Introduction

Novartis AG is a generic drug manufacturer and focused on providing sufficient solutions in the ever-changing dynamics in the health sector not only in Switzerland but also in the entire world. The company will do this through extensive research, development, and marketing of cost-effective curative and preventative health solutions (Novartis 2011). This makes the firm to be a multinational company operating in more than 140 countries (Novartis 2011). In its operation, the firm has a human resource base of more than 90000 employees who include health, technical, legal, clerical, research, financial, and administrative personnel (Novartis, 2010).

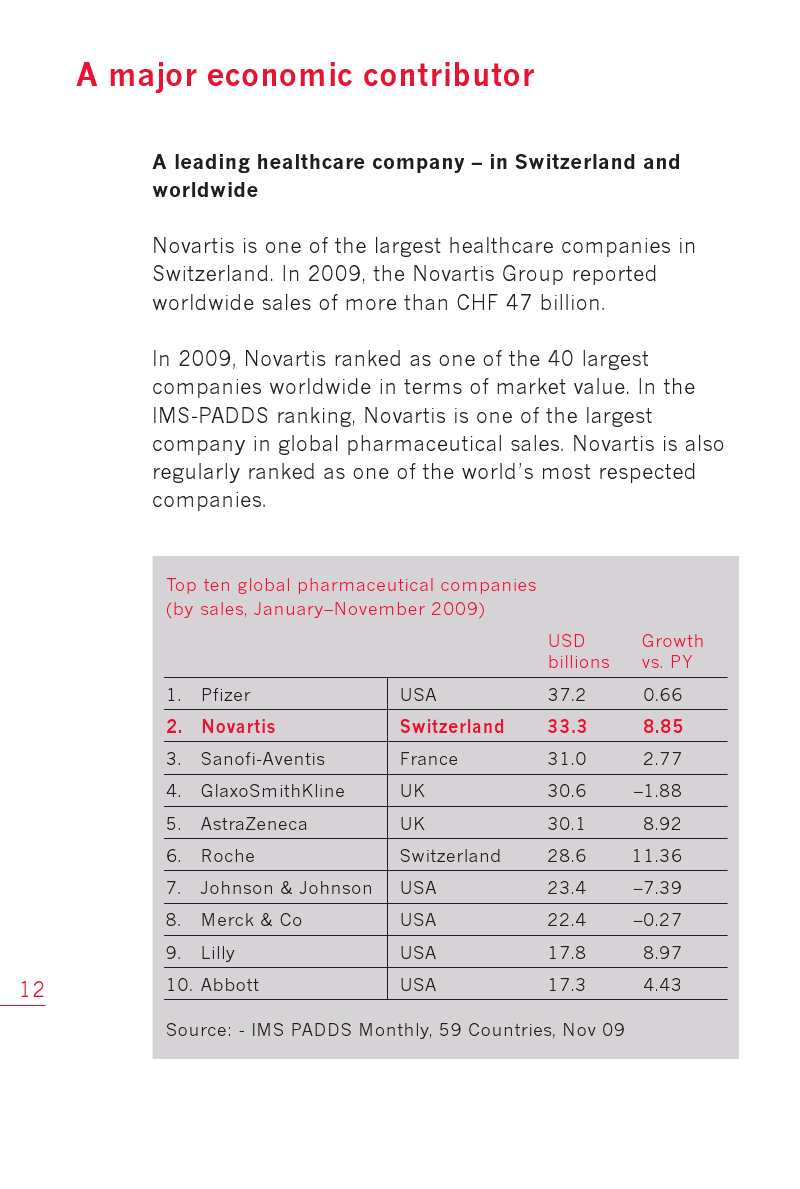

The company has done relatively well in the Swiss market. By the year 2010, it accounts for about 17% of the Swiss market index fuelled by the acquisition of Alcon Inc. (Broom 2010). By the year 2001, the company had already established itself as the leading drug market in Switzerland with an almost 10% market share by revenues despite its profit growing slowly (Gassmann, von Zedtwitz and Reepmeyer 2008). Globally the company was ranked seventh in the same year and was competing effectively with established companies such as Serono (Gassmann, von Zedtwitz and Reepmeyer 2008). As of the year 2009, the company’s Swiss market had grown to 11% while its global positioning has improved to position two overall (Novartis 2010)

The figure below shows the global analysis of the pharmaceutical industry.

