Introduction

This paper aims to present a flowchart of Parts and Suppliers, Inc.’s (PSI) sales process. The paper will also evaluate the design of internal controls for the sales process of the company.

Memo

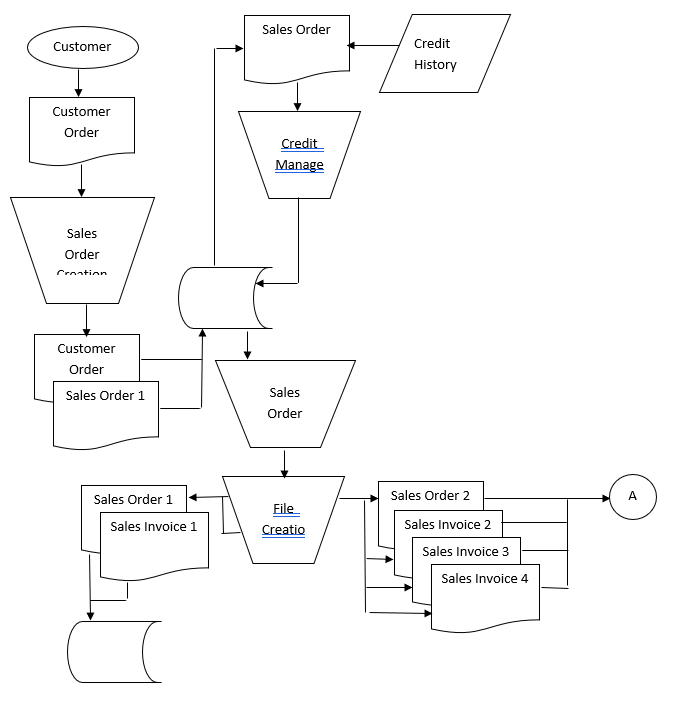

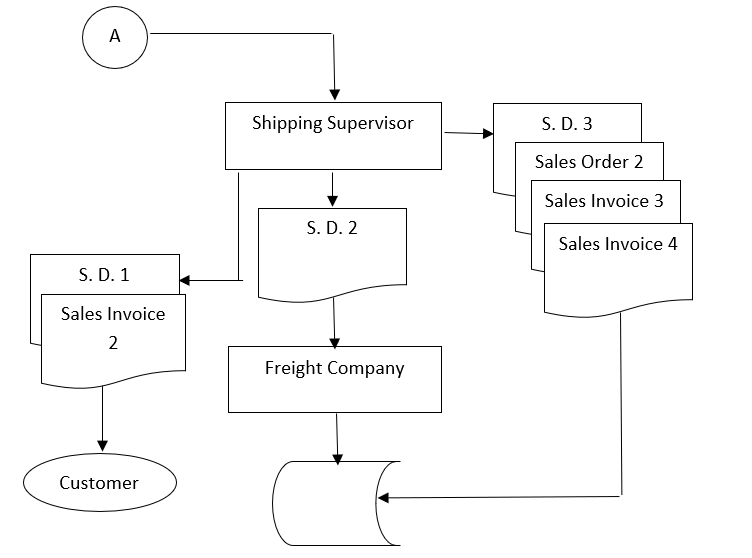

The auditor has conducted a test of internal controls for the sales process of PSI. Only one transaction cycle of the company’s economic activity has been inspected—the revenue cycle in which PSI receives revenue from its customers for provided products. The auditor has prepared a flowchart that documents a layout of the physical areas of the company’s sales process. The general ledger function, cash receipts transactions, and sales returns have not been included in the flowchart. The auditor has tested internal controls associated with “transactions, the assertions for accounts receivable, allowance for uncollectible accounts, and bad-debt expense” (Messier et al. 226). The purpose of internal controls testing has been to identify design and operation deficiencies of entity-level controls and evaluate their severity. PSI’s internal controls over its sales process relate to policies and procedures that exist to provide reasonable assurance that the maintenance of records of transactions is detailed and accurate. Also, the controls are necessary to ensure that all transactions are being made “by authorizations of management and directors” (Messier et al. 227) of the company. Furthermore, internal control over the sales process of PSI exists to guarantee that the unauthorized disposition of the company’s products does not occur. To document an understanding of PSI’s internal control elements, the auditor created a flowchart of the company’s sales process. The diagrammatic representation of the process has helped the auditor to analyze the strength and weaknesses of controls over sales transactions. The flowchart has been created based on a transcript of an interview with the company’s controller, Sally Harris, background information, and documents used in the sales process.

