Executive Summary

The purpose of this report is to analyze the operation of a selected company in the international environment and this report will concentrate on the British Airways to identify important issues related to business strategy. However, this paper will focus on the international strategy of British Airways, forces behind this strategy, and the process of international business operations.

In addition, this report will address the specific challenges of BA in internationalization of the business especially focus on the challenges in the US market and provide the solution of the dilemmas to operate in this market. Finally, this report will concentrate on the external and internal environment of BA, influence of global financial crisis on the company, volatility of fuel price, and other possible challenges in the future.

Introduction

This report has organised on the British Airways Plc to identify its different strategic issues in the international environment and to make recommendation for its effectual operation. British Airways the pioneer of global airlines industry connecting 20 million passengers through London, the world’s largest premium travel market, has been passing throw a most hard time of the history.

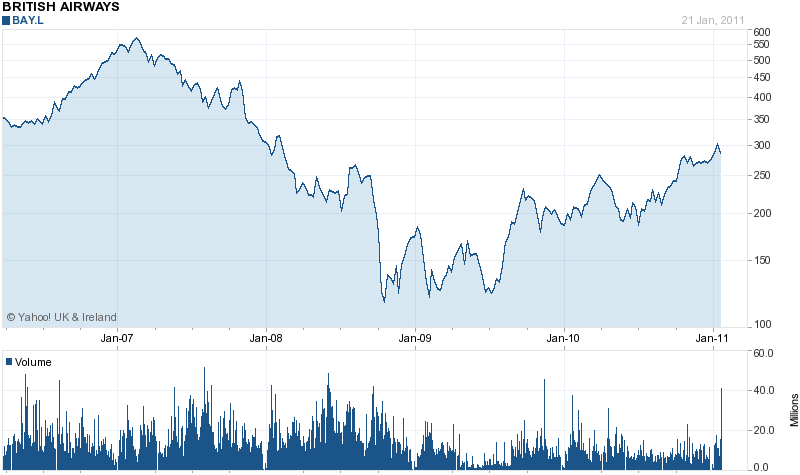

In 2008, tremendously raising of oil price and the shock of global credit crush has seriously injured the national flag carrier of Great Britain and still British Airways facing the recessionary impact and may continue up to 2013. The BA accounted its revenue of £7,994 million in the financial year 2009/10, which was £8,992 million 2008/09, at the same time, it identified £531 million losses before tax and operating losses of £231 million when as an FTSE 100 company it has been continuously loosing its share price in most of the trading hours (The Guardian, 2009).

International Strategy of British Airways

As the global financial crisis and recessionary economy has seriously influenced the growth of British Airways, it has strongly stood on its Global Premium Airline strategy to attain its objectives of industry leadership by cooperative strategy and cost reducing policy.

Following this global strategy BA has aimed to take the challenges of being official carrier of London Olympic 2012 and overcome the major shocks of financial downturn. The cooperative strategy has driven BA to work together with its competitors in the in the international operation while its cost driven strategy already contributed BA to drop £597 million fuel cost (British Airways, 2010).

British Airways (BA) addressed the British business community to collaborate with US business to triumph over the recessionary impact and announced a £15 million free travel packages for the business community aimed to economic improvement. Moreover, BA has determined another premium leisure strategy that driven BA to start on five new flights in 2010 routes to the Dominican Republic, Maldives, Las Vegas, and Caribbean region with almost forty percent increased capabilities both for passengers and cargo flights.

International cooperative strategy of BA inspired it to merger with Iberia, joint collaborated flight operation with American Airlines has facilitated British Airways to encounter with the flourishing mergers in the Airlines Industry that most of the competitors in the market already merged their major operations (BBC News, 2010).

The concurrent market trend of the airlines industry has driven its players to commence a large number of mergers and acquisitions all over the world. Thus, the mentioned collaborations of BA with Iberia and American Airlines are an appropriate initiative of BA to gain competitive advantage to open new routes in the international operation and to grow revenues.

Forces behind this Strategy

British Airways faced most terrific crisis among its sixty years history due to global financial crisis and recessionary economy that affected from the last financial year and for last eighteen months it has been striving to employ appropriate strategy to overcome situation.

