Introduction

The global approach toward the political and economical situation within countries provides different changes on the pathway of the world community to be united and protected from the negative influences of the world. This is why the aim of being a member of some great union is taken into account by civilized and developing countries. It is necessary for making the existence within countries of the world more appropriate and convenient while providing relationships of a different type. In this respect, the economic, as well as financial approach in the unification of countries, plays a great role. The ability and readiness of major countries and their leaders, particularly, to make the right decisions and theoretically correct steps should be of great significance. Moreover, the theory for global change in such vital dimensions should prop up against previous studies and historical experience in a particular field. Economic and Monetary Union in Europe is one of the gravest examples when driven by one idea several countries agreed to unite under some points in the agreement, one of which is the same currency. The research in the paper is dedicated to the problem of “openness” and its importance for the countries which agree to unite in a monetary union. Thus, it is vital to work out whether openness is the main condition for membership in a monetary union or it is just a consequence of it. Notwithstanding the situation at a different epoch monetary unions were a strong and reliable background for countries being members in it, and openness was an obligatory condition for making unions.

Discussion

First of all, it is necessary to point out that any change in the global scope can cause either positive or negative outcomes for the particular country. In this respect, the point on current monetary policy promoted in internal relationships of this definite country plays a great role. De Grauwe (2005) insists on the fact that when a country seeks improvements in making union with some other countries it should take into consideration the costs of the monetary change and, what is more, the ability to forget about national monetary policy and to join the global approach. In other words, the credibility of a country to be open toward some changes is particularly emphasized when making unions. In the example of the European countries, it is seen with some hints on pre-arranged conditions of participants before and while signing the agreement on EMU.

The historical background has some examples of monetary unions acknowledged by some countries. Scandinavian Monetary Union is one such example. According to Cottrell et al (2007), two main constituents were pointed out while making an agreement for monetary union and policy provided, namely: the area and the standard. The first part presupposes the political and territorial dimensions for the provision of monetary policy. In other words, it was a background or a platform for such global change. The second variable provides straightforwardly financial estimation of standards, i.e. gold domain and name of the currency. Both variables are implemented in their reciprocal relation.

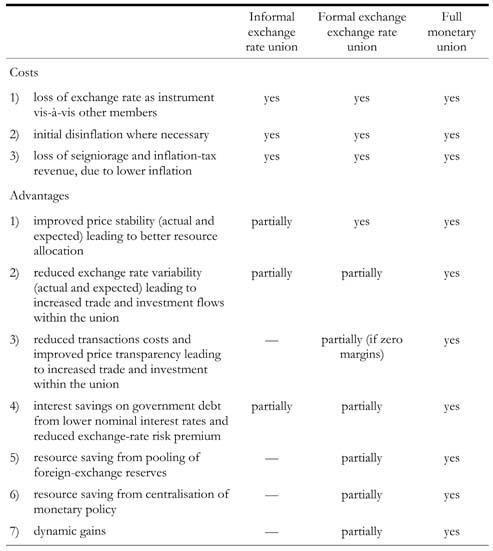

In fact, the territorial entities and similarities as of geographical division of countries and ethnicities which fulfill them should be used for making an idea of monetary unions, For example, there are many huge parts of the world where particularly the same by origin people live. For example, the USA and Canada, Latin America, Sub-Saharan Africa, Asian countries in their variety can be touched upon. Cobham & Robson (1996) looked for the main approaches and considerations of monetary integrations while making a survey on the European situation. Hence, the authors admit that a whole picture of monetary unions points out the supposed costs and benefits of countries participating. This is why it is so vital to make emphasize the foreign countries’ experience in this dimension of political and economic affairs. The chart below describes potential points on costs and benefits assets:

Looking at the data in chart one recognizes the significance of unification and its features. Hence, there is a grounded assertion that in terms of the global fast-growing development of countries in major parts of the world the reliability of monetary strength, first of all. The level of the complex development (social, political, economic, and financial) of a country is taken into account. The fiscal policy provided in the country takes place when weighing the risks and opportunities of monetary union. Kenen (1995, p. 80) in this respect notes that main fiscal dimensions should concur with three macroeconomic points, namely: “the stabilization problem, the coordination problem, and the solvency problem.” The powers of state government and encouragement of internal and external investments are, of course, important and should be applied. On the other hand, the fiscal problems are better to find the solutions.

For reaching the point of objective reasons for building up a monetary union should pass through the period of historical and diplomatic reforms inside the countries which agree to participate in such measurement, but in the short or long perspective. For most of the countries, such procedure was not applicable, and they failed to unite, because of the lack of alleged “openness” in financial and political affairs. This is why Giovannini (1990, p. 218) looks in his research at the historical prerequisites for the formation of EMU touching upon the description of how such perspective was considered by European countries as the optimal way for monetary policy: “Western European countries have been talking about the monetary union for three decades now. An understanding of the historical developments surrounding monetary union reveals much about the nature and potential success of the current initiative.”

Artis & Lewis (1993) also admitted the notion of area, as one of the parameters in Mundell’s theory. The objective to follow the way when prices are fixed is depicted as the main point for making identification of nominal and real exchange rate changes. This obstacle is distinctive due to the fact that the adjustability of nominal exchange rates in relation to real exchange rates can face asymmetric shocks (Artis & Lewis, 1993). Thereupon, De Grauwe (2005) relates this aspect of discussion to the current situation with aggregate demand and supply in some definite (mostly neighboring) countries. This is why the macroeconomic data and processes cause a negative effect on microeconomic realities. In turn, the down-up approach concerns the fact that with the stability in microeconomic readings a country can be identified as that which is ready for the process of unification in a monetary dimension.

