) modes will help shed light on how managers can develop effective strategic alliances in a multinational context. Expansion strategies can be managerially challenging for companies initiating overseas operations. Unsuccessful internationalization efforts are attributed to failure to study market preferences, supply chain problems, and cultural differences, among others (Koksal 2014). Therefore, a case study of Nestlé’s marketing practices internationally (India) would inform market-entry decisions and upstream and downstream relationships to succeed in the international context.

International Business Selection

Nestlé is a transnational firm that produces and sells over 10,000 food products ranging from coffee, pet care, bottled water, infant formula, confectioneries, and portioned coffee (Varma & Ravi 2017). The company was established in 1866 as a producer of baby food (Varma & Ravi 2017). Its headquarters are in Switzerland. Nestlé’s international business portfolio encompasses diverse operations coordinated through its geographically distinct SBUs. It segments its market into six regions – the EU, Americas, Asia, Oceania, Africa, and the Middle East – each served by an SBU (Nestlé 2017a). A single administrative unit specializes in one product line and collaborates with Nestlé’s R&D department to develop innovative and customer-centered products. This company was selected for analysis because of its successful internationalization efforts that involve innovative products, strategic capabilities, and effective responses to external environmental forces. Therefore, the investigation will give insights into effective international entry and marketing practices for firms planning to go global.

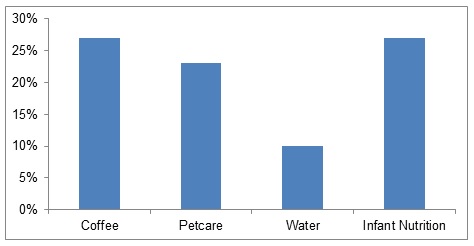

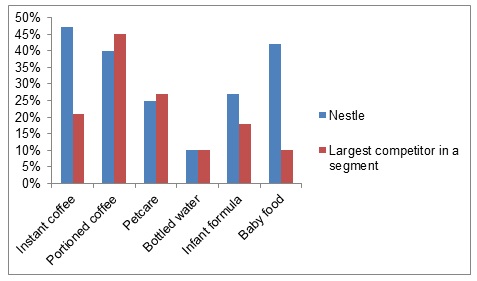

Nestlé’s market share and position among competitors in the processed food (fast-moving consumer goods) industry are illustrated in Graph 1 and Graph 2 below. From the graphs, Nestlé is a leading player in instant coffee, infant formula, and baby food. The company operates in 189 countries globally, 85 of them are hosts to its 413 factories (Nestle 2018c). A contracted version of Nestlé’s vision is “to bring consumers foods that are safe, of high quality and provide optimal nutrition to meet physiological needs” (Nestlé 2018c, para. 2). This message affirms its pledge to provide quality food products. The company’s mission is to “make better food so that people live a better life” (Nestlé 2018c, para. 1). Its primary objective is to provide tastier and healthier food options conveniently to customers. Nestlé is already a multinational company. The major modes of foreign market entry it has deployed include mergers (for example, it merged with the Anglo-Swiss Milk Company), strategic acquisitions (Mövenpick Ice Cream), and brand alliances (Polar Beverages, Inc. – a North American distributor) (Nestlé 2018a). Thus, the company utilizes multiple internationalization strategies to optimize the success of its international endeavors.

Data Collection Sources and Analytical Methods

Various internationalization models and entry modes exist in the international business sphere with variable levels of effectiveness. Firms employ multiple and diverse growth strategies to realize their global competitive goals (Azuayi 2016). This report investigates the pattern, type, and competitive gains that Nestlé obtains from its multinational operations in Asia (India). As such, it will involve an empirical analysis of reliable secondary data sources, including academic articles, organizational reports, official government documents, and market research publications, among others.

The Utilised Sources of Secondary Data and Their Justification

Table 1: Sources and their Justification. Source: Developed by the Author for this work.

The Employed Analytical Technique(s) and Its/Their Justification

This section of the report discusses the application of two analytical techniques to Nestlé’s international expansion based on secondary data. With internationalization accounting for 70.9% (Americas, Asia, Oceania, and Africa) of its global sales outside Europe, the firm has grown significantly in strategy and regional presence (Statista 2018c). Porter’s five forces and the Uppsala internationalization model (U-M) can help analyze the international growth strategies employed by Nestlé in the international markets, including Asia (India).

