Introduction

About the hospital

Greenville Hospital System Medical Center, based in South Carolina, is one largest health care provider in the state. The Center was founded in 1912 as a City Hospital. It was later established in 1947 by the Act of the South Carolina Legislature. The Center employs over 9,500 people and about 1,100 physicians (Greenville Hospital System Medical Center, 2013). The System has a capacity of over 1,000 beds. It is a nonprofit center which also provides medical training to various registered students. Further, it participates in a number of research studies in the United States of America. The research studies are aimed at improving the medical services in America.

The System has a number of facilities such as trauma centers, chest pain center, children’s hospital, pediatric ICU, cancer, rehabilitation, behavioral health and wellness services among others. It owns four acute care hospitals and 13 specialty health care facilities. Further, that the company has been on the forefront in using latest technology in the internal processes (Greenville Hospital System Medical Center, 2013). This helps in reducing the cost of operation and time wastage. The vision of the Hospital is to “transform health care for the benefit of the people and communities we serve” (Greenville Hospital System Medical Center, 2011).

Market share

The primary service area of the Center is Greenville where it has a market share of about 65%. The Center also serves Pickens where it has a market share of about 51.5%, Laurens at 29.9%, Oconee at 44.7%, Anderson at 60.1% and Spartnburg at 67.6%. The table below summarizes the market share as at 2010.

The pie chart below summarizes the market share of the Center in the major regions it serves.

Aim of the paper

The treatise aims at discussing the pricing and service decisions, planning process, time value analysis, investment decision of Greenville Hospital System Medical Center. It also discusses how the organization can address financial risks and required returns.

Factors that determine pricing and service decisions

Pricing of commodities in an organization is a key decision that needs adequate evaluation before deciding on the amount to charge for the services. For a profit making institution, proper pricing decision reflects on the profitability of the organization. The pricing decisions of a hospital heavily depend on the objectives of the organization that is, whether they are profit or sales oriented or whether they are status quo oriented. There are a number of factors that the management of Hospital needs to take into account when making pricing decisions. The factors can either be internal or external. Internal factors arise from the actions and decisions of the organizations. To a greater extent, the factors are within the control of the management of the organization and can be altered from time to time. An example of internal factor is the productivity of the hospital. Increase in productivity results in reduced cost of production hence low prices. Further, increased in productivity results in the provision of more services. Another factor that would affect the pricing decision is how the organization sets prices for the services. The hospital management can either decide to use fixed cost, cost plus or value based pricing. Other internal factors that would affect the pricing decision is whether the organization would carry out pricing discrimination and multiple pricing (Heshmat, 2003).

External factors are not within the control of hospital management and they do affect the pricing decisions of the organization. Example of external factors that the hospital management need to take into account are the prices charged by competitors, legislative requirements such as price floors and price ceilings, sensitivity of demand for the services to changes in prices, and method of payment used by the customers among other factors. It is also worth mentioning that the pricing decision chosen by the organization have a direct impact on the services offered by the Hospital management. The pricing decision affects the timing and the amount of services offered to customers. Ultimately, the pricing and service decisions chosen by the management should be consistent with the objectives of the hospital (Heshmat, 2003).

Overall planning process

The planning process varies from one organization to another. However, there is a standard process that most organizations tend to follow. The first stage in the planning process is setting goals. The stage outlines the end objectives that an organization need to achieve at the end of a given period. The second stage entails developing the planning assumptions and conditions. The second stage gives planning premises. The third stage entails reviewing the limitations and ascertaining whether they can affect the smooth running of the plans. The fourth stage is deciding the planning period. At this stage, the management comes with adequate planning period that would facilitate achievement of the outlined goals in step one. The fifth stage entails formulating policies and strategies that would facilitate accomplishment of the expected results. The sixth step entails preparing operating plans. Integrating the plans so that they are balanced and supporting each other is done on the last stage.

