Introduction

This report aimed to discuss possible acquisitions for a foreign investment company. The company had a request to select a company for acquisition in the Dutch Amersfoort city area. A shortlist of companies included Johnson & Johnson Medical, Wacker Neuson, AFS Nederland, Nedasco, Crisicom, Alveru, Hollander Techniek, Tonar International, The Surgical Company, and Arepa. The preliminary expertise narrowed the acquisition possibilities to three options, including Johnson & Johnson Medical, Wacker Neuson Group, and Hollander Techniek. This paper provides an in-depth analysis of these three companies in terms of their history, leadership, financial performance, business activities, and recent events. The purpose of the report was to recommend one of the three companies for the acquisition.

Method

Criteria

Three companies under analysis were evaluated based on analysis of eight criteria. First, the companies were analyzed in terms of the year of establishment, which was used to understand how much history the company has behind it. Second, we looked at the company size in terms of the number of employees. Third, we looked at the management team and talents. Fourth, we looked at the companies’ turnover (net sales) to understand how much money goes through the company in one year. Fifth, profitability was assessed using net profit margin. Sixth, the report focused on business activities the company specializes in. Seventh, we looked at the markets the companies targeted. Finally, the report focused on the recent events associated with the companies. The collected data is provided in the Appendix.

Data Collection Method

All the data provided in the report was taken from open source, and no insider information was included. While most of the information was taken from reliable sources, there was some data we failed to find. In particular, we experienced difficulties with collecting data about Johnson & Johnson Medical (MedTech), as the company merged with its parent company, Johnson and Johnson, and did not report any data separately. Some of the information included in the report may be incorrect due to the lack of official information.

Acquisition Options

Wacker Neuson Group

The Wacker Neuson Group is a leading global manufacturer of high-quality light equipment and compact equipment. It was established in 1848. The range is aimed at professional users in construction, gardening, landscaping, and agriculture, as well as municipalities and companies in the industry, such as the recycling area (Wacker Neuson, no date).

The company provides customers worldwide with a comprehensive range of construction equipment and compact machines, spare parts, and services (Wacker Neuson, 2021). Its leading position in the market, Wacker Neuson, is owed to being unconditionally customer-oriented; moreover, the company is famous for the reliability and innovation of its products (Wacker Neuson, 2022). In addition, Wacker Neuson offers services that meet the diverse needs of its customers (Wacker Neuson, 2022). Therefore, companies in the construction industry, gardening and landscaping, and municipalities choose innovative solutions from Wacker Neuson (Wacker Neuson, no date).

The company has around 6,000 employees worldwide (Wacker Neuson, 2022). The company’s CEO is Karl Tragl, its CIO is Anton Müchler, and its CFO is Christoph Burkhard (Wacker Neuson, 2022). All three of the managers are world-class leaders who can lead the company to profitability. The search through official data sources revealed significant concerns about the leaders’ backgrounds.

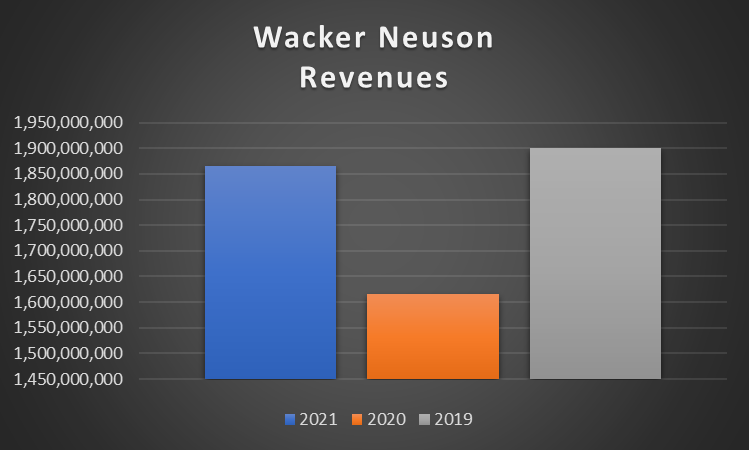

The company demonstrated significant improvement in terms of financial performance in 2021 in comparison with the crisis year of 2020. The company’s turnover grew from €1,615,500,000 in 2020 to €1,866,200,000 in 2021 (Wacker Neuson, 2022). However, even though the company recovered from the crisis, it did not reach revenues of €1,901,100,000 in 2019 (Wacker Neuson, 2021). The trends in revenues are provided in Figure 1 below.