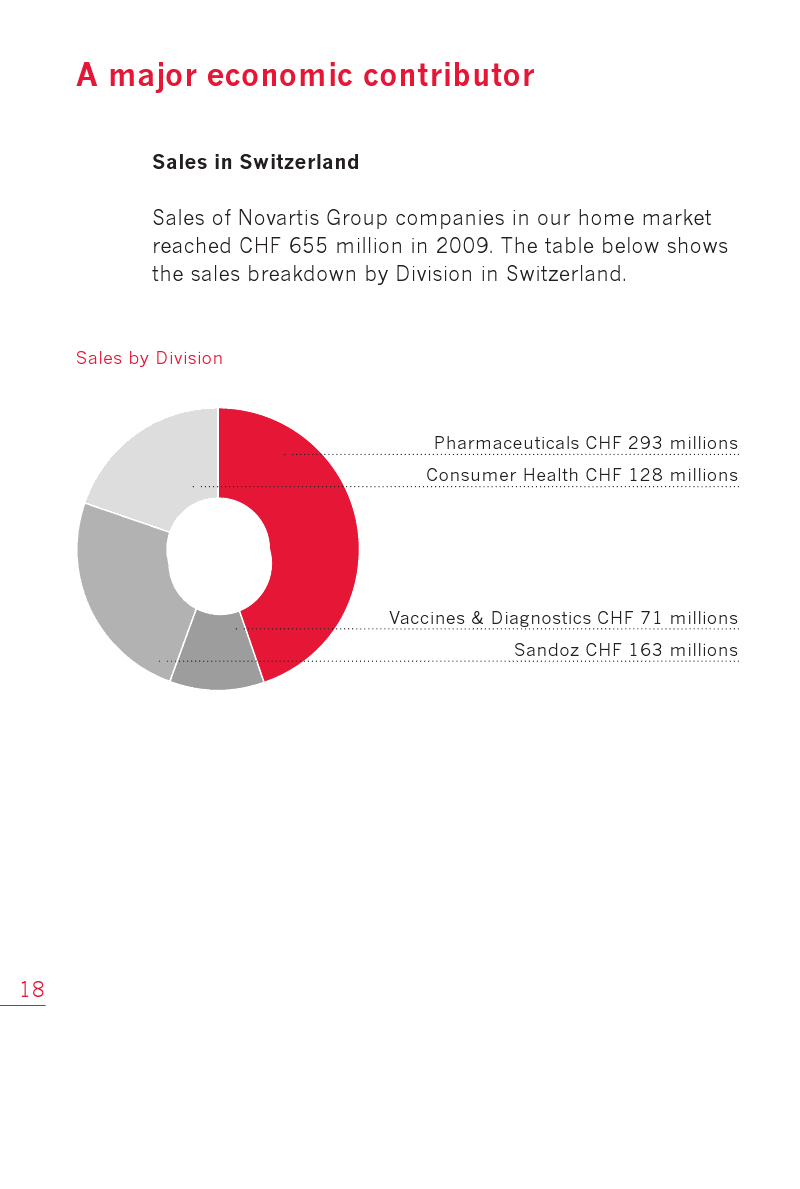

The figure below shows the company’s performance by division in the Swiss market by the year 2009.

The company has a rich product portfolio. For example, it has invested greatly in research on the best preventative solutions, medicines. Currently, the firm is the leading provider of diagnosis vaccines and offers more than 20 products for both viral and bacterial diseases (Gassmann, von Zedtwitz and Reepmeyer 2008). It also offers veterinary health services and pest control products and animal health products. The firm is also ranked as the second largest provider of affordable generic drugs through Sandoz which is its generic drug maker (Novartis, 2010, para. 7).

Novartis has had superior performance in the world market over the past few years. Recent reports indicate that Novartis is the world’s third-largest pharmaceuticals company. The first two market leaders are American firms, which include Pfizer and Merck. Its rise to the third position resulted from an increment of 14% in its sales revenue which is equivalent to $ 50 billion during its 2010 financial year (Economist Intelligence Unit 2011). The firm also experienced an increment in its net profit with a margin of 18% which is equivalent to US$ 10 billion (Economist Intelligence Unit 2011).

