Introduction

Over the past many years, the photography industry has experienced tremendous revolutions that have been brought as a consequence of the changing trends in technology as a result of changing tastes and preferences by customers. This has seen many companies compete to outdo each other in terms of complexity in technology leading to the introduction of the digital cameras (Amazon, 2012).

Current Market Situation

Currently, the company has a chain of products that range from digital/film cameras lenses such as ophthalmic lenses, binoculars, telescopes, laser rangefinders, IC/LCD steppers and scanners, optical materials and equipment and surveying instruments. Some of the rival companies in the film and photography market include Pentax, Panasonic Lumix, Olympus, Sony, and Canon. Out of this, Sony is the biggest competitor with their Sony Alpha DSLR-A900 camera. However, the Nikon D800E Digital SLR Camera remains to be the best (Amazon, 2012). This kind of innovation has seen many companies compete to outdo each other in terms of complexity in technology leading to the introduction of the digital cameras.

Market Description

Description of Market Segments

According to Kotler and Armstrong (2012), a market is made up of all people or organization and they all demand for a certain product depending on the individual’s tastes and preferences. This also depends on the customer’s ability to purchase them. Market segmentation or fragmentation is a course of action where a given market is divided into unique clusters or firms that have reasonably comparable demands (Kotler & Armstrong, 2012). The chart below is a geographical segmentation of the market:

Nikon currently has its headquarters in the Europe, Asia, the United States America, Oceania, Middle East, and Africa. Out of this wide coverage, Asia and Europe markets have the highest consumers of our products with Africa being the least consumer.

As demonstrated above, out of 90% of the total demand for Nikon products, men between the ages of 12 and 30 years of age formed the highest percentage of consumers. This is attributed to the type of lifestyle that people of this age group live.

Current Marketing Targeting Strategy

Nikon has employed a concentrated/ niche’ marketing strategy that focuses on a particular group of interest and in this case, the primary target is the youths between 12 and 30 years.

Value Proposition

Some of the ways through which Nikon aims at increasing the net present value of the expected revenues of each customer also known as customer lifetime include establishing good relationships, increasing the coverage of after-sales services, establishing a channel for collecting feedback and addressing customer issues promptly (Phau & Poon, 2000).

Factors Influencing Consumer Behavior

The center of marketing is the satisfaction of consumer needs. Nikon has put into consideration the three related aspects of consumer behavior analysis that include “motivations of the customer, consumer typologies and the consumer purchasing process” (Kotler & Armstrong, 2012, p. 190).

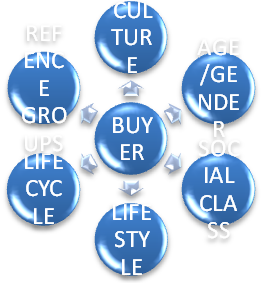

As shown in figure 3, the six key factors that influence consumers’ purchasing behavior are culture, age, gender, lifestyle, lifecycle, reference groups, and social class. However, age, gender, lifestyle, and reference groups are seen as the major determinants of consumer behavior.

Buyer decision process

Buyers between the ages of 20 and 30 years tend to have a variety-seeking buying behavior. When it comes to Nikon Coolpix P7100, variety cannot be overemphasized. The camera comes with features such as AE lock in movie mode, new front control dial and many more (Nikon, 2012).

Product Review

Levels of Product/Service

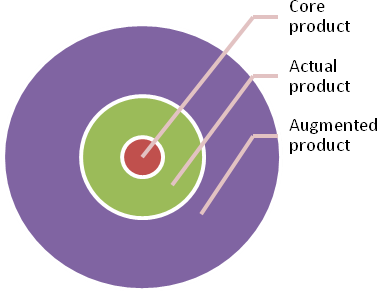

As a core product, the feature that comes along with Nikon products is core benefit or service. As an actual product, the company offers good quality products that are stylish and come with attractive packaging. The company also offers after-sales services that include installation of equipment, delivery, credit facility and warranty on all its products. All these services are disbursed at the regional levels to ensure that customer needs are addressed.

Type of Product and Service

Nikon products are tailored to meet the expectations of both the amateur and specialist photographers. For example, the Nikon D800E Digital SLR Camera combines both the latest trends as far as technology is concerned with ease of use and it produces the most incredible digital images. It comes with a 37-megapixel camera with an optical low pass filter also known as OLPF which facilitates the sharpest images, therefore, a good option for both specialized and inexperienced photographers. It also has the best night mode vision lenses that ensure all pictures taken at night especially in the nightclubs have the best quality (Amazon, 2012).

