Introduction

A portfolio is a collection of financial instruments, such as closed-end and exchange-traded funds, treasuries, assets, and marketable securities. Most people believe that equities, treasuries, and liquidity make up the basis of a portfolio. A collection may contain a variety of assets, including money investors, real estate investments, and fine art. One of the core concepts in asset management is the prudence of variation, which simply emphasizes investing all of your assets in a single stock. The portfolio seeks to reduce risk by dividing holdings among various economic instruments, industries, and other groupings.

Prioritization and Weighting Method

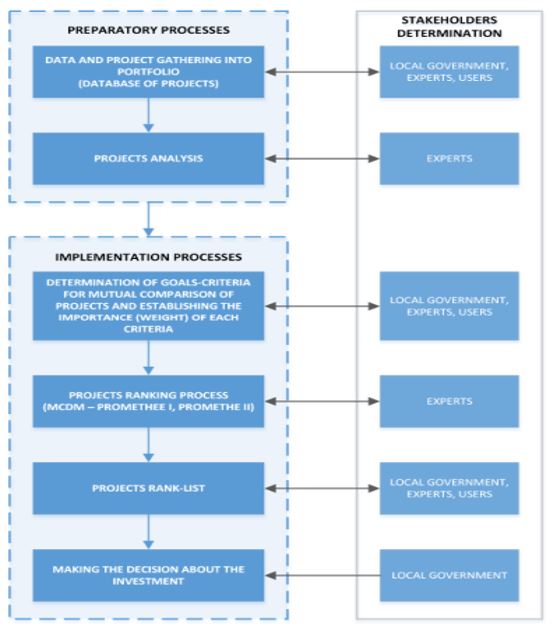

The figure below presents portfolio determination steps and approaches. It consists of two main phases: preparatory and implementation, which are executed by different players, including investors, experts, and authorities.

It is wise to invest in a variety of projects since they each provide a varied set of outcomes at the same time, which maximizes earnings. There are several methods to diversify your investments, but doing so does not always entail lower risks and higher rewards. Investors work to create a well-diversified investment to have the best risk-return allocation for their level of risk sensitivity. The three major pillars of an asset are often considered to be shares, securities, and cash, though one can diversify their holdings with several investments. Investment in real estate, gold stocks, other types of securities, artwork, and other priceless art pieces are other portfolio options.

The preliminary phase of portfolio prioritizing is the first and most crucial step in investment decision-making. Experts in finance and investments, as well as representatives of the government and regulatory agencies, carry out the phase’s operations (El Bok and Abdelaziz 764-787). Stock exchange commissions, like the Securities and Exchange Commission of the United States, are typically the regulating organizations involved in cases like these. It settles disputes, permits investors, accredits and incorporates businesses into the stock exchange platforms, and penalizes fraudulent activities (Chueh et al. 331-340).

Data Gathering and Project Rating

Securities provide data on technical, social, and economic factors, which are also utilized to evaluate and rate the market prices of securities. At the moment, stock values are greatly affected by disclosures about the reliability and performance of the factors above. The majority of the necessary data may be found on the publicly accessible database that data brokers, securities exchanges, governments, and company websites all have access to. Aspire, investors, experts, and regulatory bodies can all benefit from the data.

Before making a decision, investors can perform the necessary study by requesting data from the securities themselves. The most crucial information needed in this step, particularly for investors and experts, includes the organization’s objective, vision, and financial statements. In order to ensure compliance with legal frameworks, including financial disclosures, tax obligations, and dividend payments, regulatory agencies also need the data (Ko et al. 27-84). The available data opens the door for the analysis stage, which is covered below.

Portfolio Analysis

The important participants in this phase are financial and investment specialists since they have the knowledge and training necessary to evaluate the risk and potential return on investment. In order to help investors understand the underlying strategies, strengths, weaknesses, dangers, and opportunities of the target organization, the experts examine its social, technical, and financial performance (Micán, Gabriel, and Madalena 67–84). The economic capacities of an organization are typically given more weight in investment preparations than social and technical factors (Micán, Gabriel, and Madalena 67–84).