Michael Porter formulated Porter’s Five Forces model in the 1970s as a framework for determining the entity with power in a transaction (Dobbs 2014). It gives five macro-environmental forces responsible for a market’s competitiveness and threats to a firm’s profitability. Therefore, it follows an industrial economics view (Dobbs 2014). It provides a useful approach to examining the internal and external environment variables influencing a company’s strategic decisions (Hitt, Ireland & Hoskisson 2017). The assumption is that the organization of a market determines its appeal to investors and profitability. Its structure shapes the strategic behavior of firms (Hitt, Ireland & Hoskisson 2017). Therefore, organizational success is contingent upon the market system. According to Mighty (2017), the recognition of these forces can assist a firm to strengthen its competitive position and take advantage of opportunities in new economies, especially in the specialty coffee industry. However, these forces are not static; federal policies and macroeconomics are always changing.

The Uppsala model provides a framework for analyzing the internationalization behavior of firms (Kalinic, Sarasvathy & Forza 2014). It can be applied to a variety of organizational contexts. It was formulated in 1977 as a behavioral model that explains the international expansion of a firm (Kalinic, Sarasvathy & Forza 2014). It was later used to explain the gradual decision-making process that accompanies most foreign direct investments. Its development was grounded in empirical data that attributed the growth of a firm to the learning of the market.

According to Casillas and Moreno-Menendez (2014), internationalization is inextricably intertwined with knowledge acquisition. Thus, market experience informs the decision to start-up operations in new locations. The knowledge can be objective or experiential (Casillas & Moreno-Menendez 2014). The latter may not be shared between firms, as it is dependent on the specific organizational exposure to different market conditions. In contrast, objective knowledge can be transferred via different media (Casillas & Moreno-Menendez 2014). It cannot be replaced by experiential knowledge, which is theoretical. Objective knowledge centers on market opportunities that inform an organization’s activities (Vahlne & Johanson 2013). Nevertheless, both forms of skills are required for a successful internationalization process. Objective knowledge may entail data about a country’s customers, shared attributes, and growth strategies (Casillas & Moreno-Menendez 2014). In comparison, experiential knowledge focuses on specific customer attributes and those of competitors.

The Uppsala model stresses the significance of market-centered knowledge (Beugelsdijk & Mudambi 2013). It emphasizes the importance of experiential learning in identifying market opportunities and as an impetus for internationalization. To go global, a company learns by doing (Beugelsdijk & Mudambi 2013). The rationale for this stepwise growth process is that entrepreneurs lacking cross-border experience would often opt for incremental international expansion. For example, Nestlé began to sell its brands primarily in the Swiss market before moving to the UK and German, and later the US (Nestlé 2018b). Thus, the corporation learned by doing. Indirect entry modes such as franchising involve fewer risks and do not involve a prior exposure to the international market.

Another significant point about the Uppsala framework is commitment. It encompasses the tangible and intangible assets that a firm invests in an overseas market (Vahlne & Johanson 2013). The level of commitment is significant if more foreign direct investments are channeled to the host country. The internationalization process can be accelerated if the company already has resources in a market and adequate experiential knowledge (Casillas & Moreno-Menendez 2014; Holm, Johanson & Kao 2015). Additionally, if an organization has operated in a market similar to another, it can apply the same strategies in the second country. However, in this case, the resources may not be transferrable. Before an international expansion, a company must acquire adequate knowledge about the target market – rival firms, consumer preference, and buying power – as well as the management styles dominant in that culture (Hennart 2013). Hiring managers with international experience can help minimize risks and strengthen market commitment.

The Uppsala model holds that companies move from “low to high commitment entry modes” (Su 2013, p. 181). It involves a four-stage process known as the establishment chain. It encompasses reducing exports, using host-country representatives, opening a sales subsidiary, and foreign manufacturing (Popli & de Lemos 2018). By moving through these stages, a firm accumulates relevant knowledge that contributes to internationalization success. In the first two phases, the market experience is not necessary. After learning about a country, the firm proceeds to start operations first through a subsidiary before opening a production facility.

The justification for using Porter’s Five Forces lies in its strengths as an analytical tool. By employing this framework, firms can assess the attractiveness and profitability of a market (Kharub & Sharma 2017). Thus, the model allows organizations to develop a stronger strategic plan to enhance their competitiveness in the industry. It allows a strategist to assess the interactions between different forces shaping an industry’s attractiveness (Bhasin 2018). A further advantage of the model is that it enables the organization to concentrate on the macro-environment, as opposed to focusing on microeconomic factors (Mekic & Mekic 2014). Thus, applying this framework to Nestlé will help in evaluating the external environment variables that are significant to the corporation. It will highlight how this company has tackled these challenges to increase its global presence in the processed food industry.

