Categorizing Performance Measures

Introducing Causal Chains

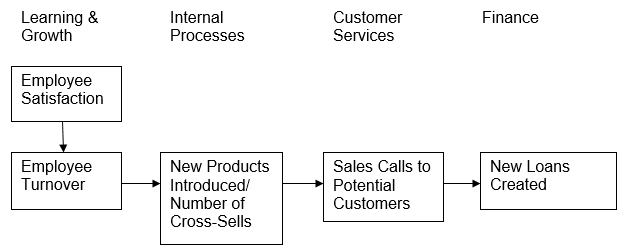

Causal Chain 1

The level of employee satisfaction directly relates to the degree of employee turnover and retention culture within an organization. Therefore, the managers of all branches should make considerable efforts to motivate employees and increase their corporate awareness because creating an incentive for working and increased productivity contributes to generating new ideas that can influence the development of new products.

As a result, the greater range of products requires employees to carry out a greater number of cross-sells since one product can closely correlate with the newly launched one. Apart from cross-sells, sales calls to potential customers should be performed to attract a new client base for new products. Due to the fact that new products may require new equipment, the organization should take care of the new loans that should be created to cover all the expenditures.

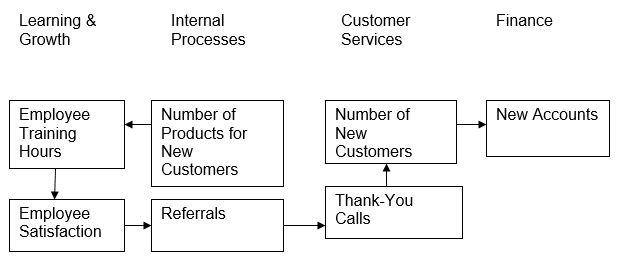

Causal Chain 2

The necessity to expand product diversity defines further perspectives of employees’ education and training. The performance analysis should also be introduced to define the issues and problems that employees face in the workplace. As soon as employee satisfaction is increased, the frequency of referrals could also be enhanced because new product analysis and greater employee satisfaction positively affect product development.

As soon as the client base is defined, thank-you calls should be introduced to attract more customers and make beneficial offerings to them. When new customers have been attracted, it is highly necessary to create new accounts for more consumers who can order the company’s products. More importantly, creating new accounts can allow the company to deepen the manager’s outlook on their products, as well as integrate new approaches to customer retention and satisfaction.

Evidence of Effectiveness of Balanced-Scorecard Approach: Comparative Analysis

With regard to the numerical data plotted in Table 3 about incomes, deposits, and loans used by branches A-E, which implemented the balanced-scorecard approach, and by branches E-J, which did not implement the approach, there were substantial improvements in the effectiveness of the company’s processes, employees’ performance, and financial activities, except for Branch E that witnessed a slight income decline (from 344 to 343). However, although advancements in Branches E-J that did not implement the balanced-scorecard were obvious, the increases were significantly lower than those introduced by Branches A-E.

The numerical data showed that the total sum of loans created by Branches A-E was increased by 9.1 % whereas loans created in the departments that did not use the approach experienced only a 1.9 % increase (Albright et al., 2001). A similar situation was with deposits and incomes where 6.8 % was assigned to those who implemented the strategy whereas only 1.4 % was typical of the rest of the departments that withdrew the strategy (Albright et al., 2001). Finally, incomes were higher among Branches A-E (8.5 %) than among Branches E-J (3.1 %).

Analysis of Relative Performance among Branches A-E with Regard to the Implementation Strategies in Each Branch

The total sum of the results does not highlight the outcomes of relative performance, as well as differences in implementing the scorecard in terms of each branch’s vision, philosophy, and employee training. Therefore, it is necessary to define which branch of ideology and corporate culture could be regarded as the most successful one in implementing the identified strategic scheme. Interviews and figures in Table 3 provide an accurate and evidence analysis of the consequences of the implemented policies.

While evaluating the numerical data on loans in various departments, the higher percentage of increase belongs to Branch B (over 16 %) whereas the lowest results refer to branch E (less than 1 %) (Albright et al., 2001). The explanation for these discrepancies can lie in employees’ vision and the company’s strategic orientations. The results of the interview prove that Branch B was more focused on meeting the financial requirements of a community with reference to the small-town orientation of the company’s services. Second, Branch B’s managers and employees relied heavily on an efficient performance rewarding system.

Unlike Branch B, Branch E was more concerned with tasks, goals, and objectives that the company should achieve through increased employee performance. However, a person-oriented approach was not associated with enhancing employee retention and satisfaction. Rather, all strategies were directed at improving the company’s achievements. Probably, this fact became the trigger of the low percentage of loans created.

Branch C’s strategies were more effective in achieving the higher ratio of deposits received in the specific period. Relying on efficient teamwork, collaborative approach, and communication was beneficial for establishing fruitful relationships with customers. At this point, the analysis of the new approach provides a new strategic framework for other branches to increase their results. In fact, successful communication introduces new dimensions of influence within the balanced-scorecard approach.

Branch A was almost as successful as Branch C because the deposit increase was tangible. In particular, this department was oriented on completely different objectives, but their policies were successful enough to achieve significant results. Similar to the loan results represented above, Branch E was not successful in reaching considerable results. Apparently, such a situation requires the department managers to revisit their positions and redefine their mission and strategies.

Finally, the income shifts also point to the effectiveness of tactics that each Branch employed while implementing the approach. Like in two previous cases, Branch C can be considered the winner in terms of their attitude to the organization’s culture and employees’ performance. Once again, the emphasis placed on communication, meeting customer needs, and testing employee productivity provide a plethora of incentives for improving an organization’s productivity in general.

An 11 % increase in incomes proves that these frameworks had the highest potential and, therefore, other departments should have borrowed these strategies for implementing the above-mentioned approach. The results shown by Branches A were even higher, which also testified to the effectiveness of hardworking and constant focus on financial activities. In particular, the accuracy of the income statement allowed the managers to take greater control of financial activities because contributed to the company’s flexibility and reaction to the emerging challenges.

Conclusion

With regard to the above-presented analysis of the balanced-scorecard implementation, the tactics and strategies used by each department have had a potent impact on the results in each branch. In particular, the most effective strategy includes such aspects as effective teamwork, successful communication, and focus on employee satisfaction and performance. All these aspects should be the main components of an organization’s culture (Murby & Gould, 2005). In general, the implementation of the balanced-scorecard was beneficial for Branches A-E, as compared to Branches E-J, which was viewed from the percentage presented above.

In fact, this strategic plan highlights the most important aspects of human resources management, as well as introduces new perspectives for learning and development (Silverthorne, 2008; Yu et al., 2008). More importantly, it supports the necessity to introduce face-to-face communication and interaction, as presented in the case with Branch B. Therefore, other departments that achieved lower results should implement these executive strategies to enhance their competitiveness and performance.

References

Albright, T., Davis, S., & Hibbets, A. (2001). Tri-Cities Community Bank: A Balanced Scorecard Case. Strategic Finance, 83(4), 54-60.

Murby, L., & Gould, S. (2005). Effective Performance Management with the Balanced Scorecard. CIMA. Web.

Silverthorne, S. (2008). Executing Strategy with the Balanced Scorecard. Web.

Yu, L., Perera, S., & Crowe, S. (2008). Effectiveness of the Balanced Scorecard: The Impact of Strategy and Causal Links. JAMAR. 6(2), 37-55.