Notwithstanding the fact that an organization’s technological prowess significantly contributes to its overall performance, the considerations. This results from investors’ desire to increase wealth, especially in terms of cash and asset value (Zarjou and Mohammad 2437-2460). To identify the least hazardous and most lucrative investments, all potential investment prospects go through the same evaluation. The most popular types of analysis performed before outlay are described in the sections that follow.

Determination of Goals for Mutual Comparison of Portfolios

The investing objectives must be established in order to analyze the target portfolio in depth. The basic objective is to maximize returns on investment; therefore, any other interests should be assessed in that light. For instance, some people may enter certain marketplaces to seize control in order to help other enterprises. In essence, investors should think about how the assets will affect their objectives. The exact reverse is true because objectives might impact how well assets perform.

Determination of the Correlation Between Portfolios

An investigation of correlation determines whether there is a relationship between variables and its strength. The relationships, trends, or patterns between the variables (portfolios) are expressed as “r,” regardless of the type of correlation used: Spearman, Kendall, or Pearson. The relationship between the variables is proportional to the matching correlation value because r varies from -1 to 1 (Giglio 1481-1522). The link can thus be interpreted or concluded as negative or positive and strong or weak, as indicated in the probable range of values. 1 denotes a strong positive correction, whereas -1 denotes a strong negative association (Ta, Liu, and Tadesse 437). Whether they are positive or negative, any values close to 0 are regarded as weak. Investors and professionals should focus on such portfolios in any situation where the r value is positive and robust.

Asset Analysis and Classification

Based on their characteristics and performance, assets need to be grouped. Receivables, cash, fixed assets, and inventories are some of the categories. Real estate, heirlooms, collectibles, bonds, cash holdings, and commodities are some categories of investing assets (Paiva et al. 635-655). Asset codification makes it easier to make decisions about investments and portfolio composition. Diversifying is crucial since the various asset classes have varying levels of risk and reward. Investments in the same class of assets may increase risk and decrease return, as observed by Paiva et al. (635–655). By categorizing the hazards appropriately, the dangers could be greatly reduced.

Location Analysis and Target Market

Investing in the same nation or region runs the danger of exposing one’s portfolio to catastrophic loss in the event of a market collapse. To lessen the likelihood of falling victim to the same class of hazards, it is wise to invest in other nations. However, it does not completely eliminate the possibility of falling victim to dangers peculiar to a given nation. Therefore, it should be used with caution (Afrifa, Ernest, and Alaa 100-619). By taking into account industries, funds, and bonds, an investor may choose to diversify their investment within the same asset class. This protects them from the risks related to particular sectors, such as the energy, technology, or pharmaceutical industries.

Risk Analysis and Tolerance Evaluation

The level of risk tolerance of an investor may have an impact on their attitude toward dispersion. In general, one is more willing to suffer relatively small losses in exchange for the possibility of long-term rewards (Yao and Abed 400-482). Depending on one’s level of risk tolerance, one is classified as either an aggressive, moderate, or conservative investor (Yao and Abed 400-482). Aggressive investors prioritize long-term gains and may have to wait up to 30 years to see a return on their investment (Yao and Abed 400-482). Comparatively speaking, other categories of investors invest more in stocks than in bonds. The average investor could expect to wait around 20 years to recover their investment’s value (Yao and Abed 400-482). Conversely, cautious investors balance their stock and bond holdings and have minimal tolerance for risk. They typically need their money repaid in fewer than ten years (Yao and Abed 400-482). It is simple to determine the finest assets to invest in using this information.