On the other hand, the Uppsala model was selected for this analysis because it resonates with Nestlé’s internationalization journey. It has applied this framework to grow internationally and overcome the liability of foreignness (Yamin & Kurt 2018). Additionally, the model dwells on the development of business relationships in an international context. Therefore, it is relevant to Nestlé’s internationalization strategy, which involves joint ventures, mergers, and foreign operations (production facilities).

Findings

Results of the Analysis

The findings from Porter’s Five Forces applied to the Nestlé case with support from relevant secondary data are described below.

Threat of New Entrants

A key feature of the Indian processed food industry is limited product differentiation. It shows a significant fragmentation with specialist retailers dominating the sector (>90%) (Mintel Group Ltd 2017). However, a culture of consumerism is slowly setting in fuelled by the rising youthful population. Over 50% of the people are aged 25 and below and another 65% of them are below 35 years old (Statista 2018a; Statista 2018b). Therefore, changing consumption patterns mean that market entry is not difficult. Additionally, the processed food sector is growing, providing opportunities for new firms to enter the market. India requires that multi-brand providers invest a minimum of 51% foreign direct investment (FDI) in local manufacturing and logistics (MarketLine 2015; OECD 2017; UNCTAD 2015; World Bank Group 2018). Firms must establish domestic factories, which may discourage foreign investment. Overall, the threat of new entrants is moderate.

Bargaining Power of Suppliers

Packaged food retailers in India have formed partnerships with multiple suppliers, including international ones (MarketLine 2015). This strategy cushions them from the dangers of exclusive domestic sourcing or changes in prices of raw materials. Nestlé purchases raw materials – coffee, milk, and packaging material – in bulk from different sellers and has an effective inventory control mechanism (distribution centers and outlets) that optimize the production capacity of its nine factories in India (Sengupta 2017). In its home country, the firm spends approximately CHF 941 million on raw materials from Swiss suppliers (Statista 2018c). The fact that Nestlé is a big buyer makes it a good trading partner for suppliers and a dominant player in contract negotiations (MarketLine 2017). The firm also supports farmers in over 40 countries, including India, by providing appropriate training to promote quality and yields (Nestlé 2015). Due to the possibility of backward integration, supplier power is determined as relatively low in this market.

Bargaining Power of Buyers

The processed food industry is characterized by end consumers, which diminishes buyer power. A large number of consumers means that the loss of a single buyer may not have a significant impact on a firm’s earnings. However, the traditional food retail segment is popular with buyers. Overall, food bazaars and markets control 91% of the retail sales (MarketLine 2015). The emphasis on traditional shopping coupled with limited brand loyalty increases buyer power in this market. Major players, such as the Aditya Birla Group, compete with Nestlé on price and product differentiation (Euromonitor International 2018b). The switching costs for buyers are relatively low. Further, changing consumer tastes and preferences (youthful population) means that consumers can easily switch to products with a higher nutritional value and convenient packaging (Varma & Ravi 2017). Thus, from the analysis, buyer power is assessed as moderate.

Threat of Substitutes

The major alternative to processed food is restaurant service. Fast food outlets are increasing in popularity in India’s urban centers. Another threat comes from subsistence agriculture that is the mainstay of the rural populations (MarketLine 2015). However, most people view farming as complementary to food retailing. Further, the growth in consumerism and high population density means that subsistence agriculture is unsustainable (India Brand Equity Foundation [IBEF] 2015; Euromonitor International 2018a). Other substitutes for Nestlé’s packaged products (such as instant tea) include tea, soda, and water. The environmental and health consciousness of consumers and the lack of alternatives to processed dairy products and premium coffees imply that the threat of substitutes is weak.

Competitive Rivalry

The processed food industry is largely unorganized (IBEF 2015). As such, competitive rivalry is high due to a large number of small and large players in the market. Furthermore, several specialty players operate in this market. The switching costs are low for consumers as firms often engage in price wars (MarketLine 2015; Euromonitor International 2017). The competition also comes from international players, such as Tata Starbucks that operates in the Indian portioned coffee sector (Nestlé 2018a). Low product differentiation also increases the competitive pressure in this industry. However, brand loyalty to particular products and firms implies that competition is low in specific segments. For example, customers are loyal to Amul, a leading provider of butter (IBEF 2015). Thus, the overall level of competitive rivalry is assessed as moderate.

