Executive Summary

This paper analyzes Nokia to revive the brand in the North American market. It is proposed that the reputation and recognition of the once-famous brand be increased by updating the line of push-button mobile phones through significant marketing implications. By analyzing the external and internal macro and microenvironment, as well as the available channels of communication with the audience, it was proposed that the market segments represented by young people under 28 and adults be emphasized, emphasizing old age.

A differentiated approach involves dividing the segments into children, adolescents, parents, and the elderly and describing the potential campaign for each group. As a result, specific tasks for the organization were obtained, which, with an integrated approach, can create conditions for the revitalization of Nokia by diversifying the business, with a description of the potential consequences of this implementation. A communications strategy was designed following Nokia’s slogan, mission, and vision, aimed at the designated goals.

Introduction

Nokia is a company headquartered in Finland that manufactures telecommunications equipment, although it became famous in the mobile phone market about twenty years ago. The collapse in this business sector is attributed to management errors; a premature and uncharacteristic organization moved towards a single bet on cooperation with Microsoft Windows Phone, which ultimately failed and could not withstand the competition of Android and iOS operating systems (GSMarena, 2022).

Nevertheless, Nokia continues to supply equipment for corporate customers, focusing on producing network solutions in IP, broadband, and mobile telecommunications. More recently, the company has unveiled a new logo that could herald steps towards similar restructuring and expansion into new markets. One of these in this paper is considered the North American market.

Nokia is quite widely represented in this region. First, 90% of the US population is connected to the company’s network equipment, with over half in the broadband sector (Nokia, 2023a). Second, the organization is represented by over ten thousand employees in 30 offices, two data centers, and four innovation institutions across the United States (Nokia, 2023a). Much of the continued success is due to the early adoption of 5G networks, which are gaining momentum in many regions worldwide. However, brand awareness among general, non-corporate consumers still has excellent growth potential in the mobile phone market, which has not entirely disappeared in the age of smartphones.

Therefore, this paper presents a revitalization strategy aimed primarily at this market in North America. Rethinking the brand’s strengths can provide concrete guidance for growing sales in this area, leading to greater recognition of Nokia among the general consumer and diversifying the business for a more sustainable position. The outlook lies in environmental and social responsibility, reviving and meeting the demand for mobile phones through innovative solutions with time-tested strengths and diversification of digital solutions for other business sectors.

Situation Analysis

The current situation in the North American market is relatively stable for Nokia if we consider only telecommunications equipment. The company is a market leader in broadband, IP, and 5G networks (Nokia, 2023a). At the same time, most of the organization’s new developments are aimed at sustainable development from an environmental point of view: emissions into the atmosphere are reduced by 39% compared to 2019, the plan for a 100% transition to renewable energy sources is moving steadily towards the goal for 2025 (Nokia, 2023b). Nokia also embraces social responsibility by promoting inclusion through staff diversity, networking in remote villages, and securing data (Nokia, 2023b). These facts are a strength and a basis for business diversification, which can raise brand awareness among corporate clients and individuals.

However, the market for push-button mobile phones is noticeably inferior to the turnover of smartphones. After an unsuccessful collaboration with Microsoft, Nokia completely abandoned these developments, especially against the backdrop of an increase in the number of budget competitors in the form of Xiaomi. It is worth noting that the demand for feature mobile phones is not zero. Nokia has succeeded in many regions over the past decade, mainly in Africa, Asia, and South America (Nokia, 2023c).

Given the current global challenges and crises, the macroeconomic performance of the United States and Canada, as the most prominent representatives of the North American market, tends to be in recession, which is why many companies cut their budgets; government support for these companies falls (Fajgelbaum & Khandelwal, 2022; Li et al., 2022). The current situation is unique and offers many opportunities with the proper market segmentation: Nokia can sell its innovative, reliable products to a target audience that does not need many smartphone features but appreciates budget communication options.

The surprising fact is the social plane of Nokia consumers. According to the company’s demographic research, the majority of feature phone users are young people, while there is also a significant percentage of those who value old technology among the elderly population (Nunan & Di Domenico, 2019). This fact opens up opportunities for diversification of the line, an attempt that was already made by the company about 5-6 years ago when Nokia implemented an analog of the hit of its time 3310 in a modern shell (Hall, 2017). Since there is a demand for this product, there is no better brand to meet it – experience and a long history of success can drive sales with proper marketing support.

