Mexico is one of the countries that underwent a rapid revolution from the old-agricultural-based economy to industrial civilization. Since the nationalization of petroleum products in 1938, it has faced an inflation discounted economy favorable to its citizens. Despite its population increase of more than 100%, Mexico has raised its per capita income to $2100 (Bleynat et al., 2020). However, the country has experienced high rates of inequitably in wealth distribution, with the gap between the rich and poor being big. In the 1980s, almost half of its population lived in poverty, with children not having any formal education and facing starvation.

GDP Per Capita

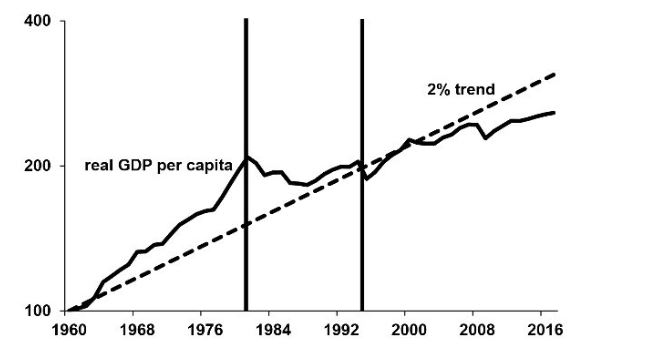

Mexico has existed with significant social tensions, which impacted the political pragmatism, revolutionary mythology, and economic oligopoly from its colonial revolution of 1910 to 1917. The high growth rate in Mexico has brought common problems such as unemployment, high dependency rates, and insufficient services; however, on the positive side, it has a significant impact on the nation’s strength. The more people it has, the more the availability of labor services that help boost the economy. Between 1960 to 1982, the GDP per capita grew at a rate of 3.2% per annum, which shows that its economy grew faster than the US, whose GDP growth rate was 2% per annum between 1875 to 2010 (Avila-Lopez et al., 2019). However, the 1982-1995 crisis caused a significant lag in economic growth due to government-driven major policy reforms, as shown in Figure 1. Since 1995, Mexico has proliferated consistently and parallel to the USA until the COVID-19 pandemic hit.

Inflation

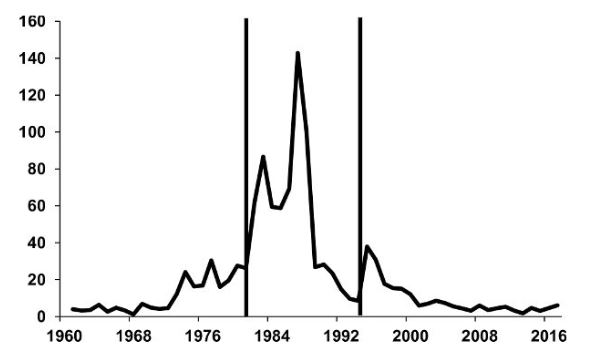

Another essential economic aspect of the Mexican economy is inflation. The country experienced low inflation rates of 4.6% per annum until 1972 (Meza, 2019). Since then, inflation in the country has been high, with the period 1973-1981 experiencing high rates of up to 25% annually (Avila-Lopez et al., 2019). The debt crisis in 1982 hiked the situation when inflation reached 61% in two phases. The first phase was 1982-1987, when it reached a historical point of 142% and then started recessing until it reached 8% in 1994 (Meza, 2019). This downward trend continued until 2006, when the country achieved a stable inflation rate of 4% until 2016, as shown in Figure 2 (Meza, 2019). This shows that Mexico has tried to maintain constant inflation rates, which is essential for economic growth as it increases the value of investment returns.

Primary Deficit

Mexico’s primary deficit was minimal until 1972, when it increased rapidly. It grew from less than 1% to over 6% of the GDP in 1975 due to foreign debt and seigniorage (Meza, 2019). Mexico had to devalue the peso in 1976, which helped stabilize the primary deficit to 3% (López-Alonso & Vélez-Grajales, 2019). Then, towards the end of the 1970s, it discovered large oil fields as oil prices rose globally, which led to an increase in the primary deficit. By 1981, the primary deficit had reached 8%, funded by debt and seigniorage (Meza, 2019). This high debt was unsustainable for the country since it had to repay in foreign currency, and due to devaluations in 1982, the government officially declared it was unable to pay some section of the debt. However, from 1983 to 1994, the government repaid the debt until the 1994 crisis, unrelated to the fiscal debt (López-Alonso & Vélez-Grajales, 2019). According to the consolidated budget constraint model, a primary deficit precedes a debt crisis in a government dominated by fiscal policy and is pursued by inflation.