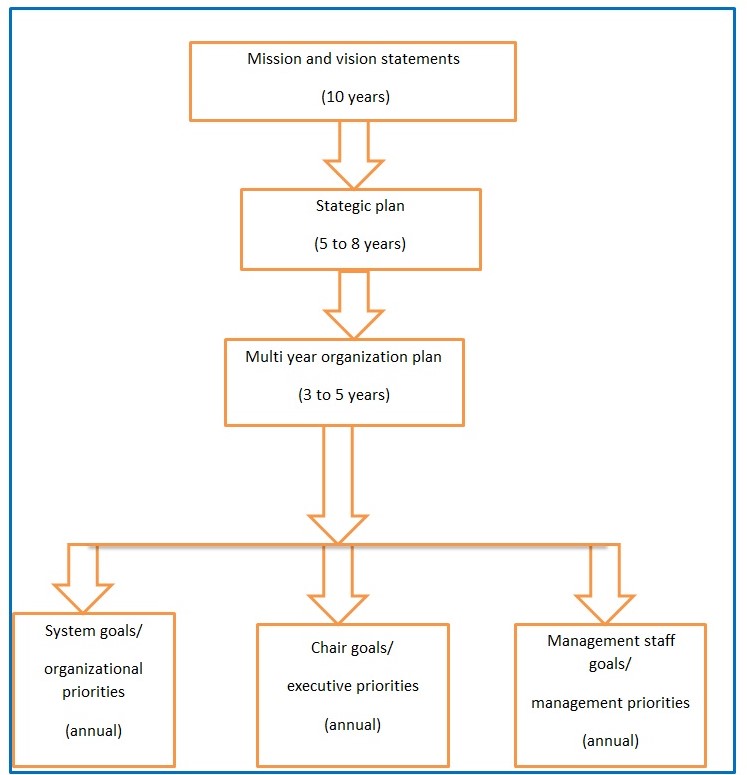

The planning process at Greenville Hospital System Medical Center tend to follow the seven stage planning process. The planning process of the organization does not only focus on the financial aspects but also other aspects such as total health and medical school among others. Besides, the planning process of the organization aims at creating links between finance, operation and strategy of the whole Center. It is worth noting that the planning process of the organization comprises of short term and long term plans. The plans emanate from the vision and mission of the Hospital. The vision and mission lasts for approximately 10 years. The vision and mission statements explain why the organization exists and the customer base of the organization. It is followed by a strategic plan which lasts for approximately 5 to 8 years. The strategic plan focuses on customers, partnerships, products, market, and organizational development of the Center. The strategic plan is followed by multi year organization goals. They last for 3 to 5 years. The multi year organization plan acts as a bridge between strategic plan and annual plans. The multi year plan is followed by system goals, chair goals and management staff goals. The three are annual plans. They focus on organization, management and executive priorities. The flow diagram below summarizes the planning process of the organization.

Components of the organization’s financial plan

The most recent plan of the Hospital focuses on five key areas. These are total health, highly integrated delivery system, accountable care organization, academics and school of medicine, and financial sustainability. The financial sustainability focuses on three areas. These are, reimbursement and managed care strategies, operating and financial overview, capital structure and investment update. Further, the operating and financial overview concentrates on key utilization statistics, statements of revenues and expenses, balance sheets, cash flow statements, and financial ratios. The financial plan of the Hospital is divided into three components. These are stable payer mix, Medicare reimbursement, key utilization statistics, statement of revenue and expenses, budget comparison, balance sheets and financial ratios. The table below shows the stable Payor mix plan between 2009 and 2011.

The table below summarizes the plan for medical reimbursement.

The third element of the plan is the key utilization statistics. The table below shows the key statistical plan of the organization.

The fourth element of the financial plan is the statement of revenue and expenses. The table below shows the forecasts for statement of revenue and the organization between 2008 and 2010.

The fifth element of the budget entails comparing budgeted values and actual results and coming up with the variances. However, in this case, it might not be possible since the actual values are not available. The sixth part of the financial plan of the organization is the balance sheet. The table below shows the balance sheet section of the financial plan of the Center.

The final part of the financial plan of the center is the financial ratios. The ratios are commonly classified into three parts. These are liquidity, profitability and leverage ratios. The ratios for the health center is slightly different from ratios for other trading companies for the reasons that the institution is not a profit oriented institution. The table below shows examples of the ratios for the Center.

Time value of money

The concept of time value of time proposes that a dollar now might not be the same in value in the future. This can be caused by differences in the purchasing power. Differences in the value of money from time to time are caused by distortions in the market. These can be caused by inflations among other things. Time value of money allows for conversion of a money of money from current value to future value of fro future value to current value. This can be done on a yearly basis or as an annuity. To discount, the management need to decide on the discount rate to use (Hansen, Mowen, & Guan, 2009). The discount rate is most commonly the rate of return required by investors. In the event that the required rate of return is not provided, the interest rate can also be used. The concept of time value of money is a vital tool for making decisions in an organization. The concept helps management make sound financial decisions. It helps the management mitigate the risks associated with the uncertainty of future cash flow. This because, future cash flow can only be estimated based on the past trends and expectations but cannot be determined precisely. Secondly, the concept of time value of money helps management in making capital investment decisions (Hansen, Mowen, & Guan, 2009). These are decisions which require heavy capital. Besides, they take a long period of time to put them in place. Besides, the returns from such projects are earned after some period of time. Therefore, the time value of money helps management to ensure that the right capital investment decisions are made. This helps in minimizing losses arising from incorrect decisions (Hansen, Mowen, & Guan, 2009). For instance, if the Center intends to invest $40 million in the current year. The project is expected to last for five years. The company expects a return of $5m in the first year, $5m in the second year, $10 in the third year, $15million in the fourth year and $15million in the fifth year. Without taking into account the time value of money, The total cost of the project is $40million. The net return for the total five years is $10 million. Use of time value of money might give different results. Assume a discount rate of 15%. Application of time value of givings different results are shown in the calculations below.