Giovannini (1990) sees the postwar development of the European countries in their mutual agreement to follow the strategic urge for constructive changes by means of two ways, known as prerequisites or primordial alteration for monetary strategy. Thus, the author does not hesitate to point out that in a historical framework of relationships elaboration between the members of the EMU in Europe all parties were aware to face two main challenges, namely the author notes two programs:

The first program, known as the gradualist strategy (the supporters of which have been labeled “economists”), relies on progressive removal of trade barriers, the convergence of inflation rates, progressive stability of exchange rates, and parallel modification of monetary policies and institutions. The second strategy involves a sudden currency reform (its supporters have been labeled “monetarists”) (Gipovannini, 1990, p. 217).

Thus, the theoretical framework of Mundell and current experience within countries to make efforts in achieving consent in global relations take place when talking about monetary correlations or even corrections. This aspect is underlined also with the fact that the parties partaking in the agreement usually lean toward more freedom in relationships. Trade and financial operations are better and more convenient to provide in the dimensions with the policy for “openness”. Hence, openness is supposed to be in part with the conditional observations in a would-be member of this structural part of economic relations.

Returning to Mundell’s optimum currency area (OCA) theory, it is vital to admit that even the author admitted and shared the assertion that for the international balance countries should appeal to more homogeneous fiscal, monetary, and exchange policy with appropriate rates. McKinnon (2005) gathers the works by Mundell for the purpose of identification of real grounds for making monetary unions. Nonetheless, the author makes an investigation in terms of current rational approaches in the financial world: “…stationary expectations underlie how monetary and fiscal policies work themselves out in an open economy” (McKinnon, 2005, p. 201). Open borders in providing constructive rationale are important in this case. It is so because the historical and economical dependence of closely related countries estimates the probable tools for making the solution as of the main attributes for making success in trade, for example. The flexibility of nominal and exchange rates should be taken into account in this respect. Kenen (1995, p. 81) reproduces the main point of OCA theory which imposes the following statement: “Two countries may be said to constitute an optimum currency area when the fixing of the nominal exchange rate between their currencies does not impose real costs on their economies.”

However, the openness of monetary union members can be also evaluated as interns of the so-called border effect. Engel & Rogers (1996) promoted research concerned with the nominal rates on goods in different parts of the country in comparison with suchlike research touching upon various countries. Thus, it was searched and stated that the problem of deviation of real and nominal exchange rates is grounded on the failure of the “law of one price”. Thus, the borders and differences in the economical and political approaches can influence the situation with price movements between countries. In order to diminish this speculative situation, countries actually tend to conclude an agreement for further participation and work in domains of new currency same for all participants. Also, the importance to concentrate efforts over one central bank drives the policy and actions of the parties to prepare and conduct all substantial features in internal relations. National borders, regarding McCallum (1995), seem to be in a state of flux and, particularly, the economic significance of borders is of great concern for many countries and the world community, on the whole. This is why the borer conflict and unfair, on the one hand, regulations of rates for definite goods can be decreased by means of monetary union and joining to it (Rose, 2000). In this respect, gravity-type equations can cause influential and rather felt impacts on the determination of international trade patterns (McCallum, 1995).

Conclusion

To sum up, the world of international changes for better provision of economical standards touches upon blocking of countries into definite unions. This reason is particular also for the monetary unification. EMU is a great example when with the help of one idea for rational support in currency alteration and development of goods provision countries may come to conclusion. The way of changes in countries trying to make a union presupposes time for this decision and its materialization and proper reforms provided in the internal relationships of a country. Moreover, Mundell’s theory supports such assertion when stating that two countries should correlate their nominal and real exchange rates for the purpose of making no difference in a distant approach. The state of “openness” should be taken into account when making efforts to join such global communities. This objective also contemplates the stimuli for different countries before joining monetary unions. The flexibility of exchange rates and their predetermined character which depends on the decisions made by the central bank of the union promotes the background for less volatility of currency in the area comprised by the union.

Reference

Artis, MJ & Lewis, MK 1993, ‘Apres le deluge: Monetary and exchange rate policy in Britain and Europe,’ Oxford Review of Economic Policy, 9(3), 36-61.

Cobham, D & Robson, P 1996, ‘Monetary Integration in the Light of the European Debate’, African Centre for Monetary Studies, 3, 14-20.

Cottrell, PL, Notaras, G & Casares, GT 2007, From the Athenian tetradrachm to the euro: studies in European monetary integration, Ashgate Publishing, Ltd., Burlington,VT.

De Grauwe, P 2005, Economics of Monetary Union, 6th edition, Oxford University Press, Oxford.

Engel, C & Rogers, J 1996, ‘How wide is the border?’, American Economic Review, 86, 1112-1125.

Giovannini, A 1990, ‘European monetary reform: Progress and prospects,’ Brookings Papers on Economic Activity, 2, 217-19.

Kenen, PB, 1995, Economic and monetary union in Europe: moving beyond Maastricht, Cambridge University Press, Canbridge.

McCallum, J 1995, ‘National borders matter: Canada – US regional trade patterns,’ The American Economic Review, 85, 615-23.

McKinnon, RI 2005, ‘Optimum currency areas,’ Exchange rates under the East Asian dollar standard: living with conflicted virtue, MIT Press, Cambridge.

Rose, AK 2000, ‘One money, one market: estimating the effect of common currencies on trade,’ Economic Policy, 30, 7-46.