One of the most striking features of the economic history of Mexico is the persistent instability in prices that has been witnessed for a considerably long period of time due to ineffective monetary policies. Reliable statistics from the World Bank indicate that variability in pricing index coupled with high inflation rates in Mexico has been a recurring phenomenon (par.2).

Consequently, the living standard in this nation as reflected by worsening income distribution, sharp wage declines, instabilities in business performance indices as well as low economic growth among other indicators have negatively contributed towards the unfavorable economic well being of Mexico. Since the 1990s, monetary policies in Mexico have been formulated and implemented with the aim of monitoring and regulating exchange rate systems.

Nonetheless, most of these policies have not yielded positive economic outcomes as expected. Loría and Jorge posit that economic failures been demonstrated in major outbreaks of inflation and in the devaluation of the Mexican peso when exchanged against the US dollar (840).

However, as this paper analyzes, monetary policies, exchange rate regimes that are flexible and inflation targeting approaches have been set in place by the Banco de Mexico to stabilize the economy since the crisis of 1995. It is against this backdrop that this paper offers a critical look at monetary policies and exchange rates in Mexico in relation to the United States dollar.

Mexico and its economic background from early 1990’s

Reports by the World Bank obtained from the 2010 Census indicate that the present day Mexico has a population of 113,432,047 people and a GDP of $ 1,034,804,491,256 (The World Bank par.1) . The country has been documented as one of the largest and fast growing economies in the world.

However, since the early 1990’s, Mexico has grappled with economic instabilities due to poor monetary policy regimes. Risso and Edgar are categorical that until 1990, the economic policies in Mexico were regarded as strong protectionist policies that had trade barriers for automotive and computer industries among other key industries (246).

For instance, in 1995, a major financial crisis springing from complex political, economic and financial factors struck the Mexican economy and caused a major economic instability. The episodes of instability among other factors paved way for the formation of proposals favoring exchange rate regimes to stabilize the economy.

Some of the proposals that gained ground included setting up a strategy to improve the monetary policy using exchange regime rates which are flexible and adopting dollarization or making the dollar a legal tender. Another option that was set at that time was to increase its integration with Canada and the United States of America.

Loría and Jorge argue that the Mexican economy was subjected to persistent variation and high inflation rates after the crisis that damaged its capacity to attain better standards of economic growth (839). The previously set policy of fixed rate regime was abandoned by the government and a floating exchange rate regime was adopted.

Within six months, the currency in Mexico took a 50% nose dive and the recession in the country deepened in late 1990, the Mexican Peso began depreciating steadily causing exports to increase and import prices to rise. This turned Mexican economy to be export-based and therefore benefitting industries, softening devaluation but hurting emerging middle class and poorest segments.

Changes over-time

After the 1995 crisis, the trajectory measure that the government in Mexico had adopted was the flexible exchange rate system which was used to maintain better economic results to the year 2000.

As a matter of fact, some of the monetary steps that were taken by Mexican government had major positive impacts to the economy in spite of the fact that there were myriad of challenges that were faced in course of the monetary reform process. Risso and Edgar posit that by using the flexible exchange rate regime, inflation rate that was 52% took fell to a low of 9% (246). Indeed, this was a clear proof that this was the best regime in the monetary policy in Mexico.

However, economic analysts posit that that drop was not satisfactory when viewed from the perspective of price stability and inflation rates in other countries. The government then adopted the floating exchange rate system regime that had been initiated in 1994 after the Mexican Peso crashed. In 1996, mechanisms were set by the Banco de Mexico to target and capture foreign reserves for exchange rates.

This led to acquisition of more foreign reserves which gave the country revenues from petroleum. The latter action led to significant improvement of overall economic conditions in Mexico and assisted it in paying its debts. The country had been heavily suffering from external debts prior to this grand economic plan.

The country’s current monetary policy is a floating exchange rate regime. The latter policy has been hailed by the World Bank arguing out that in 2007, it made Mexico’s international reserves to stand at US$ 75.8 billion (par. 4).

Ettinger is of the opinion that through this policy, the government and Banco de Mexico began a monthly auction program that traded US dollars with an intention of reducing heavy reliance on petroleum to stabilize the economy and raise the level reserves (729).

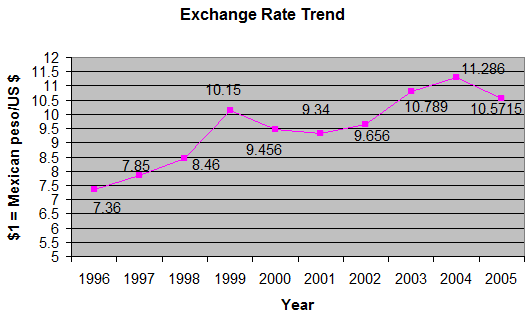

As a matter of fact, Mexico had been spending mammoth sums of its reserve currency in the importation of crude oil. It is imperative to note that in the period 1998-2008 and 1998-2004, Mexico traded its Peso with the US$ at a range from $8.46 MXN to $11.66 MXN per USD$ 1.00 respectively.

This period of ten years 1998-2008 saw the depreciation of Mexican Peso by about 38.18% (Bahmani-Oskooee and Scot 1019). During the acceleration of the credit crisis in the US in 2008 to the global financial crisis, the Peso has fluctuated from lows of $10.96 MXN to $15.42 per USD$1.00. Other exchange rate trends are shown in the figure below:

Conclusion

To sum up, it is imperative to reiterate that inflation in Mexico has been a major problem that has impacted on the living standards of the population in the country. Studies and credible statistics from the World Bank have pointed out that the major source of persistent inflation has been predetermined monetary policies and unstable exchange rates which have not been strategized to meet the objectives of stabilizing the general level of prices.

However, monetary reforms like dollarization and modifying monetary policies can create stability in investments, foreign trade and prices as already discussed in the paper. On a final note, it is also worth to mention that both exchange rates and inflation levels do affect the overall performance of an economy.

Works Cited

Bahmani-Oskooee, Mohsen and Hegerty, Scott. “The Effects of Exchange-rate Volatility on Commodity Trade Between the United States and Mexico”. Southern Economic Journal 75.4 (2009): 1019-1044. Print.

Ettinger, Aaron. “The Globalizers”. International Journal 62.3 (2007): 728-730. Print.

Loría, Eduardo and Ramírez, Jorge. “Inflation, Monetary Policy and Economic Growth in Mexico. An Inverse Causation, 1970-2009”. Modern Economy 2.5 (2011): 834- 845. Print.

Risso, Adrián and Sánchez Carrera, Edgar. “Inflation and Mexican Economic Growth: Long-run Relation and Threshold effects”. Journal of Financial Economic Policy 1.3 (2009): 246. Print.

The World Bank. Mexico. 2012. Web.