Background

Riverbank Credit is a microfinance institution in Kenya that began in 2005 as a self-help group. At that time it was known as Riverbank Crescent Self Help Group. It had a membership of seven who loaned money to each other based on trust, character and type of business one operated.

However, as it continued to grow and the demand for its loans increased, the company was forced to initiate new strategies in order to transform itself to cope with the growing market. The market had new entrants and competition had increased, hence the need for innovation.

The business had also grown; hence issuing loans based on trust was no longer effective. The business was registered in February 2009 as a Savings and Credit Society Limited by guarantee (Riverbank savings and Credit LTD SACCO, n.d).

Methodology

The company reviewed its loaning system, saving system as well as its marketing operations. It also reviewed its organizational structure and the authorities and responsibilities in each level of management. A market survey was done to find the views of the customers on how the organization could improve its services.

Based on findings of the reviews done as well as the findings of the market research, the company initiated changes. It wanted to transform its structure, whereby at that time was being run by two people; the CEO and the operations manger who shared duties which were not clearly defined. The management was to introduce functional heads, whereby each would have clearly defined responsibilities and authority.

The company was to introduce information technology in its operations which included; development and marketing of its products, management of customer accounts and company records as will as in recruitment of employees (Pickup, 2008 & Riverbank savings and Credit LTD SACCO, n.d).

Objectives

First, the company wanted to develop quality products that would give it a competitive edge over its competitors. This was to be done by developing a variety of loan and savings products as well as ancillary services that met the specific needs of the market. Secondly, it wanted to expand its market share by venturing into new markets.

It planned to achieve this through effective market strategies and aggressive marketing activities. Thirdly, it wanted to attain effectiveness and efficiency in its operations. This was to be achieved by employing technological changes in the operations of the company (Harmon, 2007).

Riverbank business transformation process

A review on the business operations revealed how inefficient the operations of the business were. The market survey done had the following findings: First, the company’s products were not meeting the specific needs of the customers. Secondly, the company had a potential market in the unbanked sector, which mostly comprised of people operating small and medium businesses.

Most banks had a high account opening fee that this group could not afford. The company also found out that this target group had a constant cash flow which they didn’t have a place to save in order to plan for it (Morgan, et al, 2010).

The management recruited functional heads; managers for marketing, finance and accounting and loans and accounts management departments. These departmental managers would be responsible for designing and implementing strategies for those functions.

The strategies were to be aligned to the overall company’s strategy and the functional heads would be answerable to the top management-the CEO and the operations manager. Each department would coordinate with the operations manager in recruiting employees for their departments. The company was to have a technology manager who would be responsible for all technology developments in the organization.

The technology officer together with the top management, would work together to develop the company’s technology strategy in line with the corporate strategy. The strategy would then be employed in all departments in line with that department’s strategy (House & Price, 2009).

The management coordinated with all employees in coming up with a new vision and mission for the organization that redefined its purpose and goals. The new Vision was to create and sustain an economic environment, in which the ability to create wealth was to be determined by an individual’s ability to take advantage of opportunities rather than the wealth inherited.

Being that the organization was registered into a SACCO; the ownership was bound to change. Apart from the initial contributors of seed capital when the organization was still a self-help group, those who were registered into the SACCO could become owners. This was possible by contributing at least 5% of the capital, which would entitle them to not less than 5% of shares (Reuvid, 2005).

Coordination of departments was to be a key recipe for its success. The marketing department was to regularly do market research and the findings would be used with all sectors in making necessary changes. The loans and accounts management department was to incorporate technology in management of loan and account holders’ records.

Employees were to be trained on technology, its relevance to there area of responsibility and how they could exploit its benefits to the company’s success. The marketing department through the field officers would as well train the customers on the new changes brought about by use of technology, its benefits to the customers and handle other difficulties that would arise in the field (McGrath, 2001).

Results of the transformation process

The company has been experiencing an increasing reduction in operation costs since 2009 when the technology was introduced. In 2009, cost reduced by 9% and 1% below the target. This was because initial costs of installation were high during that year. In the year ending 2010 the company registered a 22% reduction in costs. The company website has also been instrumental in the company.

