Background

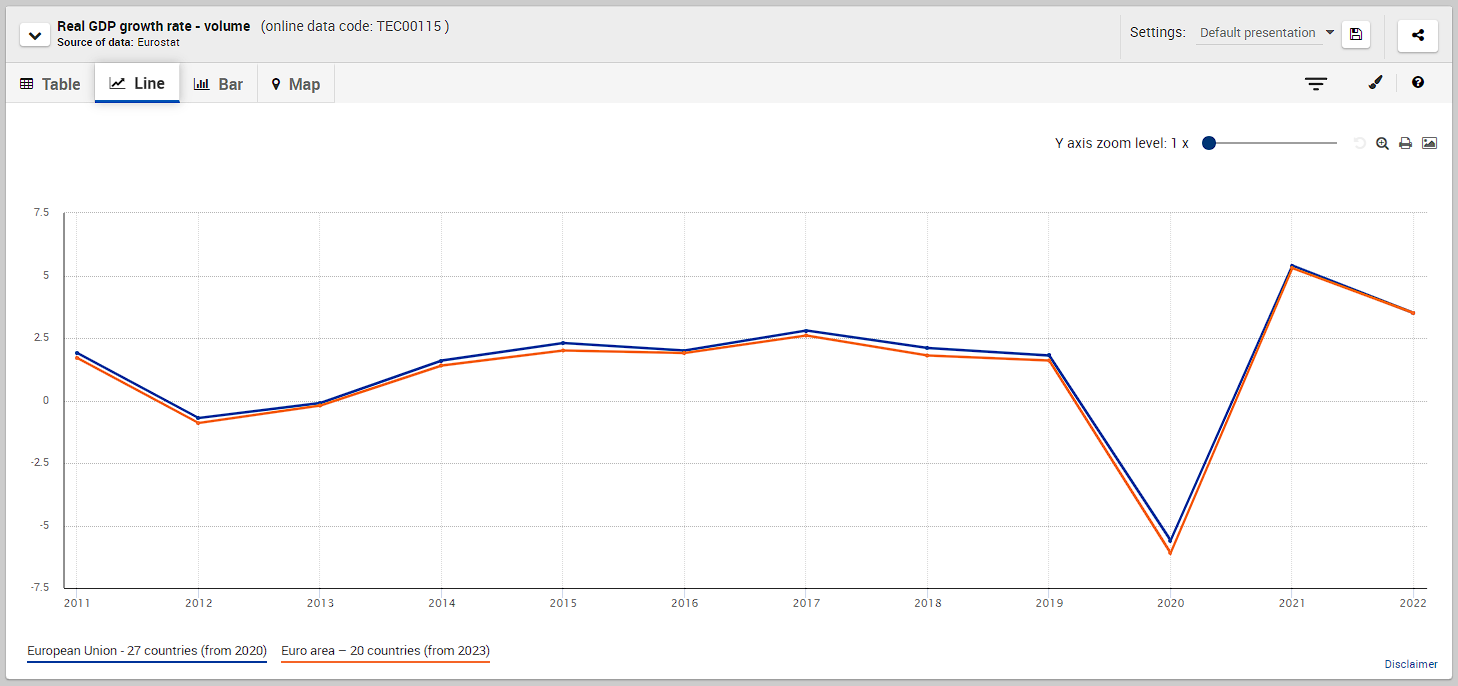

The last two years have been a post-COVID-19 economic recovery for Portugal, as for most other advanced and emerging nations. According to European economists, the country’s GDP has risen by 6.7 percent in 2022 (Figure 1) (Real GDP growth rate – volume, 2023). This number represents an ongoing positive trend from 2021 when the country finally adjusted to the global pandemic, lockdown policies, and changed norms of international economic interaction.

As for 2023, Portugal’s GDP growth is expected to be 2.4%, and it may already have reached 1.6% (Economic Forecast for Portugal, 2023). Other experts think it will achieve a slightly higher percentage, 2.5% (OECD, 2023). Only approximate figures are known regarding Portugal’s GDP per capita, and these are about US$22,000 in 2022 and nearly US$24,000 in 2023 (Portugal GDP per capita, 2021). One might think that such a sharp difference in percentage values indicates that Portugal is beginning to sink into recession. Figures from 2022 represent mainly a return to pre-coronavirus values. 2023 is a year of pure growth; there is nothing unhealthy about the economic dynamic of Portugal.

