Introduction

The business transformation of Tesco in the last 25 or so years is one of the more remarkable stories in British retailing. Tesco is the focus of much academic, analyst and commentator consideration (for instance Seth and Randall, 1999; Burt and Sparks, 2002, IGD, 2003a). Some aspects of the Tesco operations have been discussed in public by their executives (such as Kelly, 2000; Mason, 1998; Jones, 2001; Jones and Clarke, 2002; Child, 2002). Tesco has become dominant in its home market (Burt and Sparks, 2003) and closely watched on the international stage.

This paper presents a summary of this logistics and supply chain transformation in Tesco. It draws heavily on this public literature, although a series of interviews with managers and directors at different levels in the company has also informed the work. The paper aims to describe, analyse and draw lessons from the logistics journey Tesco has undertaken.

Company Background

Tesco Plc is a UK-based public company, and is the largest retailer in the UK. 75% of its sales are generated in the UK, with the rest from its operations in Europe and Asia Pacific. The company regularly reports startling growth and profit for a retailer. Total sales grew by 11% in 2006 for example. The company began life as a grocer, but subsequently expanded into a very wide range of retail, which it has supplemented with an equally wide range of services. These include financial and insurance, telecom, travel agency, and assorted other products including legal advice in the form of do-it-yourself wills and divorce kits. It also runs an extremely influential petrol retailing business.

Tesco is predominantly present in supermarkets and hypermarkets, but the company diversified greatly over the review period. Its operations include convenience and petrol retailing via its Tesco Express fascia, small high street outlets via Tesco Metro, supercentres via Tesco Extra and non-food specialists via Tesco Homeplus. “Financial services are offered through Tesco Personal Finance, and its on-line delivery channel Tesco.com has 98% coverage of the UK and is the country’s leading internet delivery service.

Its recent overall strategy has been straightforward – expansion by all available means in order to create the greatest possible economies of scale to severely threaten its competitors”. (Clive, 2007) This means selling a massive range of products, stratifying its offer so that wealthy and poor consumers can shop there and above all, opening as many outlets as possible. Famously, the small market town of Bicester in Oxfordshire was left with six Tesco stores after the company took over convenience store retailer T&S stores. There has been great muttering in the UK press about the speed and success of the strategy, but Tesco’s operations have not yet been deemed illegal or monopolistic. However, the speed of re-referral to the Competition Commision by a Parliamentary Select Committee suggests that Tesco may be challenged.

Tesco has a fully national network in the UK, although it is possibly stronger in the south of the country, given its roots in London. The company’s international plans are gaining increasing headlines in the UK. “Most recently, it withdrew from talks with Indian firm Bharti Enterprises about a retail joint venture. This is a huge opportunity for foreign retailers to get into a market expected to double in size to US$640 billion by 2015”. (Patrick, 2007) Tesco is still looking for opportunities in the Indian market, however.

Tesco in the Past: Establishing Control Over Distribution

The current retail position of Tesco is far removed from the origins of the company. Tesco made its name by the operation of a “pile it high, sell it cheap” approach to food retailing. Price competitiveness was critical to this and fitted well with the consumer requirements of the time. The company and its store managers were essentially individual entrepreneurs. The growth of the company saw considerable expansion until by the mid-1970s Tesco had 800 stores across England and Wales. This entrepreneurial approach to retailing, epitomized by Sir Jack Cohen, was put under pressure however as competition and consumer requirements changed. Tesco itself had therefore to change.

The emblematic event signifying the beginning of this transformation was Operation Checkout in 1977 (Akehurst, 1984). Dramatically, trading stamps were removed from the business, prices were cut nationally as a grand event and the business received an immediate considerable boost to volume. Stores were re-merchandized as part of Operation Checkout, and consumers began to see a different approach to Tesco retailing. After this initial repositioning event and phase, Tesco began to better understand its customers, control its business, and move away from its solely down-market image (Powell, 1991). This retail transformation brought into sharp focus the quality and capability of Tesco supply systems and the relationships with suppliers.

Such concerns have remained critical during the almost irresistible rise of Tesco in the 1980s and 1990s. By moving away from its origins, Tesco changed its business. Initially the focus was on conforming out-of-town superstores, but since the early 1990s a multi-format approach has developed, encompassing hypermarkets, superstores, supermarkets, city centre stores and convenience operations. The Tesco corporate brand has been strongly developed (Burt and Sparks, 2002) and international ambitions have emerged. In all this, the distribution and supply of appropriate products to the stores has been fundamental.

There have been four main phases in the reconfiguration of the distribution strategy and operations. First, there was a period primarily of direct delivery by the supplier to the retail store. Second, there was the move, starting in the late 1970s, to centralized regional distribution centres for ambient goods and the refinement of that process of centralized distribution. Third, a composite distribution strategy developed, starting in 1989. Fourth, the 1990s witnessed the advent of vertical collaboration in the supply chain to achieve better operating efficiency.