In 2011 the company has accounted a drop of £531 million before tax, thus BA faced serious pressure to recover its significant growth of revenue. Very specifically the forces those influenced BA to take such strategies are as-

- Recover revenue growth,

- Sustaining as a profitable global premium airline,

- Raising finance debt recovery

- Fundamentally reduce cost drives

- Adjusting working practices

- Merger and collaboration in different route with the competitors

International business operations

BA has considered safety and security at the top precedence of its international business operation for which the company has engaged with an official safety management system with full compliance with the concerned regulations of the government and airlines industry.

BA operates a wide-ranging monitoring and controlling system to guarantee all security measures for both the international and domestic passengers by International Operational Safety Audit (IOSA), which IATA made compulsory from 2009 but BA is in practice from 2007. For international operation BA’s organization structure, supply chain, human resource, and marketing are as follows –

Organisation structure

BA has a strong organisational configuration to manage and control global responsibilities through its unitary board of directors consist of non-executive Chairman, Chief Executive, Chief Financial Officer, seven Non-executive Directors, and six executive directors.

For its international operation, BA has introduced performance management system arguing with targets, strengthening control, accountability, and transparency by providing apposite training.

Supply Chain

BA maintains a strong supply chain management with an expense of £5.2 billion per annum to procure goods and services from its tested suppliers where BA looks to the quality, cost, and resolute to establish trustworthy dealings with the supplying partners emphasising on its procurement process.

For instance, the supply of jet fuel at Heathrow is a crucial event due to the dispatch of bio-fuel and jet- fuel goes through the same pipeline while the contamination can carryout any major damage, but partnering with Solena, BA has mitigated such risk up to 2014.

Human Resource

In 2010, BA reported that it human resource consists of 34,911 UK local staffing while the numbers of overseas employees are 4,990. The board of directors of BA point out the necessity of recruiting its human resources in the required fields to meet the organisational strategic objectives by reviewing management performance complying with the values and standards to bring highest outcomes.

The company has already integrated IT facilities to receive online application and selection process for its HR for international and domestic recruitments.

Marketing

The Director of Sales and Marketing of BA is responsible for international marketing in the UK and overseas, among the three hundreds of destiny globally BA maintain its own office in major cities and conduct marketing campaign from its headquarter. Rest of the marketing campaign leads by the partnering organisations guided from headquarters.

The company has huge investment for e-commerce facilitated online marketing, booking, and sales. For the new ventures like Iberia and American Airlines, BA has adopted the responsibility on the partnering organisation. Moreover, BA conducts regular customers’ survey as an independent market research imitative among the passenger in the flight that contributes the company to engage new marketing strategies.

Porter’s Diamond Theory Analysis for British Airways

Since beginning of global economic downturn, British Airways has suffered from severe financial crisis. In order to rescue from this difficulty, British Airways has recently designed several international business strategies to recovering within 2012.

In the light of Porter’s Diamond theory, following are the major international strategic tools of British Airways. However, the figure no two demonstrates Porter’s Diamond theory for the firm and figure no three illustrates the international business strategies of British Airways –

Competitive Status: Excellence through continuous improvement is the motto of delivering superior competitive status and in this way; the firm’s strategy is to lead the London airways industry and to expand the business in global route.

Consumer’s Demand: think into the way of consumer’s demand is another chief strategic approach that attributed through i) craft successes, ii) be committed, iii) simple but modern, iv) make proper solution and v) try to be an icon though exclusive communication support.

Affiliated Trading Partners: superior interconnection between both airline and non-airline sources is a strategy to focus on flawless communication service to satisfy their valued consumers. Regarding this view, British Airways has already attached with more than 500 diverse businesses and hence competent to delivering required supplier status.

Principal Factors to Succeed: build efficient human resources through adequate training program along with satisfactory financial reserve are two principal factors accomplishing vision 2012 as well as lead to the global airways market successfully.

SWOT analysis of British Airways

Strengths

- British Airways has a strapping public image for its strong brand image; the company’s reputation and the brand royalty finally contribute its future revenue & profitability.