It has helped in marketing of the company’s operations; hence this has attracted strategic partners like insurance companies. For insurance, in 2010 the company signed a contract with CIC insurance company, that the company would provide insurance services to Riverbank’s clients at relatively lower rates (Devaraj & Kohli, 2002).

The company’s clientele base had increased to 6000 customers by January 2011, which is a 400% increase from 150 customers in 2009. This is attributed to the creation of the marketing department. This has enabled the company to carry out market researches that have enabled it identify specific customer needs.

The department also together with the operations department recruited and trained field officers who were able to carry out aggressive marketing activities. The company is currently the leading all-inclusive SACCO in Kenya, both by customer base and profitability.

This has been possible by creation of functional departments which have been able to specialize in their functions and hence come up with innovative and quality services to customers (Tidd, Bessant & Pavitt, 2005).

Organizational Structure

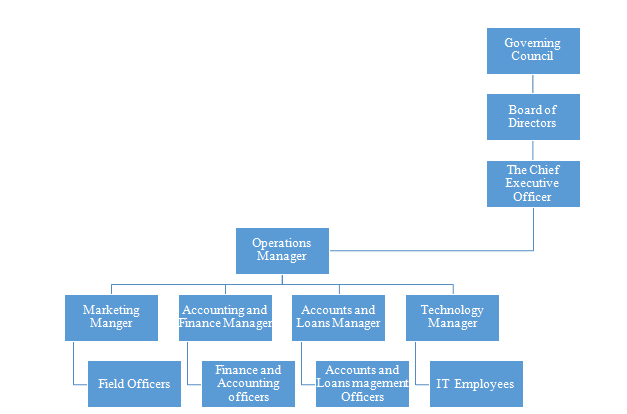

At the very top of the company structure there is the governing council. This is made up of the seven initial founders, but members of the SACCO who have bought the company’s shares are included into the ownership. Below the governing council is the Board of Directors which also has seven members.

It is answerable to the Governing Council. The CEO is at top most managerial position in the organization, followed by the operations manager. The various functional heads have employees in each of their departments and are answerable to the operations manager (Marks, 2008).

Riverbank’s Organization Structure. Source: Marks (2008)

One of the advantages of this structure is that it allows free flow of information, because a lot of bureaucracies are avoided. It is straight from the governing council to the functional heads. It also helps in avoiding overlapping and replication of tasks as each department’s responsibilities are clearly separated. This also helps in avoiding conflicts in the organization as each department knows its boundaries.

The main disadvantage is found in its simplicity. This has made other organizations to carry out many different tasks. For instance, the finance and accounting department has to manage the finances of the company as well as the accounting records. This is a big workload for the department considering that this is a financial institution (Fritz, 1996)

Challenges of the Marketing Manager

The marketing department has the following functions: First, is to carry out market research to identify specific market needs and also to identify potential markets that the organization can serve. Secondly, it markets the company’s products to current and potential customers. This includes identifying marketing strategies as well as medium of communication.

It also works with other departments to develop products that will meet the specific needs of the customers as stated in the findings of the marketing research. The company is also responsible for branding the company and its products and services. This also includes integrating the developed brand in all the company’s departments (Weissbrich, 2009).

One of the challenges of the marketing manager is to coordinate with other departments because each of these departments have a range of varied objectives. The main challenge comes when the marketing department is required to align its objectives with those of other departments. For instance, the Finance and accounting department strives for efficiency, by trying as much as possible to limit expenditure.

These conflicts with the marketing departments need for increased spending in order to aggressively market. Therefore, reaching an agreement on the marketing budget is not easy (Weissbrich, 2009).

There is coordination between the marketing and the loans & accounts management department because the marketing department is responsible for attracting customers, by explaining to customers the services that the organization would offer. Loans and Accounts management department is supposed to provide the marketed services.

The challenge is ensuring that the loans department delivers the services to satisfy the customers as promised by the field officers while marketing. The other challenge is recruiting, training and retaining the field officers as well as obtaining their commitment to the organization. This line of business requires that the company’s marketing department be effective in developing and implementing the strategies.

The company must be able to recruit effective field officers, train them into the company’s strategy and ensure that they actually apply it. Lastly the company should be able to retain them to ensure there is consistency (Hofmeyr, 2003)

Riverbank’s PETSLE factors

Riverbank has various factors in its business environment that affect its operations. They include: First, political factors, which include the actions of political parties and other political movements. The SACCO is benefiting from the political stability that is being restored in the country after the 2007 post election violence.