In 2010, Novartis experienced an increase in the number of its patented products. The patented products contributed about 60% of the firm’s total revenue, which amounted to the US $ 30 billion during the 2010 financial year (Economist Intelligence Unit 2011). This represents a 7% growth (Economist Intelligence Unit 2011). The graph below illustrates the changes in the firm’s net profit and net sales.

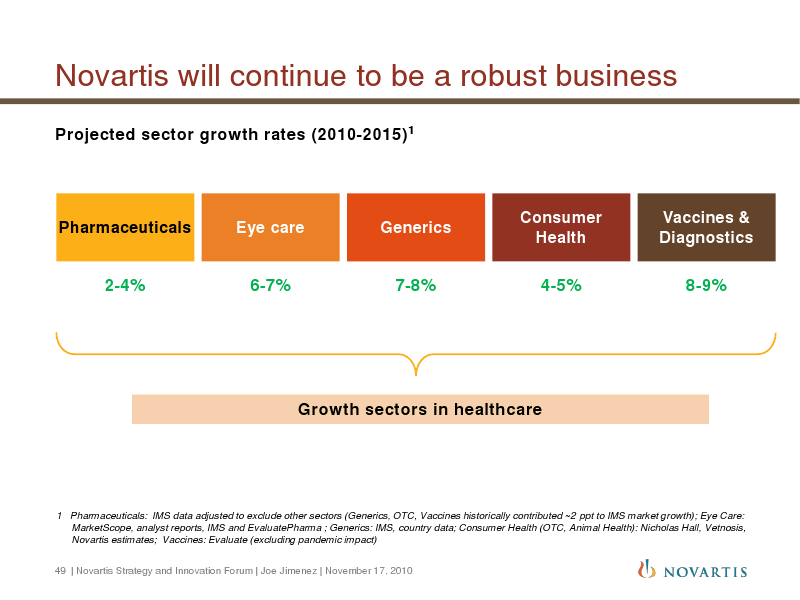

All factors held constant, the pharmaceutical industry is projected to grow at a compound rate of between 4 to 7 percentage points up to the year 2013. This rate is largely influenced by global macroeconomic factors such as improved health care access and the growth of the US health care industry. As such, the pharmaceutical industry value will surpass the US$ 975 billion in market value by the year 2013 (Pharmaceutical and Drug Manufacturers n.d.)

Main body 1

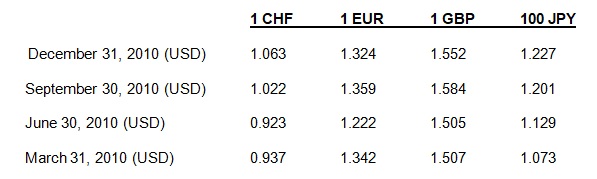

Because the firm operates on a global scale, it is exposed to numerous risks such as exchange rate fluctuation (Wessler, 2007, p.65). The group’s annual risks are affected by the fluctuation in the rates of the various world currencies for that period. Currencies may fluctuate and thus affect the transactions done with non-subsidiary currencies (Novartis 2011). The graph below shows the quarterly operational rates for the year 2010 measured against one US dollar.

Several factors drive the growth in the world pharmaceuticals market. (David, 2008, para. 4). Most of these factors originate from the external environment. One of the models which can be used to evaluate these factors is the PEST model. Political factors such as government regulation policies on the pricing and the h distribution of drugs and barriers to entry of the drug into markets have been of major influence to the industry (Castner, Hayes, and Shankle 2007). Every government has had its process of regulating drugs into its market. Some government has also had a very slow process of supervising and allowing the entry of new drugs into the market. Various governments are increasing their efforts towards motivating pharmaceutical accompanies to open as many branches especially in developing countries to achieve development goals.