Direct to Store Delivery

Tesco in the mid-1970s operated a direct to store delivery (DSD) process. Suppliers and manufacturers delivered directly to stores, almost as and when they chose. Store managers often operated their own relationships (Powell’s “private enterprise”, 1991: 185) which made central control and standardization difficult to achieve. Product volumes and quality were inconsistent. This DSD system fell apart under the pressures of the volume increases of Operation Checkout.

As Powell comments, quoting Sir Ian MacLaurin: Ultimately our business is about getting our goods to our stores in sufficient quantities to meet our customer’s demands. Without being able to do that efficiently, we aren’t in business, and Checkout stretched our resources to the limit. Eighty per cent of all our supplies were coming direct from manufacturers, and unless we had sorted out our distribution problems there was a very real danger that we would have become a laughing stock for promoting cuts on lines that we couldn’t even deliver.

It was a close-run thing. Powell continues: How close is now a matter of legend: outside suppliers having to wait for up to twenty-four hours to deliver at Tesco’s centres; of stock checks being conducted in the open air; of Tesco’s four obsolescent warehouses, and the company’s transport fleet working to around-the-clock, seven-day schedule. And as the problems lived off one another, and as customers waited for the emptied shelves to be refilled, so the tailback lengthened around the stores, delays of five to six hours becoming commonplace. Possibly for the first time in its history, the company recognized that it was as much in the business of distribution as of retailing. (Powell, 1991: 184)

The company began to gain control of the problems through operational “fire fighting”, and while problems occurred, melt-down was avoided. It was clear however that changes to distribution would be needed as the new business strategy took hold.

Centralization

The decision was taken to move away from direct delivery to stores and to implement centralization. The basis of this decision (in 1980) was the realization of the critical nature of range control on the operations. Store managers could no longer be allowed to decide ranges and prices and to operate mini-fiefdoms. If the company was to be transformed as the business strategy proposed, then head office needed control over ranging, pricing and stocking decisions.

Concerns over quality of product also suggested a need to relocate the power in the supply chain. Centralization of distribution was the tool to achieve this. Tesco adopted a centrally controlled and physically centralized distribution service (Kirkwood, 1984a, 1984b) delivering the vast majority of store’s needs, utilizing common handling systems, with deliveries within a lead time of a maximum of 48 hours (Sparks, 1986).

This involved an extension to the existing company distribution facilities and the building of new distribution centres, located more appropriately with the current and future store location profile. Investment in technology, handling systems and working practices allowed faster stock-turn and better lead times. Components of the revised structure were outsourced, allowing comparisons between contractors and Tesco-operated centres, to drive efficiency. This strategy produced a more rationalized network of distribution centres, linked by computer to stores and head office. The proliferation of back-up stock-holding points and individual operations was reduced.

These centres were the hubs of the network, being larger, handling more stock, more vehicles and requiring a more efficient organization. Centralization produced the necessary control over the business and fitted with the changed retail strategy of the 1980s (larger company superstores).

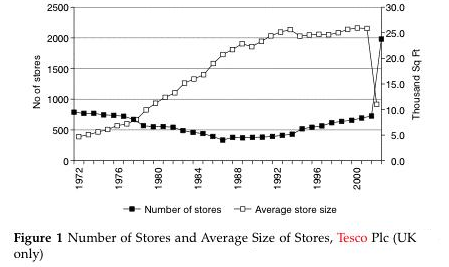

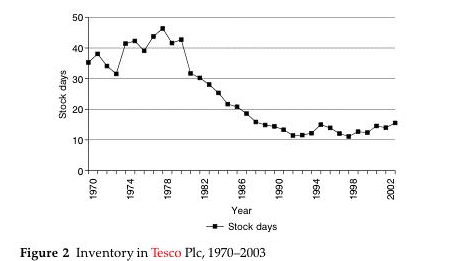

Figures 1 and 2 (see appendix) show the changing store profile and the impact of the distribution changes on corporate stock-holding. From 1984 the percentage of sales via central facilities has increased from under 30 per cent to over 95 per cent in 2002.

By 2003, the annual distribution volume had increased to more than 1 billion cases delivered, out of 25 distribution centres, covering 7 million square feet of warehouse area, holding 9.9 day’s stock for stocked products. The scale of the ambient distribution centre increased: for example Thurrock, which opened in 2002, is 500,000 sq ft with a weekly assembly capacity greater than 1 million cases. A similar very large non-food national distribution centre is located in Milton Keynes with automation for selected product lines.

