Abstract

Sony Corporation was not afraid to embrace change. In fact, the company was proactive when it comes to implementing change, hoping to guide a successful organization into the 21st century.

The moves made were radical considering the fact that the company’s core business was in manufacture of consumer electronics goods and yet it acquired Columbia Pictures and CBS Records.

From the point of view of change management, the company leadership did everything right in securing the cooperation of various stakeholders even when it was clear to many that Sony was in uncharted waters.

The acquisition of a movie company and a recording company was difficult to justify, however, Sony was able to pull it through.

Finally, change was implemented but at the end Sony realized that the commitment to implement change is not enough, it is also crucial to apply due diligence to figure out the long-term effect of a strategic move.

Introduction

In the decade of the 80’s and 90’s there was an electronic gadget that was ubiquitous from Tokyo to New York. It was none other than the Sony Walkman. At the same time household from Asia, Europe and America were entertained using a Sony Television set and the most popular model was the Sony Trinitron.

The once humble and unknown Japanese electronics company has taken the world by storm and was one of the most profitable corporations in the 20th century.

They key to their success was innovation, specifically the creation of miniaturized and portable music machines as well as cutting-edge technology that powered their TV set. Music lovers used their Walkman to enjoy music whenever and wherever they want to listen to their favorite songs.

At the same time TV viewers were delighted with the picture quality of the company’s Sony Trinitron TV set.

Needless to say, Sony became the undisputed leader in consumer electronics and was considered a savvy innovator with a knack for knowing what the people really wanted when it comes to consumer electronic goods (Nathan, 1999, p.10).

However, change management was not the strongest suit of the company’s corporate leaders during the latter part of the 20th century. It was difficult to change something that was profitable for a long time.

The corporate leaders at Sony made the decision to expand its presence in the United States and set their sights on the U.S. entertainment industry.

The company tried to change but the attempt failed (Tabuchi, 2012). The corporate leaders and major investors at the Sony Corporation must think long and hard on how to implement an effective change management program that could help the company succeed in the 21st century.

Literature Review

Sony was a small Japanese firm when it started but after a few decades, it became a household name due to its innovative electronic products. Phenomenal is the best word to describe the impact of the Sony Walkman and the Sony Trinitron TV.

The company was a leader when it comes to revenue, innovation, and mass appeal. Sony endeared itself to countless millions around the world with a parade of electronic products that are both cutting edge and practical (Nathan, 1999).

The company charged ahead and made daring moves to expand its manufacturing capability to meet soaring demand. Sony Corporation decided to expand and trained its sights on the lucrative U.S. entertainment industry. The decision to buy a film studio was a major leap for the electronics company.

The move could be considered as an extreme example of integration wherein one company tries to control every aspect of the business. For example, a restaurant purchased a farm so that everything that it needs in the kitchen is sourced from this farm.

Nonetheless, it does not require an expert in business management to know that this type of integration does not work all the time. Most of the time it is best to work with suppliers; for instance, manufacturing firms buy components from other firms.

In the case of Sony the purchase of a movie company cannot be considered integration because there is a huge divide between a television set and the movies that are viewed through it. The business decision was mind boggling because the acquisition of Columbia Pictures is not even remotely related to the electronics business.

However, corporate leaders of the company believed it was the right move.

Richard Lynch explained their decision through this remark: “The strategic logic here was that of developing a vertically integrated company – from the service that develops the pictures and music to the machines that deliver them in individual’s homes” (2006, p.207).

Richard Lynch’s explanation made sense however, it is difficult to comprehend how vertical integration could be achieved because those who purchased Sony Trinitron TV are not compelled to buy movies that were produced by Columbia Pictures.

Therefore, when Sony purchased Columbia it was a business transaction that benefited Columbia Pictures but it did nothing to improve the sales of Sony’s electronic products.

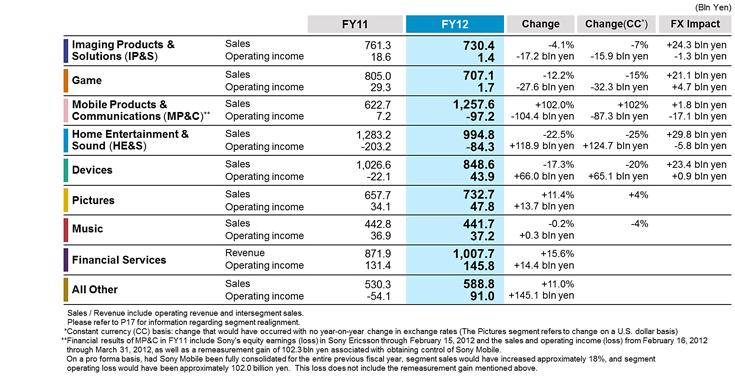

Fig.1. Financial Year 2012 Results by Segment (Sony Group, 2013).