Technological advancements have significantly necessitated the conduction of researches in the field of medicine and thus helped in the development of better health care solutions. Economic factors such as exchange rates, the strength of the currency of a nation, and the inflation rate mat affect the growth and operation of the industry (Oxford University press 2007). Oxford University Press (2007) continues to explain that higher inflation rates may trigger higher salary demands from employees while a strong currency influences the number of exports: exporting of products becomes expensive for the manufacturer.. However, several factors are hindering the growth of this industry. It is estimated that the future sales of vaccines will drop as a result of improved health conditions. As a result, Novartis notes that it has to diversify its operation to caution against loss of revenue.

In addition, the liberalization of the pharmaceutical industry has led to an influx of drugs in the world market. As such, there is going to be stiff pricing competition which will affect the companies’ turnover. Patents for generic drugs have an expiry date. As such the company is facing increased competition for its products after the expiration of its patented generics (Economist Intelligence Unit, 2011, para. 43).

Novartis annual growth rate is expected to be 4% According to (DeArment 2010, para. 4). As a result, the firm is expected to be the leading pharmaceutical company in the world by the year 2015 (Binning, 2010, para. 2). This is in comparison to the excepted annual growth rate of 1.4% for the pharmaceutical sectors in general (DeArment 2010, para 2). The figure below shows the expected growth rate in the pharmaceutical industry by the year 2015.

The company’s operation is significantly affected by exchange rate movement. Exchange rate refers to the values in which currencies are exchanged at, at particular times in specific countries (Duttagupta & Fernandex, 2006, p.65). For example, if the exchange rate of 1 for the American dollar to the British pound is 0.89, then one American dollar will be exchanged at 0.89 British pounds (Duttagupta & Fernandex, 2006, p.65). As such higher exchange rates may affect the volume of trade as well as an investment as investors may find it expensive to borrow investment capital (Oxford University press 2007).

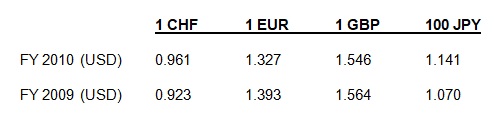

The company’s turnover for the financial years ending 2010 has been positively affected by foreign exchange rates (Hihgbeam Business 2010). Highbeam also reports that the company’s net sales rose to 18% at equilibrium exchange rates between the Swiss Franc, US dollar, Japanese yen, and the British pound. (2010). Novartis (2011a) reports that there was a movement in exchange rates throughout the year as follows: at the beginning of March the exchange rates were at1 CHF at 0.872 1, EUR at 1.324, 1 GBP at 1.431, and 100 JPY at 1.018. towards the end of the year 2010, the rates were as follows: 1 CHF at 1.063, 1 EUR at 1.324, 1 GBP at 1.552, and 100 JPY at 1.227. These currencies are measure against one US dollar. To maximize the profits the exchange rates were equilibrated as follows: 1 CHF at 0.961, 1 EUR at 1.327, 1 GBP at 1.546, and 100 at JPY 1.141 (Novartis 2011a). The results of these equilibrated rates are improved net sales. The rates at the same period the previous year were lower. This means that the lower the rate the lower the profits, while the opposite is true. The table below shows a comparison of equilibrium rates for the year 2009 and 2010.

Main body 2

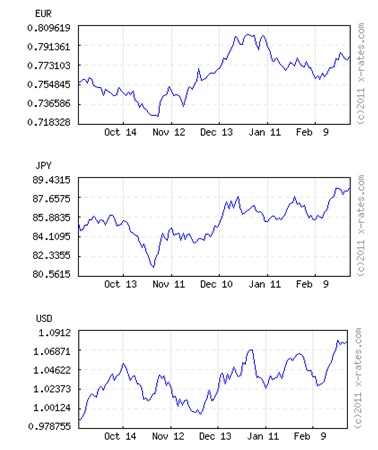

A flexible rate is an important tool in conducting foreign transactions (Foreign Exchange Rates, 2011, para. 6). This arises from the fact that they keep the currency fluctuations at a relatively low level (Visser, 2005). Thus pricing of Novartis products is kept at the optimum level (Visser, 2005). Therefore the company was able to utilize these flexible rates and keep inflation at bay between these three countries. The graphs below show the exchange rates between the Swiss franc, US dollar, and Japanese yen at end of February 2011.