- In 1990s, British Airways gained number one position in consideration of its income statement while the motto of BA aimed to be the World’s Favourite Airline,

- British Airways always provides most recent information of their company, available routes and other flight related issues in their websites for the convenience of the customer with strong IT backbone,

- British Airways has enhanced programme to attract new customer with high quality customer service,

- It is capable to effort high fuel costs and avoid low quality fuel for environmental safety,

- It has developed euro exchange rate and it helps to enhance service in EU region.

- BA emphasis on suitable strategy innovation and implementation,

- The economy of scale of BA and its learning and experience curve has in more advantages situation than its competitors,

Weaknesses

- In context of the economic downturn of 2008, British Airways is pays high salary to their executives,

- The competitors for example Ryanair, Easy Jet, Emirates, made satisfactory profit under the global financial crisis while BA lost its profitability ratio

Opportunities

- Recent decrease in fuel price will increase profitability of BA

- In order to increase its promotion, BA has provision of free travel, free redemption services including its flights for regular travellers.

- EU single market strategies have facilitated to the European Economic Area (EEA) comprising the EU as a result BA is enjoying free market for internal flights,

- Luxury flights, skilled cabin crew their efficient management, trained and motivated employees provide quick customer service with high satisfaction.

- The Corporate Responsibility Board of BA has fixed to develop the employee relationship and they always follow these rules,

- BA’s involvement with Heathrow Terminal 5 will help to expand its business by creating new routes as it has high level of cost efficiencies for further expansion to take any new challenge.

Threats

- In 2009, due to global financial crisis, the Airlines industry shares fall in most of the Europe stocks markets

- Tourism sector has seriously affected because of recessionary economy and financial down turns and generated some uncertainty future expenditure of the British Airways and may adversely effect on further growth,

- Threats of increasing intensity of competition among industry, rivals-may squeeze profit margins due to their low cost fuel consumption

- New industry may become threats for British Airways, besides existing competitors.

Major Challenges and Risks

Global Financial Crisis: According to the annual report of British Airways 2010, the airline industry is facing several influential challenges in international market such as global financial crisis, structural and cyclical change, banking crisis and high oil prices. The International Air Transport Association (IATA) reported that the actual net loss of entire industry was more than $85.0 billion in 2009 though the estimated loss amount was approximately $9.40 billion.

On the other hand, net revenue of this company has fallen 11% from the previous year. However, Mintel (2009) stated that BA had tried to control the operating expenses from £725.0m to £580.0m in 2009, and the company has cut 3,700 jobs in fiscal year 2010 while it was cut 2500 jobs in the fiscal year 2000 as part of its recovery programme from global economic downturn.

However, the following figure shows the recessionary impact of global financial crisis on total revenue of the company –

Fuel price: Volatility of fuel price is the on going problem for the company as it influences to increase the operating costs and decreasing the profits as well; for instance, the oil price was US$135 a barrel in 2008, which was the main reason of decline revenues (Scribd, 2009).

However, BA eager to reduce the fuel costs because the main reasons of the success of competitors are using low cost fuel with maintaining time frame, providing high quality inters of customer services, and neglecting serious environmental problem in case of the operation in international routes.

The data of annual report 2010 of BA shows that fuel bill of BA successfully fell by almost £597 million, which helps the company to reduce operating costs but its operating loss was greater than previous years.

The management of BA argued that this company always concern about environmental pollution especially CO2 emissions, so it will not use low cost fuel in order to overcome this condition but it will contract with few companies to produce 10% fuel from waste materials by 2014.

At the same time, Wynn (2010) stated that this company has signed an agreement with two companies in order to purchase sustainable jet fuel (would be produced from waste) to compete with low cost airways and restrain future challenges.

However, Wynn (2010) further addressed that this plant will help to decrease fuel costs as this project will produce above 16.0 million gallons green jet fuel by processing and converting 500,000.0 tones of waste and British Airways would like to get at least 10% of all its jet fuel from this segment by 2050. However, the following figure demonstrates the fuel costs of this company for last five years –

Terrorism: Because of the tension of terrorist attack, most of the companies of this industry was not interested to expand business in new route after 9/11 situation, which is another hindrance to the BA in internationalization or to expand operation in new route where the political environment is not suitable for the company.

