Executive Summary

This paper is a company analysis of J. C Penney. The company is in the retail sector and mainly sells women’s apparel as its most lucrative product category. Other products sold at J.C Penny stores include men’s clothing, children’s apparel and home products.

The store’s performance in the last seven years has been poor because it has accumulated a lot of debt and lost a significant market share to its competitors. Albeit uncertain economic conditions have partly caused the store’s decline, I highlight poor strategic leadership as a key problem in the company that has mainly contributed to its poor performance.

Using a SWOT analysis of the company’s internal environment, I find that good customer relation, sound distribution systems, and the store’s association with national brands are possible strengths of the company. Similarly, I found out that increased competition and increased opportunities for online trade are the main threats and opportunities for the company.

However, poor strategic leadership has limited the opportunities to harness these competencies. To improve the company’s performance, I recommend two short-term and long-term strategies. As a short-term measure, I propose that J.C Penny should find creative methods of reducing its debt burden and operation costs.

This strategy will improve its cash flow, in the short-term. In the long-term, the company should find a strong leadership plan that would be more proactive in embracing change and exploiting the company’s key competencies.

History of the Company

A Missouri-based entrepreneur, James Cash Penney, founded J.C Penney Company in 1902 (Sendjaja, 2009). Mr. Penney founded the first store in Kemmerer, Wyoming. He opened started it as a partnership with two other investors (Sendjaja, 2009). However, in 1907, Mr. Penney took over the business after his partners dissolved the partnership.

After taking the majority control of the business, J.C Penney expanded into new locations and allowed store managers to have a one-third stake in the business. By 1909, J.C Penney had 34 stores. In 1912, it was raking in more than $2,000,000 in annual sales (Funding Universe, 2015).

The following year (1913), the company’s founder incorporated the business as J.C Penney Incorporated. Afterwards, he moved the business’s headquarters to New York. This was a strategic move to be closer to manufacturers and suppliers.

In 1913, the number of J.C Penney stores increased to 83 (Funding Universe, 2015). With Penney as the company chairperson, the number of J.C Penney stores increased further to 175 (Makarova, 2013). The company’s growth mainly occurred from 1920s -1950s. For example, in 1929, the company listed on the New York Stock Exchange (NYSE).

During the Great depression, its profits increased to $250 million because it had created a brand name that associated with quality products (Funding Universe, 2015). By this time, the company was making enough profits to help local social organizations, such as schools and Churches, to fund their activities. In 1968, the company was making $3 billion in annual sales (Funding Universe, 2015).

In 1973, the company had grown its number of stores to 2,053 (Sendjaja, 2009). However, at this time, J.C Penney had ventured into new businesses such as beauty salons and portrait studios. Other auxiliary businesses included food facilities and auto service centers. The 1974 depression took a toll on the company because it marked a significant decline in the company’s share value, from a $51 high to a $17 low (Funding Universe, 2015).

During the same period, the company’s earnings decreased from a $185 million high to a $125 million low (Funding Universe, 2015). Besides the poor economic environment, the company also experienced increased competition from other retail companies. Between 1976 and 1985, J.C Penney continued its expansion program and ventured into new businesses, such as women’s fashion and home furnishing businesses (Makarova, 2013).

By 1979, analysts rated the business as the fifth largest catalogue merchandise store in the country (Funding Universe, 2015). During this period, the company also restructured its management framework to compete with new and more agile businesses in the retail sector. In the mid 1980s, J.C Penney moved its headquarters from New York to Dallas, Texas (Makarova, 2013).

Through this corporate restructuring process, the company tapped into new consumer spending habits and improved its earnings per share from $4.11 to $5.92 (Funding Universe, 2015). By 1994, J.C Penney had created a name for itself as a “turnaround” company. Women’s clothing accounted for more than 80% of the turnaround success.

However, in 1995, the company lost its growth momentum again. Its retail sales figures dropped from $1 billion to $823 million (Funding Universe, 2015). Comparatively, its little-known business such as insurance, banking and drug store businesses were performing well. For example, Thrift Drug (the main drug store chain) recorded sales figures of up to 1.9 billion (Funding Universe, 2015).

