Introduction

There are different factors, which influence the adoption of information technology (IT) in accounting by small business firms. Thong (1999) identified characteristics of organizational decision-makers, capabilities of technological innovation, organizational culture and external environment in which the business operates as some of the factors that affect the IT adoption decision of the small businesses. With the development of lower-cost and user-friendly mechanized accounting systems have improved the accounting practices of small business operators. With the proliferation of computer and computing technology several accounting software packages have been introduced in the market having distinctive features. This paper presents a detailed report on the salient aspects of Peachtree Complete Accounting software.

Overview of Peachtree Complete Accounting

Sage North America is a subsidiary company of Sage Group Plc. This company creates and markets Peachtree Complete Accounting software among several other accounting and business management software. The applications “cover a full range of business requirements including accounting, customer relationship management, contact management, human resources, warehouse management, specialized industry needs, among many others” (Sage Peachtree, 2010). Sage North America was started as a company with the combined effort of many entrepreneurs, who had a focus on the service to their customers. “For more than 30 years, companies that have joined the Sage family have assisted small and midsized businesses with a wide range of business management applications and services” (Sage Peachtree, 2010). Presently the company serves more than 2.7 million customers in the U.S. and Canada. Sage Peachtree product line meets the requirements of “construction, distribution, manufacturing, nonprofits and accountants.”

The company offers different products like Peachtree Pro, Peachtree Complete, Peachtree Premium and Peachtree Quantum. Peachtree Complete contains all the features of Peachtree Pro and in addition, this package offers inventory, and job costing possibilities. It also has “online bank reconciliation, electronic bill pay, 100+ customizable reports, and a multi-user version for increased productivity.” Website of the company claims that Peachtree accounting package offers superior quality and service. The product has “robust functionality in the areas of inventory, job costing, time and billing and fixed assets.” There are built-in accounting controls and better security to ensure accuracy and control.

The most important features common to all versions of Peachtree Accounting software are security, audit trail, account reconciliation, internal accounting review, backup and restore and alerts. Peachtree Complete Accounting is offered online at U.S. $ 239.99 for a single user package and for U.S. $ 559.99 for a five-user configuration. The application can work on Microsoft Excel and Outlook. Integration with Microsoft Word is possible with 2002, 2003 or 2007 versions of MS Word.

The Website of the accounting software recommends a system configuration of

- “1 GHz Intel Pentium® III (or equivalent) for single user and 1.8 GHz Intel Pentium 4 (or equivalent) for multiple users

- 512 MB of RAM for single user and 1 GB for multiple users” (Sage Peachtree, 2010a).

The minimum system requirements as suggested by the Website are:

- “1 GHz Intel Pentium III (or equivalent) for single user and multiple users

- 512 MB of RAM for single user and multiple users

- Windows® XP SP2, Windows Vista® SP1 or Windows® 7

- 1 GB of disk space for installation

- Internet Explorer 6.0 required; Internet Explorer 7.0 and 8.0 supported

- Microsoft®.NET Framework CLR 3.5. Requires an additional 280 MB to 610 MB

- At least high color (16-bit) SVGA video; supports 1024×768 resolution with small fonts required

- 2x CD-ROM

- All online features/services require Internet access with at least a 56 Kbps modem” (Sage Peachtree, 2010a).

Transactional Processing and Data Management

Transaction processing in any accounting package includes the recording of accounting transactions and business activities for the revenue, expenditure and financing cycles. This section describes the ways in which Peachtree Complete Accounting handles the recording of accounting transactions in these three cycles.

Revenue Cycle

“The revenue cycle is a recurring set of business and related information processing operations associated with providing goods and services to customers and collecting cash payment for those sales” (Scribd.com). Revenue cycle deals with revenues of the business and accounting for revenue cycle involves the recording of transactions relating to the processes of ordering, receiving, shipping and the like. Revenue cycle commences with the selling and shipping of the merchandise and ends with the receiving of the sale proceeds from the customer.