Acceptance and Utilization of Fiscal Policy

In the past decades, Mexico has moved from an era of fiscal irresponsibility to budgetary discipline and moderation, which has enabled them to lessen the high level of debt. This transition has been partially motivated by structural adjustments in the country, and others have come voluntarily and autonomously. This section will evaluate the acceptance and utilization of fiscal policy in Mexico by evaluating its revenue, expenditure, and debt.

Revenue

The primary sources of revenue in Mexico are taxes, revenue from public enterprises, and non-tax revenues. The country’s annual revenue has fluctuated between 20%-23% of the GDP over the last two decades (Lopez et al., 2018). Tax collections are more stable because they remain 10% of the GDP, and the country has the lowest taxes among the Latin American countries (Lopez et al., 2018). Revenue from public enterprises is somehow stable, fluctuating between 5%-8% of the GDP (Lopez et al., 2018). However, non-tax revenues such as hydrocarbon fees and public enterprises have been significantly volatile and unpredictable, ranging between 3%-9% (Lopez et al., 2018). This is an indication that Mexico’s revenue is relatively stable.

Tax revenue comes from mainly three sources, including value-added tax and special taxes on products and services, which the Fiscal Reform Law approved passed by the congress while direct taxes have existed since before. Direct taxes have always been essential, contributing to 5% of the GDP. This is followed by a value-added tax which contributes 3.5% of the GDP. The value-added tax was introduced in 1980 at a rate of 10% except for essential goods and in the border area, which had a rate of 6% (Lopez et al., 2018). However, the rates have been changing over time, and the last one was in 2010, when it increased to 16% and 10% for border rates (Lopez et al., 2018). This shows that the government is sensitive to essential products.

Expenditures

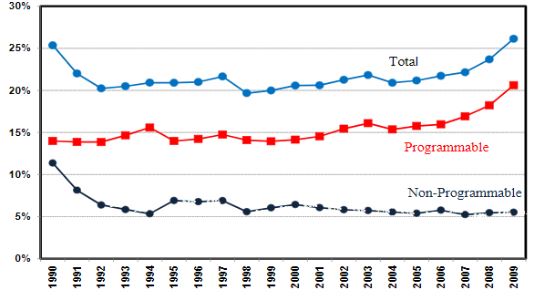

Mexico’s expenditure levels have been fluctuating for the last few decades. From 1994 to 2009, expenditure has been fluctuating at a rate of 20% (Li et al., 2021). The country’s total expenditure can be divided into programmable spending, including the current and investment price, and non-programmable cost for servicing debts. For instance, Mexico had a low total expenditure from 1990 to 1992, which can be attributed to the low financial cost of the public debt (Li et al., 2021). However, since then, the expenditure has been rising due to the programmable spending in the oil boom. This can be shown in Figure 3, which highlights the public spending in Mexico from 1990 to 2009.

This study will divide the spending of Mexico into different components to get a better understanding of its expenditure. The programmable public expenditure, divided into investment and current expenditures, has increased by 7% from 1990 to 2017 due to current expenditure, from 10% to 15% (Lopez et al., 2018). Share of capital has remained low in Mexico, ranging from about 4% to 5% of the GDP (Lopez et al., 2018). Concerning non-programmable public expenditure, there was a significant decrease in public spending due to the renegotiation and debt reduction process. It then increased during the 1994 crisis and since then has stayed stable at a rate of 2% until it was recently affected by the Covid-19 pandemic (Lopez et al., 2018). The transfer to states, a component of public expenditure, has been stable, with a meagre increase from 2% to 3% in 2017 (Meza, 2019). These two factors have contributed to the stability of non-programmable spending at a stable rate in the last two decades.

Deficit and Debt

The maintenance of revenues and expenditure in Mexico over the last three decades has led to a significant advancement of the fiscal profile and the public debt stabilization. This has enabled the Mexican government to secure annual fiscal surpluses of 2% of the GDP (López-Alonso & Vélez-Grajales, 2019). The decision by the government to reduce and renegotiate the public debt has enabled it to achieve a balanced fiscal budget and a small budget deficit. Mexico had tried significantly to balance its financial accounts for the last three decades, with a major turning point being 1991 to 1993, when it achieved fiscal surplus under President Salinas.