Application of time value of money leads to net income amounting to ($9,261,500). This indicates that the project is likely to yield negative returns at the end of the project. As illustrated in the example above, use of time value of money helps in making informed decisions.

Recommend major investment of the organization using net present value, pertinent financial ratios, break even analysis

Investment project

The Rheumatology department of the Center is considering the possibility of buying a “state-of-the-art” bone density scanner. The machine costs $2,575,000. The average fee per scan amounts $889. While the variable cost per scan is $91 per scan. The unit cannot postpone modernizing its equipment and that as a starting point of the analysis they will use the policy statement adopted by the hospital’s trustees, which directed each unit to attempt to maximize the surplus it contributes to the organization. The Scanner is expected to operate for 5 years thereafter it will be written off. The operating cost per annum is estimated at $10,000. The streams of income expected during the five years and calculation of NPV is summarized in the table below. Assume the required rate of return is 15%.

Net present value

From the calculations above, the undiscounted net cash flow amounts to $1,475,000. The net present value of the project is $30,048. Therefore, using the net present value approach, the acquisition of the machine yields a net return amounting to $30,048.

Break even analysis

Break even analysis gives the number of scans that must be executed so that the total cost equals to the total revenue earned. Therefore, it will give us the minimum number of scans that must be carried out so that the project remains viable.

Total revenue (P * Q) = total cost [Variable (C *Q) + fixed cost]

- 889 * Q = 91* Q + 2,575,000

- 889Q – 91Q = 2,575,000

- 798Q = 2,575,000

- Q = 2,575,000/798 = 3,226.81

To recover the cost of operation, the hospital needs to carry out 3,227 scans per year. This is achievable considering the size of the hospital.

Ratio analysis

In order to carry out ratio analysis, assume that the hospital carries out 4,000 scans in the year. The marginal cost statement for the scanner is summarized in the table below.

From the statement above, total revenue amount to $3,556,000 while total expenses amount to $2,949,000. This yields a net revenue amounting to $607,000. The net profit margin of the project is relatively high at 17.7%. The net profit margin is higher than the required rate of return which 15%. Return on assets is also relatively high at 23.6%. The ratios show that the project is viable. In summary, the three approaches show that the project is profitable.

Ways of addressing financial risk and require returns

The financial risks of an organization arise from a number of factors. The factors are either external or internal. Some of the external factors are interest rate fluctuations, changes in the general price level, exchange rate fluctuations, changes in prices of supplies, inflation among other factors. These factors are not within the control of the organization. Besides, they can create uncertainties in the amount of returns expected by the Center (Hansen, Mowen, & Guan, 2009). Further, they may create a potential financial loss to the organization. Examples of financial risk are market risk, liquidity risk, credit risk, foreign investment risk, and operational risk. Losses that may arise from financial risk have a direct impact the required returns. Therefore, it is important that an organization addresses the financial risks so that they do not impact on the profitability. One way of addressing financial risk is through diversification. The Center should provide a variety of products and services so that if one product does not respond well in the market, the Hospital can still receive revenue from other products and services. Another way of addressing financial risk is through hedging (Hansen, Mowen, & Guan, 2009).

Further, the Center can negotiate future contracts at constant prices. This will mitigate losses arising from exchange and interest rate fluctuations. Finally, the Hospital can consider trading in goods and services which are less risky. This helps in minimizing risks arising goods and services chosen. In summary, an organization need to manage financial risks that arise from normal operations of the organization. This will ensure stable returns (Hansen, Mowen, & Guan, 2009).

References

Greenville Hospital System Medical Center. (2011). Rating agency presentation. Web.

Greenville Hospital System Medical Center. (2013). About us. Web.

Hansen, R., Mowen, M., & Guan, L. (2009). Cost Management: Accounting & Control. USA: South Western Cengage Learning.

Heshmat, S. (2003). Framework for Market-Based Hospital Pricing Decisions. USA: Haworth Press Inc.