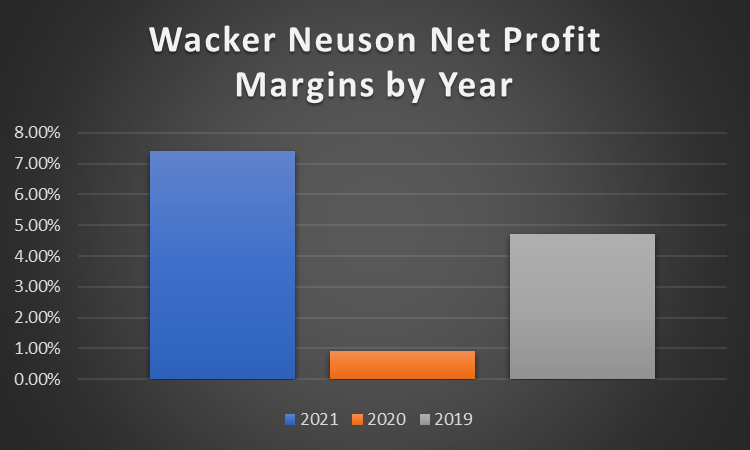

At the same time, the company had the highest net profit margin recorded during the past three years in 2021, which demonstrates that Wacker Neuson improved its ability to control costs. The company’s net profit margin was 7.4% in 2021, 0.9% in 2020, and 4.7% in 2019 (Wacker Neuson, 2021; 2022). It is crucial to note that the company managed to stay profitable during the pandemic, which is an indicator of financial stability. The trends in the company’s net profit margin are provided in Figure 2 below.

Two crucial events were identified in relation to Wacker Neuson. First, recent market reports demonstrate that the electric construction industry is growing fast, as it has reduced greenhouse emissions (Market Research, 2022). Since Wacker Neuson is one of the major players in the industry, it may mean that the company will grow financially due to the influence of the market (Market Research, 2022). Second, a recent report demonstrated that Wacker Neuson’s revenues increased by 12% in the second quarter of 2022 regardless of the world crisis associated with Russia’s invasion of Ukraine (Construction Equipment, 2022). This demonstrates that the company has high financial sustainability

Hollander Techniek

Hollander Techniek is a medium-sized technological firm situated in the Netherlands. The company provides technology solutions to help different types of companies and industries improve their operations and control over inputs and outputs (Hollander Techniek, no date). In particular, the company provides technological solutions for electrical engineering, retail technology, sustainable installations, security technology, swimming pool technology, building management systems, industrial automation, and smart industries (Hollander Techniek, no date). The company can assess, install, upgrade, and maintain these systems (Hollander Techniek, no date). The company serves various markets, including Education, swimming pools, manufacturing industry, food industries, retail, offices and buildings, industrial real estate, water purification, and waste management (Hollander Techniek, no date).