In 2005, Mexico achieved a balanced fiscal account due to the balanced-budget rule, which required the Federal Government to have an expenditure that would contribute to budget balance. This fiscal law alone had a significant impact on keeping a balanced budget. Sometimes the law allows flexibility in times of economic crisis. The government used this flexibility to ask for permission to incur some deficit in 2009 when there was a global crisis and the 2020 global pandemic. In the pandemic period, the government had to do so to avoid a weak economic recovery and severe recession compared to other countries (López-Alonso & Vélez-Grajales, 2019). Mexico’s acceptance and utilization of fiscal policies have enabled the country to achieve balanced public finances. The country brought up rules which provided essential procyclical fiscal behaviors. Its public debt has been maintained low, while its petroleum revenues have a low tax burden. Therefore, Mexico’s acceptance and utilization of fiscal policies have positively impacted its economy.

Policy Makers

Policymakers are essential in controlling fiscal policies by regulating government taxation and spending. Their decisions impact household incomes, employment levels, and money in supply, affecting consumer spending and savings (Meza, 2019). In addition, the monetary decisions that they make affect an economy through inflation and interest rates. When there is a problem in the economy, policymakers have to determine whether they are permanent or transitory. This is because it affects investors’ confidence, and therefore, the authority has to ensure that they make the right decisions. For instance, if there was a high economic growth before a crisis based on external debt from advanced economies, it may take a long for the economy to adjust. However, if a country has small financing from external sources, this may be transitory, and the economy is likely to recover quickly. In this case, the policymakers have to determine the type of crisis they face and ensure that they adopt fiscal policies that stabilize their economy.

For instance, Mexico’s oil revenue fell in 2009 due to the decreased oil prices resulting from a global recession. This led to much concern about the sustainability of fiscal policy because with a decrease in external revenues; the government was not sure about its ability to finance the economy’s growth. Thus, it required to modify several factors in the external environment, which had led to decreased foreign currency and limited borrowing capability.

Since this was not a temporary threat, it would permanently depreciate the real exchange market. Policymakers had a role in saving the economy by stabilizing the financial markets and creating policies to increase the exchange rate’s upward trajectory and evade systemic risk (Meza, 2019). Policymakers had a constricted freedom to give the citizens economic stimulus using the monetary and fiscal policies. This led to a policy mix whereby the economy had to be adjusted to the lowest possible economic and inflation activity.

The Procedure and Implementation of Fiscal Policy

For a government to implement a fiscal policy, it has to balance two economic outcomes, including collecting taxes and how to spend the taxes. Lawmakers determine these policies in the executive and legislative branches of the government. Government can collect taxes from individuals and businesses through property taxes, capital gains, and other methods and channel them to elements of the economy where they are needed most (Li et al., 2021). This can include public works, defense, public health, government employment, subsidies, and welfare programs.

An example of fiscal policy implementation is the Zero-based structural balanced rule. The establishment of a structural balance rule in Mexico aimed at smoothening expenditure fluctuations and enhancing fiscal planning. In addition, applying the zero-based structural balanced rule would positively impact savings, positively impacting debt dynamics (Li et al., 2021). This rule applies such that the government’s public sector expenditure equals structural revenues instead of the actual revenues. Then, the actual expenses are deducted from actual revenues to get the structurally balanced budget.

After the structurally balanced budget is obtained, there is a need for analysis of various preconditions, including sustainability of the fiscal policy in the medium and long term, compatibility with other institution arrangements, if it is consistent with the stabilizers, the credibility and transparency of fiscal accounts, coordination between fiscal policies and monetary policies, and soundness of the financial system.

Fiscal Policy in The Medium and Longterm

The structurally balanced budget is sustainable in the medium and long term due to the strict fiscal discipline followed by Mexico since the 1990s. Mexico has consistently followed fiscal policies and has achieved a 2% surplus (Avila-Lopez et al., 2019). The country has a relatively small public debt perfectly compatible with medium and long-term fiscal plans. Mexico has a positive primary gap indicator which shows that the country can sustain a fiscal policy.

Compatibility with Other Institution Arrangements

In this case, the policymakers evaluate whether the applied fiscal policy aligns with other institutional arrangements. Mexico has been using the fiscal rule for several decades, as shown by the Financial Responsibility Law and the Federal Budget (Avila-Lopez et al., 2019). The law is strict on having a balanced budget rule, and only when extraordinary circumstances occur can they be small deficits. In addition, the rules stipulate that the government cannot increase its expenditure without a corresponding increase in revenue. Therefore, before a fiscal policy is passed, it has to ensure that it is in line with the existing institutional arrangements.

