Options trading benefits companies since it allows them to increase income. Many traders prefer stock options to other forms of trading due to assured profits among other advantages. The options contracts allow investors to profit when the underlying stock rises. Meanwhile, corporations utilize stock options to hedge risk exposure and compensate their employees. Investors analyze a company’s stock options to speculate on stock prices, elevating a possible risk. Netflix Inc. is an American production and streaming company that utilizes stock options to manage and run its business activities. The options contract is beneficial to Netflix Inc. because it helps in generating extra income and motivates its employees.

Technological advances in the entertainment industry present myriad opportunities to investors. Netflix Inc. is one of the leading global entertainment companies with profitable securities that attract many investors (Maksyshko & Vasylieva, 2021). The company offers a wide variety of award-winning shows, movies, animations, and documentaries, among others. The firm attracts clients from various parts of the world. The rapid technological developments have caused the company to adopt strategies that maximize its consumer base. Consequently, product developers among other employees play a significant role in making sure that Netflix Inc. remains profitable. Therefore, Netflix Inc. has adopted the options contract in the stock market for its sustainability.

Netflix Inc. uses the options contract to achieve various business objectives. In 2020, the company adopted a stock options plan that was a successor to the 2011 plan (Netflix Investors, 2021). The 2020 plan was approved by the Board of Directors to serve various purposes which are in line with the company’s strategies. First, the stock options provide incentives to employees who wish to invest in the company. The incentives help in empowering and motivating the employees since they can see the value of their work at Netflix. The employees are actively involved in the company’s internal activities. Second, the stock options allow the company to increase its income. The increased profitability is significant for the company’s expansion and improvement of its products’ quality (Tambingon et al., 2019). Finally, Netflix Inc. uses the options contract to hedge risk exposure to its specific securities. Options contact is, therefore, beneficial to Netflix Inc., its employees, and its shareholders.

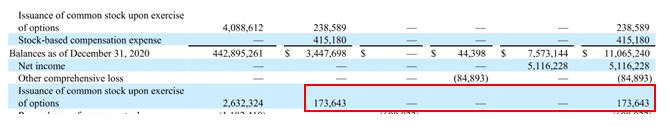

The stock options value is dynamic, and changes based on Netflix Inc.’s fair market value of the common stock. According to the financial statement for the year 2021, the stock options amount was $173,643,000 on 31st December (Figure 1). The amount had dropped from $238,859,000 in 2020 (Figure 1). The company’s stock options amount is unstable and exhibits non-uniform growth between the years 2018, 2019, 2020, and 2021.

The availability of stock options for employee incentives presents an investment opportunity for me upon retirement. After receiving my pension in form of stock from Netflix Inc., I would sell the stocks awarded and purchase the less risky put options. Unlike put options, call options quickly gain value but are unsustainable in case the stock prices decline. Meanwhile, the put options will cater to my long-term investment needs without any risk of declined share value. Given the rapid technological developments and improvements in the entertainment industry, Netflix Inc.’s shares’ value is likely to remain stable. Therefore, as a retiree from Netflix Inc. I would continue to enjoy financial benefits from the invested call options.

References

Maksyshko, N., & Vasylieva, O. (2021). Comparative analysis of the stock quotes dynamics for IT-sector and the entertainment industry companies based on the characteristics of memory depth. SHS Web of Conferences, 107, pp. 01003. Web.

Netflix Investors. (2021). Form 10-K. Web.

Netflix. (2021). Netflix – financials – annual reports & proxies. Web.

Tambingon, D. A., Titaley, J., & Manurung, T. (2019). Black-Scholes model in determining European option prices on Netflix Inc.D’Cartesian, 8(2), pp. 80. Web.