The Uppsala model is an internationalization by stage framework that can be used to explain the rise of multinational enterprises (MNEs). The UNCTAD (2015) report states that nine out of 20 economies attracting the largest foreign direct investment (FDI) are from the developing world. Their combined FDI inflow is estimated to be over $681 billion (UNCTAD 2015). The Uppsala model is based on the assumption that the drive to go global and tap into new opportunities comes after exhausting the domestic market. Nestlé’s global strategy is consistent with the four incremental stages of internationalization proposed in the Uppsala model. They include reduced exports, the use of host-country agents, establishing a sales subsidiary, and opening up a manufacturing facility (Oliveira, Figueira & Pinhanez 2017). Nestlé implemented a cautious approach to international market expansion.

The early milestones in Nestlé’s internationalization journey include the launch of the Farine Lactée product for the European market, opening up of factories in the US, UK, Spain, and Germany after the merger with the Anglo-Swiss company, and the establishment of warehousing facilities in Asia – Singapore, China and India (Nestlé 2017b; Euromonitor International 2016). However, Europe remained the major production location for the company. After World War I, Nestlé’s supply chain was affected. A scarcity of milk in Europe forced the firm to set up factories in the US to meet the demand (Nestlé 2018b). It would later merge with other firms to expand to Asia and open up 511 production facilities in 86 nations to increase their global presence. Thus, Nestlé followed an incremental internationalization approach that is consistent with the elements of the Uppsala model.

As a company goes through the four stages of this framework, its investment and market knowledge grow. The initial expansion depends on the geographical distance between the home and the host nation (Vahlne & Johanson 2013). Nestlé’s first international movement outside Switzerland was to Europe – Britain, Spain, and Germany (Nestlé 2018b). Therefore, ‘distance’ was a critical consideration in its initial overseas expansion decision. It impacts the information flows in the supply chain, learning of the macroeconomic variables of the host country, and cultural integration (Majocchi, Valle & D’Angelo 2015).

The Uppsala model centers on the gradual growth of a firm. In particular, the “acquisition, integration, and use of knowledge” related to overseas markets (Welch, Nummela & Liesch 2016, p. 788). The framework identifies two change elements critical to successful internationalization: resource commitment and market experience (Almodóvar & Rugman 2015). The fundamental premise is that having foreign operations results in knowledge about foreign markets. Thus, the lack of market experience is the leading impediment to successful internationalization efforts. On the other hand, the knowledge gained results in more commitment of resources to foreign markets.

The growth in market experience reduces risks and operational costs, which informs the decision to invest more in an economy (Sui & Baum 2014). The revised Uppsala model contains additional elements in addition to the two aspects mentioned above. It includes technological expertise and backward integration as critical factors in the internationalization paradigm (Sui & Baum 2014). It holds that rapid cross-border expansion to a host nation may limit the time required to gain market experience. Therefore, leveraging technical knowledge and supply chains can contribute to successful internationalization.

As stated above, Nestlé followed the Uppsala internationalization model to grow its global presence. The data from its historical analysis shows that the corporation was initially two distinct companies before merging in 1866 to form a single entity (Varma & Ravi 2017). Subsequently, the firm expanded its operations first to the UK then to Germany, and later to the US. Consistent with the Uppsala model, Nestlé, after gaining international market knowledge, began the exportation of its brands to the Australian market (Nestlé 2015). The Australian operations were later established in 1918 (Varma & Ravi 2017). About Asia, Nestlé first built warehousing facilities in Singapore, China, and India. The corporation would later open its production plants in Latin countries and Africa to take advantage of cheap labor (Varma & Ravi 2017). Further, in the mid-1990s, Nestlé expanded its operations by acquiring several global firms. Examples include Maggie and Crosse & Blackwell (Nestlé 2015). Towards the late 1990s, the firm built its Asian head offices in India and China to serve this region.

To extend its operations to healthcare, Nestlé formed a joint venture with pharmaceutical firms in the US and Europe (Varma & Ravi 2017). Consistent with the Uppsala model, the company begins with the exportation of its brands before establishing mergers with host-country companies. Later, Nestlé forms franchises and increases its foreign direct investments as it gains market experience. It expands geographically through a multi-domestic strategy that entails adapting products to local tastes and preferences based on the knowledge acquired.