Adaptation of past products can be implemented in conjunction with the company’s strengths. Firstly, network business presence will allow the creation of feature phones with unique features that can overtake the flagship position of their smartphone sector. Secondly, the development of environmental innovations and the presence of R&D centers in the region can contribute to unique solutions in the product’s safety, durability, and reliability at low costs and, accordingly, budgetary prices.

Finally, the need for equipment with significantly extended amortization periods could be a key driver of business demand for specific solutions during the North American economic crisis. Therefore, the area of development and revitalization of the brand lies in creating an appropriate line of push-button mobile phones and unique equipment for businesses with specific needs, where durability, environmental sustainability, and quality are priorities over the breadth of possible functions.

It is worth noting that the company is accustomed to operating in conditions of low state support. Finland, where the headquarters is based, is a prosperous country, but at the same time significantly affected by European economic shocks, which have been quite a lot lately (Lindén, 2021). Deployment in the North American market is a strength of the company, as, despite all the problems in its once booming business sector, it has maintained a presence in diversified areas.

Brand Audit

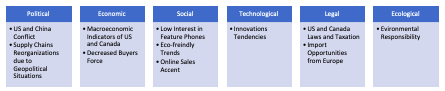

Based on the SWOT analysis in Figure 1, it is possible to identify four sets of strategies for Nokia brand revitalization, which will allow a comprehensive look at all the opportunities available to the company while considering the limitations described in the PESTLE analysis in Figure 2. S-O strategies include the following, partly described in previous chapters: resurrecting with a new marketing campaign a line of push-button mobile phones for each identified interested market segment; integration and design of high-quality and budget equipment for industries such as medicine, education, and others. It is how the company’s strengths are revealed in many ways, and the current demand in narrowly focused segments is realized.

W-O strategies are presented: an emphasis on environmental developments that will be warmly welcomed by big business and can count on government subsidies; a complete overhaul in the financial aspect of creating mobile devices – how relevant and profitable it is in the long term. This approach of the second strategy is partly a frugal optimization in favor of other diversified products, but it ignores the possibilities of realizing brand strength in the feature phone market.

S-T strategies include creating a budget and eco-friendly products in all diversified business areas and creating improvised communication devices similar in function to push-button telephones but for highly specialized business areas with relevant specifics. In this case, it means developing and designing control systems for production, sales, or other business industries, where the company’s strength in creating inexpensive and high-quality products based on network activities will be realized in the first place.

Finally, the W-T strategy involves a complete rejection of the creation of push-button phones and the revival of the brand only in the markets for the integration of network equipment through sponsorship of higher education institutions, the implementation of social responsibility through the creation of products in the field of medicine, for example, and the optimization of current production through the search for new suppliers or relocation of factories. This strategy does not realize Nokia’s strengths in any way, so it is the least preferred choice.

In connection with this analysis, strategies that focus more on the company’s strengths and capabilities should be adopted since the revival of the brand involves, first of all, changes aimed at increasing its recognition and reputation. Entering the North American market with a new line of feature phones is a difficult challenge for Nokia, as much of its success will depend solely on marketing. At the moment, turnover figures tend to fall, and this trend can hardly be trusted (Statista, 2023a). However, even in the US, this market is represented by a turnover of almost $150 million, a significant part of the company’s sales turnover in the region (Macrotrends, 2023).

Although Nokia’s financial performance reflects the company’s careful management without rash moves, which signals stable income, growth in net profit due to optimization of operating and direct costs, and continuous investments in the cash flow statement, such a move will require significant work before implementation (Macrotrends, 2023). The company can thus, without departing from the intended direction of improving current financial relations, for example, optimize inventories by reassembling existing products for a new line without impressive costs.