Consider for instance the original name of the company; it was called the Tokyo Telecommunications Engineering Corporation.

Therefore, Ibuka and other pioneers laid the business framework that future leaders should follow. It was a statement that the identity of the organization was bound up in technology and hardware. However, decades later, Sony was in the business of making movies.

In order to have a clear picture on how far the company has deviated from its core business, consider the information gleaned from a case study of Sony Corporation, specifically the circumstances that surrounded the deal to acquire Columbia Pictures:

On September 24, 1989, Sony … bid $3.4 billion in cash for Columbia Pictures Entertainment Inc. It was the highest bid ever by a Japanese company for any U.S. property. In addition to the cash price, the Japanese electronics giant assumed nearly $2 billion in debt and contractual obligations (Spar, 2003, p. 368).

Aside from Columbia Pictures, Sony also invested in the purchase of CBS Records. All of a sudden Richard Lynch’s explanation made sense, Sony wanted to produce the music that people would listen to with their Walkman.

Immediately after the acquisition of the said movie company and the music recording company, the financial situation at Sony began to change from bad to worse.

In the early part of the 1990s, problems began to crop up, specifically in relation to the acquisition of CBS Records and Columbia Pictures. Consider the highlights below (Spar, 2003, p. 378):

- 1990 – Columbia Pictures Entertainment suffered negative cash flow

- 1991 – the combined cash flow of Sony Pictures and Sony Music turned negative

- 1992 – In the third quarter alone, announced a 37% decline in operating income

- 1993 – The film Last Action Hero a $60 million production, bombed at the box office

It did not take long before the executives and shareholders realized that the creation of Sony Music and Sony Pictures was an ill-advised move.

The negative cash flow and the failure to realize their objectives were unacceptable to the shareholders and therefore a major change needed to be initiated in order to bring back Sony Corporation to the top of the list of the most profitable company in the world.

The changes that were made right after the dismal performance of the company shook the foundation of Sony. In fact the core leadership and most probably the board of directors were compelled to hire an American to become the company’s first ever CEO.

Several years later a commentary was written with regards to the historic move, “Sony Corporation of Japan did something almost unheard of in Japanese business circles.

It appointed a Welsh-born American citizen as head of the Japanese company” (Lynch, 2006, p. 107). A message was sent and it reverberated all over the world.

Michiyo Nakamoto, made the revelation that the crisis surfaced as early as April of 2003 and she added that at the same year, “…Sony revealed a sharp deterioration in its electronics business and weak mobile phone sales.

It launched a costly overhaul to regain its competitive edge. Yet barely halfway through that three year exercise Sony is again faltering” (2005).

Richard Lynch on the other hand made a complimentary analysis that supported Nakamoto’s observation and he wrote that Sony’s woes could be the result of the following: a) threat from low-wage labor manufacturing and b) shifting away from innovative products e.g. liquid crystal display (LCD) screens (20006, p. 108).

It was made clear that the former CEOs of Sony dreamt of making a great deal of money by venturing into the entertainment industry while at the same time prodded the other half of the company to manufacture and sell consumer electronic goods.

The juggling act did not work and there was no evidence to show that the firm accomplished vertical integration.

The company that was once known for its innovative technology made wrong assumptions when it comes to the future of music and TV technology.

Thus, the company was caught flat-footed in the fast transition to new technologies. Therefore, “Sony, which had not invested in manufacturing LCD panels, was forced to buy them from competitors”

(Nakamoto, 2005, p.12). This episode in Sony’s history helps explain the sudden rise to prominence of a Korean electronics company called Samsung. Needless to say, it was late in the game when the company realized that it was betting on the wrong technology.

Their problems could be traced back to the day they purchased Columbia Pictures and CBS Records. The rush to consolidate in the guise of vertical integration was a major blunder in company history.

For example, CBS Records was in the business of producing music and therefore, it placed the company in bind because it could not invest in a technology that could store music in a digital format. During that time no one knew how to handle the thorny issue of copyright infringement and digital music files.

In fact, Sony’s corporate leaders were adamant to “discourage the electronics division from marketing a portable player that could download music from the Internet” (Nakamoto, 2005, p.14). It was also the same time period when the Steve Jobs and his team were poised to change the world with their Ipod.