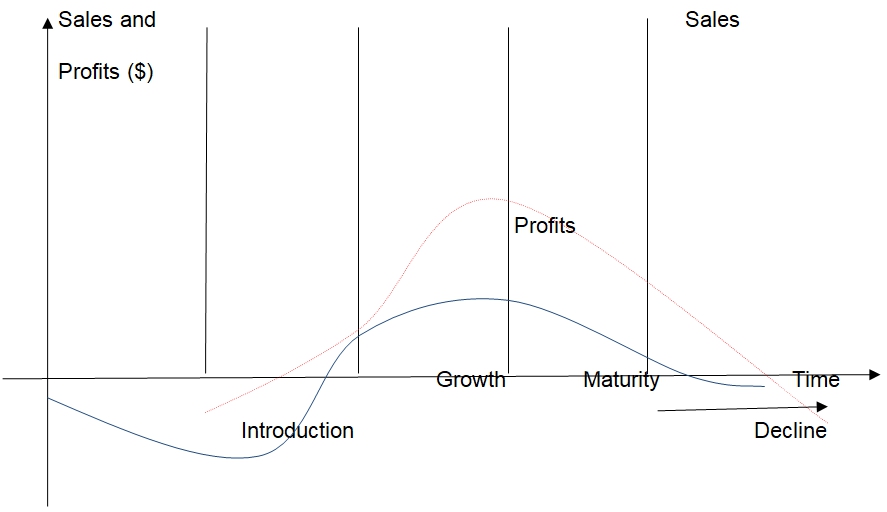

Product and Service Lifecycle

Nikon products are at the maturity level having passed the first two phases of the PLC that is the introductory and the growth stage as shown below.

At the maturity stage, the products of Nikon Company exhibit the features of low cost per customer and high profits. The company should, therefore, put emphasis on diversification of its brand and models and at the same time intensify its already existing distribution channels and establish more. The products should also have the best market prices as compared to the competitor’s profits are also supposed to be maximized while defending the market share (Kotler & Armstrong 2012, p. 205).

Benefits/Features Analysis

Nikon has the best cameras in the market that suit everyday use. Nikon D800E Digital SLR Camera is one of the most recent to be released and comes with the following feature: “new Nikon FX-format CMOS image sensor and effective pixel count of 37 -million pixels, hence clearer images”(Amazon, 2012, p. 2).

Differentiation

Nikon products are tailor-made to meet the requirements of each consumer. The products are highly differentiated from digital/film cameras, lenses, binoculars, telescopes, laser rangefinders, IC/LCD steppers and scanners, optical materials and equipment and surveying instruments so as to meet the diverse consumer needs. Nikon’s products range from the cheapest 10$ camera to the Nikon D3X that goes for a $7,999.95 that is currently being sold in Europe alone. “Through differentiation, the company is able to target a specific population and this takes place through manipulation of features, reliability, performance, presentation, design, size and variety” ( Kotler & Armstrong, 2012, p. 230).

Branding Strategy

Nikon has been around since 1917 and this has enabled the company to establish a name for itself and as a result, penetrate the market. The company produces a variety of appliances from cameras to lenses and surveying equipment.

The products, especially the cameras are centrally positioned in the market and can be found in virtually all the stores that stock rival products (Kotler and Armstrong, 2012).

Competitive Review

Competitive Analysis

As stated earlier, some of the major the rival companies in the film and photography market include Pentax, Panasonic Lumix, Olympus, Sony, and Canon. Sony, however, poses the greatest threat after launching the Sony Alpha DSLR-A900 camera in mid-July this year. However, the Nikon D800E Digital SLR Camera that was released in August 2012 reinstated company’s position as an among market leader since the camera offers some of the best features that the Sony Alpha DSLR-A900 does not have (Amazon, 2012).