However, as elections are approaching in 2012, the company is reluctant to open more branches in some parts of the country because the political temperatures are heating up and there is fear that the country might get back to war. Furthermore, the political reforms that were supposed to ensure institutions are empowered have not been implemented completely (Haberberg & Rieple, 2008).

The other political factor that affects the company is the warm reception that most of the local political leaders have shown the company. Many local government leaders around Nairobi slum areas have endorsed the company as a provider of financial services to the low economy class. The bank has few entry requirements as compared to formal Banks.

This has a positive impact on the company because many people in these areas trust their political leaders. The political factors have both positive and negative impact to the company. However, if the political reforms are instituted before the elections there will be little to worry about (Osborne & Brown, 2005)

Economic factor is another major factor that affects the company’s progress. A bigger percentage of the company’s customer base is comprised of small and medium business entrepreneurs. The performance of their businesses mostly depends on the performance of the general growth of the economy. If the economy is doing well, then there businesses will also benefit.

As a result, they will have more savings and the demand for loans will increase as well. The Kenyan economy has been experiencing positive growth in the past two years. This has been an impetus behind the increased demand for loans that has seen the company’s loan given out increase from $20, 00000 in 2009 to about $29, 0000 in 2010 (Bensoussan & Fleisher, 2008).

Another economic factor is taxes. Increase in tax on consumer goods has reduced consumer purchasing power. This has a direct effect on savings because when taxes go up the customers’ disposable income depreciates in value and customers reduce there savings. Taxes on consumer goods have been increasing and this has been weakening the consumers’ purchasing power.

Increase in taxes also affects the businesses operation costs. When taxes are increased, operation costs also increase. For instance, increase in fuel tax has adversely affected the company.

Fuel costs, account for a large percentage of the company’s expenses because field officers and loan and account officers are always in the field to meet customers. Therefore, when taxes on fuel are increased the company is bound to feel the pinch (Bensoussan & Fleisher, 2008).

Fayol’s 14 Principles of Management as applied in Riverbank

There are various areas of the organization that have applied these principles. They are as explained below: Division of work: The organization has ensured that there is division of labor to various functional departments according to their specialization. There are clear departmental boundaries that ensure each department deals with a specific area of the organizations’ operations.

For instance, marketing department is charged with the responsibility of marketing the products of the organization and carrying out research and no other department does that. Authority and responsibility: This can be seen in the functional departments.

The functional heads are responsible for the activities that take place in their respective departments. In addition, they have authority to order the implementation of certain activities. However, the authority is only limited to their departments. If an employee disobeys their authority they can punish them (Aquinas, 2005).

Unity of command: Each employee is only bound directly by the authority of the head of department in which they work. Thus, if a manger from a particular department wants something done by an employee in another department, he/she will go through the head of the department in which the employee is working at. This ensures there is no conflict of command.

Unity of direction: The company has an overall corporate strategy that each individual and department is required to work to achieve. Every departmental head is required to design and implement their strategy in line with the corporate strategy. This ensures that everyone in the organization is moving in the same direction (McCabe, 2008)

Centralization: the company has embraced decentralization concept, whereby authority has been dispersed to the lower levels of the organization. Every level of management has some given level of authority that it can exercise. The top management is composed of the governing council, the board of directors and the CEO.

This level has authority to decide on the long-term goals of the organization and the line of business as well as the products that it will deal in. The operations manager has authority over the departmental managers. She makes decisions on matters concerning more than one department as she is responsible for coordination of the departmental activities. The departmental heads have authority over the employees they lead.

They make decisions on matters concerning the performance of their various departments. The top management also exercises some level of freedom on its subordinates, by allowing them to make decisions for the organization as long it is within their authority (Watson, Gallagher & Armstrong).

Scalar chain: The organization structure defines the flow of authority from the governing council to the technical employees at the bottom. This also shows how information is supposed to flow from top to bottom or from bottom up. Everyone has an obligation to report any matter to the immediate superior, exceptions only occur in extra-ordinary circumstances.

For example, when the immediate head is uncooperative, then one can skip him/her. In spite of the organization doing well in some principles of management, it has failed in some areas. There is lack of equity: Employees in lower levels are paid relatively lesser amounts as compared to those in top management.