It is possible to use the current rate of exchange to forecast the future exchange rate of the Swiss franc against these major currencies. Given that the trend seemed to rise towards November, it is assumed that exchange rates for the near future will assume the same trend all factors held constant.

Current data available indicate that the Swiss Franc is on an upward trend. This has both positive and negative effects on the Swiss economy (Maurer & Brändle, 2011, para. 4). As a result, the Swiss government is alarmed at the movement in the exchange rate. To deal with the trend, the government is considering taking steps aimed at stabilizing the trend. This arises from the fact that appreciation of the Franc can result in numerous risks compared to the benefits. The continued appreciation of the Franc is causing a degree of panic in government circles. For example, the deterioration in the Swiss economy’s price competitiveness has prompted calls for the government to act. However economic technocrats have advised the Swiss government to lay its hands-off as the market will soon correct itself and normal business will resume (Maurer & Brändle, 2011). Furthermore, there are mechanisms within the current situation that can guarantee losses incurred by exporters will be recovered indirectly.

However, the effects of the strong Franc are varied. One of the demerits of the high exchange rate relates to the exporters (Clark, 2004, p, 8). This is because volumes of exports rose significantly in the year 2010. As such an appreciating Swiss franc means a depreciating foreign currency and as such exporters are earning less from their exports. Even though the volume of Swiss exports has risen over the last year, most exporters are claiming to have exported less than they expected to cushion themselves from losses (Clark, 2004). However, Swiss exporters are positive of a promising future business as indications show that the exchange rate will stabilize during the first half of 2011. The effect will be felt by the tourism industry as a tourist is likely to avoid the country. In effect, tourists might prefer other destinations that will guarantee better value for their money.

On the other hand, a strong Swiss Franc is affecting importers positively. The high exchange rate means that importers are incurring less in their import business. As a result, importers could increase their import and transfer that advantage to manufactures by selling the imported raw materials cheaply thus most of the exporters stand to gain (Brandle & Maurer, 2011, para. 7).

Hans Hess, the president of Swissmem (Association of Swiss electrical and mechanical companies) explains that the strong franc will greatly affect the industry (Evan, 2011). For example, the gross revenue of firms in this category increased by a margin of 6% (Evan, 2011). Contrastingly, it cut the profits margin by about 1%. Almost half of Swissmem members recorded reduced profit margins. This is challenging for most of the firms operating in this industry since they do not have the required funds to invest in technology that will help them survive the challenge.

To deal with changes in the exchange rate, various firms are incorporating several strategies (Evan, 2011, p.76). Most of the companies affected by fluctuations intend to raise the prices of their products in the next two years. However, this will harm the firms’ sales revenue. This arises from the fact that their products will become more expensive hence reducing their competitiveness in the global market. Other measures include relocating production plants outside Switzerland and the inevitable job cuts in most of these companies. These measures are predicated to save the companies a considerable amount of operating capital (Allen, 2011, para. 3).

The company is a multinational establishment and this means that it has business interest in many countries and as such has had to undertake the risk associated with foreign exchange rates because most of the company’s income and expenses is in other currencies such as the Yen, euro and the Swiss Franc (Novartis 2011). As such any changes in the rates of fluctuation in foreign exchange trade thus have the potential to affect the companies turnover either positively or negatively. To avoid any such losses occurring, the company has had to engage in a protection strategy. The company established the US dollar as the reporting currency, which means that all the company assets have to be converted into US dollars before being included in any financial reports (Novartis 2011).

However, the dollar has experienced a decrease in value in the recent past, and as such the company’s revenue has been affected. Net sales for the year 2010 using its key reprint currencies are as follows. The net sale in US dollars was 36 %, 7 5 more than net sales recorded for the same period in Euros. Net sales recorded in Yen was 8% while the Swiss franc recorded a paltry figure, 2%, as compared to the US dollar (Novartis 2011). Still focusing on the same period the companies settled most of their expenses using the US dollar, at 34% (Novartis 2011). Expenses settled using Yen were 4%, while the Swiss Franc and the Euro settled expenses worth 13% and 27% respectively of its total expenses (Novartis 2011). This shows a concurrency in the ratio of expense settled with a particular currency compared with the net sales recorded d with the same currency (Novartis 2011). The table below reflects the impact of the conversion of key currencies into the US dollar

Source: Novartis 2011.