Interpretation of the Findings

Through the above analysis, it can be established that Nestlé has employed the Uppsala model in its internationalization journey. The firm began its operations first in the Swiss market before expanding to host countries in the EU – UK, and Germany (Nestlé 2017b). Outside Europe, Nestlé’s initial market was the US. It would later expand to Asia through alliances with firms in India, China, and Singapore through its SBUs (Nestlé 2017b). Additionally, its internationalization process is consistent with the four stages of the Uppsala model. Nestlé’s entry into a country is characterized by exporting its brands, franchising, opening up subsidiaries, and establishing manufacturing plants.

From Porter’s Five Forces analysis, the threat of new entry, buyer power, and competitive rivalry in the Indian market are determined as moderate, whereas supplier power and the threat of substitutes are low. Thus, Nestlé should focus its internationalization efforts on marketing programs that target the youthful population. The approach will reduce supplier power and the threat of substitutes. In India, the trend in the food industry is characterized by changing consumer patterns – traditional food bazaars. The findings imply that the Uppsala model is relevant to firms pursuing incremental internationalization. Nestlé has leveraged its experience, innovative capacity, and brand image to expand to India and other Asian markets. Another implication of the findings is that firms should begin with less risky entry modes (export and franchising) before establishing foreign operations. In this way, they can increase their chances of success in their international endeavors.

Recommendations

Table 2: Recommendations. Source: Developed by the Author for this work.

Reference List

Almodóvar, P & Rugman, AM 2015, ‘Testing the revisited Uppsala model: does insidership improve international performance?’, International Marketing Review, vol. 32, no. 6, pp. 686-712.

Azuayi, R 2016, ‘Internationalization strategies for global companies: a case study of Arla Foods, Denmark’, Journal of Accounting and Marketing, vol. 5, pp. 191-103.

Beugelsdijk, S & Mudambi, R 2013, ‘MNEs as border-crossing muti-location enterprises: the role of discontinuities in geographic space’, Journal of International Business Studies, vol. 44, no. 5, pp. 413-426.

Bhasin, H 2018, Michael Porter’s five forces model for industry analysis, Web.

Casillas, JC & Moreno-Menendez, AM 2014, ‘Speed of the internationalization process: the role of diversity and depth in experiential learning’, Journal of International Business Studies, vol. 45, no. 1, pp. 85-101.

Dobbs, ME 2014,’Guidelines for applying Porter’s five forces framework: a set of industry analysis templates’, Competitiveness Review, vol. 24, no. 1, pp. 32-45.

Dutta, DK, Malhotra, S & Zhu, P 2016, ‘Internationalization process, impact of slack resources, and role of the CEO: the duality of structure and agency in evolution of cross-border acquisition decisions’, Journal of World Business, vol. 51, no. 2, pp. 212-225.

Elter, F, Gooderham, PN & Ulset, S 2014, ‘Functional-level transformation in multi-domestic MNCs: transforming local purchasing into globally integrated purchasing’, in T Pedersen, M Venzin, TM Devinney & L Tihanyi (eds), Orchestration of the global network organization (advances in international management, volume 27), Emerald Group Publishing Limited, Bingley, UK, pp. 99-120.

Euromonitor International 2016, Nestlé SA in packaged food: baby food and dairy, Web.

Euromonitor International 2017, Nestlé SA in hot drinks, Web.

Euromonitor International 2018a, India: country profile, Web.

Euromonitor International 2018b, Nestlé SA, Web.

Hennart, JF 2013, ‘The accidental internationalists: a theory of born globals’, International Entrepreneurship, vol. 38, no. 1, pp. 117-135.

Hitt, M, Ireland, RD & Hoskisson, RE 2017, Strategic management: concepts and cases: competitiveness and globalization, 12th edn, South–Western College Publishing, Cincinnati, OH.

Holm, D, Johanson, M & Kao, TP 2015, ‘From outsider to insider: opportunity development in foreign networks’, Journal of International Entrepreneurship, vol. 13, no. 3, pp. 337-359.

Kalinic, I, Sarasvathy, AD & Forza, C 2014, ‘Expect the unexpected: implications of effectual logic on the internationalization process’, International Business Review, vol. 23, no. 3, pp. 635-647.

Kharub, M & Sharma, R 2017, ‘Comparative analyses of competitive advantage using Porter diamond model (the case of MSMEs in Himachal Pradesh)’, Competitiveness Review, vol. 27, no. 2, pp. 132-160.