Implementation Process

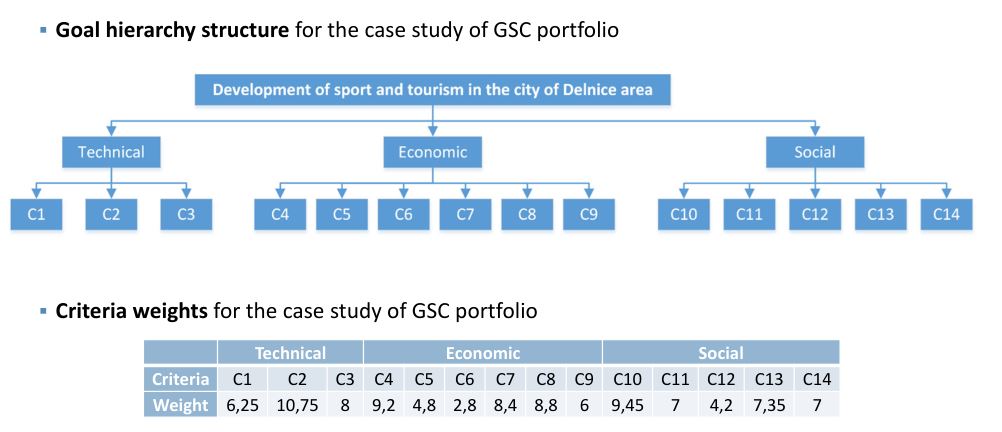

This section provides a synopsis of the portfolio prioritization procedure. Projects are categorized according to risk, asset kind, inserts, and investment period. Every asset is examined from the perspective of a moderate investor to ensure a cautious investment and maximum return. The following sections provide an overview of the technical, economic, and social evaluations of each project. The technical considerations aim to pinpoint the project’s position within the current competitive industrial and market environments. In addition, it starts to assess how well the organization’s strategic plans align with its goals.

Various projects’ effects on other investments, risks, share prices, market performance, and related financial records were assessed using weighted criteria. Social factors aim to determine how the organizations are regarded by and connected to the host community. Five categories with the letters C10 to C14 are used to classify the aspects. Also, the analysis aimed to assess organizations according to their commitment to shared social responsibility, civic engagement, and environmental damage.

Final Decision-Making for Investment and Selected Projects

In conclusion, the cumulative criteria score for all projects should be used as the basis for the final funding selection. The result is reached by adding the weighted scores for technical, economic, and social considerations. Prioritization is given to the most valuable initiatives. To make sure the portfolio did not contain any projects from the same or similar fields, additional project analysis based on risk and diversity should be conducted. This comprehensive approach ensures that funding decisions are both informed and effective.

Works Cited

Afrifa, Godfred Adjapong, Ernest Gyapong, and Alaa Mansour Zalata. “Buffer capital, loan portfolio quality and the performance of microfinance institutions: A global analysis.” Journal of Financial Stability, Vol. 44, No. 10, 2019, pp. 100-691. Web.

Chueh, Ting‐Yu, et al. “Collaborative neural processes predict successful cognitive‐motor performance.” Scandinavian Journal of Medicine & Science in Sports, Vol. 33, No. 3, 2023, pp. 331-340. Web.

El bok, Ghizlane, and Abdelaziz Berrado. “A Data-driven project categorization process for portfolio selection.” Journal of Modelling in Management, Vol. 17, No. 2, 2022, pp. 764-787. Web.

Giglio, Stefano, et al. “Five facts about beliefs and portfolios.” American Economic Review, Vol. 111, No. 5, 2021, pp. 1481-1522. Web.

Ko, Hyungjin, et al. “The economic value of NFT: Evidence from a portfolio analysis using mean–variance framework.” Finance Research Letters Vol. 4, No. 7, 2022, pp. 27-84. Web.

Micán, Camilo, Gabriela Fernandes, and Madalena Araújo. “Project portfolio risk management: a structured literature review with future directions for research.” International Journal of information systems and project management, Vol. 8, No. 3, 2020, pp. 67-84. Web.

Paiva, Felipe Dias, et al. “Decision-making for financial trading: A fusion approach of machine learning and portfolio selection.” Expert Systems with Applications, Vol. 11, No. 5 2019, pp. 635-655. Web.

Ta, Van-Dai, Chuan-Ming Liu, and Direselign Addis Tadesse. “Portfolio optimization-based stock prediction using long-short term memory network in quantitative trading.” Applied Sciences, Vol. 10, No. 2, 2020, p. 437. Web.

Yao, Zheying, and Abed G. Rabbani. “Association between investment risk tolerance and portfolio risk: The role of confidence level.” Journal of Behavioral and Experimental Finance, Vol. 30, No. 1, 2021, pp. 400-482. Web.

Zarjou, Mohammadali, and Mohammad Khalilzadeh. “Optimal project portfolio selection with reinvestment strategy considering sustainability in an uncertain environment: a multi-objective optimization approach.” Kybernetes, Vol. 51, No. 8, 2022, pp. 2437-2460. Web.