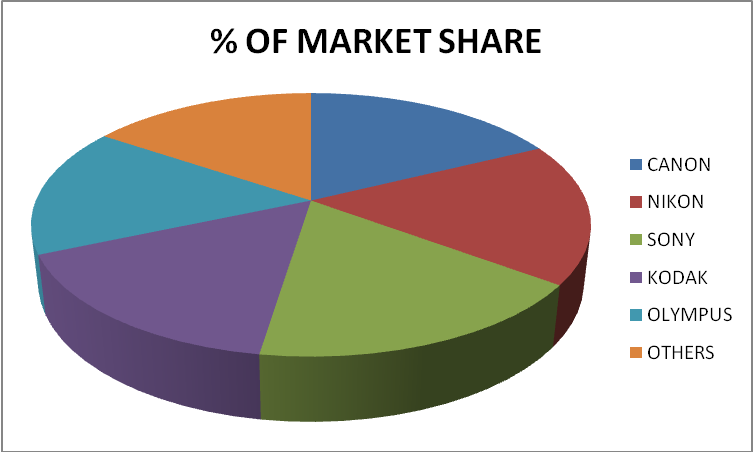

Market share

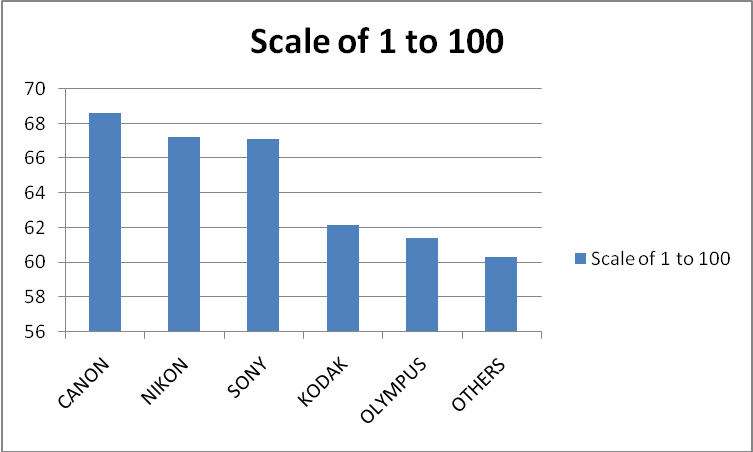

According to Harris Interactive (2012), the total volume of demand for Digital Cameras rose by 26% between 2011 and 2012. Nikon and Canon emerged as the top Digital Cameras companies with each company commanding 68.59 and 67.26 on a scale of 1 to 100 which represented 17.72% and 17.38 % respectively. Despite launching the Sony NEX – 5N and NEX – 7 in the fourth quarter of 2011, Sony came in third with 67.12 which represented 17.34%. Kodak Company was forth with 62.18 on a scale of 1 to 100 which was approximately 16.07% of the market share. Olympus was fourth with a 15.55% share which represented 61.44 in a scale of 1 to 100, with the rest taking 60.30 which represented 15.58% of the market share.

Scale of 1 to 100

Strategic Sweet Spot

The Nikon D800E Digital SLR Camera is one of the best cameras in the market that comes with a sleek look that is appealing to all customers. It also comes with features that will address the needs of both the professional as well as amateur photographers.

Positioning

Positioning deals with the perception of the customer towards the products and how they define it in order to maximize the potential benefit to the company. Nikon D800E Digital SLR Camera has positioned itself in the market as a stylish and status camera as far as its features and price is concerned. The aim of Nikon is to come up with persuasive reasons as to why the target market should buy the product or products (Kotler & Armstrong, 2012).

Distribution review

Nikon current conventional distribution channel is to sell only through camera distributors unlike before when the company used to be distributed through computer dealers. This move was brought about by the need to serve customers better.

SWOT Analysis

Some of the company strengths include the Image name, price, and features that come along with the products. Weaknesses include hierarchy leadership that has slowed down innovation processes. Threats come from well-established firms such as Canon and the declining dollar value. Opportunities lie in the emerging African markets (Kotler and Armstrong, 2012).

Recommendation

The company’s current marketing strategy is adequate to raise revenue. However, a review of the strategy yearly is highly recommended to increase revenue. Prices should remain as they are until close to the end of the year when promotion and advertisements through print and media are highly encouraged. Distribution through agents should remain as it is in addition to intermediaries who will do direct personal selling to customers.

References

Amazon. (2012). Digital cameras from top brands. Web.

Statista (2012). Ranking of digital camera brands in the United States in 2012, by brand equity. Web.

Kotler, P. & Armstrong, G. (2012). Principles of marketing. 14 edn. New Jersey, NJ: Prentice Hall.

Phau, I. & Poon, M. (2000). Factors influencing the types of products and services purchased over the internet. Internet Research, 10 (2), 102-113.