Purpose

This analytical report provides quarterly PCs shipment from the second quarter 2011 to the same quarter 2012. It would allow PC vendors to evaluate and measure their sales performances against their major rivals worldwide. As a result, they would be able to adopt new sales strategies.

The report provides data on previous shipments of PCs. Therefore, PC manufacturers can use it to predict future PC shipments globally.

Summary

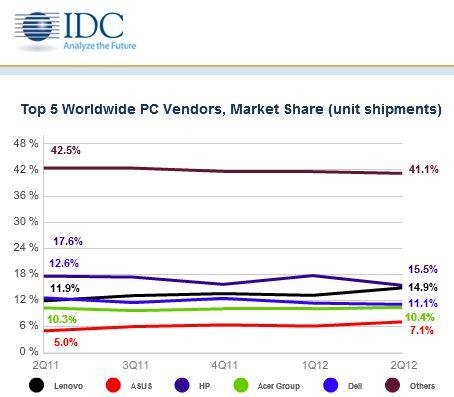

During the financial period of 2012 in the second quarter, PC shipments declined as compared to the same period the previous year. The general decline was 0.1 percent based on data from the International Data Corporation (IDC). The graph indicates that HP might lose its position to Lenovo. Overall, the market is cautious as innovative products emerge. Thus, new strategies are necessary for PC vendors.

Outlook

Overall, the worldwide PC market experienced a decline in shipments. The IDC noted that the actual results did not match earlier projections of 2.1 percent growth every year.

There were limited demands from major PC distribution channels within the first quarter of the year 2012. Most distribution channels did not want to increase their inventories before some PC firms could launch their new products.

Consumer apathy had contributed to low purchasing of PCs. They noted that it was not strategic to purchase PCs in a rapidly evolving technology environment. Consumers expected new products in the market. For instance, many waited for the launch of Windows 8.

In addition, others did not spend on PCs because of high prices. Demands for PCs have been low in the US and Europe. However, the wave of low demands increased in other regions like Asia. This marked a dismal performance for the year.

Figure 1: PCs Unit Ship 2011-2012

From the results, IDC could validate its projections for the second quarter of 2012. IDC had noted that the second quarter was a transition period in which consumers’ anticipation for new products and pricing factors played major roles to slow down PC shipment globally (IDC, 2012).

The introduction of new products and operating systems were critical in addressing the slow growth of PC shipments. These would assist distribution channels and consumers to know what to purchase.

The Graph

HP

HP was the top PC vendor worldwide, but it experienced a decline in most regions. Slow market conditions had created unfavorable conditions for HP. In addition, distributors aimed to adapt to market changes.

Lenovo

The vendor held the second position. However, Lenovo reduced the difference between itself and HP. Analysts believe that the growth of Lenovo would also decline in the coming quarters.

Dell

The manufacturer experienced significant declines over the period. Dell’s market shares declined while its target market segments did not perform well.

Acer

Acer recorded a steady shipment within the quarters. It was able to be ahead of other competitors. Although its European market had recovered, Acer faced declines in demands from other regions.

ASUS

ASUS has grown steadily over the quarters in most regions. Most of its shipments originated from Asian and EMEA regions. The vendor’s steady growth has spread to other regions too.

Regional Outlook

The US

The US market performed poorly than previously anticipated. It recorded a decline of 10.6 percent. Most vendors and suppliers faced declining demands for PCs. There was no incentive for buyers while others decided to wait for new products.

Lenovo increased its market share against its major competitor in the US market. It recorded a growth of 6.1 percent in PC shipments. Middle tier distributors are sensitive to market fluctuations because they lack extensive resources to strengthen their positions.

EMEA- Europe, the Middle East and Africa

EMEA region recorded a positive growth as earlier projected. Economic recovery in Western Europe was responsible for the growth. Central and Eastern Europe led the region as consumers’ demands for PCs increased. However, the growth remained positive but modest.

Japan

The country experienced a positive growth in the second quarter of 2012 despite poor performance in the first quarter. Most demands emanated from commercial sectors. The effect of the quake could have initiated demands for new PCs to replace the damaged ones.

Asia and Pacific region

The region experienced a slight decline in demands for PCs. Shipments had declined in India and China. Moreover, other markets also recorded slow growths. However, Lenovo performed well in this region.

Audience

This analytical report targets product developers and sales departments in various PC firms.

Recommendation

The report reveals that PC manufacturers face a tough market ahead. Technological, economic, and consumer factors have contributed to declines in demands for PCs. Thus, PC vendors must take the following initiatives:

- Sales departments must adopt new sales strategies

- PC manufacturers must create incentive for buyers

- PC vendors should introduce new competitive products in the market

- Vendors must look for emerging markets and many distributors in different regions

- PC manufacturers must be innovative to match changes in technologies

Report Conclusion

Overall, PC shipment has declined globally. Projections indicate that shipments would decline as economic, technological, and consumer factors change. Consumers have slowed down purchases while distributors want to clear inventories in preparation for new technologies and economic conditions. PC vendors need new strategies in such dynamic markets.

Reference

IDC. (2012). Global PC Shipments Stalled in the Second Quarter While Buyers Remain Cautious And Market Waits For New Products. Web.