In the mid 1990s, the company expanded internationally by venturing into new markets, such as Canada. This move was part of a $2.1 billion capital-intensive expansion program for cementing the company’s reputation as the largest department store in the US (Makarova, 2013).

In line with this goal, the company launched its first internet retail site in 1998. By 2005, the company got more than $1 billion in sales through this platform (Funding Universe, 2015). Some of the major operational characteristics of the business in the last decade are the sale of Eckerd Pharmacy locations in 2004, the discontinuation of its catalogue business in 2010, and the appointment of Ron Johnson as the new company CEO in 2011 (Funding Universe, 2015).

Main Company Products

J.C Penney is a department store that has different product segments. Its product mix comprises of women’s apparel, men’s accessories, home appliances, children’s apparel, family footwear, fine jewelry, services, and other products (Global Credit Services, 2013).

Women’s apparel accounts for 25% of the company’s sales, while men’s accessories account for 20% of the company’s sales (Global Credit Services, 2013). Comparatively, home appliances account for 15% of the company’s sales, while children’s apparel and family footwear account for 12% and 7% of company sales, respectively (Global Credit Services, 2013).

Some of the products that outline the above product categories are private brands, such as “Liz Claiborne, Okie Dokie, Worthington, St. John’s Bay, The Original Arizona Jean Company and Ambrielle” (Global Credit Services, 2013, p. 6).

Global Credit Services (2013) says the rise of private label brands accounts for the company’s growth. Company analysts say they account for 54% of the company’s gross sales (Global Credit Services, 2013). Many customers prefer to buy these products because they have a higher quality, as opposed to mainstream brands.

Moreover, they are cheaper than mainstream brands. The management board of J.C Penney prefers to stock such private label products because it could control their prices and make greater profits than they could through mainstream brands (Kumar & Steenkamp, 2007).

Organizational Assessment

Over the past ten years, J.C Penney has had mixed results. Over this period, the company has mainly focused on re-merchandising some aspects of its business (Kumar & Steenkamp, 2007). The company has also spent many resources revamping its branding strategy to its customers.

However, this strategy has not worked well because in the past five years, J.C Penney has reported a poor financial performance. For example, the diagram below shows that since 2008, it has reported declining sales figures.

Although the above graph shows a decline in J.C Penney’s sales, the company increased its number of retail stores within the same period of analysis (Global Credit Services, 2013). The poor sales figures have had a negative impact on the company’s earnings during the same period. For example, the diagram below shows the decline in earnings before interest and tax during this period of analysis

Similar to the above trend, the company’s cash flow has significantly declined in the same manner. The graph below shows this trend (the figures are in $ MMs)

Similar to the above-mentioned trends, J.C Penney has suffered from a decline of its cash deposits. Stock buybacks, dividend payouts and increased investments in the company’s brand have further worsened its financial position (Global Credit Services, 2013).

Observers believe J.C Penney’s poor financial performance stems from confusing company strategies, which have created a loss in market share (Finkler, 2011; Makarova, 2013). For example, low customer traffic, in the past few years, has highlighted the weaknesses of the company’s pricing strategy.

Part of the confusion has come from management confusion about the extremely low prices offered by the company for some of its products (Global Credit Services, 2013). This strategy is even more confusing to customers because the company has mixed its “low” pricing strategy with promotional gimmicks, such as free haircuts and prize giveaways (Global Credit Services, 2013).

Its overall pricing strategy also conflicts with the company’s overall business model because the corporate objective has been to promote the company as a specialty department, while its pricing strategy projects it as an off-price discounter (Makarova, 2013).

Stock Price Plot

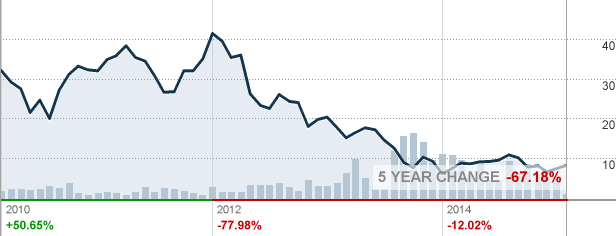

Since 2010, J.C Penney stock prices have declined significantly (CNN, 2014). However, the sharpest decline in stock prices occurred in 2012 when the stock prices dropped from a high of $42.68, in February 2012 to a low of $8.05, in February 2015 (CNN, 2014).