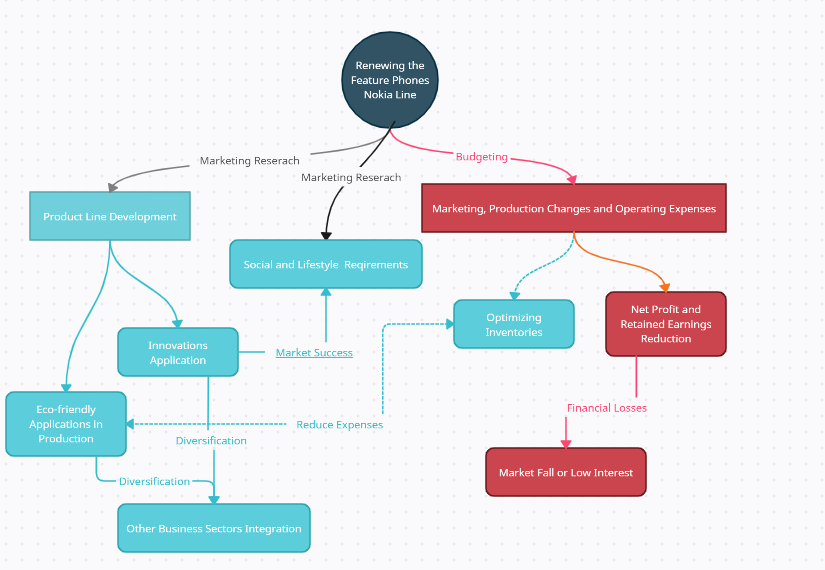

In addition, Nokia, through a broad representation of innovation centers and the work of the marketing department, can focus the release of the line according to the needs of consumers. Based on this market research, it is possible to create a product that meets these requirements while still implementing several vital features that give Nokia access to innovation. For example, the duration of the device without charging: due to low software and hardware requirements, push-button phones will be able to keep charging for a long time, which can be a competitive advantage over smartphones. In this respect, the brand’s revival is a complex task, which will entail positive and negative consequences in the case of the described changes. Figure 3 shows the links between the main idea and potential concepts resulting from such a step.

Figure 3 shows that success in the feature phone market depends on market research and related costs. In extreme cases, costs can lead to a deterioration in financial performance; however, with the complex work of the company in several areas at once, the brand will succeed in this market and potential vertical development through business diversification. Associations are represented by solid arrows, while dotted arrows represent internal processes. Consequently, potential developments in this area, preceded by relevant research, can give the following result.

First, a close relationship with customers that guarantees direct feedback to Nokia developers from the first design stage will give the brand a vital customer proximity feature despite its small overall market share. Secondly, considering the product’s technical features, lifestyle, and socio-cultural characteristics provides a vast opportunity for marketing integration. For example, a focus on young people through the creation of a product line with collaborations with the most famous brands, representing a large audience at the moment, able to pay attention to Nokia.

In this case, it is necessary to select a segment where the needs of customers in the technical equipment of the device will coincide with the lifestyle positioning of the collaboration brand: custom children’s phones under the Disney brand or sports devices for young people under the Nike or Adidas brand. The same is true in the smartphone market when Realme creates a product in collaboration with Coca-Cola (Realme, 2023). In the field of push-button phones, this niche is entirely free so far and opens up much room for Nokia revitalization.

Environmental implications may include a focus on optimizing production at the expense of the respective companies on the service side. Firstly, the ease of feedback will allow the organization to interact directly with consumers. Given their small group, it will not significantly burden the support sector. Second, setting up campaigns to collect and replace batteries that fail or have lost their performance can optimize costs and reduce the impact of these wastes if disposed of irresponsibly. Finally, changes in manufacturing, which will lead to a shift to renewable energy sources and reductions in emissions of harmful substances, may open the possibility of cooperation based on OEM and ODM for other business industries to create specific devices, which will strengthen Nokia’s interaction with corporate customers.

Customer Profiles

The push-button telephone market is highly segmented and can be divided into three main groups. Firstly, these are children under the age of majority, for whom parents, for security reasons, are not yet ready to buy a smartphone with several functions, but at the same time, they want to maintain minimal distance communication. Secondly, these are young people who, due to various cultural or economic factors, make a conscious choice in favor of these devices, often along with smartphones.

Finally, these older adults choose push-button phones because of their health opportunities and needs. Many of them are already current Nokia customers, but in general, the market is also represented by brands such as Intel, Samsung, or Techno. The company needs to create a competitive offer that can cover even falling demand for the organization’s development.

Accordingly, the first group, represented by parents as buyers, is primarily interested in the budget, reliability, and safety of the product for their child. Consequently, the line should include phones that hold a battery charge for a long time, do not offer features that could potentially harm the child, have a secure data transmission channel, and have the possibility of hacking or theft of personal information.

Most current feature phone models offer similar features, but here, the brand development opportunities lie in potential collaborations with well-known children’s brands to increase attention to the product from children or in innovative adaptations of hardware for safety and durability, as well as software – to integrate educational and entertainment features that rival those found in smartphones but offer rewarding experiences for, for example, developing fine motor skills.

The second group is more selective and dynamic: in many ways, it is interesting in North America to be found in the plane of cultural trends rather than technological ones. Suppose a student chooses a feature phone over a smartphone. In that case, they should have convenience and lifestyle characteristics with specific implications that are unique and more accessible than the corresponding smartphone models.