Novartis has had mixed fortunes from the changing dynamics of the foreign exchange market. As a result, its operations in Switzerland were greatly affected. The company recorded healthy returns during the 2010 financial year. However, immediate future risks are facing the pharmaceutical industry (Parvis, 2002, p.34). As a result, companies are being forced to adopt some measures to deal with the situation. For example, the firm is considering reducing its workforce, especially within its marketing department. This will result in a significant reduction in its expenditure on salaries and wages thus saving the firm colossal amounts in recurrent expenditure (Mussa, 2000, p.65).

Other measures that the firm intends to undertake include diversifying its operations to deal with the risks associated with exchange rate movement. In addition, the firm’s management team has come to a consensus to incorporate the concept of mergers and acquisitions. Currently, the firm is in the process of forming a merger with the leading eye care products company, Alcon (Allen, 2011b, para. 4).

Acquisition of Alcon has been facilitated by a fixed exchanged rate ratio, fixed at 2.80 for each Novartis share. This acquisition will result in the company increasing its product portfolio, which it hopes, will increase its revenues thus cautioning against losses from its main products such as generic and vaccines. Other than the acquisition of Alcon, the company has diversified its market target by investing in developing economies (Novartis Global, 2011b, para. 7). This venture is expected to increase its sales volume hence its income. To meet the demands of the emerging markets the company has had to increase its products range so as not to cut supplies to its established markets in the European Union and America (ACN Newswire, 2011, para. 1-4).

As a result of the unpredictable exchange rate movement, the company has engaged several measures in response to the situation. This is in line with its policy to use the necessary tools to ensure that it evades losses when it is necessary to do so. In effect, the company will improve its financial statement. To begin with, Novartis uses the dollar as its principal accounting currency (Novartis Global, 2011a, para. 2). All assets are denominated in US dollars and as such, the values of these assets do not change should the prevailing exchange rates change. In addition, all expenses by its foreign subsidiaries are converted to US dollars at a predetermined rate, which in most cases is the average rate at that particular time.

The company also uses hedging tools to avoid losses from foreign exchange. In 2010 the company used these tools to preserve the value of its fixed assets (Novartis 2010; Novartis 2011). This was achieved by signing a contract that sought to change in value relevant to the foreign exchange rates. Other hedging activities include the signing of forwarding contracts. These are types of exchange contracts signed between two parties where each party bears the other party’s risks should anything go wrong. The resultant effect is that Novartis was able to avoid major losses. To minimize losses in accounting in its balance sheets, the company translates its figures using year-end rates (Novartis 2010). Any difference in value arising from this translation risk in its equity is put as part of the cumulative income statement. Novartis also esteems its long held policy of not sanctioning any financial deal that has risk which cannot be translated into realistic figures at the time of the deal (Novartis 2010).

Additionally, the company would not sell something it does not possess or is not sure it will possess fully in the future. In this case, the company does not buy any assets, which are not within liquidity. Should any value in the asset fall, the company does gain the value through an increase during the transaction process. The company also avoids losses in foreign exchange by ensuring that all its foreign investments are long-term ventures and as such, any loss is recovered in the long run (Novartis 2010).

Conclusion

In conclusion, the future is bright for Novartis. This has been necessitated by the strategies adopted by the company to survive the risks and uncertainties associated with foreign exchange rates. The company expects that the gains shortly will greatly be affected by foreign exchange ratios. As such it has taken several measures to guard itself against this. Novartis has adopted the US dollar as the standard currency of its operation. As a result, the firm calculates the value of all its assets and expenses of foreign subsidiaries in terms of the dollar.

The firm has also incorporated the concept of hedging and forward contracting to caution against losses associated with exchange rate fluctuation. These fluctuations have had an effect on the company as well as other Swiss companies. Last year, various industries were significantly affected by the high exchange rate. The tourism industry and the electrical engineering industry experienced an increased cost of exports.