Drivers of Portugal’s Economy

Portugal’s economic growth in the last two years has been driven by various factors, including the service sector, specifically tourism, nature, significant financial investments, and support from the European Union (EU). Portuguese economists argue that “the external sector was the major growth driver in 2023-Q1, benefiting from the recovery in global supply chains and a very strong increase in tourism visits” (Economic forecast for Portugal, 2023, para. 2).

Tourism and related services have always been the foundation of the country’s modern economy and one of its most profitable segments. Climate has become a major contributor to Portugal’s economic development in 2023. A speedy replenishment of the country’s water reservoirs has provided “the rebound in domestic hydropower production,” which “reduced import demand for electricity and natural gas” (Economic forecast for Portugal, 2023, para. 2).

Financial inflows from the EU under Portugal’s recovery and resilience plan also helped the Portuguese economy stay positive and develop during the past two years (Portugal’s recovery and resilience plan, n.d.). One needs to clarify that European investments have always played a significant role in the analyzed country. In the last economic decade, tax revenue and exports were the other two reasons for Portugal’s GDP growth since 2014 (Wharton Staff, 2018).

The financial services and telecommunications industry have also been significant to the country’s GDP (The Heritage Foundation, 2023). For the past ten years, Portugal’s economy has been driven by tourism, European funds, finances, telecommunications, and exports. In 2022 and 2023, the first two, along with tax revenue and climate, were of critical influence.

Three Sectors of Portugal’s Economy

Portugal’s private sector defines the country’s economic performance and development. Over 4,100,000 people are privately employed, and about 750,000 work in public entities (Portugal: The Strong Start, 2022). The second category mainly works in water systems management and water supply, transportation and storage, and health and social services (State-owned enterprises in Portugal, 2023).

The first one is much more diverse regarding its industries, but food production, tourism, telecommunications, finance, textiles, apparel, and auto parts manufacturing are the best-performing ones. Goncalves and Khalip (2022, para. 7) note that private consumption “represents two-thirds of GDP.” Public consumption is much more insignificant comparatively; the non-profit sector in Portugal is even smaller as of 2022 and 2023. According to Ginter (2022, para. 1), only 185,000 are employed in this economic sector. Moreover, the majority of them are involved solely in charity activism.

Portugal’s Business Cycle

The business cycle of a nation’s economy is a concept of two stages. There is a principle in economics that economies regularly and constantly expand and diminish, and vice versa. Exponential GDP growth is considered expansion, and its gradual slowdown or long-term negative value indicates a period of decline. Judging by the existing data, 2022 was the peak of the Portuguese economy’s expansion (Real GDP growth rate—volume, 2023). 2023 is the start of a slowdown, declining phase, as annual GDP is expected to be lower than the previous year. 2022 was undoubtedly Portugal’s economic peak in the early 20s.

Unemployment in Portugal

Portugal is no different from the rest of the EU in terms of unemployment. The country and the union to which it belongs are not experiencing anything close to a crisis of a lack of jobs for its population. According to data from European government economic experts, the unemployment rate was 6% in 2022 and is likely to increase by only 0.5% in 2023 (Economic Forecast for Portugal, 2023).

The Economic Times (2023, para. 1) claims that “unemployment in the Eurozone hit a record low of 6.5 percent in March.” This is most likely due to intensified digitalization during and after the pandemic. It resulted in new jobs in science and technology, as well as telecommunications, which were quickly filled in 2022 (Duarte, 2023). It can be safely said that for at least the last two years, Portugal has been a country that has defeated unemployment.