Composite Distribution

Centralization proceeded on a product line basis. By 1989 Tesco had 42 depots, of which 26 were temperature controlled. While this was a massive reduction from the plethora of small locations in the 1970s, it was still capable of improvement. Fresh foods were basically handled through single temperature, single-product depots. These were small and inefficient and were subject to only tactical operational improvements, allowing for example more frequent store deliveries and a more accurate idea of the cost of product distribution.

While stores received some improvements in the mid-1980s, there remained some disadvantages of the centralized network. It was prohibitively expensive to have on-site Tesco quality control inspection at each location, which meant that the standards of quality desired could not be rigorously controlled at the point of distribution. It was also realized that this network would neither cope with the growth Tesco forecast in the 1990s nor, as importantly, be ready to meet expected high legal standards on temperature control in the chill chain.

The produce depot at Aztec West in Bristol opened in 1986 and represented the best of the centralized network. Tesco could have made further investment in single-product distribution systems, upgraded the depots and transport temperature control and put in new computer systems, but would still have achieved overall a less than optimal use of resources and cost-efficiency. A strategy of composite distribution was planned in the 1980s to take effect in the 1990s.

A subsidiary requirement was the importance of ensuring continuity of service during the changeover period. Composite distribution enables temperature-controlled product (chilled, fresh and frozen) to be distributed through one system of temperature warehouses and vehicles.

Composite distribution provides a number of benefits. Some derive from the original process of centralization, of which the composite system is an extension. Others are more directly attributable to the nature of composite distribution. First, the move to daily deliveries of composite product groups to all stores in waves provides an opportunity to reduce the levels of stock held at the stores, and indeed to reduce or obviate the need for storage facilities at store level.

The result of this is seen at store level in the better use of overall floorspace (more selling space) and in stock terms by a continuous reduction (see appendix Figure 2). The second benefit is the improvement of quality, with a consequent reduction in wastage. Products reach the store in a more desirable condition. Better forecasting systems minimize lost sales due to out-ofstocks. The introduction of sales-based ordering produces more accurate store orders. More rigorous application of code control results in longer shelf life on delivery, which in turn enables a reduction in wastage. This is of crucial importance to shoppers who demand better quality and fresher products. In addition, however, the tight control over the chain enables Tesco to satisfy and exceed the new legislation requirements on food safety. Third, the introduction of composite delivery provided an added benefit in productivity terms.

The economies of scale and enhanced use of equipment provide greater efficiency and an improved distribution service. Composite distribution strategically provides reduced capital costs and operationally reduces costs through for example less congestion at the store. Throughout the system there is an emphasis on maximizing productivity and efficiency of the operations, enabled by tactical involvement in various new technologies.

The introduction of composite delivery was not a simple procedure. Considerable problems were encountered, requiring Tesco to work closely with suppliers and distributors. The move to composites led to the further centralization of more product groups, the reduction of stock holding, faster product movement along the channel, better information sharing, the reduction of order lead times and stronger code control for critical products. Such changes are easy to list but hard to implement and achieve. There were also issues that existed post-composite. The need to maintain continuity of service to retail stores, which means that the implementation of improvements must be invisible, affects abilities to change.

The cost of primary distribution remained within the buyer’s gross margin and was not identified clearly and separately. This cost had to be substantiated indirectly by talking to suppliers and hauliers. In other words clarity and transparency were not achieved. Finally and most importantly, certain sectors of the supplier base were fragmented and not fully organized for the needs of retail distribution, despite the concomitant development of retail brand products.

That fragmentation made the task of securing further permanent improvements difficult. While many suppliers could reorganize their procedures to meet the changed timing demands of composite delivery, some could not. This composite structure is essentially the backbone of the current network. In order to increase the volume capability of the composites, Tesco implemented a change to its frozen strategy by commissioning a new automated frozen distribution centre at Daventry. This national frozen centre services Tesco stores by delivering through the composite distribution centres. This enabled the composite frozen chambers to be converted to chill chambers, thus releasing extra volume capability to service Tesco business growth.

Vertical Collaboration

The discussion of the phases of supply chain reconfiguration thus far has essentially focused on structural change to the distribution network. Implicit in this is some alteration to the linkages with suppliers and distribution specialists, but in many ways this was ancillary to the internal changes. Once the basic network outline was settled, however, attention turned more fundamentally to vertical collaboration in the supply chain. Information sharing, electronic trading and collaborative improvements have become critical.

This sharing of information was part of a wider introduction of electronic trading to Tesco. In particular, Tesco built a Tradanet community with suppliers (Edwards and Gray, 1990; INS, 1991). Improvements to scanning in stores and the introduction of sales-based ordering enabled Tesco better to understand and manage ordering and replenishment. Sales-based ordering automatically calculated store replenishment requirements based on item sales, and generated orders for delivery to stores within 24 to 48 hours. This information was used via Tradanet to help suppliers plan ahead both in product and distribution.