Sony had the resources and the technological capabilities to develop a device similar to iPod, however, all plans related to its development were considered taboo because of CBS Records.

It is important to point out that two major changes were made in the latter part of the 20th century. First, there was a rush to create vertical integration and second, there was the radical move to hire an American CEO to drastically alter the fortunes of the ailing company.

However, it is also important to point out the theoretical frameworks needed to understand the change process.

There are at least four major categories of change and these are: 1) Evolutionary; 2) Dialectics; 3) Life Cycle; and Teleological. Evolutionary change is a continuous cycle of variation, retention, and selection that could result in gradual or radical change (Sengupta & Bhattacharya, 2006, p.5).

The dialectic theory of change on the other hand talks about the “existence in a pluralistic world of ambiguous and contradictory forces and values that compete with one another to get control over the others” (Sengupta & Bhattacharya, 2006, p.5).

However, the life cycle theory of change proposes that there is a “linear and irreversible sequence of prescribed stages, which facilitates organization to move from the point of departure towards an end,” (Sengupta & Bhattacharya, 2006, p.5).

Finally, the teleological theory talks about the company’s “interaction with the external and internal construct and its effort to reach the defined goals” (Sengupta & Bhattacharya, 2006, p.5).

It is important to point out that the change made at Sony Corporation is described more effectively using a combination of the dialectics and teleological theory of change.

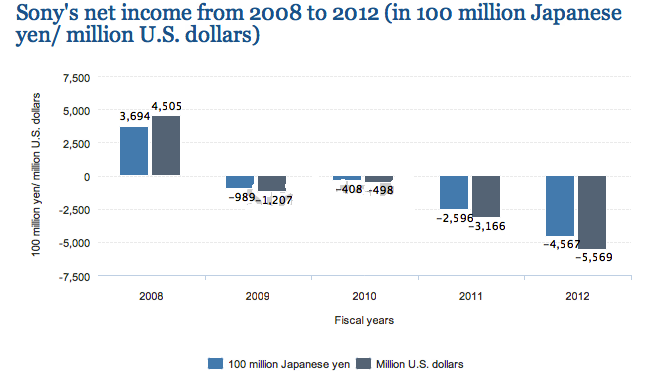

Fig.2. Sony Corporation’s Net Income 2008-2012 (Statista, 2012).

Analysis of the Research Findings

There were two major changes made in the latter part of the 20th century. First, Sony decided to expand and acquired CBS Records and Columbia Pictures. It could be argued that the dialectics and teleological theory of change is applicable in this instance.

With regards to the dialectics theory, the company was pressured to expand because at that time the company needed to sustain its growth. With funds at its disposable due to the phenomenal success of Sony Walkman and Sony Trinitron, the organization needed to invest in something that would ensure long-term growth.

In the dialectics framework there is pressure from competing forces and it could be argue that during this period Sony was wary of its rivals within the consumer electronics industry. Thus, there was the need to take the first step and there was the pressure to break away from the pack and take the lead in the race.

The teleological framework is also applicable in this instance because the company made goals to increase its profitability and ensure its position as the best consumer electronics company in the world.

Thus, the company decided that there is no other way to do it other than to increase its efficiency by creating synergy with other companies or other business partners. The decision was to establish vertical integration.

The stakeholders involved were the corporate leaders at Sony Corporation, CBS Records, and Columbia Picture. The other major stakeholders were the shareholders of the respective companies as well as the employees and customers of the three organizations.

With regards to the first major change that was made, the company must be commended when it comes to the preparation made and the actual activities that were geared towards making the change. The major stakeholders were aware of the decision and they fully supported the move.

The integration of CBS Records and Columbia Pictures into Sony Corporation was completed without a major glitch.

The change process was completed, however, this case study points out another major component of change and that is the decision-making process that was made prior to the goal of creating vertical integration. In the long run it was proven to be a costly mistake.

It is important to point out that the changes that were made were not the result of a life cycle process. In other words, it was not something that the leaders considered as inevitable. They made radical changes to the company because of the perception of competing forces and the fear of obsolescence.

In other words the company was eager to stay relevant and was more than eager to sustain its phenomenal growth. It is acceptable to make the conclusion that the company overreached and tried to do something that the organization was not built to handle.

The second major change was to overhaul the company’s management process by hiring an outsider. Needless to say it was not easy to get a unanimous vote to hire an American CEO.

An overview of Japanese history and culture, as well as an in-depth look at their management techniques would reveal that the Japanese people are almost fanatical in the way they value loyalty and raising up leaders and managers from the ground up.