Anti-Unemployment Measures in Portugal

Effective digitalization that resulted in the low unemployment rate in Portugal in the last two years was achieved thanks to the adoption of the recovery and resilience plan in 2021. It is a set of socio-economic measures designed by the EU authorities for each member of the Eurozone that considers their societal and economic contexts (Portugal’s recovery and resilience plan, n.d.). It aims to provide European countries with a fast and smooth recovery from the consequences of the pandemic and develop systemic and industrial resilience to unexpected phenomena and a changing global environment.

One of the programs in the long-term plan is the digital transition, which consists of the European Commission providing funds to Portugal. In return, the country’s government must fundamentally update all its technologies and methodologies in critical areas such as education and businesses, and educate the Portuguese in professional, cutting-edge software and hardware skills (Portugal’s recovery and resilience plan, n.d.). Low unemployment proves that Portugal is successfully fulfilling this obligation.

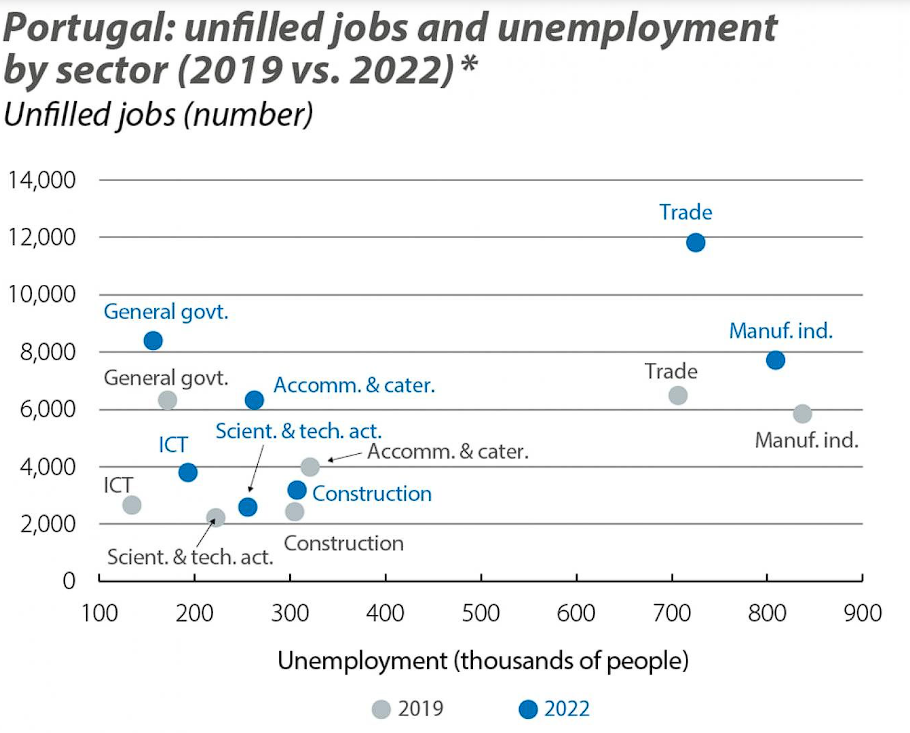

In Portugal, the three most underemployed businesses and industrial areas are listed below. According to Duarte (2023), these are trade, general government, and manufacturing (Figure 2). The recovery and resilience plan can overcome unemployment in the general government. The measure that the government can take to reduce unemployment in the other two sectors is the exemption from income taxes for new businesses. Such targeted favoritism can motivate domestic and foreign economic agents to create new jobs in Portugal.

Inflation in Portugal

A high employment rate mostly positively affects the economy, but it also has some adverse effects, and the most damaging one is inflation. In Portugal, inflation reached 8.1% in 2022 and is likely to be 5.1% by the end of 2023 (Economic Forecast for Portugal, 2023). The balance of payments (BOP) situation is the opposite for these two years.