Creating and Maintaining Customers

In order to add a customer into Peachtree, at first, the Customers & Sales Navigation Center is to be opened. By clicking the “Customers” icon and selecting “New Customer” from the dropdown menu, one can start the process of adding a customer. This step will lead us to the “Maintain Customers/Prospects” window.

The “Maintain Customers/Prospects” window has five tabs to add the customer information – contact details and address, alternate shipping address; customer’s purchasing history, sales default information and credit card details and credit terms for the customer. After adding these information, the customer record needs to be saved by clicking the “Save” icon. After this step, one will be able to record transactions in Peachtree for the customer, in respect of whom the details have been entered. If an existing accounting system is converted into Peachtree system, it is necessary to enter the beginning balance of the customer need to be entered in the “Customers Beginning Balances” window. Details of invoice number, date, purchase order number if any and the amount due from the customers are to be entered. It is possible to change the default information pertaining to a customer by selecting the Payment & Credit tab from the “Maintain Customers/Prospects” window and changing the particulars where necessary. The tabs in the “Maintain Customers/Prospects” window can be used to modify the customer information and to delete a customer permanently.

Creating Customer Invoices

For creating customer invoice, the “Sales Invoices” icon in the Customers and Sales Navigation Center is to be clicked and “New Sales Invoice” from the dropdown menu is to be selected. The next step is to enter all information pertaining to the sales invoicing like customer ID, bill to, ship to, and date and invoice number. Once these common details are entered, the sales order number applicable to the transaction is to be entered by selecting the particular order number applicable to the sale. For each of the item ordered, it is necessary to enter the number of each item shipped is to be entered. Once the quantity is filled, Peachtree automatically calculates the amount. The sales tax applicable to the sale is to be selected and with this Peachtree calculates the total value of the invoice.

Applying Customer Payments

To record the receipt of money from a customer, “Receive Money” icon in the Customers & Sales Navigation Center is to be clicked. Alternatively, “Receive Money” icon can be accessed from the Banking Navigation Center and the “Receive Money from Customer” option has to be selected from the dropdown menu. “Receipts Window” is opened on selecting this option and the details of receipts can be entered into the Peachtree. It is necessary to enter details like customer ID, address, apply to invoice, reference (either cash receipt number or check number depending on the mode of payment by the customer), date of receipt, payment method, amount paid column and received amount.

Reports on Customer Orders

Using Peachtree complete accounting reports like sales journal, customer ledgers and customer statements can be prepared. While sales journal provides a listing of invoices raised, customer ledgers provide information on the status of the customer accounts and customer statements provide information on the amounts outstanding from the customers.

Reports regarding Key Revenue Cycle Information

Cash receipts journal and aged receivables reports are some of the reports, which contain key revenue cycle information. While cash receipts journal provides information on the cash inflows into the business aged receivable report provides information on amounts pending for a long period to be realized.

Expenditure Cycle

The expenditure cycle in any business comprises of two important business events namely purchase and cash disbursements. The purchase transaction consists of acquiring specific resources or services to help improve the business. The disbursement transaction involves preparing and delivering payment to the supplier.

Creating and Maintaining Vendors

For creating and maintaining vendors in the Peachtree, vendor default information needs to be set up. By opening “Vendors & Purchases Navigation Center” in the Peachtree and clicking the “Vendors” icon, the option of “Set up Vendor Default” is to be selected. Standard terms applicable to all the vendors like payment terms, discounts offered and credit period are to be entered to set up the default information. For entering the information about a vendor into Peachtree the menu, option of “New Vendor” from the Vendors icon located in the Vendors & Purchases Navigation Center. This opens up the “Maintain Vendors” window where the vendor Id, name, address, history and purchase default information can be entered. Saving this information will create the vendor. If there is a change in the accounting system, the beginning balances of the vendor accounts are to be entered in the “Vendors Beginning Balances” window. Just in the same way the customer default information can be changed, the vendor default information can be changed by opening the Maintain Vendors window and changing the default information pertaining to any particular vendor. Similarly, it is also possible to modify or delete vendor records.