Delivery notes, invoices and other documentation were also be sent by Tradanet. In 1997 Tesco gave a commitment to share information with its suppliers. Suppliers could obtain information provided they dedicated resources to focus on Tesco customer wishes and provided appropriate product offerings. This commitment complemented the change in commercial structure to focus on category management and ECR principles. Tesco moved from the traditional single point of contact with suppliers (the buyer and the national account manager) to a more complex interaction in which functions collaborated. A commercially secure data exchange system based on the Internet (Tesco Information Exchange, TIE) was established.

This concern with information provision for collaborative purposes inevitably turned attention on to the practices of primary distribution. The changes to control the supply chain had been concentrated mainly on the distribution centre to the retail store component, but realization began to emerge of opportunities elsewhere.

The purpose of examining primary distribution (manufacturer to distribution centre) was to identify and implement changes that were profitable to the supply chain as a whole. Frequently opportunities occurred through shared user solutions, which are different from the mainly dedicated solutions found in secondary distribution. Primary distribution required some change in approach and style, with Tesco letting go of direct control and allowing appointed hauliers and consolidators greater freedom over the shape of the least-cost, good service solutions.

Once the cost of primary distribution had been calculated, there was business motivation to apply logistics resources to identify opportunities to make improvements in the organization and structure of the inbound flow of goods. The purpose was to reorganize UK, European and worldwide sourcing and distribution networks. Tesco was then able to be proactive in negotiating more competitive distribution rates as a result of the negotiation scale, the command of the sourcing of products and its own expertise in distribution operations.

These factors all contributed to enhanced operational efficiency and supply chain profitability. There was a valuable cost contribution that could be made by involving the operators in identifying more efficient ways of organizing primary distribution, and then helping bring those insights to the surface and create solutions that worked for all the segments of the supply chain. It was important in achieving this to work in a cross-functional style, and the primary distribution managers sat in the commercial areas with which they were working. This created a united focus on achieving good results for the business.

The restructuring, information sharing and primary distribution also focused attention on using assets more completely. Tesco’s 3D logistics programme sought to achieve a total supply chain perspective. This inevitably involved considering the flow of goods on shorter time horizons, allowing delivery and distribution to be reconfigured, creating more capacity in existing centres and aligning primary and secondary distribution.

An important part of this alignment relationship development has been the supplier collection programme. Tesco vehicles collect supplier products on their way back to the depot following a store delivery, saving costs and reducing emissions (DETR, 1997). Additionally, supplier’s vehicles that had delivered to depots or were conveniently in the area were routed to take goods to Tesco retail stores on their way back to their home base. Such collaborations involve three-way partnerships among suppliers, logistics service providers and Tesco.

The overall objective was to create conditions in which the unit cost of distribution reduced year on year, and at the same time, the return on the capital invested in vehicles and centres increased through better coordination and stronger confidence in the information. The result was an important strategic alliance between primary and secondary distribution which examined the peaks and troughs in utilization to find those that were complementary.

Alignment of time has been noted above, but other changes also brought full supply chain benefits. One specific opportunity was in the handling and movement of goods, with product increasingly ordered, produced and delivered in merchandiseready units. These phases of reconfiguration of the supply chain took Tesco from a position of being at the mercy of suppliers and inconsistent practice to the very leading edge of logistics expertise. Tesco distribution and supply chain was recognized as world class (McKinsey, 1998).

The Present: Tesco Supply Chain Today: The Changing Business

As Jones and Clarke (2002) point out, the process of change outlined above made huge strides towards modernizing Tesco’s supply chain. As a consequence of this, lead times to stores and from suppliers had been cut radically and stock holding reduced enormously (see appendix Figure 2). Massive progress had been made. However this progress was achieved at a time when Tesco had moved from a standardized, conforming, domestic retailer to one where the retail and supply challenges were multiplying.

These challenges involved internationalization, the development of successful home shopping and operational alterations at store level. The real process of becoming an international retail operation started in the mid-1990s, when Tesco embarked on a long-term strategy of building a profitable large-scale international business. By 2003, Tesco had successfully established that retail presence in Northern Ireland, the Republic of Ireland, Hungary, Poland, Czech Republic, Slovakia, Thailand, South Korea, Taiwan and Malaysia.

Tesco has recently purchased retail chains in Japan and Turkey. It has become the market leader in five of those international countries, in addition to being number one grocery retailer in the UK. That overseas operation now accounts for almost half the Tesco Group retail space and 20 per cent of retail sales (Tesco plc Annual Report, 2003). The approach is to use local knowledge to tailor the operation and not to spread the business too widely, although other markets remain possible (such as China and the United States, Child, 2002).

