Numico has grown from humble beginnings to become of one of the largest companies that manufactures nutritional products. Acquisition is one of the major strategies of the company. Throughout, the history of the company, it has acquired companies in various locations.

This has enabled the company to venture into foreign markets. This company has helped in sustaining its growth. Acquisitions enabled the company to control interests in more than 100 countries. This enabled the company’s products to reach a large number of people.

Numico uses a medical platform marketing. This implies that the company uses its experience in manufacturing products that have a medical backing. The company has laboratories in several countries. These laboratories use scientific data to develop new products.

This enables the company to develop products for vulnerable people. Research enabled the company to develop products that focused on the link between nutrition, diseases, and health. This enabled the company to improve its competitiveness.

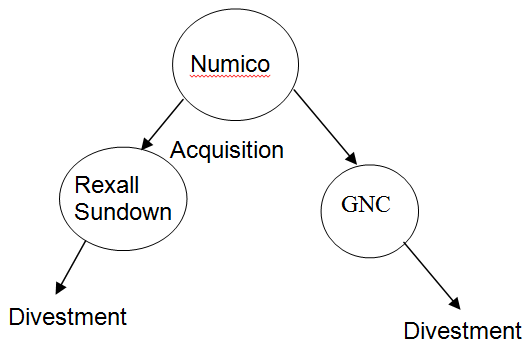

The U.S. is one of the most lucrative markets. Numico acquired General Nutrition Companies (GNC) to improve its competitiveness. GNC was the largest producer and marketer of nutritional supplements. The company exported its products to more than 25 countries.

Therefore, acquisition of the company enabled it to acquire the customers of the company. This enabled Numico to improve its competitiveness globally. GNC had a strong brand name. This brand name and Numico’s scientific knowledge would help in improving the competitiveness of the new entity.

Acquisitions of new companies made Numico venture into industries that were different from its traditional areas of operation. Enrich International specialized in the sale of nutritional supplements and personal care products. On the other hand, Rexall Sundown Inc. specialized in the sale of vitamins, nutritional supplements, and consumer health products. The demand for nutritional supplements was income elastic.

The demand was dependent on the income of customers. Reduced income reduced the demand of the nutritional supplements. Nutritional supplements were not vital products. This necessitated the company to device strategies that would enable it to market the nutritional supplements effectively.

Acquisition of new companies exposed the companies to several risks. Numico specialized in the production and marketing of nutritional products that targeted infants, patients and other people who had special nutritional needs. It was vital for the company’s products to meet the nutritional needs of the target market. Failure to meet the nutritional needs would reduce its competitiveness.

Numico acquired companies in different geographical locations. This exposed the companies to risks due to the volatility of the exchange rate. Volatility of the exchange rate may have a negative or positive impact on the company. Drop in the rate of the U.S. dollar versus the euro reduced the profitability of Rexall Sundown and GNC.

This is despite the fact that these companies has improved performance. Reduced profitability of these companies forced Numico to sell the companies and exit from the nutritional supplements market.

Traditionally, Numico specialized in the sale of products that targeted infants and other people who had special nutritional needs. However, the acquisition of new companies forced the company to start selling nutritional supplements.

These products were more sensitive to the prevailing economic situations. Fluctuation in the demand of these products exposed the company to several risks. However, customers’ increased consciousness of their health increased the demand of these products.

Acquisition of new companies necessitated Numico to specialize in the production and sale of infant nutrition products, healthcare products, and supplements. Historically, Numico was a high growth and high profit margin company. However, Rexall Sundown was a low growth low margin company. In addition, GNC was a high margin low growth business.

These companies did not fit Numico’s strategy of high growth high margin. This necessitated Numico to sell the companies.

Numico acquired several companies during its history. In 1999, the company acquired General Nutrition Companies. In 2000, Numico acquired Enrich International and Rexall Sundown. However, in 2003, Numico sold Rexall Sundown and GNC. The sale of these companies was due to the fact that the companies did not fit Numico’s strategy.

The companies did not meet Numico’s profit expectations. Nutritional supplement market was a low growth market. In addition, the market was income elastic. However, soon after the sale of the companies they became profitable. The sale of the companies was a right decision.

Failure to sell the companies would have necessitated Numico to change its strategy. This may have had a negative effect on the company. However, sale of the companies made Numico lose the money it had invested in the companies. In addition, Numico lost the competitive edge it had due to the acquisition of the companies.

Sale of the companies enabled the company to concentrate on its traditional market of infant nutrition and clinical nutrition products. The company had vast experience in producing and marketing these products. This enabled it to have a competitive edge in the market.