Creating and Maintaining Inventory

For adding an item of inventory into the Peachtree, it is necessary to open the Inventory & Services Navigation Center in Peachtree. By clicking Inventory items icon and selecting “New Inventory Item” from the dropdown menu, one can reach the “Maintain Inventory Items” window. Details like inventory item ID, description of the item, item class and other relevant details about the inventory items need to be entered before the inventory items can be created and maintained. If the information on inventory are transferred to Peachtree from another existing accounting system, after adding the details of the inventory items, the beginning balance of the items need to be entered in the “Inventory Beginning Balances” window.

For adding an item of inventory in to the Peachtree, the “New Inventory Item” menu from the dropdown list available in “Inventory Items” icon in the “Inventory & Services Navigation Center” in the Peachtree. After adding the item of inventory, the following details like item ID and description, quantity and unit cost (purchase price per unit of the item of inventory) are to be entered. Peachtree will automatically calculate the total cost of that many items of the inventory based on the quantity entered. By opening the “Maintain Inventory Items” window, the required changes in the inventory items like modifications and deletions can be made.

Generating Payments to Vendor

For recording the payment to a vendor, the “Pay Bill” menu item from the dropdown menu of the “Pay Bills” icon is to be selected from then “Vendors & Purchases Navigation Center.” The Pay Bill menu can be accessed through “Pay Bills” icon in the “Banking Navigation Center.” The “Payments” window is opened, where the details about the payment like the vendor ID, pay to the order, apply to the invoices, check number, date and amount paid column need to be filled to generate payment.

Reports on Information regarding Vendors

Vendor ledger, purchase order journal and purchase journal are some of the reports relating to information regarding vendors. Vendor ledger provides information on the status of the vendors’ accounts, purchase journal and purchase order journal provides the listing of purchase orders placed during any period.

Reports regarding Key Expenditure Cycle Information

Check register and aged payable reports provide key information on the expenditure cycle. While check register provides information on the cash outflows from the company the aged payables register provides information on amounts pending for a long period to be paid to the vendors. Inventory valuation report provides information on the value of inventory procured and utilized.

Financing Cycle

Financing cycle comprises of different phases like estimating the funds required, identifying the available resources, determining the financial gap, mobilizing funds and monitoring expenses to improve the cash flow within the organization so that it can perform effectively.

Creating and Maintaining Chart of Accounts

When the company data file is created in the Peachtree, the chart of accounts is automatically created by the package based on the type of business selected in the “Create a New Company” wizard. Although, many of these accounts might match the requirements of the business, it may be necessary to add a new account or to modify an existing account or delete an account from the chart of accounts. Future changes in business may also necessitate changing the chart of accounts. Adding a new general ledger account into the Peachtree can be accomplished by selecting “New Account” from the dropdown menu in the “Chart of Accounts” icon located in the “Company Navigation Center.” The access to the New Account menu, will display the “Maintain Chart of Accounts” window, where the details of the new account can be entered into the Peachtree. It is necessary to enter details like account ID, description of the account and account type. By accessing the Maintain Chart of Accounts window, one may be able to modify or delete an existing account. Alternatively, the account to be edited or deleted can be accessed by selecting View and Edit Accounts from the dropdown menu in the Chart of Accounts icon, which will lead to the Accounts List. From the list, the account to be edited or deleted can be selected and double clicked to open the particular account in the Maintain Chart of Accounts window. Then it is possible to delete the account or make suitable modifications to the account.

Posting Journal Entries

While many types of transactions can be entered through specialized windows available in Peachtree, there might be the need for a general journal for recording entries that could not be entered through any specialized fields. These “entries include infrequent transaction types as well as adjusting entries.” Journal entries can be posted by opening the Company Navigation Center and selecting “General Journal Entry” link. This leads to the opening of General Journal Entry window, where details of the journal entry like date of entry, reference, general ledger account, description, debit column and new line (where the credit side of the entry by choosing the account number to be credited) can be entered.