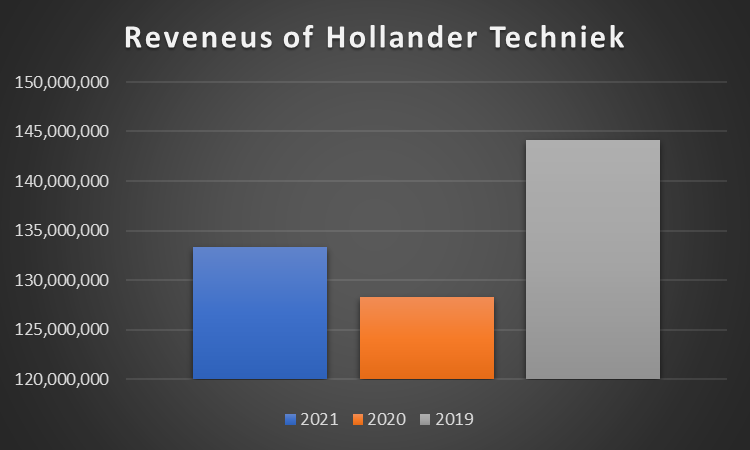

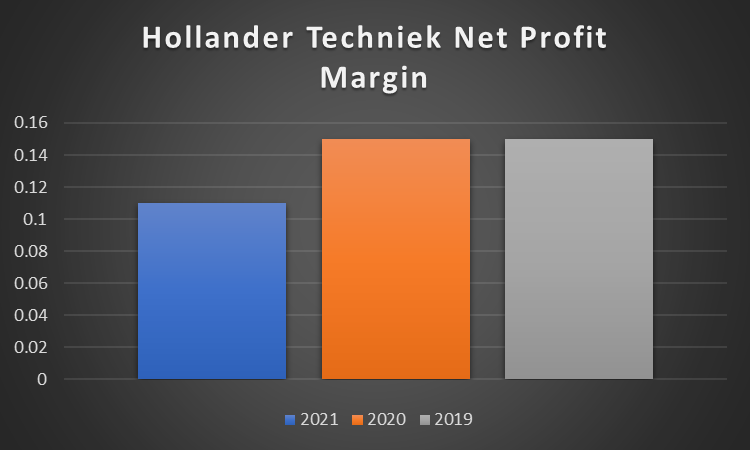

The company was established in 1974, and its current size is around 550 employees. Erik Hollander is the CEO of the company. Even though he does not have much managerial background, he has been running the company successfully with his sister, Emily, after his father’s death in 1999 (Hollander Techniek, no date). The company’s revenues increased from €128,314,000 in 2020 to €133,355,000 in 2021 (Hollander Techniek, 2022). However, the company’s net profit margin decreased from 15% in 2020 to 11% in 2021, which may be a matter of concern. The trends in the company’s revenues and profitability are visualized in Figures 3-4 below correspondingly.

There are several relatively recent events that should be mentioned concerning Hollander Techniek. First, the company was selected by Arnhem Museum to install its security system (Beveiliging Nieuws, 2017). Hollander Techniek received top reviews for their job (Beveiliging Nieuws, 2017). Second, the company created a robot that automatically glued brick slips as facade cladding in 2018 (Brok, 2018). It is one of the special projects with which the company profiles itself in the manufacturing city of Almelo (Brok, 2018). It demonstrates how much the company is dedicated to innovation and bold projects. Third, the company recently ran into an issue with the reporting of fire alarms and malfunctions of the fire alarm system via a customer’s intruder alarm panels (Beveiliging Nieuws, 2022). The intruder alarm panels did not conform to EN54-21 and EN50136 (Beveiliging Nieuws, 2022). Even though the problem was addressed timely, it may be a sign of concern for future customers (Beveiliging Nieuws, 2022).

Johnson & Johnson Medical

Johnson & Johnson Medical was recently renamed to Johnson & Johnson MedTech (Diaz, 2022). The Company offers products for baby hygiene, baby medical care, cosmetics, body care, pharmaceuticals, surgical wound care, implants, surgical sutures, and invasive instruments. Johnson & Johnson Medical serves customers worldwide (Bloomberg, no date). The company operates in four central markets, including orthopedics, surgery, interventional solutions, and vision. The company was established in 1956, and it has more than 10,000 employees (Johnson & Johnson MedTech, 2022). However, it should be mentioned that the number of employees is true for all the divisions of the company, and it is unclear how many employees the branch in the Netherlands has. The company’s CEO is Ashley McEvoy, the company’s CIO is Annick Faes, and the company’s CFO is Kurt Van den Bosch (Johnson & Johnson MedTech, 2022). These people are the top talents in the industry, and they are of great value to the company (Johnson & Johnson MedTech, 2022). These top managers have the highest potential among all the companies reviewed for this report.

Johnson & Johnson MedTech is one of the active branches of Johnson & Johnson, and the company does not report its financial performance separately. However, Johnson & Johnson’s net income grew from $15,119 million in 2019 to $20,878 million in 2021 (Johnson & Johnson, 2022). Moreover, the medical technology market grew significantly due to the increased demand associated with the pandemic (Medtech Europe, 2022). Therefore, it may be assumed that the company is expected to demonstrate improved financial performance in the future. However, the evidence about the financial performance is only indirect.