The auditor has conducted an assessment of control risk for the following sales transaction assertions: occurrence, completeness, authorization, accuracy, cutoff, and classification (Messier et al. 224). The strengths and weaknesses of each control activity were organized by the assertions. The company’s controls over the occurrence of sales transactions are efficient. No weaknesses have been found in a cutoff of sales transactions. However, the controls are not entirely effective when it comes to the completeness of sales transactions because open sales order file is not reviewed periodically. Also, sales managers can introduce changes to an authorized price list, which is a weakness of the control process, because they have an incentive to make more sales. The company does not seem to have specified terms of trade, which may lead to inaccuracy of sales transactions. Furthermore, there also is a minor weakness in controls of the classification of sales transactions. Namely, the company does not classify its sales invoices to distinguish between FOB Destination and FOB Shipping Point sales. It also does not have codes for different goods it sells.

Based on this evaluation, the auditor has concluded that PSI’s internal control over its sales process is effective and provides reasonable assurance that the company can achieve its objectives. Senior management of the company does not override its control activities. The auditor has concluded that control risk is low because the company effectively employs the segregation of duties in its sales transactions and relies on the proper authorization. However, some controls are performed manually, which might influence their operating effectiveness because they are subject to human mistakes. Despite the minor weakness of the company’s internal controls over sales transactions, it has been concluded that PSI’s control environment is sufficiently effective.

Parts and Supplies, Inc.

Analysis of Internal Controls over Sales Transactions 4/16/2017

- The occurrence of Sales Transactions

- Strengths

There is a segregation of duties between individuals responsible for determining an amount of credit and individuals responsible for the authorization of an order. All sales are recorded only with an authorized customer’s order and a copy of a shipping document (Messier et al. 224). - Weaknesses

N/A - Conclusion

Taking into consideration the fact that the sales force is not responsible for the company’s credit function, it can be argued that there is very little risk that PSI will incur bad debts. No implication of weakness.

- Strengths

- Completeness of Sales Transactions

- Strengths

The company relies on numerical orders of its sales invoices and sales orders. Furthermore, shipping documents are matched to sales orders. Also, the billing department stores a sales invoice, a sales order, and a shipping document in numerical order for each transaction. - Weaknesses

An open sales order file is not reviewed periodically - Conclusion

The company’s sales team should periodically examine open sales order files to ensure that there are no unfilled orders.

- Strengths

- Authorizationof Sales Transactions

- Strengths

Authorization of credit terms by the credit manager is the strength of the control. Authorization by the accounting department is necessary for introducing changes in standing data. - Weaknesses

Sales managers are authorized to change the price list - Conclusion

Many authorization procedures are required to ensure that goods are not shipped for customers with bad credit risk. However, changes to the authorized price list that are being introduced by sales managers who have an incentive to make more sales is a weakness of the process.

- Strengths

- Accuracy of Sales Transactions

- Strengths

PSI has an authorized price list that is regularly reviewed and approved by the management. Sales invoices are tied to shipping documents and are being checked by a shipping supervisor. - Weaknesses

The company does not seem to have specified terms of trade. Moreover, the interview showed that there is no comparison of prices to the authorized price list in the company, which may lead to transactions being recorded inaccurately. - Conclusion

The company should have terms of trade in order and compare prices of its goods to those specified in the authorized price list to avoid inaccuracies in dollar amounts of its transactions.

- Strengths

- Cutoff of Sales Transactions

- Strengths

The billing department receives sales invoices after goods are shipped to customers. The sales transactions are completed upon the entering of shipping dates into the system by a billing clerk. - Weaknesses

N/A - Conclusion

There is an authorization process preceding entering of sales invoices into accounting records. No implication of weakness.

- Strengths

- Classification of Sales Transactions

- Strengths

N/A - Weaknesses

The company does not classify its sales transactions. - Conclusion

All sales invoices have to be properly classified to distinguish between FOB Destination and FOB Shipping Point sales. Also, codes for different goods have to be in place.

- Strengths

Flowchart

To transcribe the interview with the controller of PSI into a visual format, it is necessary to create a flowchart. Figure 1 shows a flowchart of PSI’s sales process.

Conclusion

The paper has outlined the flowchart of PSI’s sales process. It has also presented an evaluation strengths and weaknesses of internal controls for the company’s sales process.

Work Cited

Messier, William, Steven Glover, and Douglas Prawitt. Auditing & Assurance Services: A Systematic Approach. 9th ed. McGraw-Hill, 2013.