Consistency with Automatic Stabilizers

Although Mexico has no effective stabilizers such as a compensation program for unemployment, fiscal policies implemented in the country have to ensure that they do not increase public expenditure above the set ceiling. The country has managed to implement some minor stabilizers with the revenue from petroleum products (Lopez et al., 2018). Therefore, before implementing any fiscal policy, it is important to consider its impact on the existing stabilizers. For instance, fiscal policies to reduce the existing benefits would deteriorate the economy, while those made to increase the stabilizers by distributing sovereign funds would be welcome by the legislators. This shows that fiscal policies should be consistent within the automatic stabilizers.

Credibility and Reliability of Fiscal Accounts

Fiscal policies have to prove that they will be credible and transparent. Mexico is a country that has shown strict adherence to various fiscal policies, such as the 2006 Federal Budget and Financial Responsibility law. Thus, to have a new fiscal policy implemented, policymakers must determine how it will be credible and not harm the economy. Concerning transparency, it was significantly improved following PEMEX debts due to Pidiregas projects recorded as expenditure only to be changed to public debt (Lopez et al., 2018). There are problems linked with accounting for petroleum products and gasoline selling mechanisms regarding reliability. Thus, if there is a fiscal policy regarding petroleum products, the previous mechanisms must be abolished.

Coordination of Fiscal and Monetary Policies

Before a fiscal policy is established, there should be good coordination between the fiscal and monetary authorities. However, since Mexico has been under fiscal policies for a long time, the country has already created relationships with monetary authorities. For instance, the Banco De Mexico and Treasury Secretariat participate in the exchange commission (Lopez et al., 2018). Thus, implementing new policies has to be in line with the already laid out relationships to gain support and quick momentum.

Soundness in the Financial System

The final factor considered is the soundness of the fiscal policy to the financial system. Mexico’s financial system was improved after the 1994-1995 crisis, and it was capitalized at 15% and a liquidity level of 190% (Meza, 2019). In addition, the country has well laid out laws to protect their bank savings and other financial institutions. It has strict liquidity levels imposed on them, even better than in some advanced economies. Thus, it has to be integrated into the financial system when implementing a fiscal policy.

Expansionary and Contractionary Fiscal Policy

This fiscal policy is implemented to expand the aggregate demand by reducing taxes or increasing government taxes. This can be obtained by expanding consumption by reducing taxes, cutting business taxes to encourage investments, and increasing government purchasing to increase money in circulation. On the contrary, implementing a contractionary fiscal policy includes decreasing investments by increasing taxes, decreasing consumption of goods, and reducing government spending to ensure that there is no surplus money in circulation. This can be demonstrated in the 2009 crisis; the Mexican government decreased the issuance of long-term securities while increasing the one for short-term bills (Meza, 2019). This move was aimed to make short-term government securities attractive to the government. In addition, the government purchased bonds up to MXN 40 billion to ensure that there I more money in circulation. In meeting the high demand for withdrawals, the bank’s liquidity levels were restructured, and they were allowed to buy government securities using mutual funds to enable them to meet the customer withdrawals.

Conclusion

Mexico is a country that has faced many economic volatilities in the last few decades. However, its leadership has been beneficial in controlling the economy by increasing GDP per capita, controlling inflation, and managing the public deficit. All this could not be achieved with the application of the fiscal policy. Fiscal policies help lay out a foundation to be followed by policymakers, which is why they had less freedom in determining what they could do because they had laws regulating them. Finally, various factors determine the implementation of fiscal policies, which include sustainability of the Fiscal policy in the medium and long term, compatibility with other institution arrangements, if it is consistent with the stabilizers, the credibility and transparency of fiscal accounts, coordination between fiscal policies and monetary policies, and soundness of the financial system.

References

Avila-Lopez, L. A., Lyu, C., & Lopez-Leyva, S. (2019). Innovation and growth: evidence from Latin American countries. Journal of Applied Economics, 22(1), 287–303. Web.

Bleynat, I., Challú, A. E., & Segal, P. (2020). Inequality, living standards, and growth: two centuries of economic development in Mexico †. The Economic History Review, 13(2). Web.

Li, Y., Sun, Y., & Chen, M. (2021). An Evaluation of the Impact of Monetary Easing Policies in Times of a Pandemic. Frontiers in Public Health, 8. Web.

Lopez, B., Banco De México, M., Ramírez De Aguilar Banco De México, A., Sámano, D., & De México, B. (2018). Fiscal Policy and Inflation: Understanding the Role of Expectations in Mexico. Web.

López-Alonso, M., & Vélez-Grajales, R. (2019). Height And Inequality In Post-1950 Mexico: A History Of Stunted Growth. Revista de Historia Económica / Journal of Iberian and Latin American Economic History, 37(2), 271–296. Web.

Meza, F. (2019). The Case of Mexico. Web.