This price change is in sharp contrast to the relative increase in stock price from $24.89 in February 2010 to a high of $42.68 in February 2012 (CNN, 2014). The following graph represents a 5-year historical analysis of J.C Penny stock prices

According to the graph above, we see that in the last 5 years, J.C Penny’s stock value has declined by 67.18% (CNN, 2014). In 2009, the share price of a J.C Penney stock was $16.75 (CNN, 2014). However, during this period, there was a devaluation of J. C Penney’s stock because the intrinsic value per share was $23.77, while the company’s stock was lower. The loss in stock value stems from poor corporate strategies that have created a poor customer perception of the company.

Gross Profit Margin

Understanding a company’s gross profit margin is important in evaluating the financial health of a business. For investors, the gross profit margin is important in knowing the percentage of revenue left in a company after subtracting the sales costs (Makarova, 2013).

J.C Penney witnessed an increase in its gross profit value from 2005 to 2006. However, since 2007, this figure has steadily declined (Makarova, 2013). Two reasons could explain this decline. The first reason is the poor economic conditions that plagued American companies after the 2007/2008 financial crisis. Secondly, during the same period, there was a steep increase in the cost of sales (Makarova, 2013).

Earnings before Income and Tax (EBIT)

EBIT often shows a company’s profitability and overall financial health. To come up with this figure, we often divide the earnings before interest and tax with the net revenue. Between 2005 and 2007, J.C Penney’s EBIT increased from 7.12% to 9.49% (Global Credit Services, 2013).

This increase in EBIT stemmed from a decline in operating expenses and a reduction in depreciation. However, increased operating expenses in 2009 changed the company’s fortunes by decreasing the EBIT by 6% (Global Credit Services, 2013). There has been a constant decline in this index since then.

Net Profit Margin

Similar to the EBIT index, the net profit margin of J.C Penney also measures the financial performance of a company by highlighting its profitability. We derive the net profit margin by dividing the net income by the net operating expenses. Therefore, we come up with this figure after subtracting all operating costs and expenses.

J.C Penney witnessed an increase in the net profit margin after this figure doubled between 2005 and 2006 (Makarova, 2013). This positive financial performance stemmed from an increase in income tax provision. However, a high income tax in 2009 led to its decline during the same period, and beyond (Makarova, 2013).

Sales Growth Rate

Before the 2007/2008 global economic downturn, J.C Penney reported an increase in its growth rate between 2006 and 2007 (Makarova, 2013). Within this period, this figure increased from 1.94% to 5.97% (Makarova, 2013). This statistical change shows that the company sold more merchandise in 2007 than 2006 and beyond.

However, when the global economic crisis hit the global economy, the sales growth rate decreased to -0.22% (Makarova, 2013). Conflicting corporate strategies partly contributed to this trend.

Industry Comparison

This paper has already shown that some of J.C Penney’s main competitors are Bon-Ton, Burlington Coat, Belk, Kohl, Macy’s, Dillard’s, Ross Stores, and TJX. Kohl’s, Macy’s, and TJX have higher revenues than J.C Penney does (Global Credit Services, 2013).

Understandably, TJX has a high number of stores in this competitor group, because, unlike J.C Penney, it has 3,046 stores, while J.C Penney has 1,115 stores (Global Credit Services, 2013). J.C Penney’s earnings before tax and interests are $146 (MM).

However, all the above-mentioned competitors have better earnings in this regard because Bon-Ton has $157.1 (MM), Burlington Coat has $305.8 (MM), Belk has $455.6 (MM), Kohl has $2,823 (MM), Macy’s has $3,590 (MM), Dillard’s has $766.9 (MM), Ross Store has $1,383 (MM), and TJX has $3,367 (Global Credit Services, 2013).

Based on these statistics, J.C Penney has the lowest EBITDA margins compared to its competitors. Indeed, Bon-Ton, Burlington Coat, Belk, Kohl, Macy’s, Dillard’s, Ross Stores, and TJX all have an EBITDA of 5.3%, 7.5%, 11.9%, 14.9%, 13.3%, 11.6%, 14.8%, and 13.5% respectively (Global Credit Services, 2013).