Key Financial Statements Available

The key financial statements generated using Peachtree Complete Accounting includes balance sheet, income statement and cash flow statement. While the balance sheet represents the value of assets and liabilities of the company as at the end of a particular accounting period, the income statement presents the financial performance of the company during the accounting period. The cash flow statement contains information about the movement of cash from and to the company.

Key Reports to Measure Firm’s Financial Performance

Income statement, cash flow statement, quarterly earnings statement and yearly earnings statement are some of the reports, which provide information on the financial performance of the company. By studying these reports, it is possible to evaluate the financial performance of the company.

Reporting

Reporting using Peachtree Complete Accounting has many purposes like improving the customer service, tracking the inventory, planning purchases and improving financial health of the company by creating customs reports like budgeting.

The following are some of the reports generated by using Peachtree.

Reports under Revenue Cycle

Sales journal, customer statements and aged receivables register are the three reports generated under revenue cycle. Sales journal provides information on the total sales made during a particular period. This report contain number of information such as customer orders completed, customer id, invoice numbers, items supplied and total value of sales during a specific period. Customer statement is another important report, which provides complete information on the purchase history of a customer including the amounts outstanding from the particular customer. The aged receivable report provides information to the management for efficiently managing the working capital by pushing the collection of receivables pending for a long time.

Reports under Expenditure Cycle

Purchase order journal, vendor ledger and inventory valuation report are some of the key reports, which provide valuable information on the expenditure cycle of the company. Purchase order journal provides complete historic information on the quantity and value of purchases made by the company during a particular accounting period, which can be compared with the same information for the previous period to assess the efficiency of the company in making purchases. Vendor ledger provides the information about the vendors, which would enable the management to decide on continuing the business relationship with specific vendors, based on their dealings with the company. Inventory valuation report is an important report to decide on the efficiency in managing the working capital of the company, as usually the cash flow of the company will be affected, if large amounts are held up in inventories.

Reports under Financing Cycle

Income statement, cash flow statement and earnings statement are the key reports generated under Peachtree covering the financing cycle. Income statement provides information on the financial performance of the company during a given period. This performance can be compared against the budgeted performance of the company to identify the areas of weakness for possible improvements. The cash flow statement enables the management to have complete information on the liquidity position of the company, which would enable the management to mobilize funds when required. Quarterly and yearly earnings statement is the reports, which provide information on the surplus available for plough back into the company to ensure future growth of the company. By studying the earnings reports, the investors, banks and other lenders will be able to assess the true financial performance of the company. In fact, these are the reports that help management to plan their financial activities in the ensuing periods by drafting the budgets based on historical information available through these reports.

Evaluation of the Software and Final Thoughts

Peachtree Complete Accounting being popular accounting software by Sage is a larger package as compared to Peachtree Pro version. Peachtree Complete Accounting includes “standard accounting features, business management tools and more advanced features like auto creation of purchase orders, audit trail, fixed assets, job costing phase and cost level” (Isoftware reviews.com, 2010). There are more than 125 reports and financial statements, which can be generated using Peachtree Complete Accounting software package.

Peachtree Complete Accounting is an upgraded version over many other simpler versions of Peachtree accounting software packages. It is a wide-ranging accounting solution with its sophisticated features like multi-user capabilities and audit trials. This package can help the management of any midsize business to streamline its finances.

Peachtree Complete Accounting has numerous template companies to choose from while setting up the software for a new company. The package provides for importing a preexisting template from another version of Peachtree or from another accounting program. The user can customize an entirely new template for a new business. Although the enormous user guide accompanying the package may create an impression that the it might be a daunting thing to learn, if one is willing to invest time and efforts in learning and possessing in-depth knowledge in accounting Peachtree Complete Accounting can be a comprehensive tool for managing the finances of a mid-sized business.