The critical indicator of accessibility here, as a rule, is financial: push-button phones are sometimes ten times cheaper than smartphones, while they can also provide even minimal access to Internet resources and have a set of auxiliary functions, such as an alarm clock, a flashlight or a calculator, at a much lower cost. However, the emphasis should be placed primarily on the results of direct marketing research in the form of surveys, and only then should the corresponding models be adapted to the needs.

Finally, the elderly segment of the market will appreciate adaptations for people with related health problems that make communication easier to use. Firstly, this includes phones with large buttons and a screen requiring minimal effort to access the relevant functions. Secondly, low-budget models will meet the needs of this segment, which only requires a partial range of smartphone features, even from a cheap class. In addition, this group will be more willing to participate in traditional surveys through physical media or direct interaction, which will create a brand reputation for intimacy with the client, which in the case of this segment is often critical.

Media Landscape

Accordingly, for the selected three groups, choosing a field through which Nokia will influence its future potential customers is necessary. Children are the most complex segment, as they can act as a sales force, but their parents from a more adult audience make the decision. Therefore, two channels need to be worked out here. Firstly, social networks, like Instagram or TikTok, where this audience is often present, aim to influence the segment’s consumers. According to statistics, almost 70% of this age group in the United States are members of these social networks (Allen, 2023). In addition, this channel presents wide variations for creativity and compliance with current marketing trends. Nokia advertising may reach a new level due to the need to integrate the PR department into these channels since the company’s social networks are now informative.

Parents, in turn, will evaluate the potential purchase of a push-button telephone according to the characteristics of the technical orientation. As stated above, safety and reliability will be critical at a reasonably low price. Consequently, this audience should be influenced through outdoor advertising or TV commercials. According to studies, more than 120 million homes in the United States have television, meaning the population is hugely involved in this channel (Statista, 2023b). Such a differentiated approach can be most effective if these campaigns are divided into a focus on entertainment for children and safety, cost, durability, and education for parents.

Young people under 25-28 at a more conscious age are also a broad audience of social networks. In addition to Instagram and TikTok, Facebook and Twitter should be added as the most common media in the region (Oberlo, 2023). Nokia’s representation in social networks is currently not diversified and is generally aimed at corporate clients and, in general, maintaining the brand’s news agenda. If we multiply the number of accounts and create specialized departments, such as Nokia for Kids and Nokia for Teens, where content relevant and exciting to the target audience will be presented, the engagement of this segment should increase. Promoting the product here should focus on comfort and lifestyle, following the company’s mission, vision, and slogan, “connecting people.” This task will be difficult: how to make communication a key feature without the capabilities of a smartphone. However, Nokia has much more critical knowledge in the network business sector, which can be used as a strength.

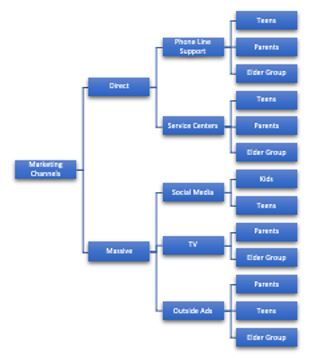

Finally, older people often turn to television, newspapers, magazines, and outdoor advertising if they can move. Direct interaction here can be provided through a hotline with round-the-clock access or through physical mail. The latter option is best used as a tool for long-term marketing research in business planning due to the slow speed and low mass returns. Therefore, Figure 4 reflects the media landscape for this project through two structures: direct interaction with clients and mass broadcasting through specific channels. The goal is to revive brand awareness in the push-button mobile phone market and develop it through a solid yet diversified marketing campaign.

Communications Strategy

In translating this analysis into a concrete strategy, Nokia must focus on the following. Firstly, the company should adapt its social networks not only for corporate clients but take a differentiated approach for each dedicated segment: for example, create accounts on TikTok and Instagram, “Nokia for Kids” and also on Facebook and Twitter, “Nokia for Teens,” where it will broadcast commercials and content that attracts the attention of target customers.

Second, the organization should conduct massive market research to identify the most critical features of the feature phones for its audience: in the case of a group of older adults, physical mailings will be required, and in the case of young people, feedback on social networks is possible. Thirdly, the task is to launch a campaign on television, where the main aspects are safety, reliability, durability, and a unique competitive offer, which will be formed based on the study.

Finally, based on the mission, vision, and slogan, the marketing department needs to form a lifestyle philosophy for target audiences and, as a result, look for applicants for bright collaborations that will be promoted through social networks, mainly for young people. As a result, personal feedback must be kept at all times through telephone lines, social networks, and service centers, receiving information from which Nokia will constantly adapt the product line to customers’ needs.