Comparatively, the EBITDA of J.C Penney is 1.0% (Global Credit Services, 2013). The table below summarizes these figures

According to Makarova (2013), J.C Penney’s default frequency measure increased to 8.5% during the 2013/2014 financial period. This figure was among the highest in the country). Although other department stores have suffered the effects of a poorly performing economy, J.C Penney’s competitors, such as Macy’s, Sears, Kohl’s, and Target, have had better ratings (Makarova, 2013).

In fact, recently, many of these companies have improved their default credit rating because of an improving economy (Makarova, 2013). Particularly interesting is the declining market risk of Sears (another struggling retail giant), which, similar to J.C Penny, has had poor financial fortunes stemming from a weak corporate strategy.

In fact, during the 2012/2013 financial period, the company’s EDF measure increased and became among the highest in America (Makarova, 2013). The negative momentum of J.C Penney’s EDF measure reinforces the fact that the company is among the riskiest firms in its industry (to invest in).

Based on the above facts, Moody’s analysts say that J.C penny is likely to experience higher default rates because their studies reveal that most companies, which underperform their peers, are likely to suffer this fate (Makarova, 2013).

However, the analysts still believe that J.C Penney is a company that should be watched closely because their analysis about historical defaults show that “firms whose EDF levels are in the 75th percentile of their industry sectors or higher are, on average, 4.5 times more likely to default than firms below the 75th percentile” (Makarova, 2013, p. 3).

Observers believe J.C Penney’s poor performance stems from the decline of its liquidity levels and weak corporate strategies (Global Credit Services, 2013; Makarova, 2013). Similarly, besides increased competition from other brick and mortar department stores, the company continues to lose its market share from the online retail giants, such as Amazon (Makarova, 2013).

SWOT Analysis

Strengths

Over the past 10 decades, J.C Penny has developed an exclusive distribution system that has improved the efficiency of its store networks. This distribution network includes exclusive in-house distribution networks and selective distribution networks (Global Credit Services, 2013; Makarova, 2013).

The exclusive distribution networks refer to the distribution systems used by the company to distribute private-label brands. Comparatively, the company distributes national brands through selective distribution. As part of the existing in-house distribution system, J.C Penny uses an effective product identification system that tracks and manages existing inventory.

This system has greatly improved the company’s service delivery. To affirm the critical role of this system for the company’s past and future success, Makarova (2013) said, “JCP has a very strong distribution practice and a strategy shaped by combining both systems to create a strong integration of information and efficient distribution. This effective system is one of the main strengths of the J.C Penney Company” (p. 4).

Customer Relationships

Existing customer relationships is also J. C Penney’s strength because, over the years, the company has thrived on an effective communication strategy that has, in the past, worked by increasing the company’s market share (Global Credit Services, 2013).

For example, the J.C Penney rewards credit program allows customers to get coupon rewards for spending a stipulated amount of money in the company’s stores. So far, this system has helped the organization to learn more about customer purchasing behaviors and improve its strategies to reflect these changes (Makarova, 2013).

National Brand in Focus

Over several years, J.C Penney has developed invaluable relationships with many national brands in the country, such as Van Heusen and Dockers (Makarova, 2013). The company has also developed the same relationship with other brands, such as Carter’s, IZOD, Alfred and Dunner (Makarova, 2013).

Through these relationships, J.C Penney has developed an image of being a leader in the omni-channel retail segment in America (Makarova, 2013). This advantage has partly contributed to the company’s past success.

Weaknesses

High Turnover and Low Employee Morale

Over the last few years, JCP has often experienced low employee morale (Makarova, 2013). This problem has caused a high employee turnover rate in the company. Makarova (2013) said that any employee who quits a job costs J.C Penney $1000. Long-serving employees have a higher exponential cost to the company, if they leave.

Poor Decision-Making

Poor decision-making skills have largely contributed to some of J.C Penney’s problems (Makarova, 2013). Particularly, poor management decisions have contributed to some aspects of the organization’s low sales. This challenge has made it difficult for the company to manage some of its environmental problems.