However, the annual report 2010 published that policy makers of most of the countries have introduced various security measures to contest the hazard of terrorism and control illegal immigration but repeated changes of rules and regulation to protect terrorism activities is another area of expenses though it is important to diminish the external and internal risks regarding security issues.

Future Risks and Challenges for British Airways

However, BA also addresses few other challenges and takes necessary steps in order to mitigate such risks, for example –

- Failure of IT system: Critical failure of IT system may cause severe problem for the operation of BA as this company has to depend on It for business process though BA has already taken measures to reduce such risks like BA ensures System controls, and disaster recovery arrangements;

- Swine flu: British Airways experienced financial crisis in 2009 and this situation was prolonged because of a number of external factors, for instance, swine flu virus. BBC News (2009) reported that shares in BA fell about 7.70% as a consequence of this virus;

- Adverse Weather: At the same time, adverse weather condition like snow, fog or volcanic ash may cause of the huge loss.

- Competition: According to the annual report 2010, BA has both direct and indirect competitors in most of the segments of the global market.

However, low cost Airlines such as Ryanair or EasyJet have comparatively lower cost structures; so, these companies are the key national players in the aviation industry though all the major international airways are also the competitor of BA. However, BA has tried to reduce operating costs to face the challenge of competitors and it successfully reduce its operating costs in most of the segments, which has shown below –

Recommendation

Since airlines industry is too competitive, BA should focus on its fundamental service delivery to restore its competitive advantage. British Airways should develop customer care service in terms of better punctuality, less lost bags and smaller amount cancellations rate because Ryanair is the number one customer service provider while BA holds fourth position.

In addition, BA should restructure its pricing strategy considering economic condition of target customers, oil price, and competitors’ business position. However, Mintel (2009) pointed out that BA lost 14.9% of premium traffic in 2009; so, it should change its existing strategy to minimise business risks. BA should conduct marketing campaign to aware people that low cost fuel increase CO2 emissions. Moreover, BA should survey the market to assess business risks, customers’ preference, and so on.

It should lessen operating costs in order to minimize the adverse effect of global economic downturn. Recently, BA has included a scientific calculator to demonstrate that the price of its service also competitive comparing other low cost airways like Ryanair or EasyJet. It should recruit more employees from the overseas market in order to reduce costs to compete with other companies. However, BA should make the journey safe and comfortable to the customer. It should require additional investment for technological developments, promotional activities and market research.

Conclusion

British Airways has experienced more than £531.0 million loss before tax and profits down £1.0 billion due to the worst recession for 60 years. BA has already taken few initiatives in order to recover from the recessionary impact and carry on the operation in international market as a market leader.

However, BA operates in an environment where many competitors in the market offering lower price than this company’s price, so, BA and Iberia have signed an agreement to merge and build one of the largest groups of the world. On the other hand, it has followed cost effective strategies, co-operative strategies and simulation of strategy, and managed £3.7 billion pension deficit to sustain in such competitive market.

Reference List

BBC News. (2009) Swine Flu Fears Hit Travel Shares. Web.

BBC News (2010) British Airways and Iberia sign merger agreement. Web.

British Airways (2010) Annual Report and Accounts 2008/09. Web.

British Airways (2010) Principal risks and uncertainties. Web.

Márkus, G. (2010) Measuring Company level competitiveness in Porter’s Diamond model framework. Web.

Mintel (2009) Short-haul Airlines – UK – July 2009: Companies and Products. Web.

Mintel (2009) Short-haul Airlines – UK – July 2009: Market in Brief. Web.

Scribd (2009) British Airways Strategic Plan. Web.

The Guardian (2009) British Airways climbs as FTSE ends the week on a high note. The Guardian News and Media Limited. Web.

Wynn, G. (2010) British Airways to buy jet fuel from city waste. Web.

Yahoo Finance (2011) Basic Chart for British Airways (LSE). Web.