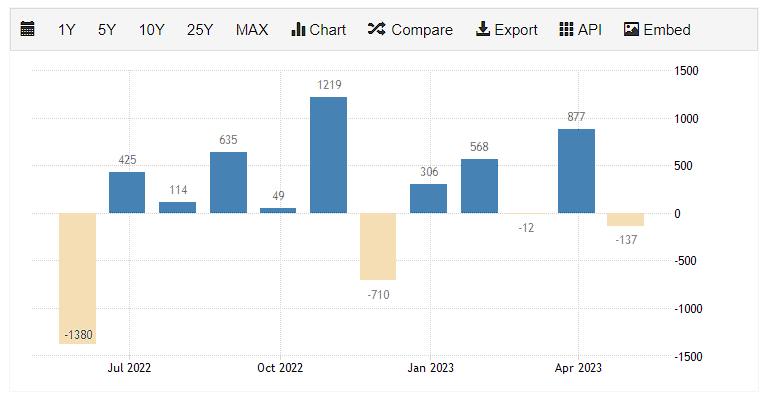

Experts claim Portugal’s BOP “reached a record high of €1219.00 Million in October of 2022 and a record low of €1380.00 Million in May of 2022” (Portugal – balance of payments, financial account, 2023, para. 1). Last year, high employment simultaneously provided higher productivity, resulting in more exports of goods and services, and caused inflation, which motivated foreign economic agents to interact more with the markets and industries of the country. This is why the BOP surplus was phenomenally high in 2022 (Figure 3).

In 2023, unemployment increased, inflation and economic productivity naturally declined, and the intensity of financial interactions of local agents with international ones decreased, resulting in a BOP deficit. Portugal is more of an importing country than an exporting one. Financially, in March 2023, they imported more products than they exported, and this dynamic has been going on for many years (Portugal, 2023). It is more beneficial for Portuguese businesses to have low inflation, as a high inflation rate would devalue the Euro, and they would have to spend more on non-Eurozone products.

The same is true for consumers, as food and energy prices are high in Portugal (Goncalves & Khalip, 2023). Inflation would raise these and the interest rate even more, discouraging families and individuals from spending and reducing their income. A highly fluctuating BOP is also bad for Portugal; it would create disturbances in the currency rate and scare foreign economic agents.

Portugal has two constant macroeconomic needs: jobs and affordable housing. The government has adopted the recovery and resilience plan discussed above to create 50,000 new jobs (Figure 4) (Portugal’s recovery and resilience plan, n.d.). For the past two years, the country has undergone all-encompassing technological and methodological change.

The Portuguese authorities are trying to develop new professional knowledge and qualities of the Portuguese and to form a green energy industry. The success of these measures is seen in low unemployment and a rising GDP rate. However, there is no program to make housing more affordable. Many Portuguese have to work two jobs or overtime to afford a place to live (Fernandes, 2023).

Portugal may try the Chinese model of monetary support for lower-income strata. It implies “subsidizing commercial housing purchases or by offering low-rent public (social) housing to middle- and low-income families” (Man, n.d., para. 1). It would require greater funds and increased production from all its industries and a transition from an import-oriented economic model to an export-oriented one.

Reference List

Duarte, V. (2023) The paradox of the Portuguese labour market: high long-term unemployment and record job vacancies. Web.

Economic forecast for Portugal (2023) Web.

Fernandes, A. (2023) Portugal housing crisis: ‘I’ll have to move back in with mum’. Web.

Ginter, T. (2022) 5 charities operating in Portugal. Web.

Goncalves, S. and Khalip, A. (2023) Portugal economy slowing after strongest year in decades. Web.

Man, J. Y. (no date) Affordable housing in China. Web.

OECD (2023) ‘OECD economic outlook, volume 2023 issue 1: Preliminary version’, OECD Economic Outlook, 2023(1), pp. 1-253. Web.

Portugal (2023) Web.

Portugal – Balance of payments, financial account (2023) Web.

Portugal GDP per capita (2021) Web.

Portugal’s recovery and resilience plan (no date) Web.

Portugal: the strong start to the year pushes annual growth towards 6% (2022) Web.

Real GDP growth rate – volume (2023) Web.

State-owned enterprises in Portugal (2023) Web.

The Economic Times (2023) ‘Eurozone unemployment drops to record-low 6.5% in March’, Web.

The Heritage Foundation (2023) Portugal. Web.

Wharton Staff (2018) Portugal’s economic recovery: How much came from ditching austerity? Web.