One of the lessons in internationalization that Tesco does not have to relearn is the importance of expertise in supply chain logistics. Its UK experiences have provided a solid base for supply chain operations in these international markets. While the extent and the approach vary depending on market circumstances (IGD 2003a), the core processes are being introduced and allowing efficiencies to be gained.

In 1995 Tesco conducted a home shopping pilot scheme at a single store. Customers could use a variety of methods to order, with these orders picked at the store by Tesco staff, and collected or delivered to the customer’s home or drop-off point. This pilot was extended to 10 stores in 1997, and a store-based picking operation was expanded nationally from 1999. By 2003 Tesco. com covered 96 per cent of the UK population geographically and had annual sales of £447 million.

A fleet of 1,000 temperature controlled vans was delivering 110,000 orders per week, which is a 65 per cent share of the UK Internet grocery market. A similar approach is now established in the Republic of Ireland and in South Korea, where over 70 per cent of the population has Internet access. Grocery Works, which is a partnership between Tesco. com and Safeway Inc, has established coverage in parts of the western United States.

This store-based model was not the common approach adopted by competitors, and criticism of the approach was “vitriolic” (Child, 2002). Jones (2001) in an interview with John Browett (CEO of Tesco. com) points to three key elements of the decision to use store-picking. First, Tesco realized that warehouse picking schemes could not make money. Second, customers wanted the full range of products, and economics showed Tesco needed the wide range to drive basket size. Third, geographic coverage from warehouses is insufficient. The Tesco. com experiment is now profitable, and has shown to some extent how supply chain systems can add value to the business in new ways. The Internet however places pressure on the accuracy of speed of supply chain systems, forcing even Tesco to look again at the processes.

The retail base of Tesco has also changed domestically from the 1980s. The present-day Tesco is a multi-format retailer with formats ranging from Extra hypermarkets to small Express convenience stores. This variation has been compounded by retail operational changes. Store opening hours have been extended in many locations to encompass 24hour opening. Service levels and quality thresholds have been enhanced. Nonfood has become a much greater proportion of even standard store offers than before. Product ranges, operating times and service standards all combine to pressurize a supply system that was essentially developed for a simpler, more standard situation.

The extension to non-food lines, the growing internationalization of the business (including product sourcing) and the consumer demand for fresh products also come together to internationalize the supply chain. From being heavily domestic in nature, the procurement of products from overseas has become a key feature of the business. This breadth of supply again demands efficiency in the supply chain.

The Current Network

The current Tesco supply chain network is well documented (IGD, 2003b). This report shows that there are 25 distribution depots with a warehouse area of 7.3 million square feet and annual total case volumes of 1.17 billion. Centralized distribution accounts for 95 per cent of the volume. Of these 25 depots, 15 are run in-house by Tesco and the remainder are contracted to Wincanton (five), Exel Logistics (two), Tibbett and Britten (two) and Power Europe (one).

National Distribution Centres (four) are combined with Regional Distribution Centres (ambient) (nine, of which four are “mega-sites”, three fast-moving sites and two medium-moving sites), Composite Distribution Centres (one) and Temperature Controlled Depots (11, including seven fresh foods, three fresh and frozen and one new frozen site). In additional there are 24 consolidation centres run by a variety of operators which feed into this system. The system operates almost 3,000 vehicles, covering 224 million km per annum. In short, this is an extensive, large-scale network of supply.

The operations of the components of this network have also undergone radical change. Performance is now much more rigorously monitored, mainly through the ‘steering wheel’ approach widespread throughout Tesco. Any distribution centre steering wheel focuses on Operations (safety and efficiency), People (appointment, development, commitment and values), Finance (stock results, operating costs) and the Customer (accuracy, delivery on time). Through such performance measuring at all levels, quality standards are maintained and enhanced. Current Initiatives

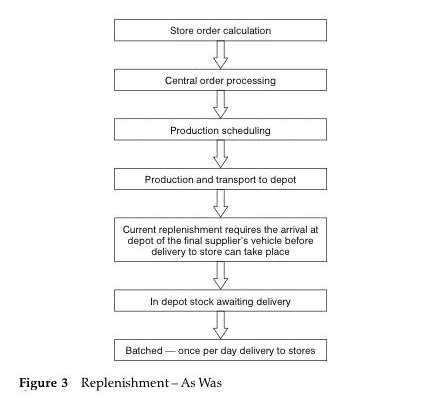

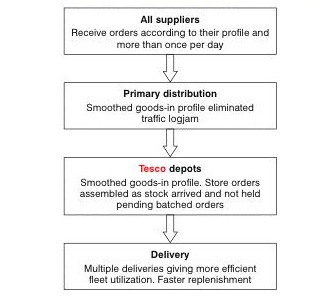

Jones and Clarke (2002) point out that despite the successes of the reconfiguration of the Tesco supply chain in the 1980s and 1990s noted above, analysis of the chain pointed to a number of areas where benefits could still be achieved. This first step involved the mapping of the traditional value stream. This mapping process demonstrated the stop” start” stop nature of the value stream (see appendix Figure 3). Second and consequently therefore, value streams that “flowed” were created/ designed (see appendix Figure 4). Third, arising from flow principles, Tesco began to look at synchronization and aspects of lean manufacturing by its suppliers.