Novartis looks into the future with a high degree of optimism. However, the firm has to diversify its operations to enhance its long term survival. One of the ways through which the firm is implementing this is by undertaking mergers and acquisitions as is evident in the firm’s decision to acquire Alcon, the leading manufacturer of eye care products. This has been the most significant diversification strategy. In addition, the firm has also decided to expand its operations to other countries especially developing countries to minimize risk. The firm will also increase its product base to effectively cover these new markets without affecting the already existing market. Currently, the company offers preventative cures, generic drugs, animal care products diagnostic tools, and healthcare consumables.

Several factors have affected the company’s growth. Reports indicate that the future market for one of its core products, vaccines will diminish. Patent expiration is another growth hindrance. Some of the company’s patented generic drugs are in the process of expiring. This means that the company can no longer prevent other manufactures from producing the said drugs. However, the future is not so bleak for Novartis. Governments are committing more funds to provide affordable health care. Novartis as the leading provider of affordable healthcare solutions is set to benefit from this program.

Recommendation

To survive in the global market as a going concern entity, the Novartis management team should incorporate the concept of intensive research and development. This will enable the firm to develop new products and also improve on the existing products. The resultant effect is that the firm will be able to improve its competitive advantage. To be effective in its innovation processes, the firm should ensure that continuous market researches are conducted. This will increase the probability of its products being in line with the market demand.

Considering the changes in the exchange rate, the firm should ensure that the hedging strategy adopted is effective. In addition, the constant market analysis should be conducted to effectively set the price of its products to avoid loss.

Reference List

ACN Newswire, 2011. Shareholders approve all proposed resolutions of Novartis board of directors. web.

Allen, M., 2011a. Firms warn worst franc effects: yet to come. Web.

Allen, M., 2011b.Drug firms seek to cure to profit squeeze. Web.

Binning, D., 2010. Novartis to outperform wider pharma industry: data monitor tips Swiss firm to reach CAGR of four per cent to 2015. (Online). Web.

Broom, G. 2010. Swiss Stocks Rise for Second Day; Novartis Soars on Alcon Deal. Web.

Clark, B., 2004. A new look at exchange rate volatility and trade flows. New York: International Monetary Fund.

Castner, M, Hayes, J., and Shankle, D. 2007. Political Determinants: Governments and Trade Agreements that Affect the Industry. Web.

David, F., 2008. The Changauiign dyanamics of the global pharmaceauticals industry. Web.

DeArment, A., 2010. Expect to see growth from Novartis. Web.

Duttagupta, R. & Fernandex, G., 2006. Moving to flexible exchange rate: how, when and how fast. New York: IMF.

Economist Intelligence Unit. 2011. From the economist intelligence unit. Web.

Evan, D., 2011. Exchange-rate dynamics: New York: Princeton University Press.

Gassmann, O, von Zedtwitz ,M, and Reepmeyer, G. 2008. Leading Pharmaceutical Innovations: Trends and Drivers for Growth in the Pharmaceutical Industry. Springer Verlag Berlin Heidelberg Foreign Exchange Rates, 2011.Exchange rates. Web.

Hihgbeam business, 2010. AMD drug boosts Novartis’ sales. Web.

Jimenez, J. 2010Novartis: building sustainable Leadership in healthcare. Novartis. Web.

Maurer, C. & Brändle, N., 2011. Switzerland: how the Swiss economy is coping with a strong currency.Web.

Mussa, M., 2000.Exchange rate regimes in an increasingly integrated world economy. New York. IMF.

Novartis, 2010. Annual report 2010, Novartis. Web.

Novartis 2010. Novartis in Switzerland. Novartis. Web.

Novartis Global. 2011a. Selected exchange rate data. Web.

Novartis Global. 2011b. Novartis to acquire majority control of Alcon, a global leader in eye care and proposes merger for full ownership. Web.

Novartis, 2011. United State exchanges and securities commission form 20-F. Web.

Oxford University Press (2007) PESTEL analysis of the macro-environment. Oxford university press. Web.

Parvis, E., 2002. The pharmaceutical industry: access and outlook. New York: Nova Publishers.

Pharmaceutical and Drug Manufacturers, n.d. Market Trends 2010. Web.

Visser, H., 2005. A guide to international monetary economics: exchange rate theories, systems and policies.New York: Edward Elgar Publishing.

Wessler, W., 2007. Economics. New York: IMF.