Price discrimination strategy is appropriate for the sub shop in a college town, since a lot of potential revenue is lost when using single price strategy for visitors who are willing to pay high prices for similar products. Price discrimination strategy is applicable in businesses where sale of similar goods and services can be transacted by different clients.

This is in addition to theoretical markets where there are perfect product and services substitutes, perfect market information, and no products and services re-selling. Strategy of price discrimination only exists with oligopolistic and monopolistic markets where businesses exercise market power.

Such market power will allow the firm to avoid cases where the resident buyer may take advantage by buying the standard or low priced goods and selling them to the visitors at a relatively higher price, knowing very well that such a deal will eventually be profitable to him. Therefore, an effective strategy is important for sub shop, knowing that higher prices charged on visitors can significantly increase the revenue considering that visitors’ demand for goods may remain the same (Mills, 2002, p.35).

The impact of the strategy of price discrimination between the residents and visitors on social efficiency cannot be understood, since the strategy generally leads to higher prices for the visitors and lower prices for the resident consumers. The strategy will focus on increasing sales for the resident consumers, while extracting reasonable amounts of surplus from the visitors.

This would help in ensuring efficiency of the price discrimination strategy and avoid decrease of sales to visitors who pay higher prices for similar goods. The sub shop would undertake market segmentation before price discrimination so as to discourage resident customers from reselling the goods, considering the discounts offered.

A firm may still apply price discrimination strategy, but still prevent product resale by using rate fences and maintaining confidentiality of pricing information, an action that will limit chances of resident buyers having access to both pricing models.

The product discount should also be restricted to student residents only, and not local residents, who may otherwise turn out to be competitors. Unlike single price strategy, the discriminative strategy rate fences ensure that customers who can pay higher prices for the same product do not pay lower prices.

Rate fences strategy makes it impossible for the visitors to switch to the resident class and pay lower prices (Simchi-Levi, Kaminsky & Simchi-Levi, 2003, p.250). The sub shop may also relax the similar goods requirement for enacting price discrimination through price variation for different products with similar costs of production. This strategy of price discrimination will help to reveal consumers who are willing to pay higher prices for satisfaction of similar needs (Ferrell and Hartline, 2008).

Price Ceilings

In case the government enacts price ceiling laws of the TV cable industry, the company will have no option but to lower the price in line with legal limit of the cable TV. For the legal limits, the government must place the price ceiling below market equilibrium for the law to be effective.

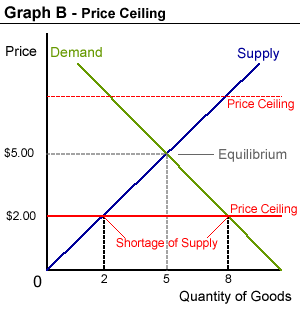

When the cable TV price ceiling is set, there would be a shortage, since there will be more demand than the industry can supply at the equilibrium price. This will result into the cable TV market inefficiency because quantity supplied by the industry at the price ceiling would lead to marginal benefit exceeding marginal cost (Mankiw, 1998, p.112). The graph below indicates the shortage that will occur when price ceiling is set below the equilibrium.

Price Ceiling Graph

The dashed line represents the maximum ceiling price above the market equilibrium while the red line represents price ceiling below the equilibrium level. There is a different effect when the price ceiling is below the equilibrium price.

The suppliers cannot charge the price demanded by the market and must meet the price limit set by the government legislation. The equilibrium price of the cable TV is the price at which the number of cables TV demanded is equal to the number of cable TV supplied. In general terms, the market forces of the industry do not vary to change both demand and supply at equilibrium level.

If the government regulations would have placed the price ceiling above the equilibrium, there would be no effect since the limit is above the market price. When consumers demand increases above supplier’s ability to supply, it results in shortages, which leads to rationing of cable TV in the market.

Perfectly Competitive Markets

When demand for products is perfectly elastic in perfectly competitive markets, there are no consumers’ surpluses, since prices that consumers are willing to pay precisely match the prices with which the goods are sold.

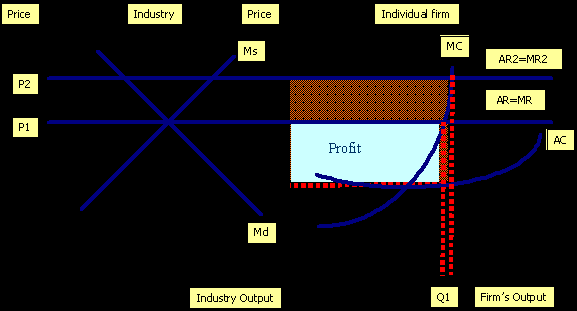

Firms in this kind of market are price-takers of the ruling market price, since all firms aim at selling as much as they could, thus influencing demand and supply in the market, which in turn fluctuate price levels. In perfectly competitive markets, individual firms cause minor impact on market price, have highly elastic demand, and have no entry barriers.

In addition, average revenue of firms in perfectly competitive market is equal to price, which is constant and equal to marginal revenue. Profitability of the firms depends on revenue and costs of the firms. Therefore, profitability is maximized when marginal costs are increasing, but equal to marginal revenue. Marginal revenue, which is dependent on every additional sale decreases when demand of products falls, consequently hampering profitability, both in the short run and in the long run.