Finally, Tesco utilized its consumer knowledge from its loyalty card to rethink what products and services should be located where in the value stream (Humby et al, 2003). Jones and Clarke (2002) describe this process as the creation of a “customer-driven supply chain”. Others might use the term “demand chain”. This process is essentially where Tesco is currently in terms of its supply chain. Clarke (2002) describes the five big supply chain projects that Tesco is currently engaged in (see also IGD, 2003a) and which derive essentially from the process outlined above:

Continuous Replenishment (CR)

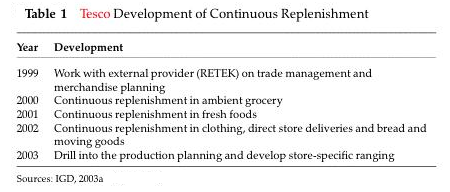

CR was introduced in 1999 and has two key features. First, there is a replacement of batch data processing with a flow system, and second, using the flow system, multiple daily orders are sent to suppliers allowing for multiple deliveries, reducing stockholding through cross-checking and varying availability and quality. This approach has been extended since 1999 (see appendix Table 1) and has further potential both domestically and internationally.

In-Store Range Management

Based on customer behaviour data and stock-holding capacity analysis at store, Tesco can now produce store-specific planograms and store-specific ranging. The system is designed to improve store presentation as well as stock replenishment and availability. Tesco is able to provide the exact stock requirement for specific shelves in specific stores to its out-replenishment system. This system has been rolled out in 2003/ 5.

Network Management

Network management attempts to integrate and maintain the network assets and extend the life of the system. Two new sites in 2001 added 18 per cent to the capacity of the system. The frozen element of the composite system has been centralized in a new frozen centre, allowing chill and ambient expansion in the released space. Cross-docking is used at the regional centres for frozen and slow-moving lines. Consolidation centres provide fresh produce for cross-docking. These changes have produced a more integrated network which has made better use of the assets, extended the life of centres and improved performance by selecting the right “value stream” for appropriate products.

Flow-Through

As noted above, flow-through or cross-docking is now more extensive. Product storage is now much reduced and increasingly distribution centres have no racking and do not store product. The importance of cross-docking is set to increase, given the substantial savings delivered from reduced stock holding. A different but nonetheless important aspect of flow-through is the use of merchandisable ready units to allow product to be put on sale in stores without extra handling. Such units (often called “dollies”) are increasingly common in fast-moving items, but can be used for many other items as well.

Primary Distribution

Primary distribution and factory gate pricing (FGP) is the area of focus for cost reduction in inbound logistics. Primary distribution is the term Tesco prefer, seeing the process as a ‘strategic change in the way goods flow… (and about) achieving efficient flows and not a pricing process” (Wild, quoted in Rowat, 2003: 48).

However cost reduction is a key driver behind the interest in primary distribution. Essentially, primary distribution is about control (and pricing) of the supply chain from the supplier despatch bay to the goods in bay of the retail distribution centre. It separates out the cost of transportation from the purchase price of the product itself, and by putting it into a separate primary distribution budget, it allows direct control and analysis by Tesco. By March 2003, 30 per cent of all Tesco inbound freight was under such agreements, which amounts to 300 million cases annually or 10,000 deliveries a week from 500 suppliers.

Prior to this initiative, the commercial buyer used to purchase products at a price which included the delivery by the supplier into the retail distribution centre. The gross margin, on which buyers are measured for performance, is the difference between this purchase price and the price charged to the consumer at the retail store. Hence, as can be imagined, removing the transport cost element from that purchase price impacts on the way the gross margin is calculated, and the commercial buyers have to adjust their targets accordingly. It is a major financial development within a retail organization to implement such a change and still retain strict control over the disciplines of making individual buyers accountable for achieving the new level of gross margins during the period of transition.

Primary distribution is a strategy that requires the cooperation of the whole of the supply chain including the retail buyers. This Tesco achieved by bringing together cross-functional teams and by the full endorsement of the policy from senior directors including the chief executive. Naturally the suppliers, and their transport service providers, went through quite major changes to their arrangements for the delivery of their goods to the retail distribution centres, as they implemented this policy planned by the primary distribution team at Tesco.