Koksal, MH 2014, ‘The differences between successful and unsuccessful new manufacturing products in international markets’, Asia Pacific Journal of Marketing and Logistics, vol. 26, no. 1, pp. 21-38.

Majocchi, A, Valle, LD & D’Angelo, A 2015, ‘Internationalisation, cultural distance and country characteristics: a Bayesian analysis of SMEs financial performance’, Journal of Business Economics and Management, vol. 16, no. 2, pp. 307-324.

MarketLine 2015, MarketLine industry profile: food retail in India, Web.

MarketLine 2017, Company profile: Nestlé India ltd, Web.

Matzler, K, Bailom, F & Kohler, T 2013, ‘Business model innovation: coffee triumphs for Nespresso’, Journal of Business Strategy, vol. 34, no. 2, pp. 30-37.

Mekic, E & Mekic, E 2014, ‘Supports and critiques on Porter’s competitive strategy and competitive advantage’, Conference: International Conference on Economic and Social Studies, Sarajevo, Bosnia, pp. 1-15.

Mighty, MA 2017, ‘We likkle, but we tallawah: maintaining competitive advantage in the crowded specialty coffee market’, Journal of International Food & Agribusiness Marketing, vol. 29, no. 1, pp. 70-91.

Mintel Group Ltd 2017, Global food & drink trends 2018, Web.

Murmann, J P, Ozdemir, SZ & Sardana, D 2015, ‘The role of home country demand in the internationalization of new ventures’, Research Policy, vol. 44, no. 6, pp. 1207-1225.

Nestle 2015, Improving supply chain resilience, Web.

Nestlé 2017a, Annual review 2016, Web.

Nestlé 2017b, Nestlé India limited: annual report 2017, Web.

Nestle 2018a, Annual review 2017, Web.

Nestlé 2018b, About us: history, Web.

Nestlé 2018c, Mission and vision, Web.

OECD 2017, OECD economic surveys: India, OECD Publishing, Paris, France.

Oliveira, R, Figueira, A & Pinhanez, M 2017, ‘Putting the Uppsala model against the wall: the challenges posed by the rise of EMNEs’, European Journal of Business and Social Sciences, vol. 6, no. 2, pp. 63-89.

Popli, M & de Lemos, FF 2018, ‘Reusing Uppsala lens in cross‐border M&As of emerging markets’, Strategic Change, vol. 27, no. 1, pp. 35-42.

Schneider, M 2017, Nestlé: strong foundation, clear path forward, bright future, Web.

Sengupta, A 2017, ‘Supply chain inventory control model for Nestle India Ltd’, International Journal of Scientific & Engineering Research, vol. 8, no. 8, pp. 523-526.

Statista 2018a, India: statistics & facts, Web.

Statista 2018b, Leading markets of Nestlé worldwide in 2017, based on sales (in billion CHF), Web.

Statista 2018c, Sales distribution share of Nestlé in Asia, Oceania and sub-Saharan Africa (AOA) from 2012 to 2017, by product categories, Web.

Su, N 2013, ‘Internationalization strategies of Chinese IT service suppliers’, MIS Quarterly, vol. 37, no.1, pp. 175-200.

Sui, S & Baum, M 2014, ‘Internationalization strategy, firm resources and the survival of SMEs in the export market’, Journal of International Business Studies, vol. 45, no. 7, pp. 821-841.

Takashima, T 2016, The manufacturing industry – direction and potential of its growth, Web.

Teece, DJ 2018, ‘Business models and dynamic capabilities’, Long Range Planning, vol. 51, no. 1, pp. 40-49.

UNCTAD 2015, World investment report 2015, United Nations, New York, NY.

Vahlne, J & Johanson, J 2013, ‘The Uppsala model on evolution of the multionational business enterprise – from internalization to coordination of networks’, Multinational Business Enterprise, vol. 30, no. 3, pp. 189-210.

Varma, GR & Ravi, J 2017, ‘Strategic analysis on FMCG goods: a case study on Nestle’, International Journal of Research in Management Studies, vol. 2, no. 4, pp. 11-22.

Welch, C, Nummela, N & Liesch, P 2016, ‘The internationalization process model revisited: an agenda for future research’, Management International Review, vol. 56, no. 6, pp. 783-801.

World Bank Group 2018, Country: India, Web.

Yamin, M & Kurt, Y 2018, ‘Revisiting the Uppsala internationalization model: social network theory and overcoming the liability of outsidership’, International Marketing Review, vol. 35, no. 1, pp. 2-17.