Hiring an outsider who did not have a deep understanding of the company’s history was not a popular choice. However, the decision was made to deal with consequences of the Columbia Pictures and CBS Records fiasco.

The hiring of an American CEO is not an example of a life cycle type of change. In other words, it was not part of the natural growth and development of the company to hire an American business leader.

Thus, the change that was made was totally out of character. The change framework applicable is dialectics and teleological because the company responded to external pressure and made the decision to change.

The decision to hire an American CEO did not result in radical changes, such as, the sale of Sony Pictures and Sony Music.

It could be argued that the purpose of the hiring may have been to appease investors and to show stakeholders that Sony was trying its best to mitigate the impact of the decision to acquire two companies that struggled to make a profit.

Conclusion and Recommendation

The financial and business related problems of Sony Corporation are important reminders that organizational transformation must be top priority of the company.

The phenomenal growth of the company from a fledgling electronics consumer company in Japan to a world-leader in miniaturized music equipment to cutting-edge TV technology and its near collapse is proof that change must be constant. It is therefore critical to understand the nature of change.

Thus, business leaders must be grateful that thinkers and analysts were able to determine four broad categories of change management frameworks. Although there four major frameworks only two are applicable in the case of Sony’s change management process.

The dialectical and teleological frameworks could explain why Sony was compelled to make changes. These two frameworks focused on external and internal forces that created pressure for a firm to make the necessary changes to adapt. As a consequence Sony Corporation was compelled to make radical changes.

It is therefore imperative to point out that Sony did not wait for changes in the outside world to overtake them and render the organization obsolete. In fact, the company adopted a more proactive approach.

Other companies fail to embrace change. Sony did not fear change, however, the change management process that they adopted required a second look. The turning point was the decision to adopt vertical integration. Without a doubt leaders of various industries believe in the importance of vertical integration.

The purpose of vertical integration is to create a more cost-efficient operation. Moreover, the strategy was also implemented to significantly increase Sony’s market share when it comes to their portable music devices.

It is not clear however, how the leaders were able to connect a music recording company to a portable music device like Sony’s Walkman.

It is difficult to understand how someone could make the assumption that the purchase of Sony equipment would compel consumers to buy files, data, or software from the same organization.

For example, a car manufacturer is not expected to create their own tires because consumers have the freedom to choose the best brand.

There are so many things to consider when it comes to the purchase of ancillary items. Consumers base their decision on price, quality, and even the convenience of purchasing a particular item.

The justification to acquire CBS Records on the pretext of vertical integration requires a stretch of the imagination.

However, there seems to be no justification for the purchase of Columbia Pictures because Sony’s Trinitron does not operate using film from the movie studio. Therefore, it is hard to understand where vertical integration could be inserted in this particular business deal.

Executives at Sony must realize that the eagerness to anticipate change and the commitment to change are not enough to succeed. It is important to pursue due diligence in thinking through the decision process. For instance, the two companies struggled with billions of dollars in debts.

Secondly, there was no clear plan how Sony could transform a financial liability like Columbia Pictures into a cash cow. Furthermore, they purchased CBS Records at a time when music studios were losing money because of digital music files.

Sony Corporation must also reconsider how the company interpreted vertical integration. Even a small business firm understands that it is not prudent to integrate everything into the company’s supply chain. It is best to focus on their strengths and establish business partnerships to help them deal with their weaknesses.

The change process must not only focus on the need to change in the present time, it must also focus on the long-term and immediate effects of the changes that were made. A comprehensive feasibility study should have been included in the change management process.

Finally, Sony should rediscover its roots and remember that the company rose to prominence because of innovation and not the acquisition of other companies.

References

Lynch, R 2006, Shaking up Sony: restoring the profits and the innovative fire, Indiana University Press, Indiana.

Nakamoto, M 2005, Caught in its own trap: Sony battle to make headway in the networked world, Financial Times, London.

Nathan, J 1999, Sony: the private life, Houghton Mifflin Company, New York.

Sengupta, N, & Bhattacharya, M 2006, Managing change in organizations, New Jersey, Prentice Hall.

Sony Group, 2013, Financial year 2012 results by segment. Web.

Spar, D 2003, Managing international trade and investment, Imperial College Press, London.

Statista 2012, Sony’s net income from 2008 to 2012 (in 100 million Japanese Yen/million U.S. dollars). Web.

Tabuchi, H 2012, Sony revises expected loss to $6.4 billion. Web.