It was now the retailer, not the supplier, that appointed which transport and distribution companies would do this work, at a price negotiated directly between the retailer and the logistic service provider. It is not surprising, therefore, that there was some adverse reaction in the industry, especially from those transport operators that had lost work as a result. As a result the remaining volume from those suppliers and manufacturers, which they still had to deliver to other retailers, was no longer at a volume and delivery pattern that was economical without raising costs. This, they said, was the direct result of the primary distribution decisions made by the retailer to reorganize the consolidation of product delivery.

The case put forward by the retailer was that to maximize competitive advantage, the whole supply chain needed to be aligned with the demand patterns of consumers, and that this must now include primary distribution. It further argued that it saw no justification for other retailers to benefit from the economies of scale derived from the major retailers, which ordered the majority of the volume. Factory gate pricing is a sign of a very mature retail supply chain.

It provides both full visibility of the costs and the accountability to organize how the primary network is structured. It requires a high level of co-operation between suppliers and retailers to leverage the benefits of a fully controlled supply chain. The result for Tesco is significant cost savings and thus lower prices for consumers. For those involved with Tesco in this there are major opportunities for the most efficient distributors, and the manufacturers may see their jobs becoming simpler, through changed collection and backhauling procedures. Tesco’s vision for primary distribution is an in-bound supply chain which is visible, low-cost, efficient and effective.

The current position for Tesco’s supply chain is therefore again one of change. The reconfiguration of the 1980s and 1990s has now been modified by the conceptual and intellectual approaches of the recent years. The ideas of how a supply chain should look, perform and be costed are sweeping through the existing system and those that supply product into it. In the same way that Tesco itself does not stand still, so too the supply system is having to adapt and change.

SWOT Analysis

“Tesco is one of the largest food retailers in the world. In addition, the group also sells non-food items, electrical goods, home entertainment technology and clothing. Tesco is the number 1 retail operating group in the UK”. (Brenda, 2007) The group’s leading market position in the UK enhances its brand, provides economies of scale and makes it easier for the group to launch private label brands. However, intense competition in both domestic and international markets could adversely affect its profitability.

The Future: Evolution or Revolution?

It is impossible to fully predict the future and to state categorically what the Tesco supply chain will look like in the coming years. Some things are known, however. The processes and procedures described above that have been put in place by Tesco have at least five more years to run. They will change the supply chain but represent the continuing evolutionary influence of developments already known. Likewise, work in the area of environmental aspects of logistics will continue to place pressure on retailers and suppliers to improve their performance. Key performance indicators at government and other levels are becoming more fundamental (for example DETR, 1999; DfT, 2003a, 2003b).

Concerns about the environment and about aspects of recycling and reuse will continue to be influential. Perhaps however the future could be more radical. While the concerns above will undoubtedly be maintained and influence supply systems, the processes put in place may also have more wide-reaching consequences. Tesco is at the beginning of understanding all the issues in primary distribution. Manufacturers likewise are only now getting to grips with some of these issues. Is the scene set therefore for a more fundamental examination of the supply relationships. Jones (2002) puts forward a variety of scenarios for grocery supply chains.

All have at their heart a move away from the current system of bigger, centralized and dispersed to a model of faster, simpler and local. Such a system focuses on moving value creation towards consumers and eliminating non-value creation steps in supply. Information systems are simplified so as to avoid order amplification and distribution. The supply chain is thus compressed in space and time, producing and shipping closer to what is needed just in time. As Jones (2002) concludes, “We can not predict exactly what forms these developments will take.” Nevertheless there are huge opportunities for improving the performance of the grocery supply chain, for those willing to think the unthinkable.”

Conclusion

This paper aimed to understand and account for the changes in logistics in food retailing by examining changes in Tesco logistics. The basic premise was that the transformation of retailing that the consumer sees at store level has been supported by a transformation of logistics and supply chain methods and practices. In particular, there has been an increase in the status and professionalism in logistics as the time, costs and implications of the function have been recognized. Professionalism has been enhanced by the transformation of logistics through the application of modern methods and technology.

For all retailers, the importance of distribution is now undeniable. As retailers have responded to consumer change, so the need to improve the quality and appropriateness of supply systems has become paramount.

The Tesco study demonstrates many aspects of this transformation. In response to a clear business strategy, logistics and supply chains have been realigned. From a state of decentralization and poor control, the company has moved through centralization and composites which enabled control to be exercised stringently. These in turn have led to new methods and relationships in supply systems, both within Tesco and throughout the supply chain.

Logistics does not stand still, and recognition of the need to think clearly about supply pervades the case study. The developments outlined above and the transformation described are not the ultimate solutions. As consumers change their needs, so retailing must and will respond. As retailing responds, companies will modify their operations, not least their logistics, or be placed at a competitive disadvantage.