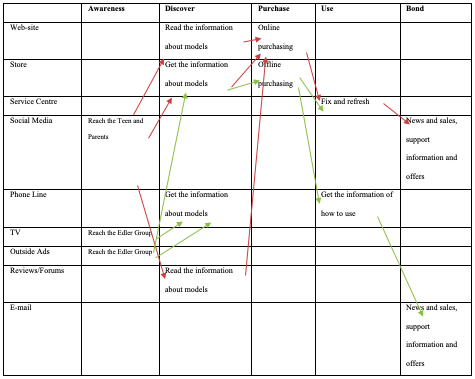

Accordingly, a specific message or message is allocated for each audience, stimulating sales and brand awareness. This mission has something in common with the selected segments in many ways. For example, battery life and data security can be critical considerations for youth and parents of school-aged children. Through the channels described in Figure 4, Figure 5 describes the goals and stages of each marketing channel: green line is for elderly group, while the red line is for parents, kids and teens.

As a result, social media is becoming a critical success factor for brand recovery for the teen and kids segment, while mass engagement with other groups requires a holistic approach. Nokia must communicate about collaborations, data security, product sustainability, and technical specifications through social media. Accessibility and inclusiveness in the form of adapted features for the elderly can be demonstrated through outdoor advertising, mailing lists, and television. The final marketing channel should also combine the message of sustainability, reliability, and safety. As a result, Nokia has a differentiated roadmap for marketing activities that are comprehensively targeted at four distinct groups, which can be divided into two: young people and adults. The company’s strengths will be realized through appropriate slogans that can reach a niche market’s target audience to create a seamless competitive value proposition.

Performance Evaluation

A key indicator of success will be the sales of specific models, which must be constantly monitored to optimize the production line. However, marketing metrics will play an important role in addition to them, which are easy to track when integrating advertising into social networks. These include views, activity demographics in likes, comments, reposts, link clicks, and overall response.

It is generally more difficult to track the segment of the elderly since the interaction will be more targeted and through communication channels where there are no integrated statistics tools – it will have to be done manually. Unlike smartphones, where sales wave average one year, marking the renewal of the flagship line, Nokia products involve a more extended use of one unit of goods. Accordingly, for the reputation of the company, the most important is the support and availability of services, where the relevant metrics will already include the frequency of requests and quality of service.

Finally, as the central control system, it is necessary to constantly calculate the correlation between Nokia’s marketing metrics and financial performance: how much they affect the short-term liquidity, payback, efficiency, and long-term solvency of the organization. Given the company’s lean policy regarding its assets and its global presence in the network business, Nokia has a margin of financial strength for several similar projects that could restart the brand in a niche market.

References

Allen, V. (2023). Libs of Tiktok creator Chaya Raichik calls for national ban on app. The Daily Signal. Web.

Fajgelbaum, P. D., & Khandelwal, A. K. (2022). The economic impacts of the US–China trade war. Annual Review of Economics, 14, 205-228. Web.

GSMarena. (2022). Flashback: A decade of Microsoft’s failed attempts to conquer the phone market. GSMarena. Web.

Hall, C. (2017). Nokia 3310 vs Nokia 3310: What’s the difference 17 years on?Pocket-Lint. Web.

Li, Z., Farmanesh, P., Kirikkaleli, D., & Itani, R. (2022). A comparative analysis of COVID-19 and global financial crises: Evidence from US economy. Economic Research-Ekonomska Istraživanja, 35(1), 2427-2441. Web.

Lindén, C. G. (2021). Kingdom of Nokia: How a nation served the needs of one company (p. 274). Helsinki University Press. Web.

Macrotrends. (2023). Nokia income statement 2009-2023 | NOK. Web.

Nokia. (2023a). North America. Web.

Nokia. (2023b). Nokia’s People & Planet 2022 report underscores the exponential potential of digital to build a sustainable future. Web.

Nokia. (2023c). Worldwide Presence. Web.

Nunan, D., & Di Domenico, M. (2019). Older consumers, digital marketing, and public policy: A review and research agenda. Journal of Public Policy & Marketing, 38(4), 469-483. Web.

Oberlo. (2023). Most popular social media in the US. Web.

Realme. (2023). Realme 10C Pro Coca-Cola Edition. Web.

Statista. (2023a). Feature phones – United States. Web.

Statista. (2023b). Number of TV households in the United States from season 2000-2001 to season 2022-2023. Web.