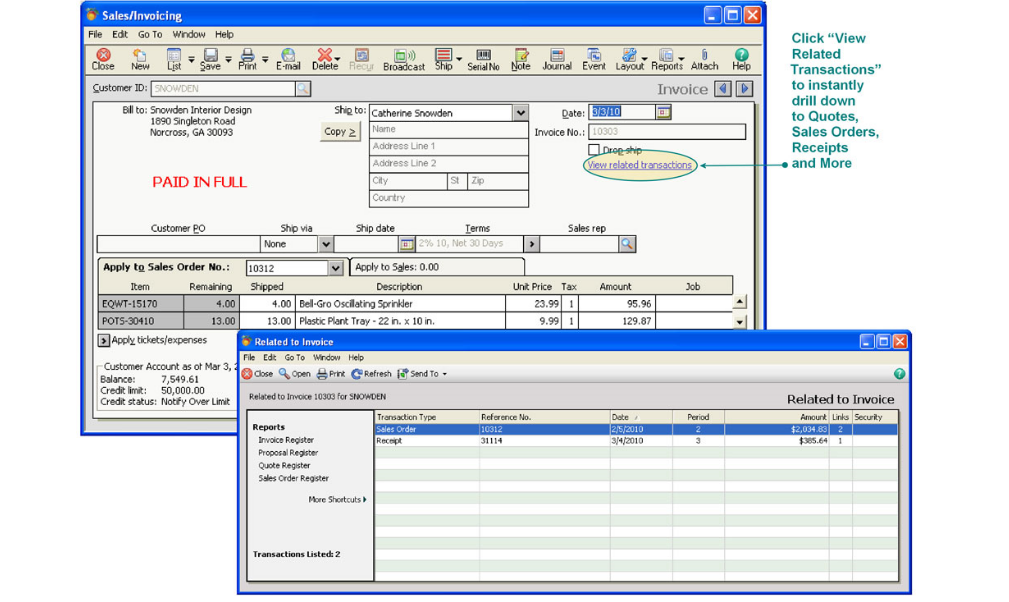

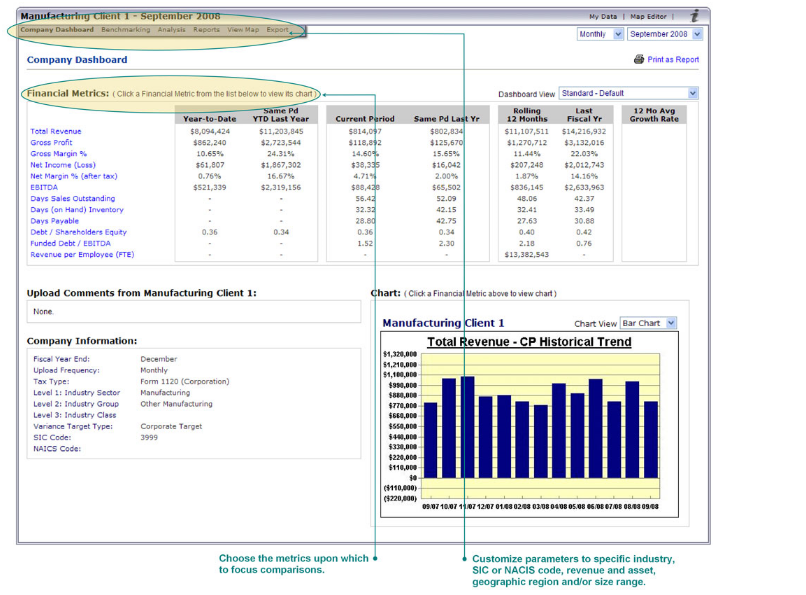

There are different accounting areas, where Peachtree Complete Accounting package can provide valuable information for the management to take meaningful decisions. In the area of transaction history, it becomes possible to view all history relating to specific customers or vendors “throughout the entire chain of events” at a particular point of time in the process of sales or purchase. It is also possible to view the transaction history from the point of purchase order to the stage of payment and from a receipt from the customer to the point of quotation submitted to the customer. This accounting software enables “save time getting to the information” to the time needed to follow proper course. The software offers a dashboard, which is a distinctive feature of the accounting software, which enables a comparison of the performance of the company with the performance of the competitors in the segment. It enables getting “instant access to view up-to date key financial trends in order to compare items such as Total Revenue, Gross Margin %, Days Sales Outstanding, and much more” (Amazon.com, 2010). The business analytical tools help improving the financial performance of the company and enables management in sound decision-making. However, the use of the analytical tools requires access to the Internet.

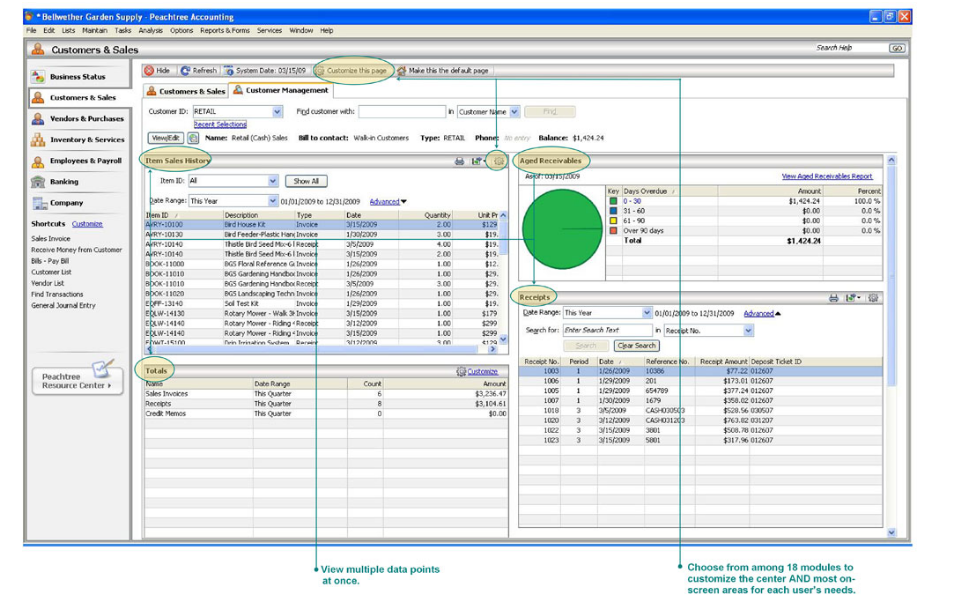

There are certain distinct benefits available to the business in managing its customers. There is considerable saving in time as one can view all the required details about the customers in one place. This enables efficient management of customers and provides them satisfactory service. It is possible to create a customized dashboard, which could provide all the customer-related information like “converted and unconverted quotes, invoices, receipts, time tickets, aged balances, items and services sold.” The package enables drilling down to details quickly so that the management can take necessary action immediately. People using the software, will be able to look up the customer-related information quickly using the customer ID or telephone number or any of the contact information of the customer. There is the provision to use the recent selection to pull up the accounts of customers quickly, whose accounts were viewed recently. It is possible to export the customer information to Microsoft Excel or PDF easily. The manager can also send an email from the Customer Management Center.

Overall, in my opinion, Peachtree Complete Accounting is superior accounting software in the areas of customer management, business analytical capabilities and in providing transaction history to improve the financial performance of a mid-sized business.

References

Amazon.com, (2010), Peachtree by Sage Complete Accounting. Web.

Isoftware reviews.com, (2010), Peachtree Complete Accounting Review. Web.

Sage Peachtree, (2010), About Sage. Web.

Sage Peachtree, (2010a), Products and Services. Web.

Scribd.com, Completed Revenue Cycle. Web.

Appendix