For instance the loan officers are paid twelve times lesser remuneration as compared to the operations manager. This shows that the principle of remuneration has not been met as well (Gallagher & Tombs, 1997).

In addition, this has led to lack of discipline because employees have disobeyed their superiors several times when asked to do some work, yet their pay has been delayed. This has also resulted into high employee turnover.

Field officers have also been forced to recruit more customers in an attempt to make more money. This has made them to compromise the interest of the organization. As a result, the principle of subordination of individual interest from the general interest has not been adhered to (Gallagher & Tombs, 1997).

Conclusion

It is evident that Riverbank Credit Ltd has made great strides after implementing new business processes. Started as a self-help group with seven members, now it has over 6000 members after incorporating technology in its processes as well as changing its structure.

This has enabled the company to effectively use its functional departments in identifying and developing products that meet specific customer needs. The company also faces PESTLE factors, some of which favors its operations while some have adverse effects.

In addition, the company has managed to use some of Fayol’s principles of management, at least six of them. However, there are areas that still need improvement. Therefore, if it succeeds to make improvement in those areas it will have a competitive edge over its competitors.

References

Aquinas P.G., (2005). Principles Of Management. New Delhi: Anmol Publications PVT. LTD.

Bensoussan, B. E., and Fleisher, C. S., (2008). Analysis without paralysis: 10 tools to make better strategic decisions. Upper Saddle River, NJ: FT Press.

Devaraj, S. and Kohli, R., (2002). The IT payoff: measuring the business value of information technology investments. Upper Saddle River, NJ: FT Press.

Fritz, R. (1996). Corporate tides: the inescapable laws of organizational structure. San Fransisco, CA: Berrett-Koehler Publishers.

Gallagher, K. and Tombs, S. (1997). People in organisations: an active learning approach. Oxford: Wiley-Blackwell.

Haberberg, A. and Rieple, A., (2008). Strategic Management: Theory and Application. Oxford, NY: Oxford University Press.

Harmon, P., (2007). Business process change: a guide for business managers and BPM and six sigma professionals. Burlington, MA: Morgan Kaufmann.

Hofmeyr, J. and Rice, B., (2003). Commitment-Led Marketing: The Key to Brand Profits Is in the Customer’s Mind. Lansdowne: Juta and Company Ltd.

House, C. H.and Price, R. L., (2009). The HP phenomenon: innovation and business transformation. Stanford, CA: Stanford University Press.

Marks, E. A., (2008). Service-oriented architecture governance for the services driven enterprise. John Wiley and Sons.

McCabe, S., (2008). Marketing communications in tourism and hospitality: concepts, strategies and case. Burlington, MA: Butterworth-Heinemann.

McGrath, M. E., (2001). Product strategy for high technology companies: accelerating your business to web speed. New York, NY: McGraw-Hill Professional.

McGarity, T. O., (1991). Reinventing rationality: the role of regulatory analysis in the federal bureaucracy. New York, NY: Cambridge University Press.

Morgan, M., Cole, A., Johnson, D. and Johnson, R., (2010). Executing Your Business Transformation: How to Engage Sweeping Change Without Killing Yourself Or Your Business. Hoboken, NJ; John Wiley and Sons.

Osborne, S. P., and Brown, K., (2005). Managing change and innovation in public service organizations. New York, NY: Routledge.

Pickup, S. L., (2008). Defense Business Transformation: Status of Department of Defense Efforts to Develop a Management Approach to Guide Business Transformation. New York, NY: DIANE Publishing.

Reuvid, J., (2005). Managing business risk: a practical guide to protecting your business. London: Kogan Page Publishers.

Riverbank Savings and Credit SACCO LTD (n.d). Our Organization. Web.

Tidd, J., Bessant, J. R. and Pavitt, K., (2005). Managing innovation: integrating technological, market and organizational change. West Sussex: John Wiley and Sons,

Watson, G., Gallagher, K. and Armstrong, M., (2005). Managing for results. London: CIPD Publishing.

Weissbrich, D., (2009). The marketing-sales-finance triangle: an empirical investigation of finance-related interactions & managerial challenges among marketing, sales, and finance actors. Heidelberg: Gabler Verlag,