References

Akeh urst, G (1984) Checkout: the analysis of oligopolistic behaviour in the UK grocery retail market, Service Industries Journal, 4 (2), pp 198-242.

Burt, S L and Sparks, L (2002) Corporate branding, retailing and retail internationalisation, Corporate Reputation Review, 5 (2/ 3), pp 194-212.

Burt, S L and Sparks, L (2003) Power and competition in the UK retail grocery market, British Journal of Management, 14, pp 237-54.

Child, P N (2002) Taking Tesco global, McKinsey Quarterly, 3, pp 135-44.

Clarke, P (2002) Distribution in Tesco. Presentation for Tesco UK Operations Day. Web.

Corina, M (1971) Pile It High, Sell It Cheap, Weidenfeld and Nicolson, London.

Department of Environment, Transport, and the Regions (DETR) (1997) Good Practice Case Study 364: Energy savings from integrated logistics management, Tesco plc, HMSO, London.

DETR (1999) Energy Consumption Guide 76: Benchmarking vehicle utilisation and energy consumption, measurement of Key Performance Indicators, HMSO, London.

Department for Transport (DfT) (2003a) Benchmarking Guide 77: Key Performance Indicators for non-food retail distribution, HMSO, London.

DfT (2003b) Benchmarking Guide 78: Key Performance Indicators for the food supply chain, HMSO, London.

Edwards, C and Gray, M (1990) Tesco case study, in Electronic Trading, DTI, HMSO, London.

Fernie, J (ed) (1990) Retail Distribution Management, Kogan Page, London.

Fernie, J (1997) Retail change and retail logistics in the UK: past trends and future prospects, Service Industries Journal, 17 (3), pp 383-96.

Humby, C, Hunt, T and Phillips, T (2003) Scoring Points: How Tesco is winning customer loyalty, Kogan Page, London.

Institute of Grocery Distribution (IGD) (2003a) The Tesco International Report, IGD, Watford.

IGD (2003b) Retail Logistics 2003, IGD, Watford.

INS (1991) Tesco: Breaking down the barriers of trade, INS, Sunbury-onThames.

Jones, D T (2001) Tesco. com: delivering home shopping, ECR Journal, 1 (1), pp 37-43.

Jones, D T (2002) Rethinking the grocery supply chain, in State of the Art in Food, ed J-W Grievink, L Josten and C Valk, Elsevier, Rotterdam. Web.

Jones, D T and Clarke, P (2002) Creating a customer-driven supply chain, ECR Journal, 2 (2), pp 28-37.

Kelly, J (2000) Every little helps: an interview with Terry Leahy, CEO, Tesco, Long Range Planning, 33, pp 430-39.

Kirkwood, D A (1984a) The supermarket challenge, Focus on PDM, 3 (4), pp 8-12.

Kirkwood, D A (1984b) How Tesco manage the distribution function, Retail and Distribution Management, 12 (5), pp 61-65.

MacLaurin, I (1999) Tiger by the Tail, Macmillan, London.

Mason, T (1998) The best shopping trip-How Tesco keeps the customer satisfied, Journal of the Market Research Society, 40 (1), pp 5-12.

McKinsey Global Institute (1998) Driving Productivity and Growth in the UK Economy, McKinsey, London.

Powell, D (1991) Counter Revolution: The Tesco story, Grafton Books, London.

Reynolds, J (2004) An exercise in successful retailing: the case of Tesco, paper 26 of Retail Strategy: The view from the bridge, ed J Reynolds and C Cuthbertson, Elsevier Butterworth-Heinemann, Oxford.

Rowat, C (2003) Factory gate pricing: the debate continues, Focus, pp 46-48.

Seth, A and Randall, G (1999) The Grocers, Kogan Page, London.

Smith, D L G (1998) Logistics in Tesco: past, present and future, in Logistics and Retail Management, ed J Fernie and L Sparks, pp 154-83, Kogan Page, London.

Smith, D L G and Sparks, L (1993) The transformation of physical distribution in retailing: the example of Tesco plc, International Review of Retail, Distribution and Consumer Research, 3 (1), pp 35-64.

Sparks, L (1986) The changing structure of distribution in retail companies, Transactions of the Institute of British Geographers, 11 (2), pp 147-54.

Clive Humbly, Terry Hunt, Tim Phillips. (2007) Scoring Points: How Tesco Continues to Win Customer Loyalty. Kogan Page; 2nd Ed.

Patrick M. Dunne, Robert F. Lusch. (2007) Retailing. South-Western College Pub; 6 Edition.

Brenda Sternquist. (2007) International Retailing. Fairchild Books & Visuals; 2Rev Ed.

Appendix