Two recent events associated with Johnson & Johnson MedTech came to our attention. First, Johnson & Johnson Medical acquired Emerging Implant Technologies in 2018, which made the company’s position even stronger in the market due to increased innovation (Medical Device Network, 2018). Moreover, the company recently partnered with Microsoft to enable digital surgery solutions, which also helps the company to be more innovative (Biospace, 2022).

Analysis of the Options and Conclusion

The analysis of three options revealed that the acquisition of Wacker Neuson was the most preferable option for acquisition. The reasons are discussed below by criteria and the importance of the criteria.

- Year of establishment (low importance). It was assumed that the older the company, the more established market position it has. Wacker Neuson was established in 1848, which makes it the oldest company among the three options.

- Number of employees (low importance). It was considered that the smaller the company, the easier it would be to purchase. Hollander Techniek was the smallest company among the options (550 employees), which made it the preferred company for acquisition.

- Manager team (medium importance). Hollander Techniek was run as a family business by the son of the founder of the company, and the abilities of the company’s managers are questionable. The talents hired by Johnson & Johnson are top-class professionals, which makes them the most expensive option. Therefore, Wacker Neuson was preferred as a middle option.

- Financial performance (high importance). The profitability of Johnson & Johnson was the highest among the three options, with a net profit margin of 21% in 2021 (Johnson & Johnson, 2022). However, it is unclear if Johnson & Johnson MedTech in the Netherlands has the same profitability. Hollander Techniek had higher profitability in comparison with Wacker Neuson. However, since Wacker Neuson had a positive trend in profitability growth, while Hollander Techniek had a negative trend, Wacker Neuson is the preferred option in terms of financial performance.

- Markets (high importance). Johnson & Johnson Medtech appears to be in the most preferable position in terms of market conditions due to the increased demand associated with the pandemic. Wacker Neuson was also found to operate in rapidly developing markets. Hollander Techniek had great diversity in the markets it served, which made its position very stable. Thus, none of the three options were preferred based on this criterion.

- Recent events (medium importance). The analysis of recent events demonstrated that Johnson & Johnson Medtech has very high potential in terms of innovative solutions due to recent acquisitions and the establishment of partnerships. At the same, Wacker Neuson has already been showing extraordinary results in terms of growth. Therefore, Wacker Neuson was a preferred option for acquisition based on this criterion.

- Further considerations (medium importance). It was assumed that Wacker Neuson would be the easiest option to purchase in terms of negotiations. Johnson & Johnson is unlikely to sell one of its branches, as the company is looking for further growth (Johnson & Johnson, 2022). At the same time, Hollander Techniek is a family-run business, which may be difficult to negotiate with. Thus, Wacker Neuson was preferred based on this criterion.

Since Wacker Neuson was the preferred acquisition option based on the majority of criteria mentioned above, it is recommended that the foreign investment company consider acquiring Wacker Neuson.

Reference List

Beveiliging Nieuws (2017) State of the art security for renovated Museum Arnhem. Web.

Beveiliging Nieuws (2022) CSL helpt Hollander Techniek met innovaties ‘uit de brand’Web.

Bloomberg (no date) Johnson & Johnson Medical GmbH. Web.

Biospace (2022) Johnson & Johnson Medical Devices Companies Announces Strategic Partnership with Microsoft to Further Enable its Digital Surgery Solutions. Web.

Brok, H. (2018) Hollander Techniek from Almelo makes work easier. Web.

Construction Equipment (2022) Wacker Neuson Revenue Jumps 12% in Quarter. Web.

Diaz, N. (2022) Johnson & Johnson renames medical device branch. Web.

Hollander Techniek (2022) Cijfers en Feiten. Web.

Hollander Techniek (no date) Pushing boundaries in technology together. Web.

Johnson & Johnson (2022) Annual report 2021. Web.

Johnson & Johnson MedTech (no date) About Us. Web.

Johnson & Johnson MedTech (2022) Johnson & Johnson MedTech. Web.

Market Research (2022) Electric Construction Equipment Market Business Strategies and Massive Demand by 2030. Web.

Medical Device Network (2018) J&J Medical acquires Germany’s Emerging Implant Technologies. Web.

Medtech Europe (2022) The European Medical Technology in Figures. Web.

Wacker Neuson (2021) Annual report 2020. Web.

Wacker Neuson (2022) Annual report 2021. Web.

Wacker Neuson (no date) The Wacker Neuson Group at a Glance. Web.