Although the company has recently made significant strategic strides, the company took too long to accept most of its corporate strategies. This weakness is a significant hurdle for the company in its quest to manage the changing business challenges of modern enterprises because the willingness to accept change is a significant part of strategic management (Cooper, 1984). This problem has further worsened the company’s ability to undertake long-term strategic planning processes.

Threats

This paper has already shown that increased competition in the retail industry has largely contributed to dwindling sales for J.C Penney. This situation is worsening because competitors have become more aggressive in their quest to increase their market shares. If this threat continues unabated, it would be difficult to reverse the trend, thereby threatening the future existence of the company.

Opportunities

There is potential in online retail for J.C Penny. The retail enterprise has mainly focused on its brick and mortar business compared to its online business platform (Petouhoff, 2011). The company could realize a turnaround if it adopts a more balanced approach of investing in its online retail business, as it does its brick and mortar business.

Virtual retail companies, such as Amazon, have succeeded in this regard. J.C Penney could capitalize on the same potential if it focuses on it online retail business. So far, its online presence is dismal (Petouhoff, 2011).

Flexibility

J.C Penney has a long history of remodeling and restructuring its business operations to align with the growing demands and pressures associated with its business environment. For example, the company has discontinued some of its poorly performing business segments and eliminated products that have low margins to cope with increased business competition (Petouhoff, 2011).

This flexibility has largely contributed to the company’s past and present success. Over the past few years, this trend has continued. For example, in 2014, the company discontinued some of its poorly performing brands (Funding Universe, 2015).

At the same time, the company has exploited the market potential associated with seasonal brands that have accounted for most of the company’s profits for 2014 and past years (Funding Universe, 2015). For example, the sale of seasonal items has largely contributed to the company’s sales figures for 2014 (Funding Universe, 2015).

The company intends to depend on its flexibility plan to drive further sales in 2015 by delivering superior quality and fashionable items (Funding Universe, 2015). However, the company slowly embraces most of the business strategies that emanate from its flexibility. Therefore, there is a potential for the business to adopt timely strategies to outwit its competitors.

Planning and Budgetary Concerns for the Company

Poor business planning strategies have largely contributed to the poor performance of J.C Penney in the last decade. Recent business strategies have departed from the past business model used by the company’s founder, in 1912 (Funding Universe, 2015).

Therefore, recently, the company has failed to live up to the vision of the company’s founder because low profits and low public confidence have similarly declined. While the poor economic environment that characterized the American business sector, during and after the 2007/2008 global economic crisis, partly contributed to the company’s poor financial performance, some of the company’s poor strategies have also contributed to this undesirable situation.

For example, a change in the company’s business model has contributed to poor sales volumes in the last three years. Poor planning has also caused a high cash burn rate, job cuts and a slumping equity price. Collectively, these factors have contributed to increased market risk for J.C Penney.

Company’s Future Prospects

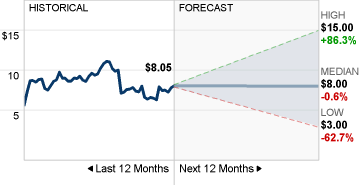

This paper has shown that J.C Penny has reported a poor financial performance in the past five years. In 2015, this poor performance is likely to continue. Particularly, the company’s stock price would show this trend because analysts estimate that the median share price is likely to stick at $8 (CNN, 2014).

However, the stock value could reach a high of $15 in the next 12 months (CNN, 2014). This change would mean that the stock price has increased by 86%. Experts also estimate that the stock could hit a low of $3 in the coming 12 months. The diagram below depicts this forecast

Is the Company a Buy, Sell or Hold kind of Stock?

J.C Penney Company is a “sell.” Concisely, new investors should not buy this stock because the company needs a “turnaround” for the stock to perform well. However, as business research and investor advice show, such turnarounds seldom occur (Cooper, 1984).

Therefore, new investors should focus their energy on priced stocks that have the potential of performing. Their odds of succeeding are better if they do so, as opposed to buying J.C Penney stocks at a bargain, while the same stocks may fail to perform (Cooper, 1984). To affirm the need to sell J.C Penney stocks, the failure by J.C Penney stock to perform has disappointed many investors.