When demand of a product falls in a perfectly competitive market, it negatively affects profitability in the short run. Moreover, persistent low demand in the long run would lead to a number of companies shutting down, thus leaving the most competitive firms for increased profitability.

Indeed, firms may exit the industry permanently after consecutively making loses where average revenue is more than average total costs. However, firms that are on downward trend are likely to incur huge loses, since fixed costs outweigh average revenue when the demand is low. Alternatively, firms may strive to remain in operation and seek competitive advantage over their competitors, with the understanding that fixed costs incurred are unrecoverable whether they shut down or proceed with operation.

Firms have the option of leaving the industry when their sales revenue is less than projected long run revenue. In addition, firms need to exit when their total revenue is not equal or more than total cost, since they make no profits in the long run.

In perfectly competitive markets, new entrants are encouraged to enter the market in order to benefit from potential profits, as evidenced by the existing firms (Hall & Lieberman, 2009, p.360). The graph below shows prices of products with regards to marginal revenue and costs, which are major determinants of the number of firms and their profitability in the perfectly competitive market.

Competitive industry and firm Prices and Output

Average Cost Curves

Economies and diseconomies of scale of specific firms are indicated by long run average cost curves. When a company grows, it aims at attaining maximum amount of economies of scale and minimum amount of diseconomies of scale depicted by a positively sloping curve.

Average cost curve becomes steeper on the downward side because the firm is more inelastic to variations in cost with regards to production quantity. In the firm’s microeconomic short run, managers need to ensure that the firm puts into consideration the aspect of fixed quantity of factors of production.

Such factors may include buildings and machineries used for production in the long run and may not be easily varied to meet short run needs of production. In case quantities of factors of production remain fixed during a specified period, then they are regarded as fixed factors of production. On the other hand, when quantities of factors of production can be varied during a specific period, then they are regarded as variable factors of production.

Managers of firms should put into consideration the use of factors of production in the long run, and consider modification and selling of fixed factors of production in the short run. In the long run, firms consider all factors of production as variable, unlike in the short run. Moreover, companies use factors of production to come up with other products. Indeed, production function is the relationship between a firm’s output and factors (Rittenberg & Tregarthen, N.d).

Price Discrimination

A new model of digital camera may cost more when it is being released into the market than a year later when it will no longer be considered new. Generally, a new model of camera released into the market qualifies for fashion goods, signaling status. For effective signaling of status, the camera must cost more to obtain, since firms exercise price discrimination for clients willing to spend more to achieve status. However, similar cost for the camera now and a year later negates the value that clients are looking for.

Resource needed to attain the fashion status can be limited wealth. Non-wealth constraint with regards to purchase of status products enables status signal to be recognized easily as a relative rank indicator. Status seekers are continuously attempting to improve their social rank perceptions through status acquisition.

The absence of price discrimination on new models of cameras that have just been released into the market may fail to achieve status, since there would be difference between the product purchased now and one purchased a year later. Moreover, a unique feature of market demand curve for new models of camera is that, it varies inversely to the stock of the product in the market.

Prices of fashion goods or new models have a positive relation with supply of goods. Perception of theses goods remains positive until the price of the product is reduced and is now readily affordable to many consumers. Nevertheless, consumers who initially buy the product are willing to pay a higher price, since the model is new unlike a year later when other models will be in demand (Krishnamurthy, 2005, p.45)

Implications and Rationale of the New Guidelines

The Department of Justice and the Federal Trade Commission issued new Guidelines that place emphasis on innovation as a factor to be considered in determining acceptability of horizontal mergers. The rationale of innovation is that, it is often initiated by competition and the need to minimize costs and increase efficiency. The new Guidelines seek to outline major analytical techniques, enforcement legislations, and practices used to evaluate potential competitors undertaking mergers and acquisitions.

The new Guidelines by the Department of Justice and the Federal Trade Commission puts into consideration economic and legal developments, although according to agencies, the guidelines are not intended to bring about changes with regards to merger review policies. The guidelines are intended to enhance clarity in issues regarding the processes of merger review so as to help the business environment, particularly in mergers and acquisitions (Jones & Mortin, 2000, p113).

The guidelines aim at helping agencies and the business community to challenge and identify harmful mergers in uniformity, while also evading unnecessary merger interferences that are either beneficial competitively or have the likelihood that it will have no competitive impact in marketplace. Considering this, byproducts will act as an indicator to the business environment on the types of mergers that are likely to cause widespread scrutiny.

References

Ferrell, O. C., and Hartline, M. (2008). Marketing Strategy. OH: Cengage Learning.

Hall, R. E., & Lieberman, M. (2009). Economics: Principle an Application. OH: Cengage Learning.

Jones, P. L., & Mortin, J. F. (2000). Federal Trade Commission: Study Needed to Assess the Effects of Recent Divestitures on Competition in Retail Markets. NY: DIANE Publishing.

Krishnamurthy, S. (2005). Contemporary Research in E-Marketing. PA: Idea Group Inc (IGI).

Mankiw, G. (1998). Microeconomics. NY: Elsevier.

Mills, G. (2002). Retail Pricing Strategies and Market Power. Melbourne Univ. Web.

Rittenberg, L., & Tregarthen, T. Principles of Macro-Economics. Production costs. Web.

Simchi-Levi, D., Kaminsky, B., & Simchi-Levi, E. (2003). Designing and Managing Supply Chain: Concepts, Strategies and Case Studies. NY: McGraw Hill Professional.