This is why the same stocks have failed to find their way into Berkshire Hathaway’s (Warren Buffet) portfolio. A review of 24 analysts, about the matter, also support the above view because they advise investors to sell the company’s stock (Finkler, 2011). This view is in line with recent financial reviews, for the month of February 2015, about the company’s stocks.

The company’s rising index in the “probability of default” category strengthens the above views. This poor financial performance stems from the company’s weak operating performance (Finkler, 2011). To affirm this fact, the company’s one-year probability of default increased from 0.4%, in 2012, to 8.5%, in 2013.

This increase represents a 2000% increase in the “probability of default” measure (Makarova, 2013). The 8.5% EDF measure is 101 times higher than the industry’s average (Makarova, 2013). In fact, compared to other entrants in the US retail industry, J.C Penney is among the riskiest firms in this group.

Financial experts say that the increased risk profile of J.C Penney stems from its increased financial and business risks (Makarova, 2013). For example, in the past one year, J.C Penney’s market risk has more than doubled (Global Credit Services, 2013). Experts project it at 62% (Makarova, 2013). This percentage makes it among the riskiest companies to invest in America.

Efforts by the new company CEO to revive the company in the last few years have further resulted in an increased business risk because within the last two years, the company’s asset volatility has increased from 19.5% to 24.4% (Makarova, 2013).

Concluding Thoughts

In the past, J.C Penney thrived on offering its customers daily price promotions. Through this strategy, the company benefitted from several partnerships with other firms. These partners contributed to the company’s past success. However, when the crisis hit, the company’s fortunes started dwindling through an oversaturation of the market, poor customer purchasing power and an assumed lack of quality of consumer products.

This is why the company’s competitors outperformed it. Now, the company is more concerned with reviving its success by creating a positive image about the company to investors and customers. To do so, the company has invested a lot of money in improving its pricing strategy. Similarly, the company has invested a lot of money in starting new marketing programs that focus on highlighting some of the exclusive brands sold in the stores.

Although these strategies strive to improve the company’s fortunes, J.C Penney is yet to focus on other important operational areas, such as strategic planning. Failing to focus on this key area could jeopardize ongoing efforts to improve the company’s performance. To address the issues affecting J.C Penney, comprehensively, it is imperative to understand the history and future of the company.

In the future, J.C Penney needs to find creative methods of reducing its debt burden and operation costs. For example, it could find innovative ways of reducing its rent burden by subletting some of the free space in its facilities to other businesses.

Its current strategy of focusing on asset sales would remain valuable in the next couple of years. Therefore, the company needs to continue focusing on this strategy in the short-term as well. However, in the long-term, it should improve its strategic planning process.

What I learned from the project

This company analysis has helped me understand the importance of investigating corporate performance from a multi-sectional view. Corporations are often dynamic business entities that need thorough investigations to understand their performance.

For example, in this paper, I have analyzed the stock market performance, compared industry performance, highlighted budget issues, and explained the company’s strategy weaknesses. These assessments highlight the multifunctional aspects of JCP’s business, which affect its performance. This holistic assessment helped to understand the company’s performance because without it, I would not have a complete picture of J.C Penney.

References

CNN. (2014). J C Penney Company Inc. Web.

Cooper, R. C. (1984). New product strategies: What distinguishes the top performers? Journal of Product Innovation Management, 1(3), 151-164.

Finkler, S. (2011). Finance and Accounting for non-Financial Managers. Chicago, IL: CCH.

Funding Universe. (2015). J.C. Penney Company, Inc. History. Web.

Global Credit Services. (2013). J.C Penney Company Inc. Web.

Kumar, N., & Steenkamp, J. (2007). Private Label Strategy: How to Meet the Store Brand Challenge. Cambridge, MA: Harvard Business Press.

Makarova, I. (2013). J.C. Penney Company. Web.

Mohammed, R. (2012). J.C. Penney’s risky new pricing strategy. Cambridge, MA: Harvard Business Press.

Petouhoff, N. (2011). Like My Stuff: How to Get 750 Million Members to Buy Your Products on Facebook. New York, NY: Adams Media.

Sendjaja, S. (2009). Valuation J.C Penney (Nyse:Jcp). Web.